Summary of Japanese automakers' China sales in Feb.

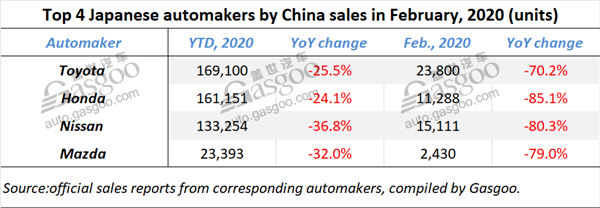

Shanghai (ZXZC)- In February, four major Japanese automakers all suffered nosedive in their China sales due to the COVID-19 epidemic. Notably, both Nissan and Honda, which have joint ventures with the Wuhan-headquartered Dongfeng Motor Corporation, even posted year-on-year decline of over 80%.

Toyota

Toyota said its new vehicle sales (including the sales of premium Lexus cars) in China plunged 70.2% year on year to 23,800 units in February. Due to the coronavirus epidemic and the Spring Festival holiday, the Japanese automaker saw its YTD China sales slide 25.5% to 169,100 units.

(Photo source: FAW-Toyota)

After a month-long shutdown, the company has already resumed work at all of its China-based plants. Reuter reported on Mar. 13 that Toyota’s vehicle plant in Guangzhou would restart its second shift on Mar. 16, returning the outputs to a normal level before the outbreak. The plant in southeast China, which produces the Camry sedan and the Yaris compact hatchback models, had resumed its first shift in middle Feb.

Productions at Changchun and Chengdu plants have already returned to normal as well, while the Tianjin plant was only operating a single shift, Reuter said then.

In spite of the sales slump, Toyota still unveiled a significant investment in China last month. Pony.ai, a Chinese autonomous driving startup, announced on Feb. 26 it had raised $400 million from Toyota to deepen and expand the two companies' collaboration in mobility services. Building upon the foundation established last year, both companies would further advance their joint efforts in autonomous driving technology development and mobility service deployment.

Honda

Honda said its China deliveries in Feb. reached only 11,288 units, slumping 85.1% from the previous year.

(Photo source: GAC Honda)

To be specific, GAC Honda saw Feb. retail sales tumble 81.5% year on year to 7,485 units. Dongfeng Honda, the joint venture headquartered in the epicenter Wuhan, suffered a severer slump of 89.3% with only 3,803 new vehicles handed over to consumers.

As for the YTD performance, a total of 161,151 consumers in China took delivery of Honda-branded vehicles, a decrease of 24.1% over the year-ago period. Of those, GAC Honda contributed 83,751 units, posting a 28% decline, while Dongfeng Honda’s volume represented a double-digit drop of 19.5%.

According to the paper number, the decrease in cumulative sales was much lower than that of Feb. sales. It owes much to the rising performance the automaker delivered in January. Although the overall industry was saddled with both the Spring Festival holiday and the epidemic outbreak, Honda's China retail sales grew 9.8% from the prior-year period.

Nissan

Last month, Nissan's new vehicle retail sales in China tumbled 80.3% to 15,111 units, as demand for its Sylphy sedans and X-Trail and Qashqai SUV crossovers continued to plummet.

(Photo source: Dongfeng Nissan)

Hit by the coronavirus and Lunar New Year holiday, the company's YTD sales in the country sharply declined 36.8% from the year-ago period to 133,254 units.

The commuting bans and road closures across China during the anti-coronavirus fight has resulted in production slowdown since the outbreak, especially its only joint venture in China, Dongfeng Motor Company Limited (DFL), is located in the epicenter Wuhan.

However, with the coronavirus epidemic being effectively controlled, DFL is steadily forging ahead with its work resumption. According to DFL, Dongfeng Nissan reopened its plants in Guangzhou Huadu District and Liaoning Dalian, and of Zhengzhou Nissan in Feb. Then the plants in Hubei Xiangyang and Henan Zhengzhou also resumed production on March 12 and 14 respectively with employees' safety, governmental request and suppliers' inventories taken into account.

Mazda

Retailing only 2,430 new vehicles, Mazda saw its China sales slump 79% from a year ago in Feb. The sharp slide also the fate both joint ventures inevitably faced. According to Mazda Motor (China) Co., Ltd, FAW Mazda delivered 1,253 vehicles with a 75.1% collapse, and Changan Mazda saw its retail sales nosedived 81.9% to 1,177 units.

(Photo source: Changan Mazda)

Regarding the year-to-date performance, Mazda posted a doubly-digit drop of 32% in the world's largest auto market with 23,393 vehicles delivered in total. The volumes of FAW Mazda and Changan Mazda reached 8,792 units (-27.1%) and 14,601 units (-34.6%) respectively.

Regardless of the flagging overall sales, Mazda still honestly announced the concrete sales data of several main models. The Mazda3 Axela was the hottest-seller in Feb., while its deliveries failed to exceed 1,000 units. Besides, the retail sales of the Mazda6 Atenza, the Mazda CX-4 and the Mazda CX-5 reached 660 units, 593 units and 212 units respectively.