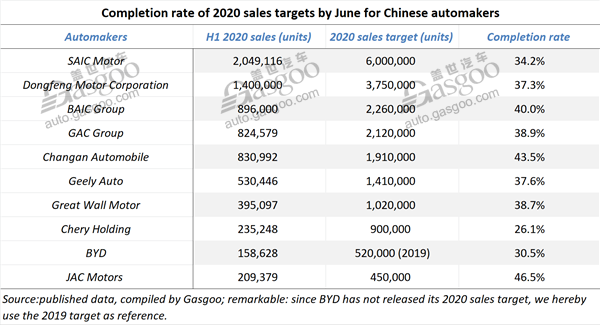

Summary: 2020 H1 sales target completion rates of major Chinese automakers

Shanghai (ZXZC)- ZXZC hereby compiled the first-half 2020 sales results and annual sales goals announced by ten mainstream Chinese automobile groups. Primarily bruised by the COVID-19 pandemic, none of them has achieved 50% of their sales targets. Only three of them—BAIC Group, Changan Automobile and JAC Motor—fulfilled over 40% of respective goals. Chery Holding features the lowest completion rate even though it has already reduced its target by 100,000 units.

SAIC Motor's PV units post sweeping drops

SAIC Motor sold 479,464 new vehicles in June, achieving a 2.77% year-on-year growth. This is also the first-time increase the Chinese biggest automaker gained in 2020.

For the first half of the year, the automaker completed 34.2% of its 6-milliom-unit sales target by selling 2,049,116 vehicles in total.

(Passat, photo source: SAIC Volkswagen)

PV units witnessed sweeping drops in Jan.-Jun. sales. Two major joint ventures—SAIC Volkswagen and SAIC-GM—saw their cumulative sales plunged 37.18% and 33.31% respectively to 577,385 units and 556,206 units. Besides, the sales of SAIC Motor PV and SAIC-GM-Wuling fell 22.52% and 28.69% from a year earlier.

Apart from the impact of COVID-19, there were other factors leading to the 37.18% decrease in SAIC-Volkswagen’s H1 wholesales. The sales contributors of SAIC Volkswagen were still such models as the Lavid, the Tiguan, the Tharu and the new Santana. Although the joint venture put the Viloran onto the market in late May, it is rather difficult for the MPV model to bring a sales hike in the near term.

BAIC Group fulfills 40% of 2020 sales target

BAIC Group sold roughly 896,000 vehicles from January to June, completing 40% of its 2.26-million-unit sales goal, the automaker revealed at its mid-year operation and management conference.

(Mercedes-Benz GLB SUV, photo source: Beijing Benz)

Foton Motor, Beijing Benz, Fujian Benz and Beijing Benz accounted for over 94% of the group's H1 sales. According to the data offered by subsidiaries and the China Passenger Car Association (CPCA), the sales of Beijing Benz and Fujian Benz totaled around 284,000 units, while Foton Motor and Beijing Hyundai sold about 325,000 units and 235,000 units respectively.

However, the performances of BAIC's self-owned PV arms were comparatively gloomy. With only 3,008 units sold, BAIC BJEV suffered an 88.46% slump from the previous year. In the Jan.-Jun. period, the NEV unit saw its cumulative sales sharply dip 77.44% to 14,700 units.

Dongfeng Motor's join ventures score growth in H1 sales

Dongfeng Motor said via its WeChat account that the group's June sales climbed 9.77% year on year to 322,200 units, representing the third-month-in-a-row YoY growth. Its H1 sales amounted to 1.4 million units, versus 1.698 million vehicles sold during the year-ago period.

(Sylphy, photo source: Dongfeng Nissan)

Major joint ventures featured stable rebound with the pandemic ebbing in China. Dongfeng Nissan sold 107,700 vehicles (+9.7%) in June, achieving year-on-year growth for three consecutive months. Dongfeng Honda's June sales jumped 16.9% from a year ago to 77,400 units. Moreover, Dongfeng-Yueda-Kia sold 22,200 units last month, which were more than the year-ago level.

The CV branch obtained a significant growth in the first half of the year. Dongfeng Motor announced that its CV sales rose 10% to 345,500 units for the first six months, of which 106,600 units were the medium-/heavy-duty trucks sold by Dongfeng Trucks, a year-over-year increase of 9.6%.

Regardless of the sever impact of COVID-19 pandemic, Dongfeng Motor hasn’t lowered its 2020 sales and profit goals. The automaker will strive to sell 3.75 million vehicles and gain not less than 40 billion yuan ($5,714,204,000) in both annual profit and operational cash flow.

GAC Group fulfills 38.9% of annual sales goal

GAC Group said its sales in June only edged down 1.26% from a year earlier to 186,587 units, while jumped 12.66% compared to May.

The group sold a total of 824,579 new vehicles during the first two quarters, posting a 17.51% decrease, 3.79 percentage points lower than the decline in Jan.-May volume. As of June, GAC Group fulfilled 38.9% of its 2020 sales target.

(Trumpchi GS4, photo source: GAC Motor)

Amid the general downturn for the overall China's auto market, GAC Group failed to complete its 2.225-million-unit sales target set for 2019. Affected by the pandemic, it decided to reduce its 2020 sales growth rate target to 3% from 8%.

In June, GAC Honda achieved all-time highs in both outputs and sales, said GAC Group. The joint venture saw its June wholesales leap 14.26% year over year to 83,293 units with four models recording sales of over 10,000 units. In the Jan.-Jun. period, it sold a total of 318,451 vehicles.

The year-on-year growth in GAC Toyota's year-to-date wholesales returned to positive for the first time this year. By selling 320,888 vehicles so far this year, it is honored the biggest sales contributor to the entire group.

Changan Automobile completes 43.5% of target

Chongqing Changan Automobile Co., Ltd. (called “Changan” for short) saw its sales surged 38.11% from a year ago to 194,406 units in June, which made its year-to-date sales represent growth for the first time so far this year.

By the end of June, the automaker has completed 43.5% of the 1.91-million-unit target it strives to achieve in 2020.

(Ford Focus Active, photo source: Changan Ford)

The increase in H1 sales should owe much to the robust jumps gained by Hefei Changan and Changan Ford. The Sino-U.S. joint venture boasted a 29.65% year-on-year growth with 97,448 vehicles sold.

Changan said the sales of its self-owned PV brands climbed 6.64% over the prior-year period to 420,400 units for the first six months. Nevertheless, Changan Mazda saw its H1 sales drop 8.37% to 56,041 units.

Geely Auto completes 38% of annual sales target

With 530,446 units sold as of June, Geely Auto has completed 38% of its 1.41 million-unit annual sales goal. Pummeled by the pandemic, the automaker still determined not to change this target.

Among vehicles sold between Jan. and Jun., there were 324,061 SUVs and 197,030 sedans.

(Lynk & Co 02, photo source: Lynk & Co)

The automaker still heavily relies on the Emgrand, the Boyue and Lynk & Co-branded vehicles in seizing market shares. Lynk & Co saw its June sales soar around roughly 53% to 13,214 units, hitting a new-high level for the past seven months. As of June, the brand has received year-on-year two-digit growth for three straight months.

Great Wall Motor achieves 38.7% of 2020 sales goal

For the first half of the year, GWM saw its sales dip 19.95% over a year ago to 395,097 units, fulfilling 38.7% of its 2020 sales goal.

Except the Great Wall pickup, the other businesses units, including Haval, WEY and ORA, all posted plunge in H1 sales.

The H1 sales of Haval-branded SUVs dwindled 25.69% to 262,216 units. Aside from the Haval H9 and M6, the other models all recorded year-on-year decrease of over 25%.

(All-new Haval H6, photo source: Haval)

With 121,771 units sold so far this year, the best-selling Haval H6 had a 33.28% plunge in H1 sales. An industry insider said that the Haval H6 is approaching a critical point of upgrading and changeover. Compared to the other models in the same segment, the Haval H6 based on the old platform features the weaker competitiveness due to its high fuel consumption. According to the automaker, the third-generation Haval H6 will go on sale in this year's third quarter.

WEY, the SUV brand targeting premium market, saw its H1 sales plummet 43.18% to 26,639 units. Posting a year-on-year slump of 65.07%, the BEV-focused ORA was significantly outpaced by the overall NEV market that faced a 37.4% decline in H1 sales, according to the China Association of Automobile Manufacturers (CAAM).

Chery Holding's sales target completion rate only stands at 26.1%

Chery Holding sold 46,189 new vehicles in June, a growth of 10.9% over a month ago. The company said it has gained month-on-month increase for the fourth month in a row.

For the first half of the year, Chery Holding sold 235,248 vehicles, including 41,799 PVs, which were 42% more than the year-ago level.

The group has decreased its 2020 sales target from 1 million to 900,000 units, Yin Tongyue, chairman of Chery Holding, revealed in May at this year's two sessions. It completed only 26.1% of the lowered sales goal during the first half of the year.

(Tiggo 3X, photo source: Chery Automobile)

To revive businesses depressed by the COVID-19 pandemic, Chery Holding said it spared no effort to stabilize production and increase operational efficiency by adopting measures like helping dealers relieve stress, grabbing the chance of governmental policies, innovating in marketing models and satisfying the post-pandemic consumers' demands.

For instance, Chery Automobile provided a 60 million yuan ($8,571,306) worth of special fund for its dealerships. Jetour rolled out a series of policies, such as reducing interest on loans and offering housing and operation subsidies, to ease pressure for dealers.

During the first two quarters, Chery Holding successively rolled out such new models as the new Tiggo 7, the new Tiggo 8, the Jetour X70M, the Jetour X70 Coupe and the Cowin Xuanjie, which are expected to further drive the groups' sales with the pandemic abating in China.

BYD's H1 NEV sales more than halved over a year ago

BYD sold a total of 158,628 new vehicles during the first two quarters, logging a 30.45% plunge over a year ago.

The company has not announced its 2020 sales target. Taking the 2019 goal as a reference, BYD just finished 30.6% of the 520,000-unit target as of June.

With 60,677 units sold in total, its NEV sector was hit by a year-over-year decrease of up to 58.34% for the first six months.

(Tang DM, photo source: BYD)

Part of the explanations for the NEV sales downturn is that consumers' purchasing power was somewhat curtailed due to their wait-and-see attitude towards the BYD Han, an all-new flagship NEV sedan model that hit the market on July 12, according to a senior analyst from ZXZC Auto Research Institute (GARI). On the other hand, consumers have been distracted by other new products as automakers are scrambling to deploy NEV businesses and put NEV products onto the market, he added.

JAC Motors boasts highest completion rate of 46.4%

JAC Motors witnessed its Jan.-Jun. sales fall 10.96% over the year-ago period to 209,379 units. After six months of the year passed, the Hefei-based automaker completed 46.5% of its 2020 sales target, boasting the highest completion rate among automakers listed here.

(JAC Shuailing Q3, photo source: JAC Motors)

Its CV sales reached 142,587 units in the first half, edging up 1.86% year over year, versus the 29.81% slump in PV sales. Some market analysts reckoned that the release of the pent-up consumption demands, the promotion of infrastructure construction and the phase-out of China Ⅲ vehicles all resulted in the sales hikes in the H1 CV sales, especially truck sales.

Compared to CV's blooming performance, JAC's PV unit was much eclipsed. The company said it only sold 66,792 PVs in the Jan.-Jun. period, a year-on-year decrease of 29.81%.