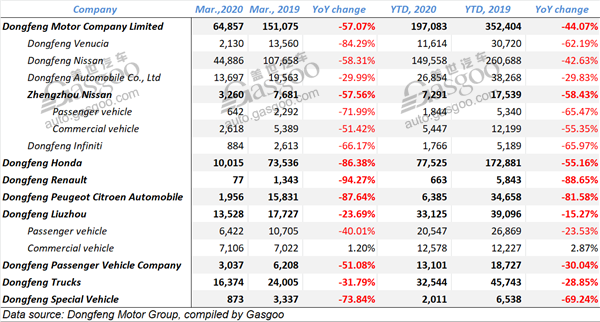

Summary of Chinese mainstream automobile groups’ Q1 sales

Shanghai (ZXZC)- China auto sales for the month of March tumbled 43.3% year on year to 1.43 million units, making the first-quarter (Q1) sales aggregate 3.672 million units with a 42.4% decrease, according to the China Association of Automobile Manufacturers (CAAM).

The sharp downturn was substantially triggered by the COVID-19 spread. With the alleviation of the pandemic, the vehicle sales volume in March has remarkably rebounded over the previous month for both the overall market and each automaker.

Among the mainstream Chinese auto groups listed above, SAIC Motor and Dongfeng Motor Corporation saw their Mar. sales more than halved from a year earlier. The state-run FAW Group also reported its quarterly sales, and revealed that its premium brand Hongqi became one of the few brands in China that achieved growth.

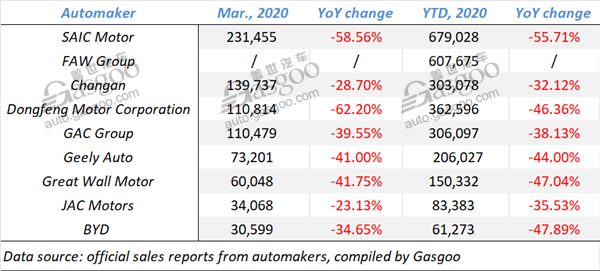

SAIC Motor

SAIC Motor saw its first-quarter (Q1) sales slump 55.71% from a year ago to 679,028 units with most of its subsidiaries hit by the coronavirus-caused downturn as well.

The Q1 sales volume of three major joint ventures—SAIC Volkswagen, SAIC-GM-Wuling and SAIC-GM—were all more than halved over the year-ago period.

With regard to overseas businesses, MG Motor India sold 6,928 vehicles during the first three months, and SAIC GM Wuling Indonesia Co.,Ltd. posted a 23.83% year-on-year decrease with 2,174 vehicles sold in total.

(Photo source: Roewe RX5 MAX, photo source: SAIC Group)

In March, the Chinese biggest automaker encountered a 58.56% plunge over the previous year, while achieved a tremendous rebound compared to 47,365 units sold in February.

SAIC-GM-Wuling (SGMW) still outsold the other subsidiaries in spite of the 55.88% year-over-year decline. The joint venture said its retail sales in March topped 130,000 units, taking the championship from Chinese indigenous auto brands by deliveries.

FAW Group

FAW Group output and sold 556,948 and 607,675 complete vehicles respectively in the first quarter of 2020 (Q1), the Chinese state-owned automaker announced on April 8.

(Hongqi HS7, photo source: Hongqi)

The year-to-date outputs and sales of the premium Hongqi brand reached 21,626 units and 25,001 units respectively, surging 75.4% and 87.4% over a year ago. This is an extremely uplifting performance as the whole market was substantially bruised by the coronavirus pandemic.

There were 22,006 consumers taking delivery of Besturn-branded cars during the first quarter, a year-on-year growth of 12%. The Q1 wholesale volume edged up 0.5% to 21,216 units.

The truck manufacturing maker FAW Jiefang output 87,882 units and sold 108,066 units from January to March.

With regard to joint ventures' performance, sales volumes of FAW-Volkswagen and FAW-Toyota stood at 319,596 units and 122,969 units in Q1.

Selling 14,106 vehicles so far this year, FAW-Mazda overfilled its Q1 sales target with the market share rising 21% year on year.

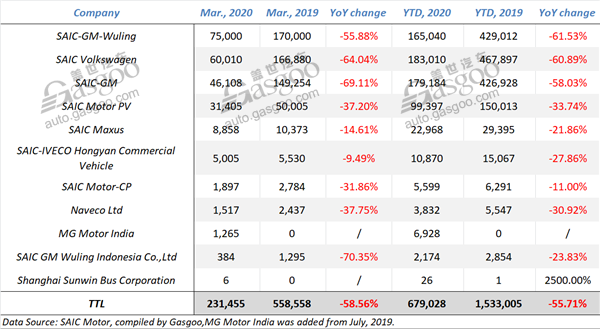

Changan

Chongqing Changan Automobile Co., Ltd. (Changan) announced that its March sales slid 28.7% over a year ago to 139,737 units, while skyrocketed 385.8% compared to that of February. Of those, the sales of homegrown vehicles reached 113,821 units, including 56,904 SUVs.

For the first quarter of 2020, the automaker sold 303,078 new vehicles, posting a year-on-year decrease of 32.1%.

(Changan CS75 PLUS, photo source: Changan Automobile)

There were four models whose respective sales exceeded 10,000 units in March. With 18,424 units sold in total, the Changan CS75 series achieved an impressive growth of 35.2% from the previous year. The other three were the CS35, the EADO and the Changan Oushang X7 with respective sales volumes of 10,891 units, 10,432 units and 11,677 units.

Due to the factors of coronavirus and Spring Festival holiday, most subsidiaries still suffered double-digit downturn over a year ago. Nevertheless, Hefei Changan still boasted a year-over-year surge of 132.7%, and its growth in year-to-date sales stood at 122.9%.

Two major joint ventures—Changan Ford and Changan Mazda—clocked 27.9% and 52.8% year-on-year slump in March respectively.

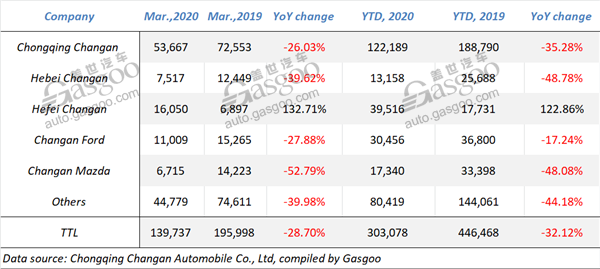

Dongfeng Motor Corporation

Dongfeng Motor Corporation faced the sharpest decrease in March sales as it trailed others in work resumption due to the lockdown still remaining in its headquarters Wuhan.

The sales slump should be more ascribed to the decrease in PV sales. Last month, the group sold a total of 70,049 PVs, nosediving 70.05% from a year ago. Both SUV and MPV branches were hit by decline topping 70%.

For the first quarter, its auto sales plunged 46.36% year on year to 362,596 units, only fewer than that of SAIC Motor.

(Sylphy, photo source: Dongfeng Nissan)

Dongfeng Motor Company Limited, the 50/50 joint venture between Dongfeng and Nissan, saw its Q1 sales fall 44.07%. In March, it encountered a 57.07% year-on-year drop, versus 75.18% decrease in Feb. sales.

Dongfeng Honda had an 86.38% plunge in Mar. sales. Thanks to its rising performance in Jan., the decrease for the first three months was at 55.16%.

Both Dongfeng Renault and DPCA (Dongfeng Peugeot Citroen Automobile Co.,Ltd.) witnessed year-to-date sales plummet over 80%.

By signing a non-binding memorandum, Dongfeng stated on April 14 it had reached a preliminary agreement with Renault, which intended to transfer its 50% equity stake in Dongfeng Renault to the Chinese parent. Besides, the joint venture would stop its activities related to Renault brand.

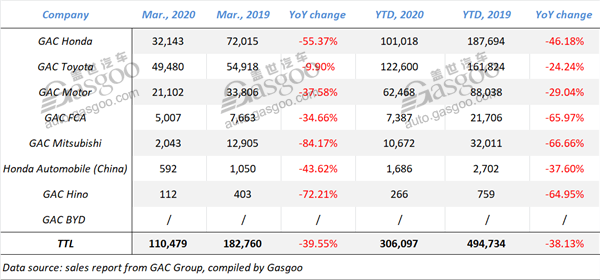

GAC Group

In March, GAC Group clocked a year-on-year sales drop of 39.55%, but saw a significant rebound compared to the previous month. Year-to-date sales fell 38.13%, versus 42.4% slump in China's overall sales announced by the China Association of Automobile Manufacturers (CAAM).

NEV sales in March soared 130% over a year ago to 4,111 units, of which 3,503 units (+121%) were the contribution of GAC NE. The sales volume of the Aion S reached 2,957 units, which made the model's Q1 sales total 7,038 units.

GAC Trumpchi, GAC Group's self-owned PV brand, sold 17,644 vehicles in total last month. During the same period, its export volume surged 114.5% over the prior-year period to 2,714 units.

(The second-generation Trumpchi GS4, photo source: GAC Group)

Trumpchi put forth great efforts to reduce inventories, upgrade main products and improve marketing system in 2019. The second-generation Trumpchi GS4 hit the market in last November, and for the first time introduced Tencent's in-car WeChat, an extremely popular instant messaging app in China.

The respective sales volumes of the GAC Honda, GAC Toyota and GAC Mitsubishi were 32,143 units, 49,480 units and 2,043 units in Mar. Among them, GAC Toyota posted a 9.9% year-over-year decline, versus 79.78% drop for Feb.

Geely Auto

Geely Auto's vehicle sales volume (including the Lynk & Co brand) reached 73,201 units in March, tumbling roughly 41% over a year ago, but skyrocketing 245% from February.

The sales for domestic market slid around 40% year on year to 69,869 units last month. Export business also took a hit with the volume plunging about 60% to 3,152 units.

(Photo source: Geely Auto's WeChat account)

With 48,414 units sold in March, the SUV arm outsold both the sedan and the MPV sectors, whose sales volumes amounted to 23,593 units and 1,014 units respectively.

Besides, Geely Auto sold 2,503 new energy and electrified vehicles (NEEVs) in March.

During the same month, Lynk & Co sold 7,369 vehicles in total.

Due to the continual impact of COVID-19 spread, the automaker saw its first-quarter sales plummet 44% from the year-ago period, only achieving 15% of its annual sales target of 1.41 million units in 2020.

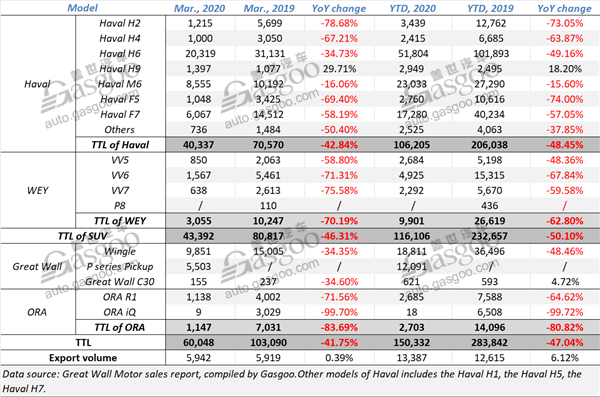

Great Wall Motor

Great Wall Motor (GWM), China's biggest SUV and pickup manufacturer, announced its vehicle sales in March dropped 41.75% year on year to 60,048 units, while rose precipitously 671% from February. Meanwhile, export volume edged up 0.39% from a year ago to 5,942 units.

For the first three months, the automaker sold a total of 150,332 new vehicles with its decrease in year-to-date sales shrinking to 47.04% from 50.05% for Jan.-Feb. period.

(Haval F7, photo source: Great Wall Motor)

The mainstay SUV brand Haval sold 40,337 vehicles in March, representing a vigorous growth from the virus-hit February. The sales for the first quarter amounted to 106,205 units with a year-over-year decline of 48.45%.

WEY, the SUV brand embodying GWM's ambition to move upscale, saw its Jan.-Mar. sales reach 9,901 units (-62.8%). As the first China-born premium brand whose cumulative outputs exceeded 300,000 units, WEY competes head-on with some joint-venture brand with its average unit price topping RMB160,000.

With 15,354 units sold in total, GWM's pickup products accounted for nearly 50% of China's pickup sales in March. Regarding the number of pickups handed over to consumers, the automaker obtained year-on-year growth in 27 provinces across China in March.

JAC Motors

JAC Motors' vehicle sales in March slid 23.13% year over year, but its Q1 sales represented larger decrease by reason of steeper downturn in sales of first two months.

With 24,491 units sold last month, the CV unit posted a decline of only 10.64%, which substantially cushioned the loss caused by the PV arm.

The 19.07% decrease in the light-duty truck sales should be mainly accountable for the overall CV sales downturn. Nonetheless, the growth in volumes of medium-duty trucks, heavy-duty trucks, bus chassis and multifunctional CVs all remained positive.

(JAC iEVS4, photo source: JAC Motors)

There were 4,926 all-electric PVs among the vehicles sold through Mar., a year-on-year collapse of 67.18%. Moreover, the automaker exported 9,475 vehicles during the first quarter, posting a decline of 22.82% over the previous year.

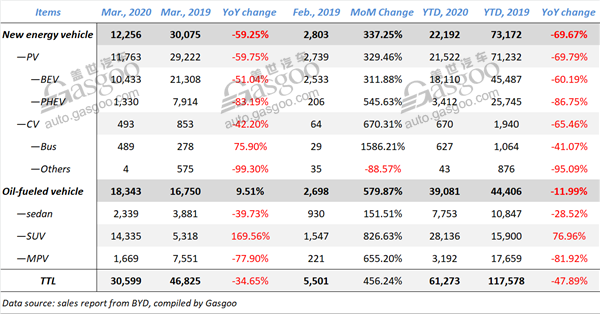

BYD

In March, BYD recorded a 34.65% decrease from the year-ago period, while boasted a stupendous 456.24% increase from Feb.

Oil-fueled vehicle sales in March grew 9.51% over a year earlier to 18,343 units. Before the virus-hit February, BYD had been achieving year-on-year increase in fuel-powered vehicle sales for five consecutive months.

(BYD Tang DM, photo source: BYD)

Nevertheless, NEV sales for the same period were more than halved over the previous year to 12,256 units, for the ninth month in a row showing downturn.

Since China has weathered the hardest period amid the fight against coronavirus, the pent-up consumer demands have been gradually unleased accordingly. Thus, both NEV and fuel-burning vehicle arms clocked over 300% surge from a month earlier.

Selling 61,273 vehicles for the first quarter, BYD posted a 47.89% plunge from the prior-year period, versus 56.65% decline in Jan.-Feb. sales. More of the blame should be laid on the 69.67% decrease in year-to-date NEV sales.