China's PV retail sales grow 8.8% year on year in August

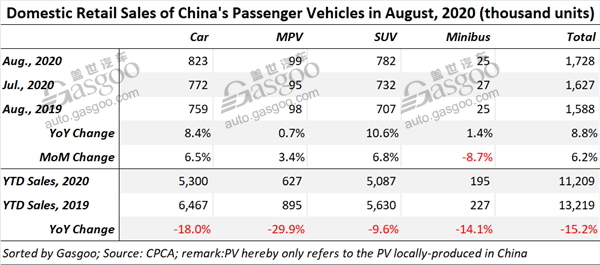

Shanghai (ZXZC)- For the month of August, around 1.728 million locally-produced PVs (referring to cars, MPVs, SUVs and minibuses) were handed over to consumers in China, representing a year-on-year growth of 8.8%, the biggest-ever increase achieved since May 2018, according to the China Passenger Car Association (CPCA).

The upturn in Aug. PV deliveries should owe to the sales growth attained by all of four segments. The car and SUV retail sales evidently rose 8.4% and 10.6% over a year earlier respectively. The MPV deliveries almost remained flat from the year-ago period. Notably, roughly 25,000 consumers took delivery of China-built minibus, a slight year-on-year increase of 1.4%.

Compared to July 2020, China's PV market nabbed a 6.5% increase in deliveries. The CPCA said the roll-out of new products and upgrades of existing models driven by the Chengdu Motor Show, and the greater discounts OEMs and dealers offered in the slack season invigorated the PV market in August earlier than expected.

China's PV market posted robust movement in both July and August. It should be largely thanks to the greater-than-expected recovery in macro-economic climate and export business, especially China's export still showed sustained strength despite the pandemic in Europe and America, which consolidated consumers' confidence, said the association.

Besides, the CPCA also considered that the relatively low year-ago base number due to the implementation of the China Ⅵ emission standards in some regions and the apparent rebound in new energy vehicle (NEV) retail sales also contributed to the overall PV sales growth.

The Aug. retail sales of premium cars surged 32% year on year and climbed 3% month on month. The resilient demands for premium vehicles partly stemmed from the consumption upgrading which encouraged consumers to replace cars with upscale models and the price reduction coming after substantial sales promotions, according to the CPCA.

Besides, the deliveries of the PVs under mainstream joint-venture brands and China's self-owned brands were up 6% and 4% compared to the same period a year ago.

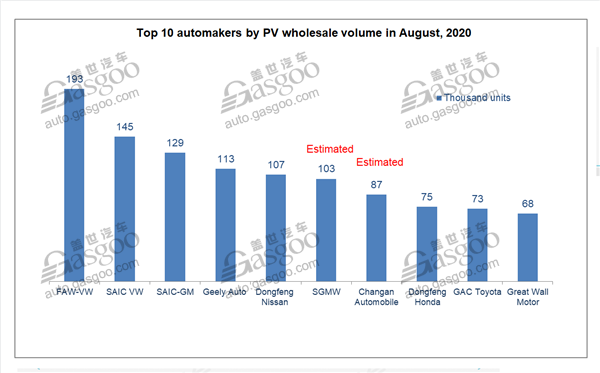

Compared to the previous month, the top five automakers by August homegrown PV retail sales were still FAW-VW, SAIC VW, SAIC-GM, Geely Auto and Dongfeng Nissan. Among them, SAIC VW and Dongfeng Nissan recorded 10.7% and 2.9% year-on-year decrease respectively, while the other three all attained growth.

The occupants of the sixth and the seventh places were still SGWM and Changan Automobile, while got their rankings swapped over a month earlier. Dongfeng Honda once gained appeared on the top 10 list. FAW-Toyota dropped two places to the tenth.

Notably, the No. 6 to the No.10 automakers all garnered double-digit growth in August PV deliveries.

For the first eight months, China's locally-produced PV retail sales slid 15.2% over a year earlier to 11.209 million units. The earlier Spring Festival and the outbreak of the COVID-19 outbreak were primarily blamed for the year-to-date downturn, said the CPCA.

As to the wholesale performance, automakers in China sold roughly 1.766 million domestically-made PVs in August, a 7.1% increase compared to the year-ago period. The Jan.-Aug. PV wholesales dipped 15.6% to 11.251 million units.

The CPCA noted that a large part of OEMs opted to take high-temperature vacation in August. Thus, the wholesales in the month moved higher after a relatively dismal start.

The top 5 automakers by Aug. PV wholesale volume were as same as that of the retail sales. Dongfeng Honda and Great Wall Motor were new comers on the top 10 list if taking the July rankings for reference. SGMW and GAC Toyota moved up two and one spots to the sixth and ninth place respectively.