Summary of Chinese mainstream automobile groups’ May sales

Shanghai (ZXZC)- China auto sales reached 2.194 million units in May, jumping 14.5% from a year ago respectively, according to the China Association of Automobile Manufacturers (CAAM).

The auto market is posting gradual rebound as consumers' pent-up demands have been unleashed thanks to the country’s effective pandemic prevention and control, companies' faster move on the resumption of work and production, and the launch of policies to stabilize employment and the incentives to spur car sales, said the association.

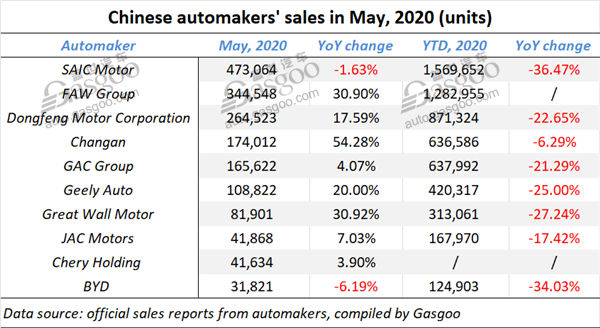

Amid the general resilient milieu, quite a few mainstream automakers in China logged double-digit growth in their May sales, such as FAW Group, Dongfeng Motor, Changan, Geely Auto and JAC Motor. Notably, Changn gained a remarkable increase of 54.28%. In addition, the decrease in SAIC Motor and BYD continued to shrink.

SAIC Motor says May sales only drop 1.63% YoY

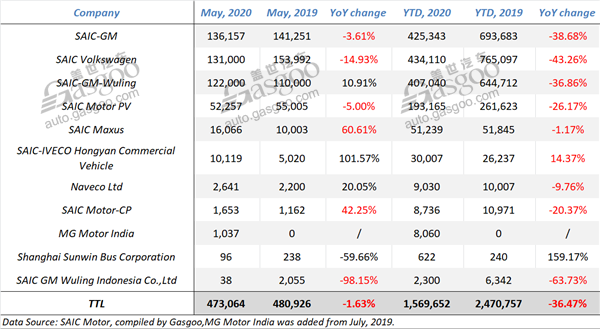

SAIC Motor reported a wholesale volume of 473,064 vehicles in May, representing a slight year-on-year decrease of 1.63%. With 1,569,652 units sold in total, the Chinese automaker posted a 36.47% decline for the first five months, 8.42 percentage points fewer than the drop in Jan.-Apr. volume.

The sales of two PV joint ventures have been back to normal. In May, SAIC-GM saw its wholesales edge down 3.61% over a year ago to 136,157 units, for the first time outnumbering SAIC Volkswagen (“SAIC VW” for short) over the past 21 months. Compared to April, it also achieved a 23.78% growth.

The manifest recovery in SAIC-GM sales mainly stemmed from both the strengthened sales promotion and the faster launch of new products. In the month of April and May, the joint venture rolled out a number of heavyweight new models such as the Cadillac CT4, the Chevrolet Blazer, the new-generation Buick GL8 ES and GL8 Legacy and the refreshed Buick sedan family.

(New Baojun, photo source: SAIC-GM-Wuling)

Amid the COVID-19 pandemic, SAIC-GM-Wuling must be the least-hit and fastest-recovering one among all SAIC's subsidiaries. Its wholesales in May amounted to 122,000 units, rising 10.91% over the year-ago period. Besides, the joint venture also boasted a year-over-year hike of 47.7% with 13,588 completed vehicles exported during the first five months, SGMW announced via its WeChat account.

FAW Group once again obtains double-digit YoY sales growth

FAW Group output and sold 352,273 and 344,548 complete vehicles in May, up by 23.5% and 30.9% year on year respectively, versus the 20.4% growth in its April sales.

Hongqi saw its May sales rose precipitously 133.3% from the previous year to 15,103 units, and its production outputs soared 97.2% to 16,002 units.

The sales of Besturn and FAW-Mazda aggregated 18,226 cars in May, jumping 27% over a year earlier, and their combined outputs reached 19,255 units.

(Mazda6 Atenza, photo source: FAW-Mazda)

FAW Group's independent business unit set for Mazda brand officially started operation on June 1, and it will take over the whole operational businesses of the Sino-Japanese brand from FAW Car Co., Ltd, according to the Chinese state-owned automaker.

Under the group's direct leadership, FAW-Mazda is expected to grow faster by virtue of higher management efficiency, more autonomy in decision making, stronger control of production quality and less pressure in gaining short-term profits.

FAW-Volkswagen (FAW-VW) produced and sold 193,746 (+31.7%) and 184,322 vehicles (+36.5%) last month, according to FAW Group.

The Sino-German joint venture said it was once again honored the champion in China PV market in May with a delivery volume of 186,777 units, a year-on-year jump of 22% and a month-on-month growth of 12.7%.

Additionally, FAW-Toyota posted a 1.2% year-over-year increase with 72,035 vehicles sold in May.

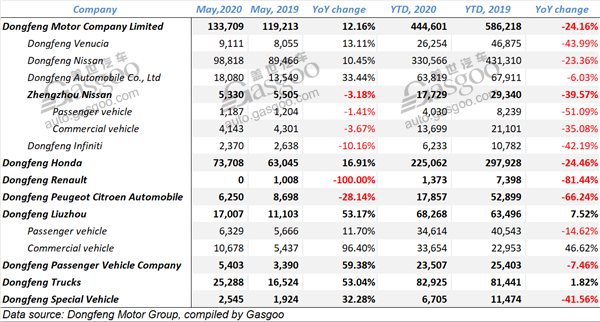

Dongfeng retains growth from April, while Dongfeng Renault logs zero sales

The Wuhan-headquartered Dongfeng maintained its YoY rising momentum from April with 264,523 vehicles sold last month.

Both PV and CV sectors posted double-digit increase in May sales. Within the PV unit, car and MPV sales rose 11.42% and 13.56% year on year respectively, and the growth in SUV sales stood at 6.06%.

Dongfeng Motor Company Limited gained a 12.16% YoY growth thanks to the upward movement showcased by Dongfeng Venucia, Dongfeng Nissan and Dongfeng Automobile Co.,Ltd.

Dongfeng Honda saw its May sales leap 16.91% to 73,708, which significantly contributed to the group’s overall sales. According to Honda’s China branch, the joint venture's retail sales reached 65,534 units, with three models—the Civic, the CR-V and the XR-V—having their respective deliveries exceed 10,000 units.

(Koleos, photo source: Dongfeng Renault's WeChat account)

Dongfeng Renault failed to sell even a single car. The “zero” might stem from a preliminary agreement reached by Dongfeng Motor and Renault S.A., saying the French parent would transfer its 50% stake in the joint venture to the former, and Dongfeng Renault would stop its activities related to Renault brand. It signifies that the Sino-French joint venture will bow out of operation in the world’s largest auto market.

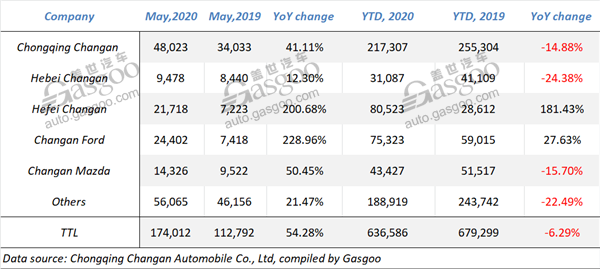

Changan clocks 54.28% YoY hike in May sales

Chongqing Changan Automobile Co., Ltd. (called “Changan” for short) saw its May sales surge 54.28% over a year earlier to 174,012 units, keeping a double-digit growth after April.

Thanks to the vigorous increase in May, the decrease in Changan's year-to-date sales has shrunk to 6.29%, versus the 18.45% drop in Jan.-Apr. sales.

The automaker's self-owned subsidiaries—Chongqing Changan, Hebei Changan and Hefei Changan—all attained evident year-over-year growth. Of them, Hefei Changan boasted the biggest one, and its year-to-date sales also showed a 181.43% upward movement.

The growth in the respective sales of two joint ventures—Changan Ford and Changan Mazda—was quite impressive. Changan Ford clocked a stupendous growth of 228.96%, which made its year-to-date sales represented positive increase for the first time so far this year.

(Ford Escape, photo source: Changan Ford)

Changan Ford's blooming performance was linked to the general upturn in China's overall auto market as coronavirus has been ebbing there. Another contributing factor is that the automaker changed its strategy to “basing production on sales” from the previous “basing sales on production”. The adjustment was also good for perfecting the relation with dealers and arousing their initiatives.

Changan Mazda's May sales soared 50.45% from the prior-year period to 14,326 units. The Sino-Japanese joint venture said there were 8,341 consumers took delivery of the Mazda3 Axela cars, a month-on-month surge of over 30%.

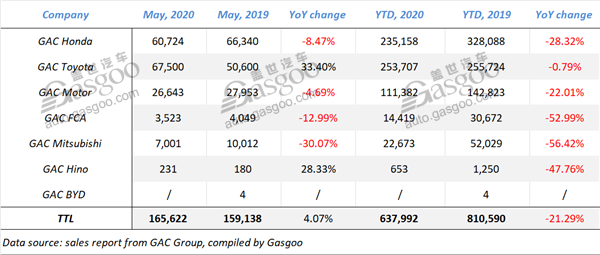

GAC Group gains growth in May thanks to GAC Toyota’s sales hike

GAC Group's auto sales stood at 165,622 units in May, rising 4.07% compared with the same period last year, said the automaker. Although the growth in year-to-date sales still remained negative, it was 6.2 percentage points fewer than the drop in Jan.-Apr. sales.

The PV and CV sectors posted 4.05% and 25.54% year-on-year increase in May sales. Of the 165,391 PVs sold last month, there were 78,522 cars (-6.79%), 8,167 MPVs (-6.21%) and 78,702 SUVs (19.23%). CV sales jumped 25.54% over a year ago to 231 units.

GAC Group's upturn in May sales should be mainly attributable to the blooming growth offered by GAC Toyota. The Sino-Japanese joint venture saw its wholesales leap 33.4% year over year to 67,500 units, which made the decline in its year-to-date sales narrowed to only 0.79%.

(Wildlander, photo source: GAC Toyota)

GAC Toyota announced its retail sales in May surged 32.1% from the previous year to 68,518 units. There were 48,532 consumers taking delivery of the TNGA-based models, representing a significant growth of 122% from the prior-year period, which included 15,513 Camry cars, 20,629 Levin cars (+81%) and 7,588 Wildlander SUVs, the sibling of the Toyota RAV4 that just hit the market in late February.

Geely Auto attains 20% YoY sales growth in May

Geely Automobile Holdings Limited and its subsidiaries (collectively referred to as the “Group”) sold 108,822 new vehicles in May, a year-on-year jump of roughly 20% and a month-on-month increase of 3%, the automaker announced on June 5.

Of the vehicles sold in May, 6,101 units were the so-called new energy and electrified vehicles (NEEVs), including the Geometry A, the Emgrand EV and the Emgrand GSe. Geometry, Geely's BEV-focused brand, is going to launch its second mass-produced model the “Geometry C”, which is also the brand's first SUV model.

Lynk & Co brand saw its May sales soar around roughly 41% to 12,950 units, hitting a new-high level for the past six months.

(Photo source: Geely Auto's WeChat account)

Nonetheless, the automaker was still hit by a 25% year-over-year decline in the Jan.-May sales for the coronavirus reason. With 420,317 units sold as of May, the Group has completed 30% of its 1.41 million-unit annual sales target.

If the sales goal stays unchanged this year, Geely Auto must double its efforts in the remaining seven months. To fulfill that target, the company plans to roll out six all-new models—the ICON, the Haoyue, the Preface, the Geometry C, the Lynk & Co 05 and 06, and several refreshed models to enrich its existing lineup and carve out new segments.

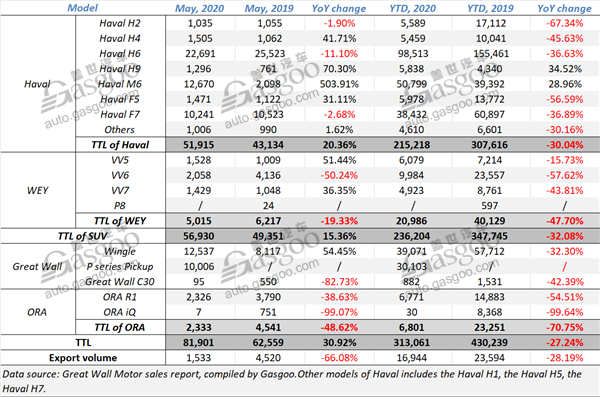

Great Wall Motor achieves 2020’s first-time YoY sales growth

Great Wall Motor (GWM) said its Jan.-May auto sales slumped 27.24% year on year to 313,061 units. However, the company recorded a 30.92% hike in May sales, which was also its first-time growth for the year of 2020.

Among 56,930 SUVs sold last month, 51,915 vehicles bear the Haval brand. Compared to the prior-year period, the popular SUV marque acquired a 20.36% year-over-year surge, which made its year-to-date decrease shrink to 30.04%.

With respect to the sales of specific models, the Haval H4, H9, M6 and F5 all had growth of over 30%, especially the increase in the Haval M6 sales stood at 503.91%. Thanks to the robust jump offered in May, both Haval H9 and M6 have seen the year-on-year change in their year-to-date sales turn positive.

(WEY VV7, photo source: GWM)

WEY, the SUV brand carrying GWM's ambition to move upscale, saw its sales fall 19.33% in May. Nevertheless, the sales of the VV5 and the VV7 soared 51.44% and 36.35% compared to the year-ago period respectively.

Last month, the automaker still dominated China's pickup market by taking nearly 50% market share. Specifically, the sales of the P series pickup leapt 25% month on month to 10,006 units, the best-ever monthly performance since it hit the market.

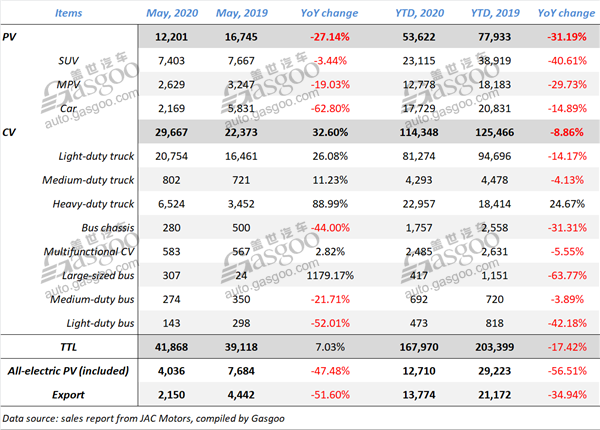

JAC Motors' May sales climb 7.03% from a year earlier

JAC Motors' new vehicle sales climbed 7.03% over a year ago to 41,868 units in May, while edged down 1.99% compared to April.

Affected to some policy factors like the governmental support in new infrastructure investment and the elimination of motor vehicles under the China Ⅲ emission standards or below, the company's CV sales continued to grow. In May, the light-duty and heavy-duty truck sales surged 26.08% and 88.99%, substantially resulting in a 32.6% increase in total CV sales.

(iC5, photo source: JAC Motors' WeChat account)

Last month, the automaker's PV sales shrank 27.14% from a year earlier to 12,201 units, of which 4,036 units (-47.48%) were all-electric vehicles. With the advent of the iC5 BEV, JAC Motor has ushered in a new era of BEV development.

The Hefei-based automaker recently drew a lot of public attention due to the transaction with Volkswagen Group. The German auto giant agrees to purchase 50% in JAC Motors’ parent company, Anhui Jianghuai Automobile Group Holdings Limited, and raise its equity stake in the joint venture JAC Volkswagen to 75% from 25%.

Chery Holding's Jan.-May exports surge despite worldwide coronavirus spread

Chery Holding announced its auto sales in May climbed 3.9% over a month ago to 41,634 units, displaying month-on-month growth for the third month in a row.

Its overseas markets' performance hasn't been whittled down by the worldwide spread of the novel coronavirus. The company said it exported a total of 35,279 PVs during the first five months, a remarkable growth of 53.3% from a year ago. Of those, 5,454 units were sold in May, which rose 2.1% compared to April.

(The all-new Tiggo 8, photo source: Chery Automobile)

Chery Holding stated its PV sector posted a 6.8% month-over-month increase in May sales. The brands like Chery, EXEED, Chery Jaguar Land Rover (CJLR), Cowin and Qoros all attained growth compared to April.

CJLR boasted a substantial year-on-year growth of 38.3% in its May wholesale volume, which was also 24.2% more than that of a month ago, the Sino-British premium auto joint venture announced on June 4.

Moreover, the sales of Chery Holding's NEV unit, which operates the eQ1 (at home also known as AnteQ), the Tiggo e, the Arrizo e and others, climbed 7.6% over the previous month.

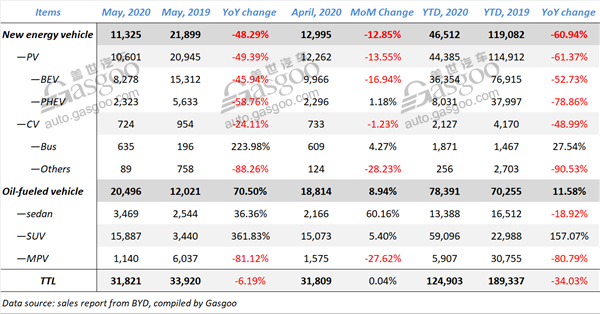

BYD posts smaller YoY decrease in May sales

BYD said it sold 31,821 new vehicles in May, which slid 6.19% year on year, versus the 15.94% decrease in April sales. Its year-to-date auto sales still plunged 34.03% from a year ago to 124,903 units.

The contracted decline in BYD's sales coincides with the general growth trend for China's overall auto market. “With the coronavirus epidemic ebbing in China, the pent-up demands have been unleashed and the auto market is resilient in part due to the efficacy of the governmental incentives and frequent roll-out of new products,” said the aforementioned analyst for GARI.

(BYD Tang EV, photo source: BYD)

BYD's NEV sales reached 11,325 units last month, tumbling 48.29% over a year earlier and falling 12.85% over a month earlier. With 46,512 units sold in total, its NEV sector suffered a year-over-year slump of 60.94% for the first five months.

Part of the explanations for the NEV downturn is that consumers' purchasing power was somewhat curtailed due to their wait-and-see attitude towards the forthcoming BYD Han, an all-new flagship NEV sedan model that is set to hit the market this month, according a senior analyst from ZXZC Auto Research Institute (GARI). On the other hand, consumers have been distracted by other new products as automakers are scrambling to deploy NEV businesses and put NEV products onto the market, he added.

In June, the BYD Han, BYD's all-new flagship sedan to its “Dynasty” series, will go on sale with four variants—three BEVs and one PHEV—offered at one go.

However, the ZXZC's analyst also pointed out that relying on a single model is far from a done deal, especially in the NEV market that embraces so many powerful rivals. Stabilizing and improving the competitiveness of its whole NEV matrix and recovering to the former growth level are more important than anything else.