China gains stronger-than-expected homegrown PV sales in supposed-to-be slack season

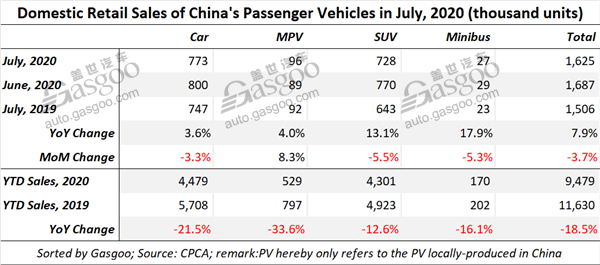

Shanghai (ZXZC)- For the month of July, around 1.625 million PVs locally produced in China (referring to cars, MPVs, SUVs and minibuses) were handed over to consumers, a year-on-year growth of 7.9%, according to the China Passenger Car Association (CPCA). It is also the biggest increase achieved since May 2018.

In the Jan.-Jul. period, the deliveries of homegrown PVs amounted to 9.479 million units, sliding 18.5% from a year earlier, 4 percentage points lower than the decrease in the first-half volume.

The plunge taking place in the first quarter in the wake of COVID-19 outbreak and earlier Spring Festival holiday should be primarily blamed for the downturn in the year-to-date PV retail sales, said the association. However, the contracted decline for the second quarter and the rise shown at the beginning of the second half of 2020 reflected a fast recovery for China’s overall PV industry.

The upturn in retail sales was a combined result of the growth achieved by all of the four segments. Last month, the deliveries of China-made cars, SUVs and minibuses rose 3.6%, 13.1% and 17.9% year on year respectively. Notably, the MPV segment terminated its prolonged drop, which also contributed to the upward movement for the overall PV market.

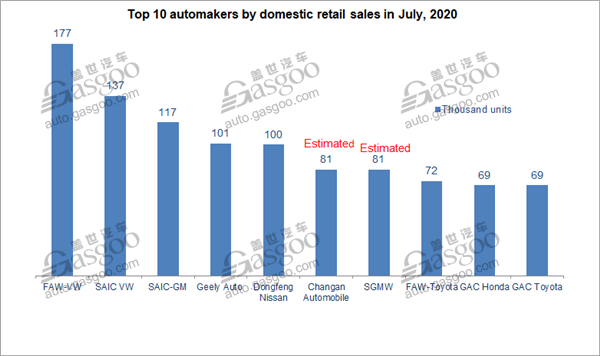

Compared to June, the No.1 to No.3 and the No.6 to No.8 automakers by July PV retail sales remained unchanged. The occupants of the fourth and fifth places were still Geely Auto and Dongfeng Nissan, while got their rankings swapped. GAC Group's two joint ventures—GAC Honda and GAC Toyota, were ranked ninth and tenth respectively.

In terms of wholesale volume, automakers in China sold 1.668 million homegrown PVs in total, representing a 7.4% year-over-year growth, 0.5 percentage points less than that of deliveries. The slower growth indicates that the inventory pressure on dealerships was reducing and the relationship between OEMs and dealers were becoming sounder.

In July, FAW-Volkswagen, SAIC Volkswagen and SAIC-GM were still the top 3 automakers by PV wholesale volume. Geely Auto outsold Dongfeng Nissan, moving up to the fourth place. Both Dongfeng Honda and SGMW climbed two spots to the seventh and eighth places. GAC Honda was a new entrant compared to the ranking for the month of June.

It was supposed to be a slack season for car shopping in July due to the high temperatures. Nonetheless, the final result was better than the industry's expectation. The CPCA attributed this phenomenon to these factors. First of all, coordinated efforts to prevent and control pandemic and the policies launched to boost economy growth smoothed away the operational issue for various industries, so as to further unleash car shopping demands.

The second contributing factor is the full strengthening of some regional markets. Despite the severe flood along the Yangtze River, work and normal life were still resumed in an orderly manner thanks to the effective pandemic prevention and control, which enabled a faster rebound in automobile consumption.

In addition, the recovery of the offline marketing activities also significantly spurred car sales. For instance, such top-level motor shows held in Chongqing, Changchun and Chengdu grabbed attention of many viewers, signifying that the offline market model is still irreplaceable as of today.

Moreover, the car purchase demands in China's central and western regions were further unleashed because migrant workers stuck there due to the pandemic and have to start businesses to earn a living.

Furthermore, the pandemic made some people who attempted to travel abroad shifted to self-drive trips at home, which to some degree stimulated the vehicle sales.

According to the CPCA, the retail sales of premium auto brands leapt 30% from the previous year in July, while dropped 4% from the previous month. Premium cars accounted for 15% of total PV deliveries. Its remarkable recovery should own much to the rising demands in replacing old cars with premium vehicles and the price cut of luxury vehicle models.