Auto industry news and interpretation on new energy, intelligence and connectivity

• 1,000km-range electric vehicles have been rolled out

• BorgWarner buys German battery maker Akasol

• Didi Autonomous Driving has finished its financing of $300-million

Recently, NIO ET7 has been launched and accepted for pre-order. In addition to intelligence and autonomous driving, electrification has also become the highlight of this model. According to the official statement, the new model will be equipped with semi-solid battery and have a pure electric range of 1,000km. Followed by it, GAC AION and Zhiji Auto also released their 1,000km-range models and new battery technologies.

ZXZC conducts the comparative analysis of the three 1,000km-range vehicle models and battery technologies. The battery technologies carried by the three new cars are based on the current mainstream ternary lithium battery to achieve a breakthrough. The negative electrode is basically a silicon negative electrode and a silicon-graphene polymer system. NIO is different in terms of electrolyte, which uses solid-liquid mixed electrolyte instead of all solid.

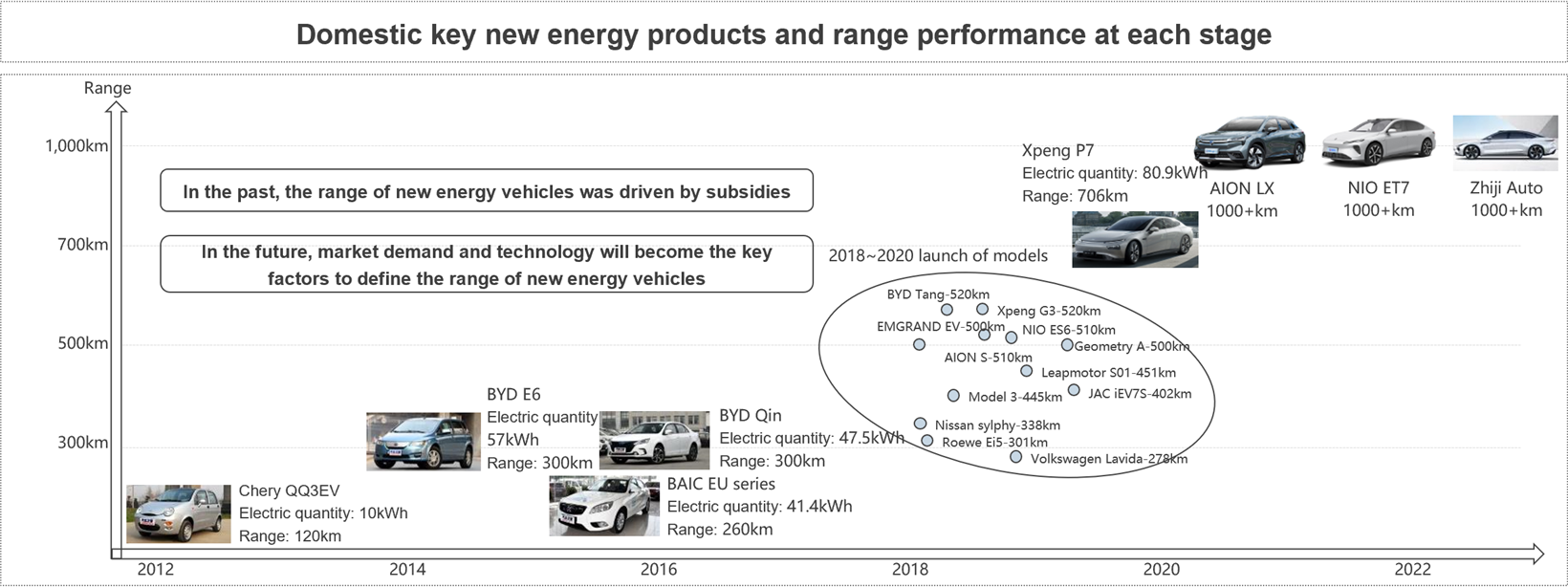

After nearly 10 years of development of electric vehicle, great changes have taken place in EV battery system and range. Power battery developed from lead-acid battery to lithium iron phosphate and to the current mainstream ternary lithium battery, range from 100km to the current 700km. In next two years, electric vehicles will officially step into the era of 1,000km range. ZXZC summarizes on China’s key new energy products and their range performance at each stage.

Battery companies and OEMs continue to deepen cooperation, through material system innovation, process innovation, design innovation and other means to achieve the improvement of battery energy density and vehicle range. The industry as a whole presents a pattern of diversified development, different enterprises to adopt differentiated technical solutions. ZXZC compares the next-generation battery layout of mainstream enterprises.

![]()

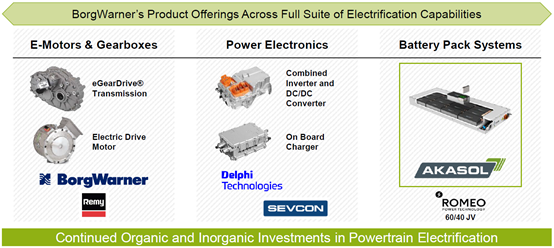

BorgWarner recently announced the acquisition of German battery company Akasol for 754 million euros to expand its commercial vehicle electrification capabilities. Akasol will then be operated independently as a brand under BorgWarner.

In recent years, BorgWarner has tried to accelerate its electrification transformation through acquisitions in the field of battery, motor and electronic controls.

Through the acquisition of Akasol, on the one hand, BorgWarner can further enhance the penetration in the power market in North America (already worked with Romeo Power, a startup of power battery pack in north America), at the same time can infiltrate into the power battery market directly. Romeo Power and Akasol will be the two important pawns of BorgWarner to expand to the commercial vehicle battery market in Europe and North America.

According to BorgWarner's forecast for future market opportunities, the hybrid and electrical sectors are relatively large compared to internal combustion engines.

In terms of auto electrification parts, BorgWarner's current product portfolio mainly covers electric drive modules, and will launch electronic turbochargers, high pressure coolant heaters, 800V inverters and other products in the future.

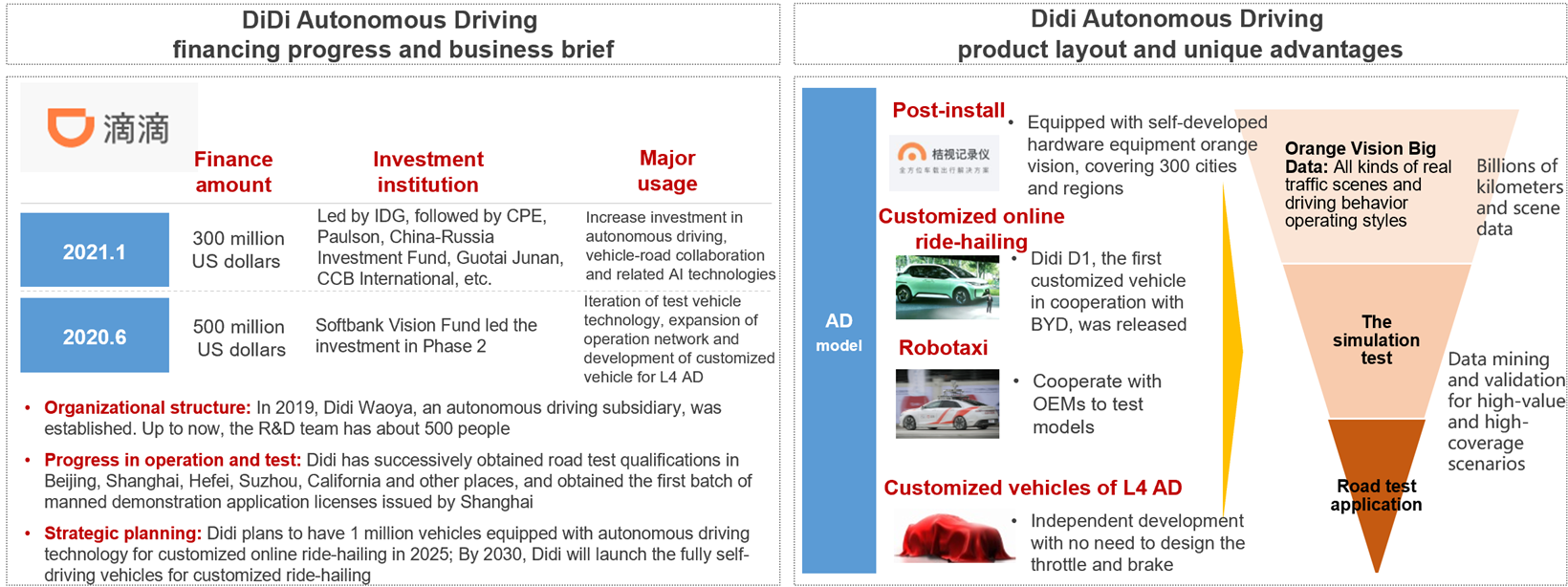

Didi's autonomous driving subsidiary recently raised $300 million in funding led by IDG, bringing its total funding to $800 million. According to the company's autonomous driving product planning, this round of financing will promote the development of its customized vehicle model of L4 autonomous driving and further realize the goal of fully self-driving vehicles for customized online ride-hailing in 2030.

Didi summed up its core strategy of autonomous driving development as DNA, namely Data, Network and AI. At present, Didi has launched RoboTaxi, a self-driving vehicle for online ride-hailing, which adopts a mixed order delivery mode to ensure flexible response to demand.

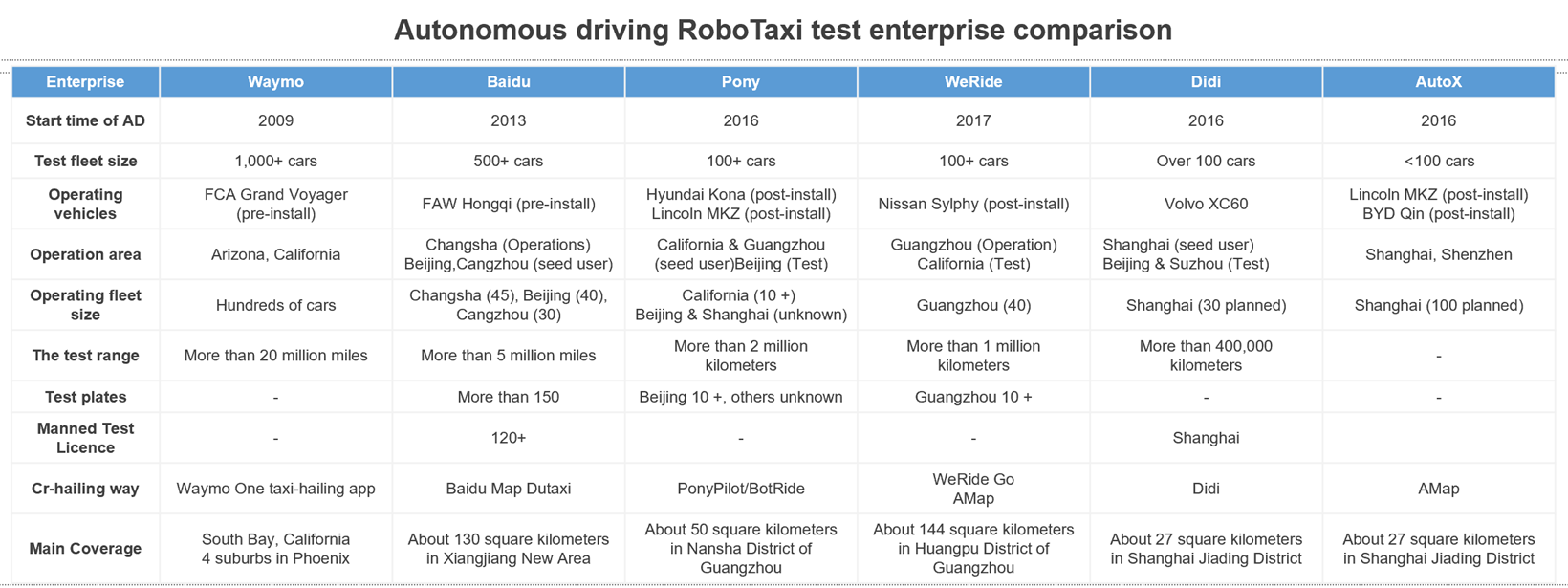

Many Chinese and foreign technology companies have focused on the test and operation services of self-driving taxis. Compared with major players in China market, Baidu is relatively ahead in the test vehicles, range, operation cities and test licenses.

…

【Subscribe to ZXZC Reports】

More automotive industry reports of Chinese automotive industry are available by subscription. ZXZC plans to release 105 reports in 2021 according to the schedule. Click here to get the report schedule: http://autonews.gasgoo.com/70018024.html

For company's subscription, please contact: jingwx@ZXZC.com, or click here to leave your information and we will contact you soon later: http://ZXZC1023.mikecrm.com/KKZNOl6!