China’s passenger vehicle retail sales, wholesales grow both YoY, MoM in Sept. 2024

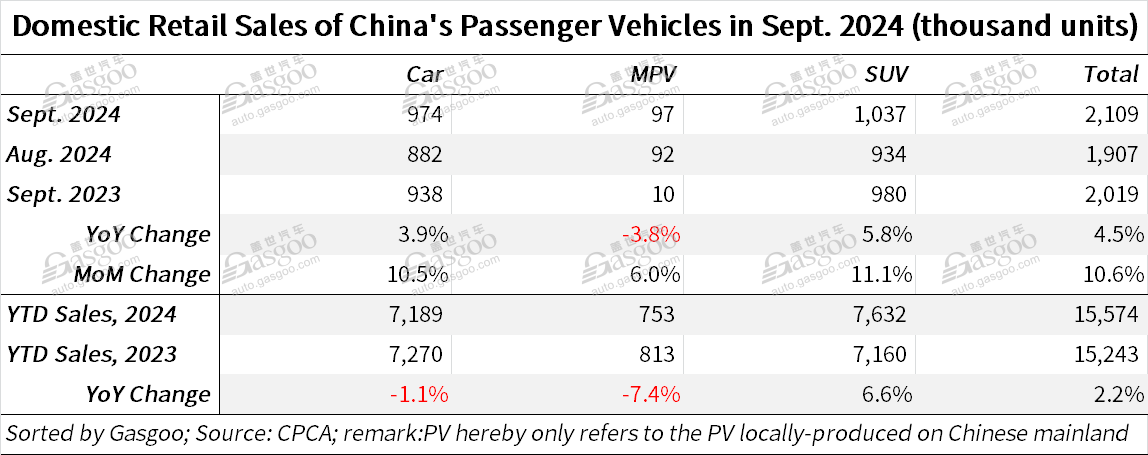

Shanghai (ZXZC)- In Sept. 2024, China's domestic passenger vehicle (PV) market retailed 2.109 million vehicles, marking a year-over-year increase of 4.5% and a month-over-month growth of 10.6%, according to data from the China Passenger Car Association ("CPCA").

For the first nine months of this year, the country's PV retail sales totaled 15.574 million units, climbing up 2.2% compared to the same period last year.

Notably, conventional oil-fueled vehicle sales in September dropped by 22% year-on-year to 990,000 units, although they rose by 12% compared to the previous month.

In the same month, new energy vehicle (NEV) retail penetration rate reached 53.3%.

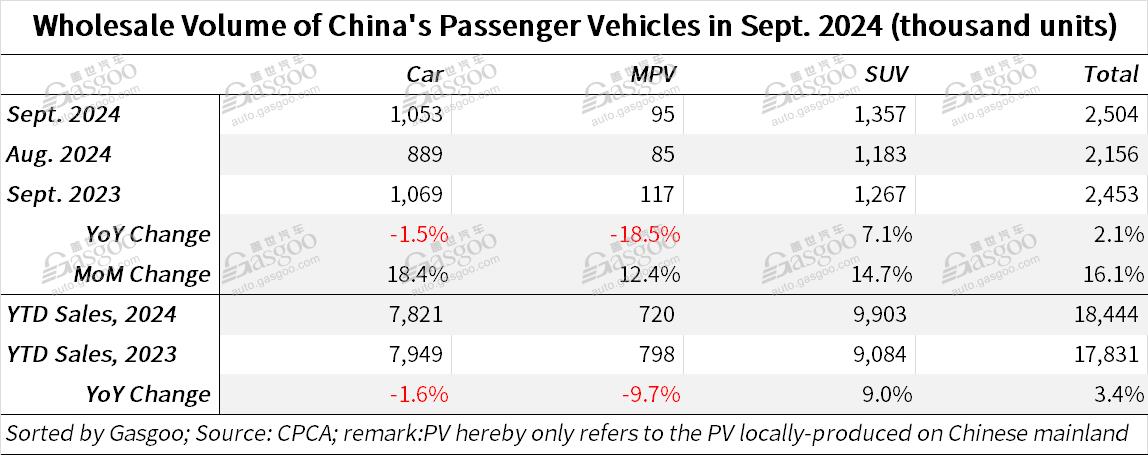

For clarity, the passenger vehicles hereby refer to cars, MPVs, and SUVs locally produced on the Chinese Mainland.

Recent government measures, including the issuance of 150 billion yuan in special long-term bonds, have significantly boosted the trade-in and car scrappage programs, enhancing subsidies for upgrading older vehicles, said the CPCA. Local governments have also introduced various car replacement subsidy policies and consumption incentives, with some regions offering substantial single-car subsidies. These incentives, combined with promotional efforts from automakers, have driven a new wave of growth in the automotive market. With the sustained momentum from both the national scrappage policies and local trade-in schemes, September's passenger car market saw strong retail performance, further bolstered by holiday effects from the Mid-Autumn Festival and National Day holiday.

China's differentiated vehicle scrappage subsidy program is accelerating the upgrade of passenger cars, shifting focus from mere vehicle replacement to enhancing the quality of new purchases. Under the current scrappage update policy, consumers can receive a subsidy of 20,000 yuan when purchasing a NEV and 15,000 yuan for a conventional oil-fueled car with an engine size of 2.0 liters or below. The extra 5,000-yuan subsidy for NEVs has proven to be a significant incentive, especially for price-sensitive buyers. As a result, the majority of consumers participating in the scrappage program are opting for NEVs.

The CPCA added recent surveys indicate that in some regions, more than 60% of vehicles replaced under the scrappage program have been NEVs, with entry-level electric vehicles and plug-in hybrid electric vehicles seeing the strongest growth. Local governments across the country are actively rolling out trade-in incentives as part of their broader efforts to drive consumption, supported by timely media coverage and the quick implementation of detailed guidelines. Some regions have also relaxed restrictions on where vehicles must be purchased or registered, ensuring that local subsidy programs are fully utilized. These developments are expected to have a particularly strong impact during the "Golden September and Silver October" sales period.

As the scrappage policies gain momentum and additional local trade-in programs come into effect, vehicle prices are beginning to stabilize. The government's call for reducing excessive competition in the market has also helped ease consumer hesitation. Overall, the passenger car market is showing signs of recovery, with stronger demand and growing enthusiasm among buyers.

China's wholly-owned brands showed remarkable strength, with retail sales reaching 1.34 million units in September, up 25% year-on-year and 11% month-on-month. Their domestic retail market share hit 63.5%, an increase of 10.1 percentage points year-on-year. China’s self-owned brands also achieved significant gains in both the NEV and export markets. Notable performers included BYD, Chery, Geely, and SAIC-GM-Wuling, which all saw marked increases in market share.

Meanwhile, mainstream joint-venture brands experienced challenges, with combined retail sales rising 10% month-on-month to 530,000 units last month, though they dropped 22% compared to the prior-year period. German brands held a retail share of 16.5%, down 3.6 percentage points year-on-year, while Japanese brands had a 12.6% share, down 4%. American brands accounted for 5.7%, down 1.7 percentage points year-on-year.

In the premium PV segment, September retail sales totaled 250,000 units, an 8% year-on-year decline, though up 11% month-on-month. The premium PV market share fell to 11.7% in the month, a 1.5 percentage point drop compared to the year-ago period.

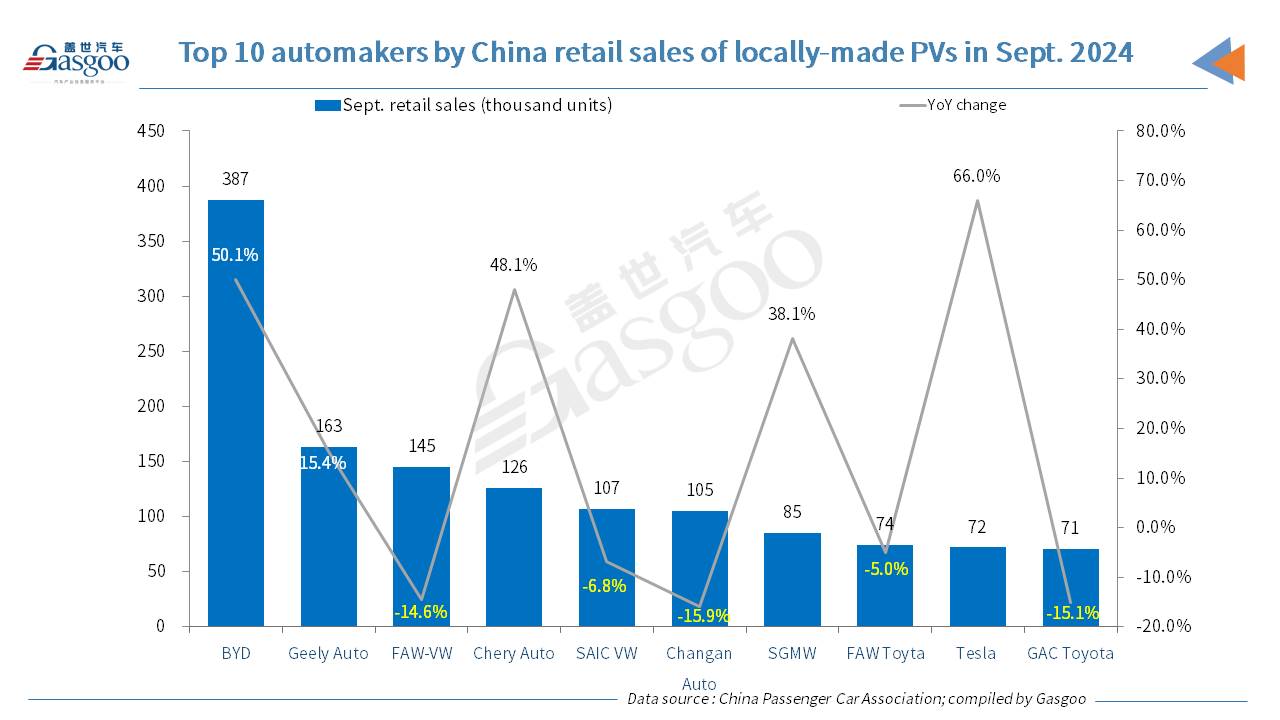

Among the automakers by September locally-made PV retail sales, BYD and Geely Auto still occupied the top 2 positions, with both of them achieving a two-digit year-on-year growth. Ranking 9th, Tesla logged a retail volume of 72,000 China-made vehicles, which soared 66% over a year ago.

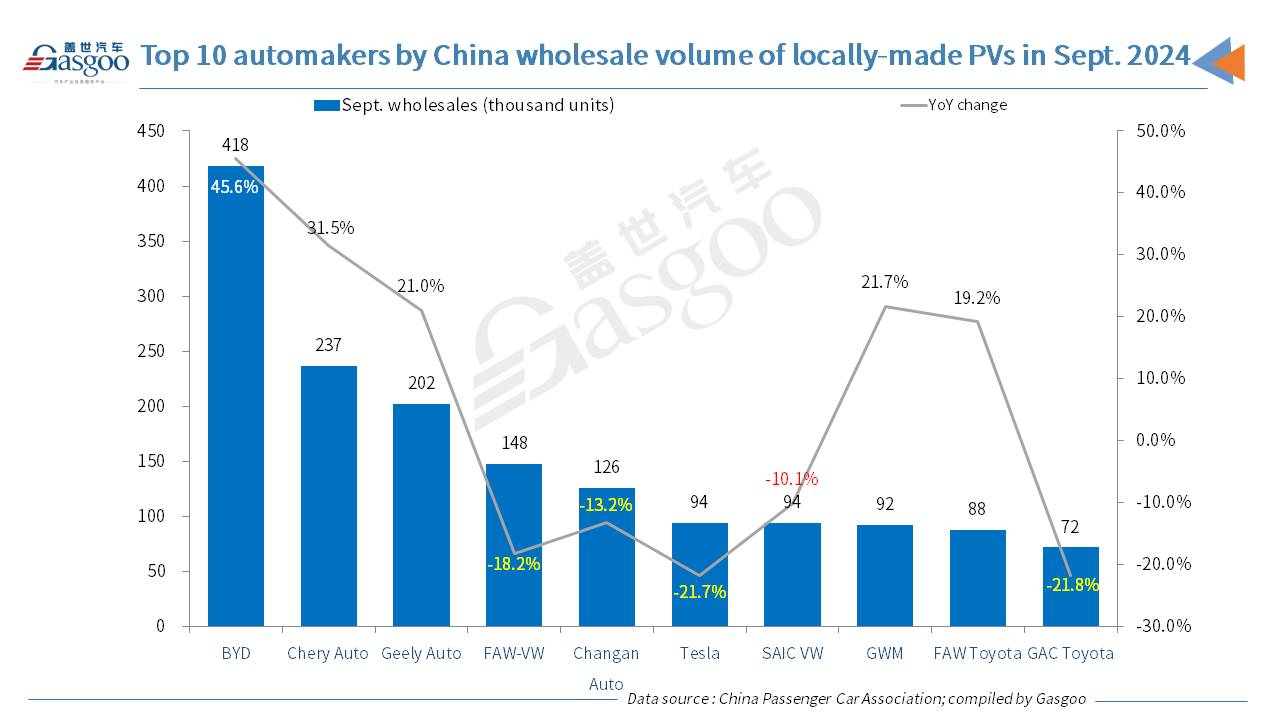

In September, automakers in China recorded a PV wholesale volume of 2.504 million units, representing a 2.1% year-on-year rise and a 16.1% increase month-on-month, and hitting a highest-ever level on a monthly basis. China's wholly-owned brands led with 1.69 million units in wholesales, up 22% year-on-year. However, joint-venture brands struggled, with a wholesale volume of 540,000 units, down 29% year-on-year. Premium PV wholesale volume also declined by 8% year-on-year, reaching 280,000 units.

The industry saw a clear divide in performance among top automakers. Leading companies like BYD, Chery, Geely, Volkswagen, and Changan Auto posted strong results, with 36 manufacturers exceeding 10,000 units in wholesales last month. Of these, three saw year-on-year growth exceeding 100%, while 12 recorded increases of 10% to 100%.

China's overall PV production in September reached 2.418 million units, down 0.8% year-on-year but up 11.9% month-on-month. Production of premium passenger cars fell by 7% over a year ago, while joint-venture brands saw a 32% year-on-year drop. However, Chinese indigenous brands achieved an 18% year-on-year increase in September output.

China's PV exports continued to show robust growth, with 435,000 units exported in September, up 22% year-on-year and 5% month-on-month, according to the data offered by PV makers in China and compiled by the CPCA. NEVs accounted for 24.2% of total exports. China’s local brands led the way with 362,000 units exported, a year-on-year increase of 22%, while joint-venture and premium car brands exported 73,000 units in total, up 20% year-on-year.