China's locally-made PV deliveries fall 6.4% YoY in July 2021

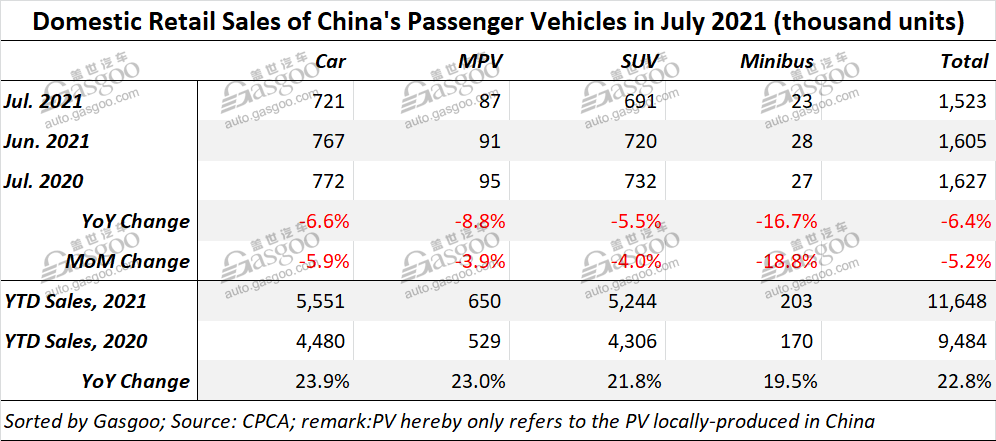

Shanghai (ZXZC)- In July 2021, around 1.523 million locally-produced PVs (referring to cars, MPVs, SUVs and minibuses) were handed over to consumers in China, representing a year-on-year drop of 6.4% and a month-on-month decline of 5.2%, according to the China Passenger Car Association (CPCA).

The association said some automakers in China lost plentiful vehicles of production as a result of the global chip supply constraint and uncertainty, and thus suffered plunge in their wholesales. Due to this reason, car dealers had to slow down in replenishing inventories, leading to weaker retail sales performance.

In July, car demands in Guangzhou and Shenzhen evidently picked up thanks to the incentives local authorities rolled out to boost car sales. The resurgence of coronavirus cases in Nanjing and the Zhengzhou floods have not caused apparent effects on July's PV market, said the CPCA.

For the first seven months of 2021, there were about 11.648 million consumers in China taking delivery of locally-built PVs, representing a 22.8% year-over-year increase. The double-digit growth should be credited to the low base for the year-ago period, said the CPCA.

In July, the deliveries of China-made luxury vehicles amounted to approximately 200,000 units, shrinking 18% from the previous year, while rising 7% compared to July 2019. The stable upward movement hinted at the robust demands of replacing old cars with premium ones.

The retail sales of Chinese indigenous PV brands reached around 640,000 units in July, growing 20% from the prior-year period, while also rising 23% compared to July 2019. Such brands as BYD, GAC Aion, Hongqi, and Chery all scored high year-on-year growth thanks to their strenuous efforts to overcome the chip shortage, and to strengthen product, marketing and service quality.

Retailing roughly 670,000 new vehicles in total, joint-venture brands posted a 19% decrease year-on-year and a 15% drop from the corresponding period in 2019. Of those, 23% and 9.1% retail sales were contributed by Japanese and American brands.

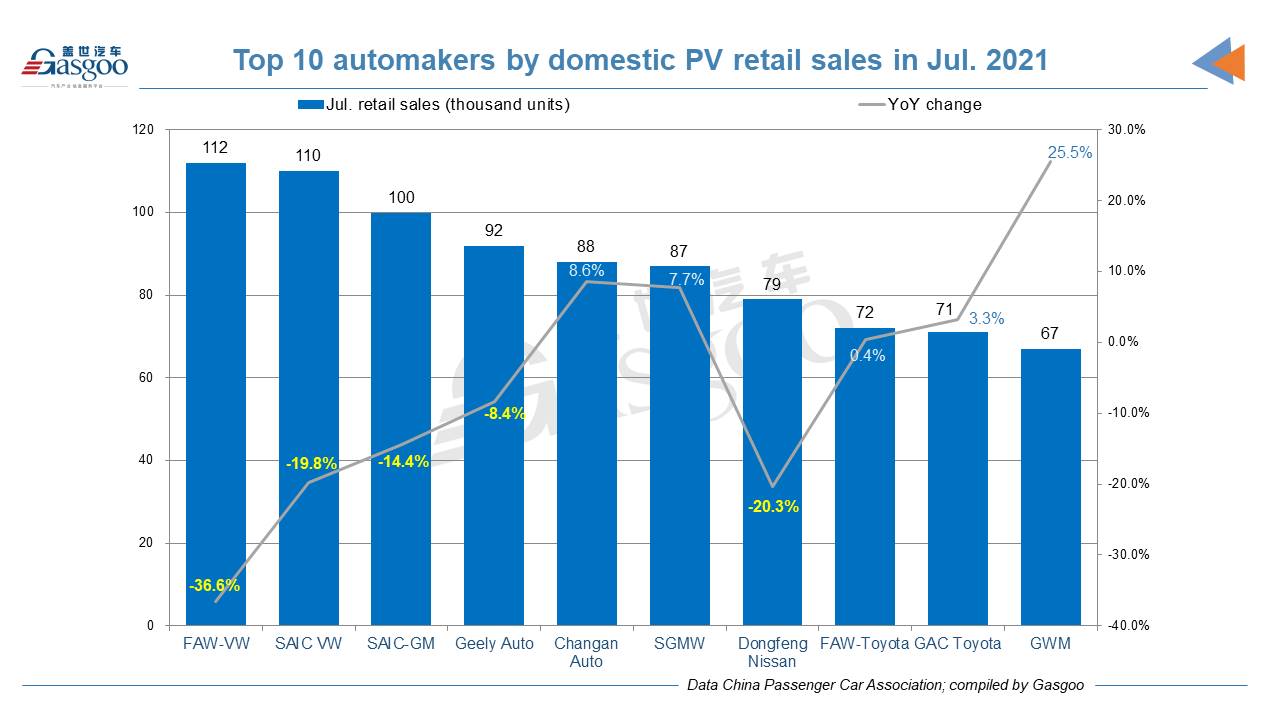

Among the top 10 automakers by domestic PV retail sales of July, FAW-VW ranked highest by delivering around 112,000 new vehicles. On the top 10 list, there were five automakers recording year-on-year decrease, including the top 4. Toyota Motor’s two Chinese joint ventures ranked eighth and ninth respectively.

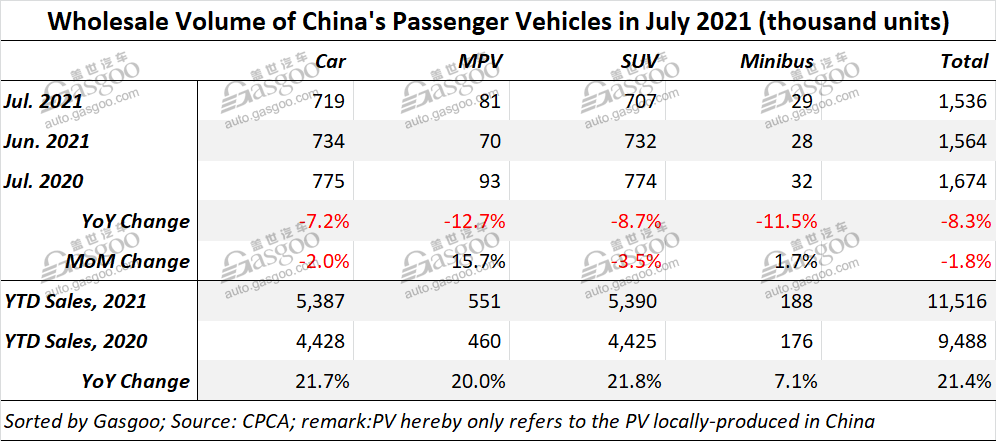

China's monthly PV wholesales reached 1.536 million units, dropping 8.3% over a year earlier, while also edging down 1.8% from the previous month. The year-to-date volume still jumped 21.4% from a year ago.

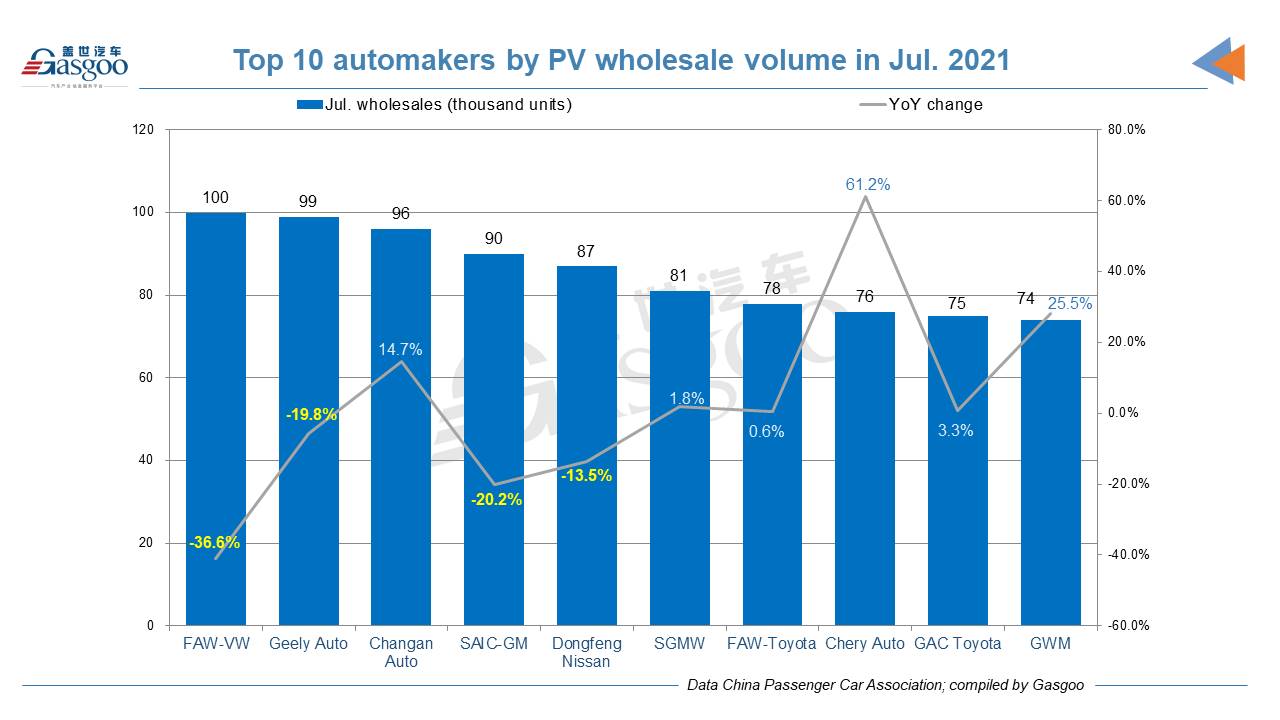

Among the top 10 carmakers by July PV wholesales, FAW-VW was still the champion, while it suffered the sharpest year-on-year decrease. Double-digit decline also hit Geely Auto, SAIC-GM, and Dongfeng Nissan, which ranked second, fourth, and fifth respectively. Notably, Chery Auto moved up to the eighth place with a 61.2% surge.