Car and City: China’s monthly new energy passenger vehicle registrations hit new high in Aug. 2024

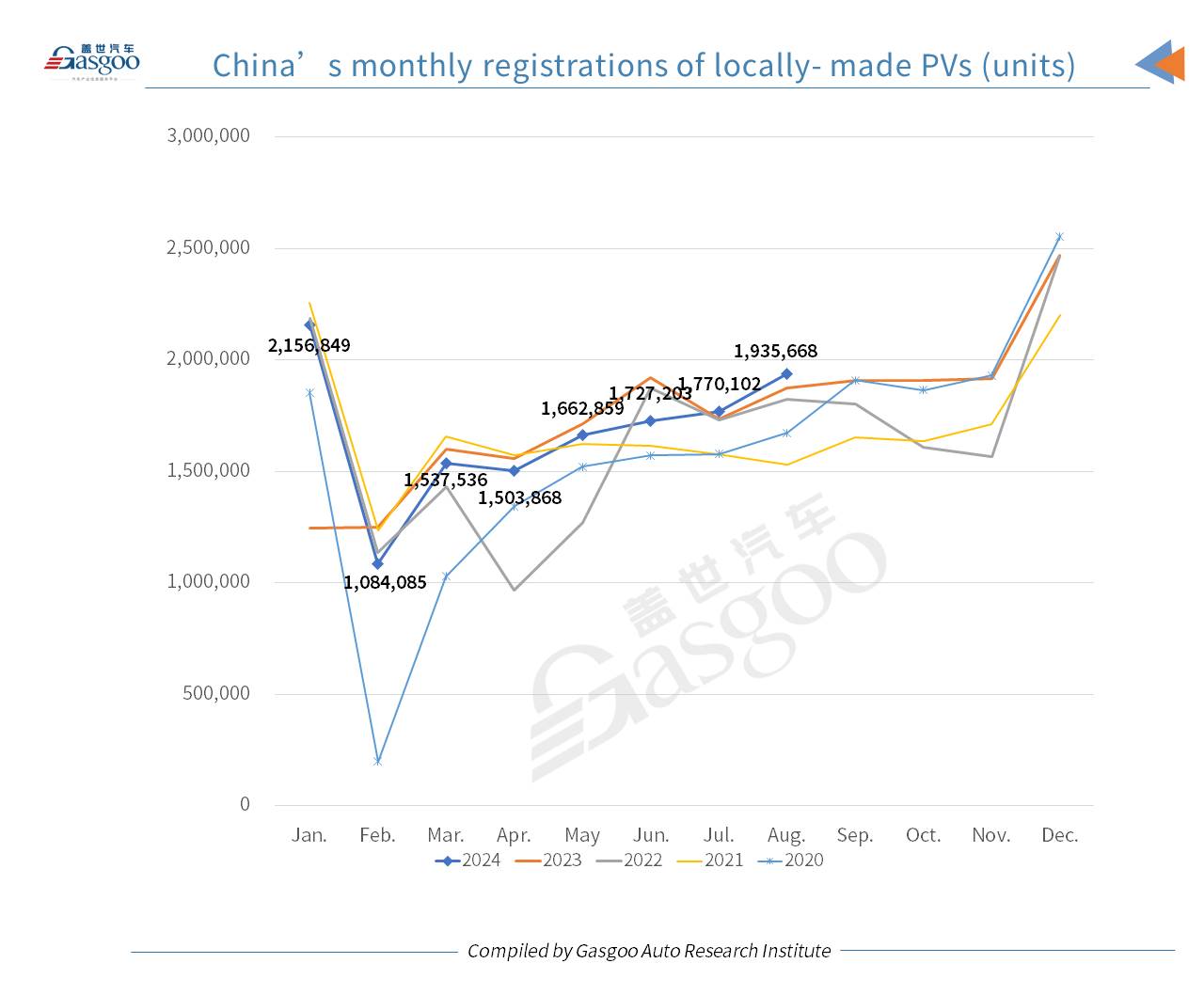

In the eighth month of 2024, there were a total of 1,935,668 locally-produced passenger vehicles (PVs) registered across the Chinese Mainland, representing a 3.32% year-on-year (YoY) growth and a 9.35% month-on-month increase, according to the data compiled by the ZXZC Auto Research Institute ("GARI").

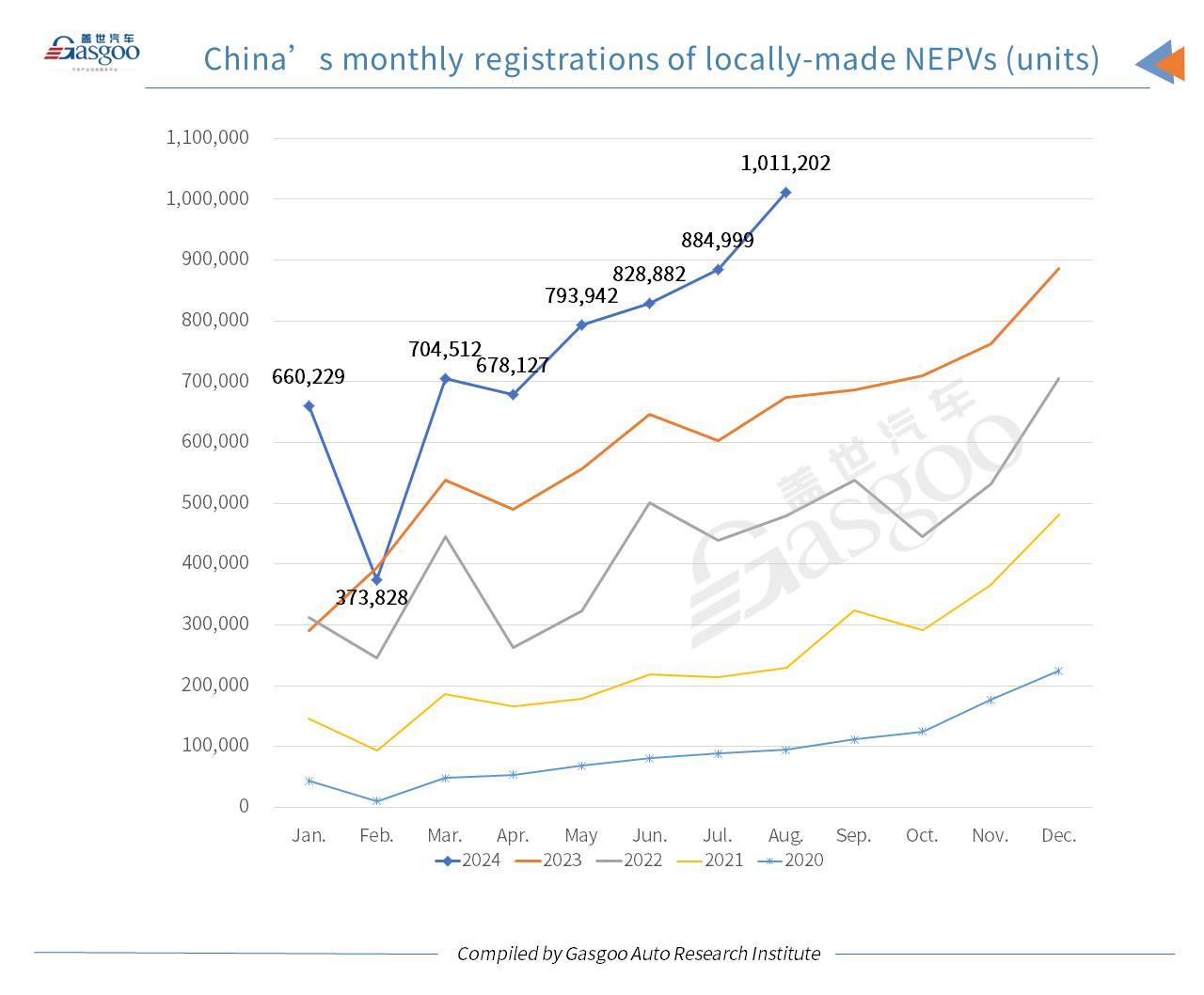

Of the PVs registered in August, 1,011,202 units were contributed by the new energy vehicle (NEV) sector, marking a highest-ever volume on a monthly basis.

For clarity, the PVs hereby refer to the vehicles locally produced and registered on the Chinese Mainland.

The China Passenger Car Association commented that the overall automobile market in China has shown signs of recovery, driven by policy support for scrapping and upgrading vehicles, as well as local trade-in incentives. Following government calls to curb unhealthy price competition, terminal prices have stabilized, easing consumer hesitation and boosting market activity. The growing momentum in the NEV market, with penetration exceeding 50% for the second consecutive month, reflects a shift in energy structures. While traditional oil-fueled vehicle performance followed a seasonal pattern, NEV demand surged in August, continuing a strengthening trend in the second half of the year.

At the national level, policy guidance aimed at the auto industry has been frequently issued with the goal of further stabilizing and expanding vehicle consumption. The effectiveness of the Ministry of Commerce's "Hundred Cities in Action" auto festival and "Thousands of Counties and Towns" new energy vehicle consumption season has become evident. Local authorities across the country have continued to roll out consumption-boosting policies that, combined with automaker sales promotion measures, provided stable support for the market at the end of last year and start of this year. The trade-in policy has also triggered significant consumer expectations.

For the first eight months of this year, China's cumulative PV registrations summed up to 13,378,170 units, growing 3.72% from the previous year.

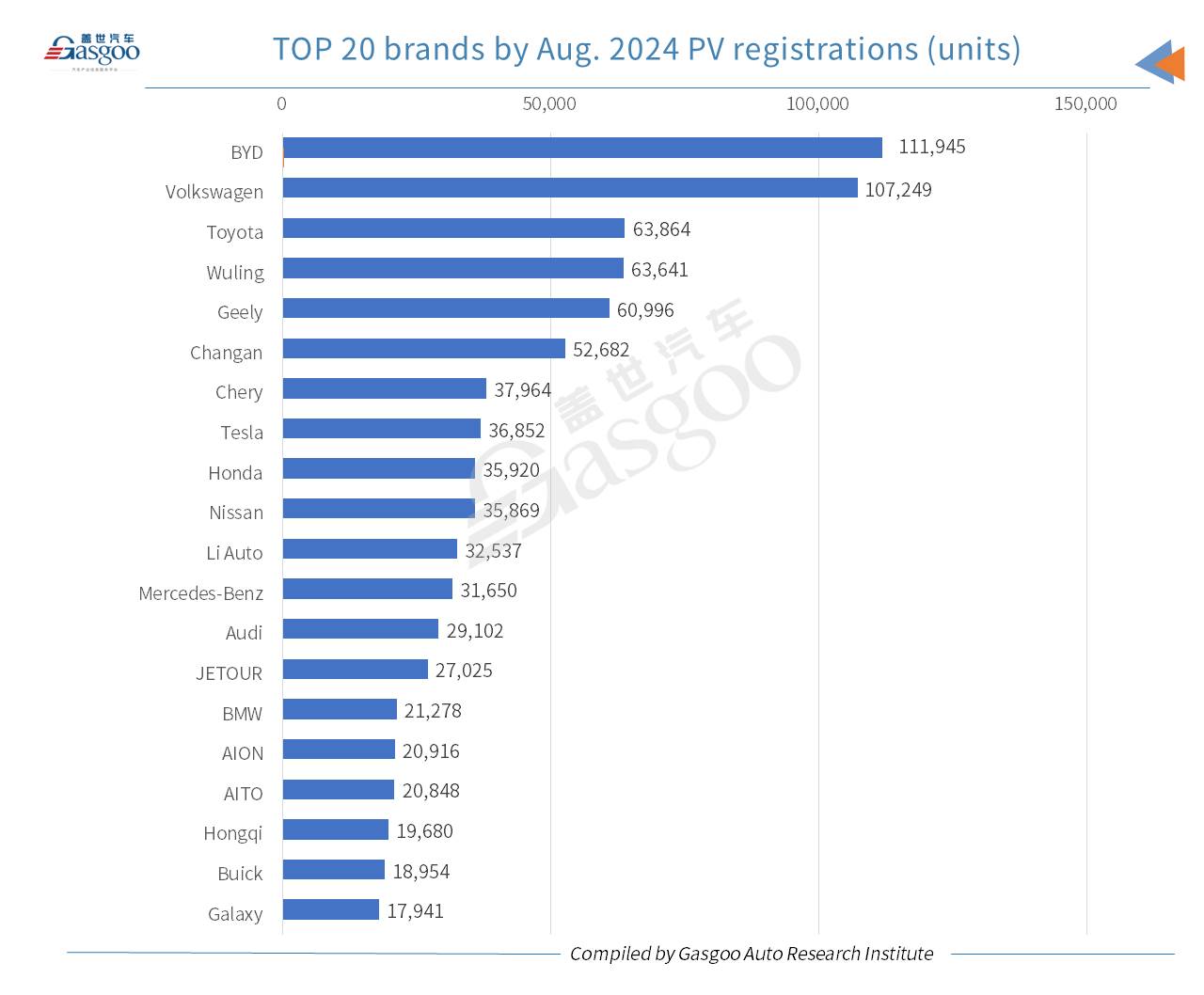

Looking at brands' performance by locally-made PV registrations in August, BYD topped the chart with 111,945 vehicles registered. Wuling, Geely, Changan, Chery, and Li Auto are other Chinese brands that make significant appearances, demonstrating the strength and competitiveness of domestic brands in China.

In addition, Volkswagen ranked second with 107,249 units of registrations, narrowly trailing BYD, highlighting its persistent popularity in China, despite the growing strength of local brands. Toyota, Honda, and Nissan still maintained positions within the top 10, indicating that Japanese automakers still enjoy a solid customer base in China despite their sliding trend in sales.

Tesla, though ranked lower at 36,852 units, continues to be a significant player in the premium electric vehicle market with only two China-made models.

The German trio, Mercedes-Benz, Audi, and BMW, made it to the top 20 list, with 31,650, 29,102, and 21,278 units of registrations, respectively. This shows that despite the rising interest in affordable EVs, premium brands still attract a considerable customer segment.

Li Auto, AION, and AITO—relatively new players in the NEV sector—registered solid figures, with 32,537, 20,916, and 20,848 units, respectively.

Brands like JETOUR and Hongqi, although not in the top 10, still showed impressive figures (27,025 and 19,680 units, respectively), suggesting that second-tier automakers are also finding success in some specific segments.

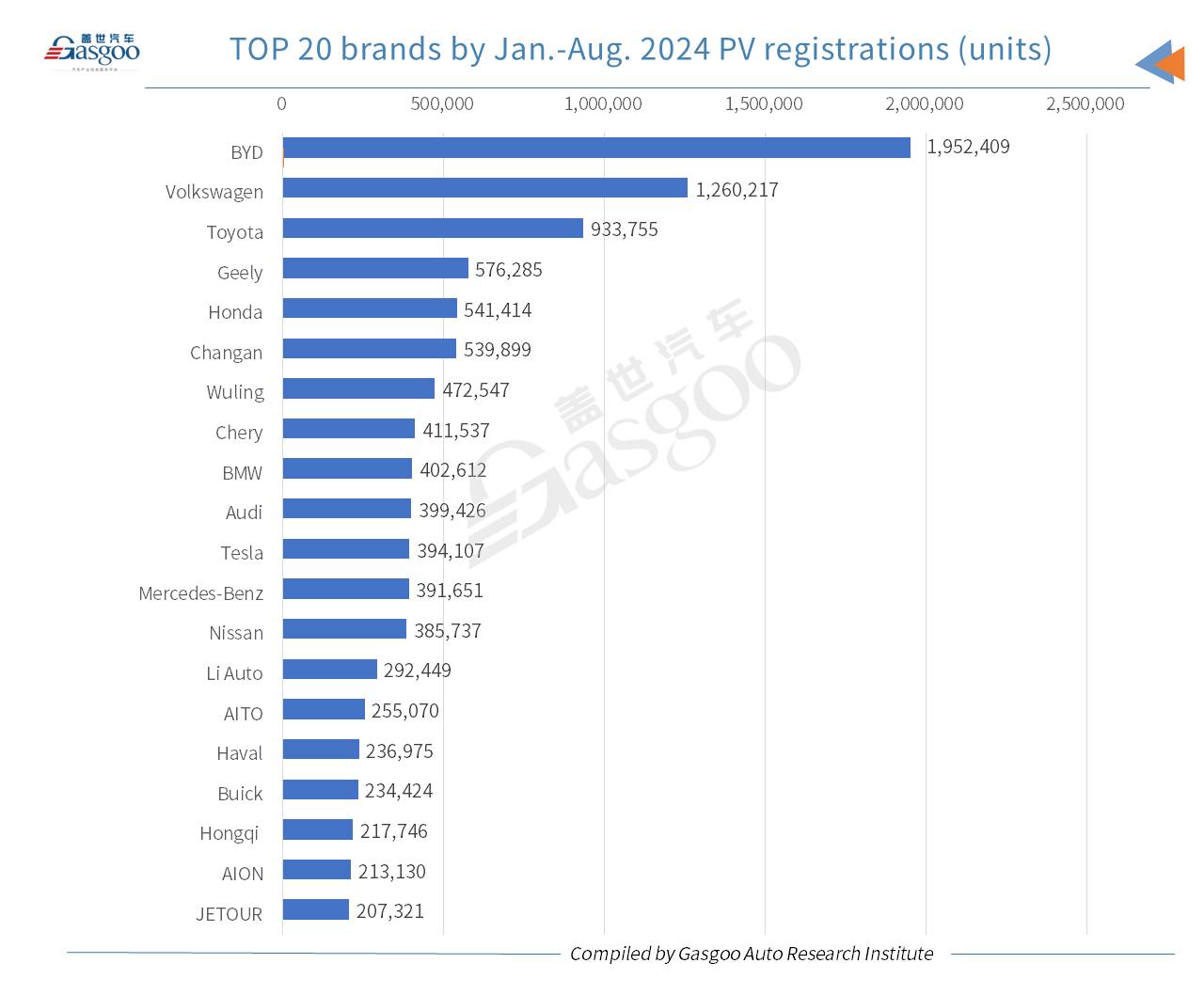

In terms of the Jan.-Aug. locally-made PV registrations, BYD's remarkable performance stood out as the clear market leader, registering 1,952,409 units, far outpacing its competitors. Its commanding lead, approaching the two-million-unit mark, is a testament to its diversified product portfolio and strong brand recognition in the domestic market.

Volkswagen followed in second place with 1,260,217 units registered in the first eight months. Toyota ranked third with 933,755 units registered. Toyota's conservative approach to NEVs compared to BYD has likely contributed to the difference in numbers, but its reputation for reliability and fuel efficiency continues to resonate with consumers.

Among China's wholly-owned brands, Geely, Changan, Wuling, and Chery occupied strong positions within the top 10 rankings, each with Jan.-Aug. registrations exceeding 400,000 units.

Lower down the chart, we see the emergence of newer brands like AITO, which registered 255,070 units in the Jan.-Aug. period, indicating the increasing presence of the Chinese fresh player in the NEV market.

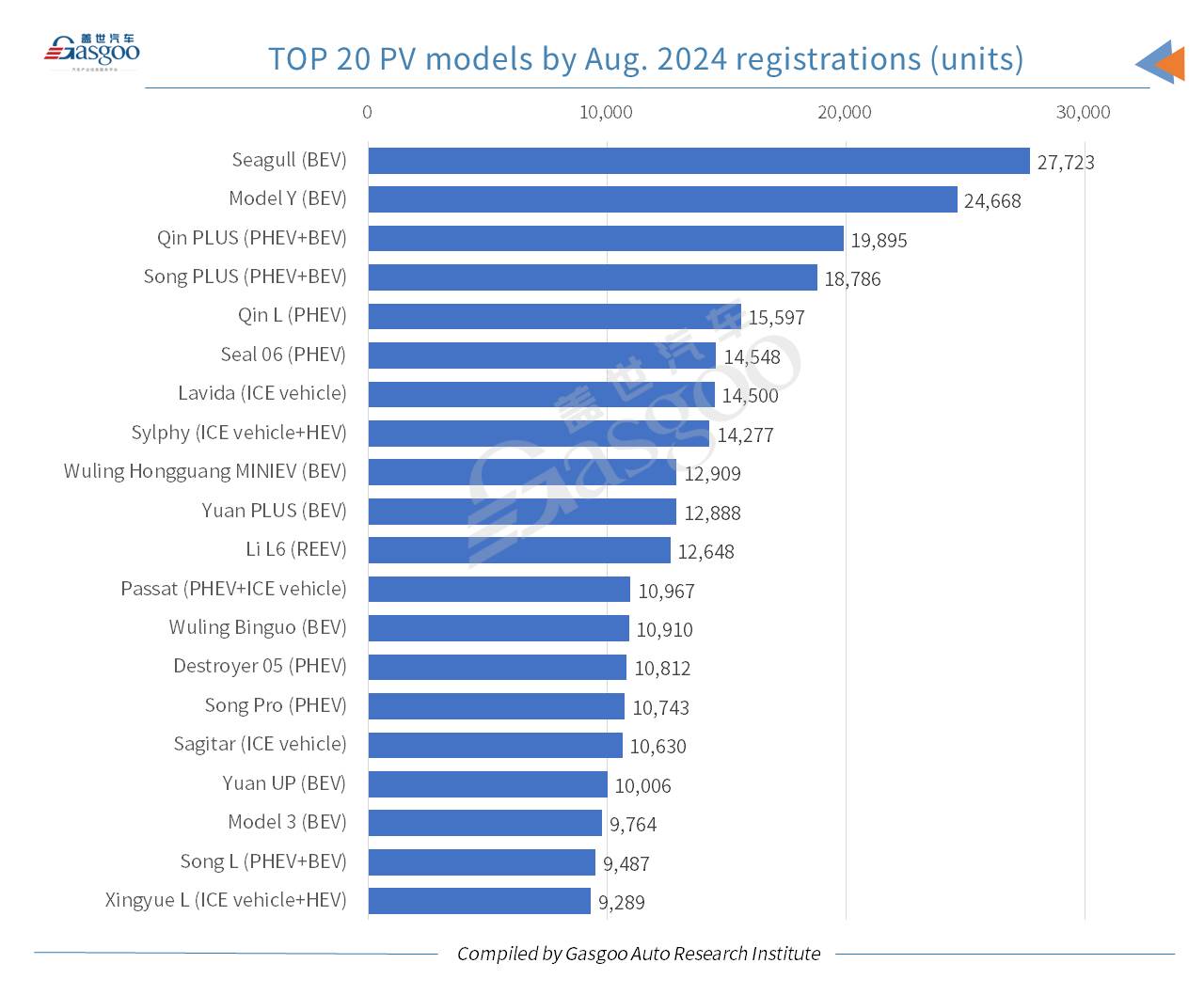

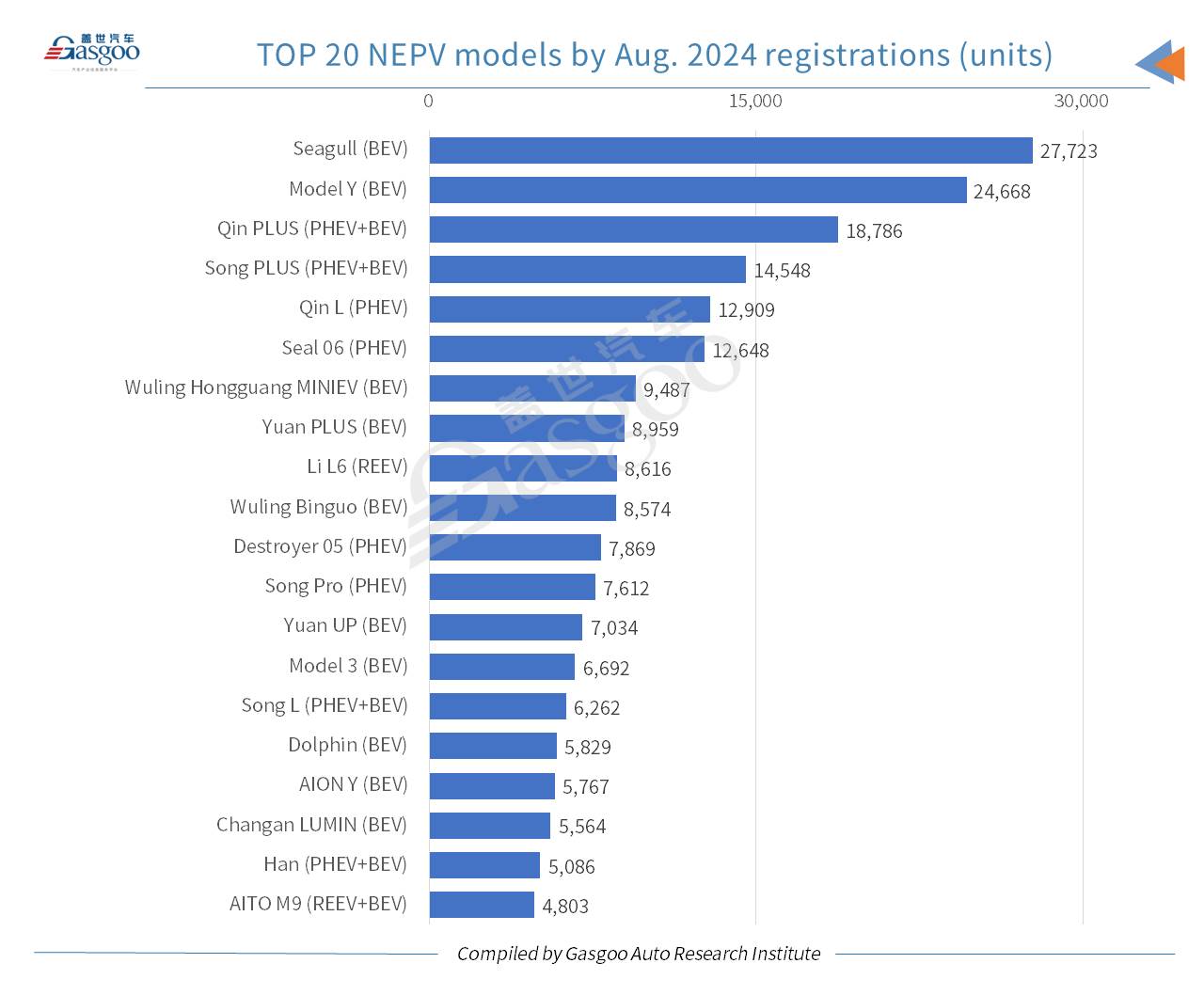

As for the performance of top-selling PV models by Aug. registrations, BYD's Seagull led the pack with 27,723 units, further cementing BYD's stronghold in the Chinese market. As a small, affordable electric vehicle (EV), the Seagull's success demonstrates the rising demand for entry-level battery electric vehicle (BEVs) among Chinese consumers, likely driven by its competitive price point and practical design for urban environments.

Tesla's Model Y ranked second with 24,668 units registered in Aug., proving that despite growing competition from Chinese automakers, Tesla remains a major force in China's EV market.

The next four spots are occupied by BYD's Qin PLUS, Song PLUS, Qin L, and Seal 06. These models reflect BYD's strategic advantage in offering both plug-in hybrid electric vehicle s (PHEVs) and BEVs, catering to a wider range of customer preferences. For drivers seeking flexibility and less reliance on charging infrastructure, PHEVs provide an attractive solution, allowing BYD to dominate the PHEV segment.

Volkswagen's Lavida and Nissan's Sylphy, both in the top 10 with 14,500 units and 14,277 units registered, respectively, represent the continuing relevance of traditional internal combustion engine (ICE) vehicles, albeit with hybrid options to cater to more environmentally conscious buyers.

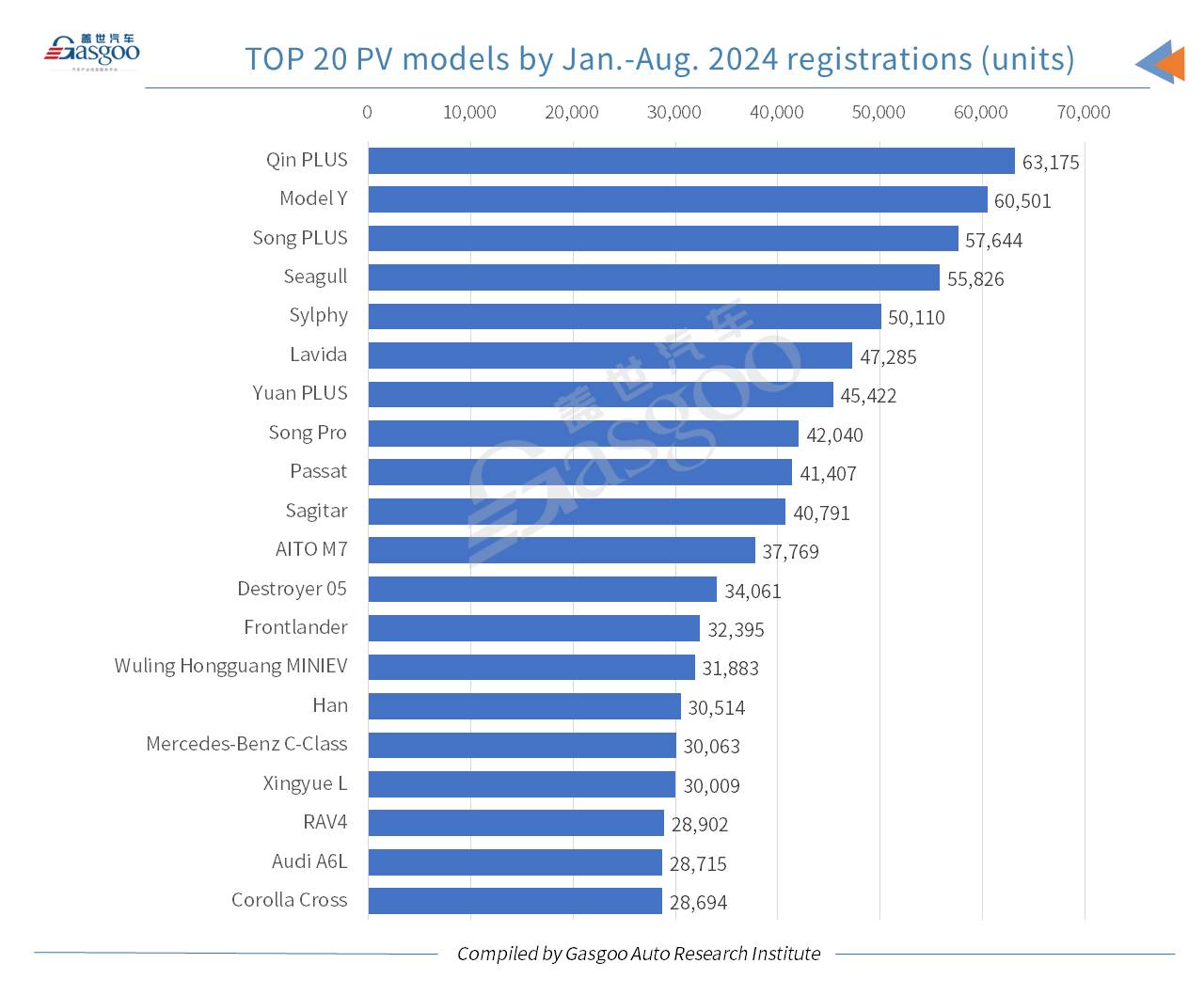

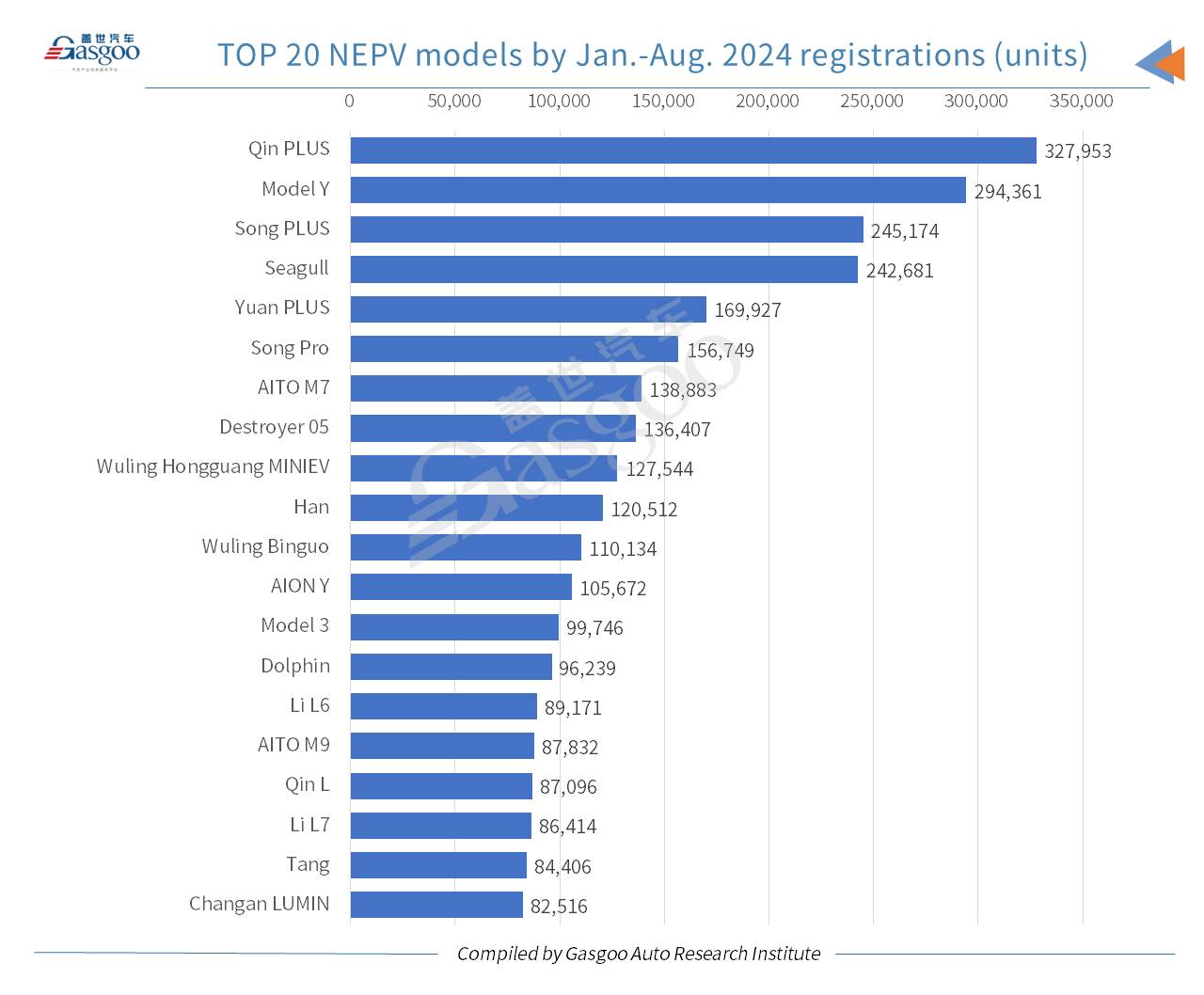

In terms of Jan.-Aug. registrations, three BYD models – the Qin PLUS, the Song PLUS, and the Seagull - occupied the three of the top four positions, underscoring the company's strong market presence. The Model Y was the runner-up with over 60,000 units registered in this period.

Lower down the rankings, BYD still had four models on the top 20 list, namely, the Yuan PLUS, the Song Pro, the Destroyer 05, and the Han.

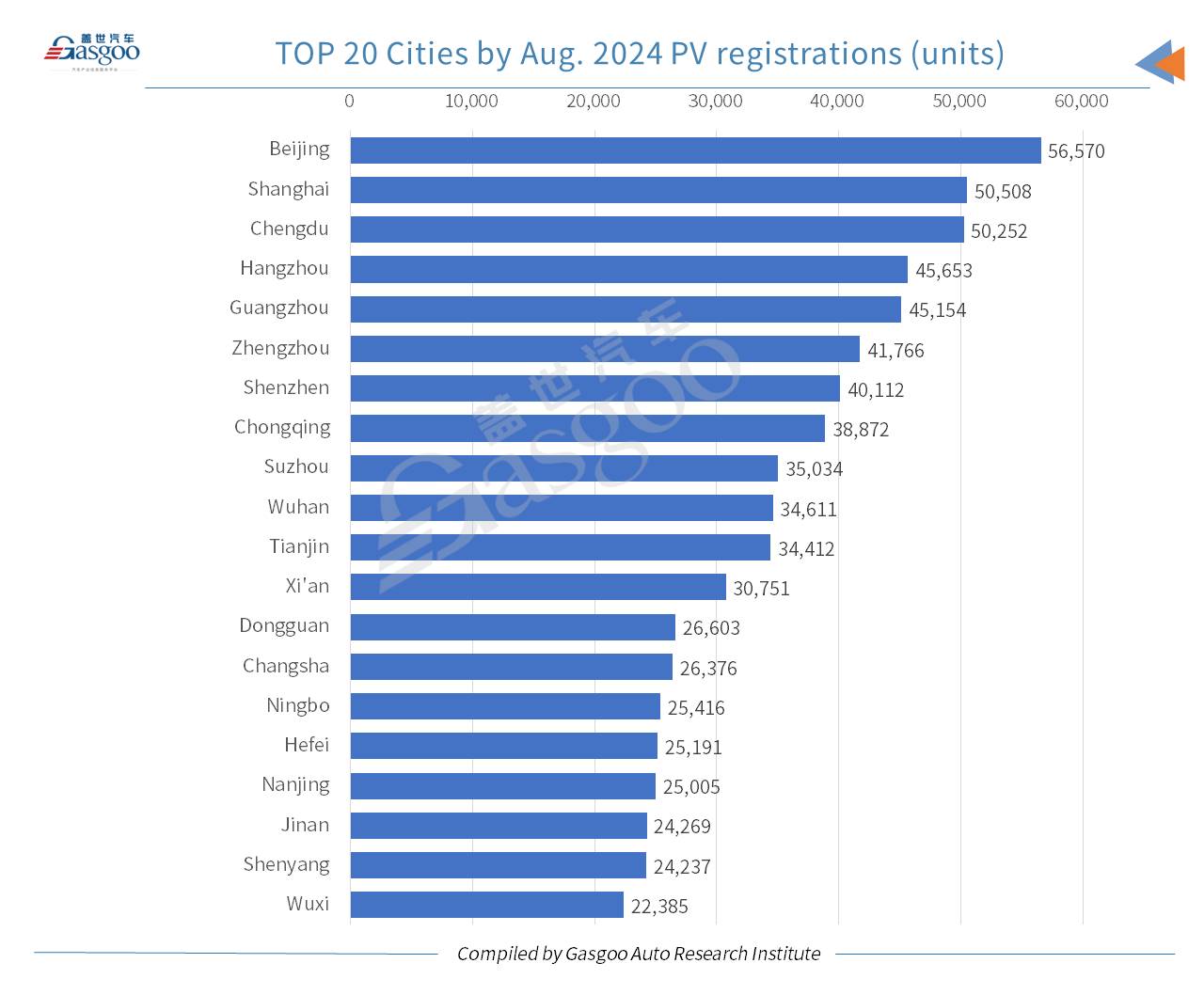

Among cities on the Chinese Mainland, Beijing and Shanghai occupied the top two positions in terms of PV registrations for August 2024. Other major cities, including Chengdu, Hangzhou, and Guangzhou, also featured prominently in the top 10.

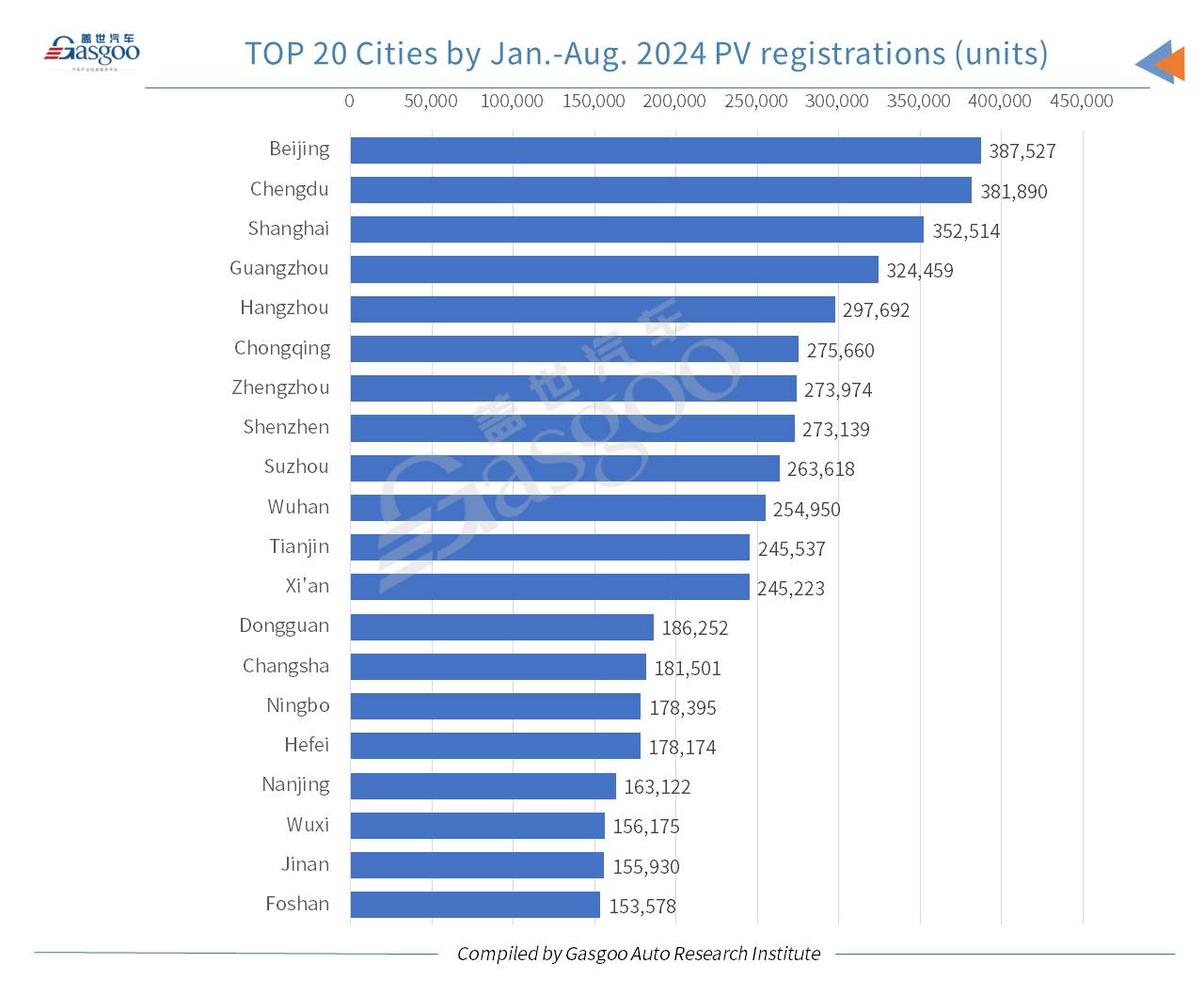

Beijing also led the way in terms of locally-produced PV registrations for the first eight months of 2024. Chengdu, Shanghai, and Guangzhou followed closely behind Beijing.

In Aug. 2024, the new energy passenger vehicle (NEPV) sector posted a year-on-year surge of 49.97% and a month-on-month jump of 14.26%. It accounted for 52.24% of the country's total PV registrations, up 2.24 percentage points over the previous month.

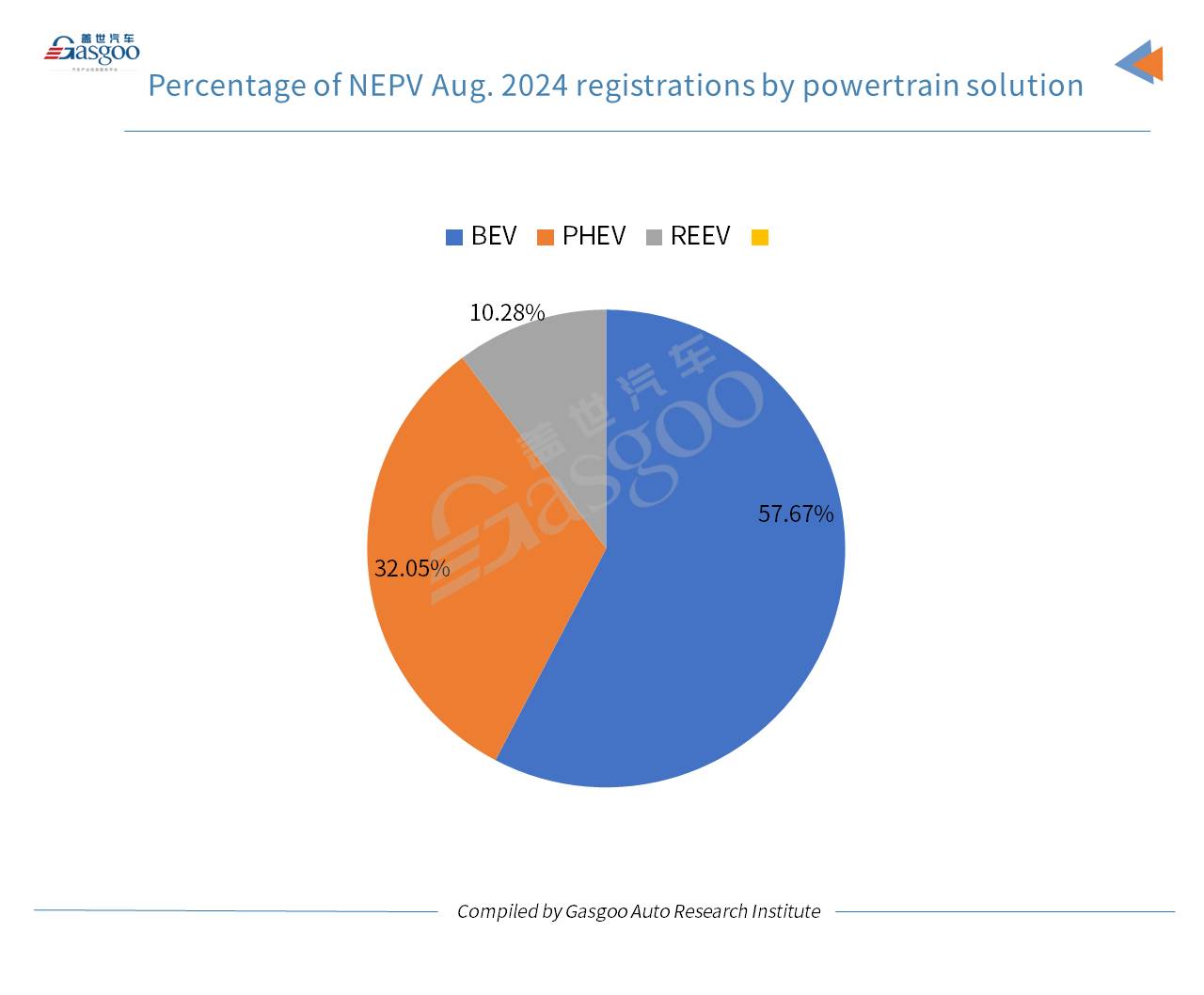

Breaking down China's Aug. NEPV market by powertrain solutions, BEVs held a significant lead with a share of 57.67%, while PHEVs constituted 32.05% of the market. Range extended electric vehicles (REEVs) made up a smaller portion of the market, accounting for 10.28%.

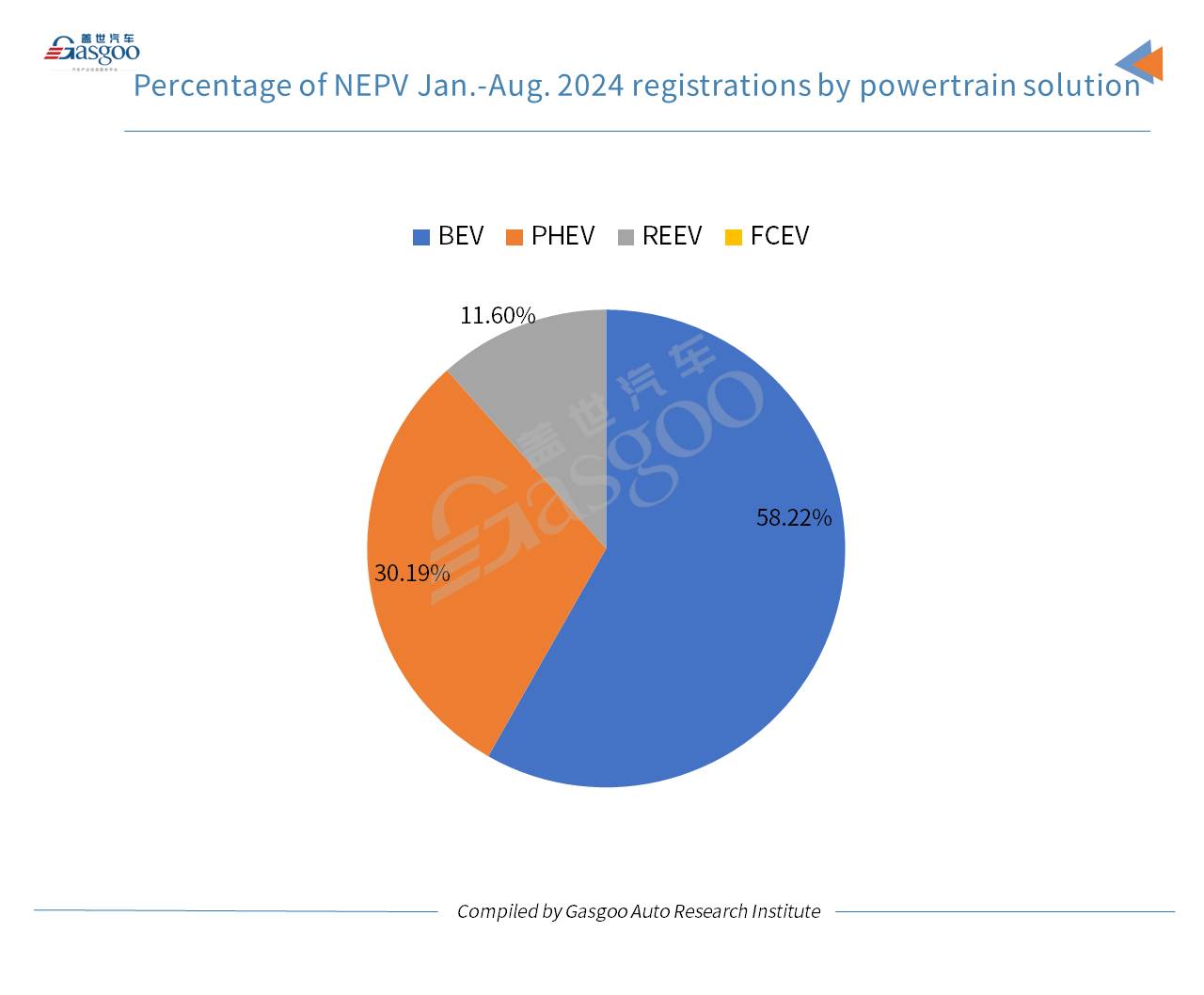

Regarding the market share of each powertrain solution in the NEPV market for the Jan.-Aug. period, BEVs had the largest market share at 58.22%, while PHEVs held a significant share of 30.19%, suggesting that consumers are gravitating towards vehicles that offer the benefits of both electric and traditional internal combustion engines, possibly due to concerns about range anxiety or a preference for hybrid technology. REEVs had a share of 11.6%. Notably, there were 23 fuel cell electric vehicles (FCEVs) registered across the Chinese Mainland in the first eight months of this year, but their percentage contribution is negligible given the extremely small number.

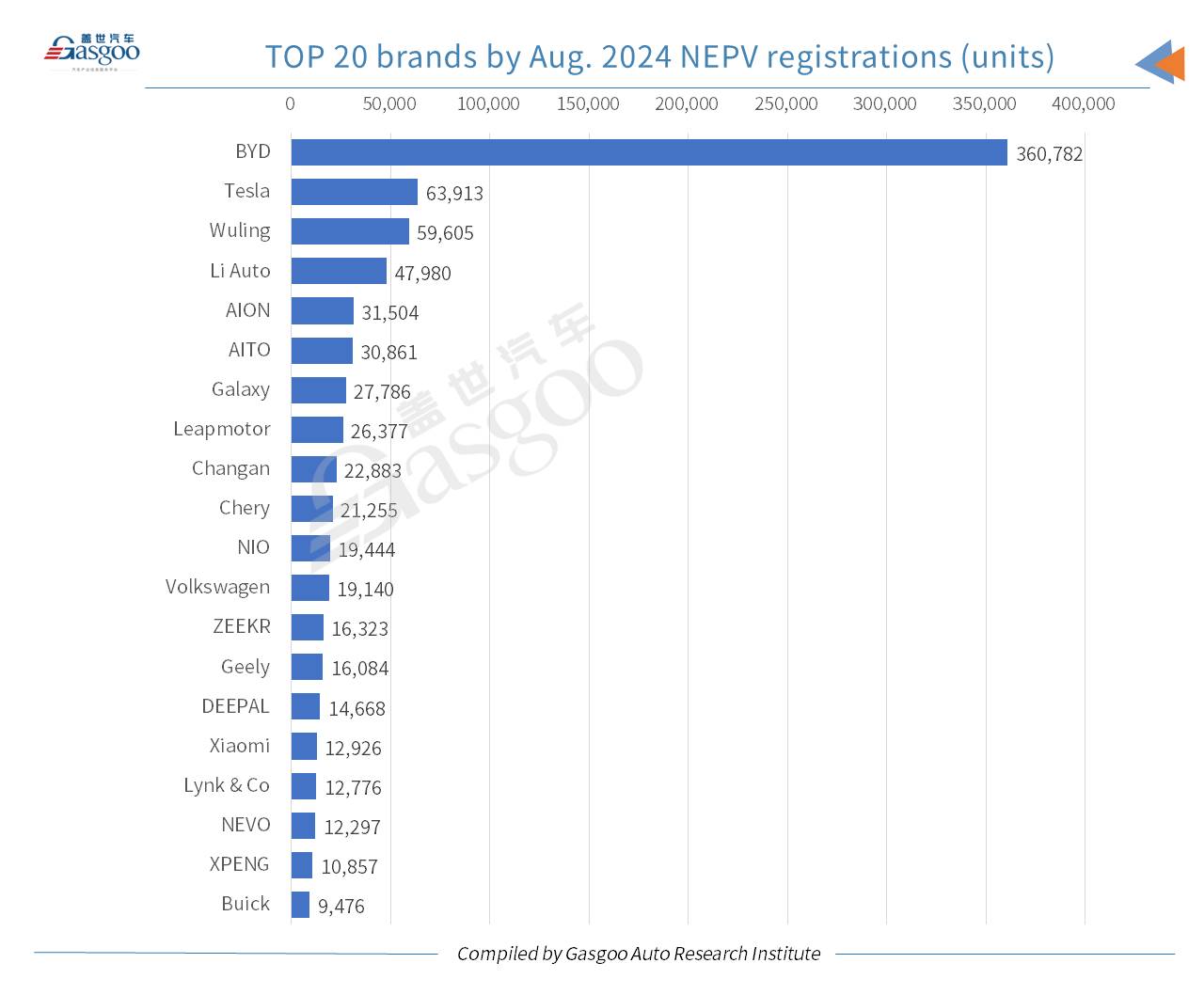

As for the landscape of vehicle brands by Aug. NEPV registrations, BYD still led the chart with over 360,000 vehicles registered, outperforming the sum of the No.2 to No. 11 spots' occupants. Tesla recorded a registration volume of 63,913 units in the same period. Wuling and Li Auto have made notable gains, securing the third and fourth positions, respectively. Several other Chinese brands, such as AION, AITO, and Galaxy, were also making their presence felt in the top 10.

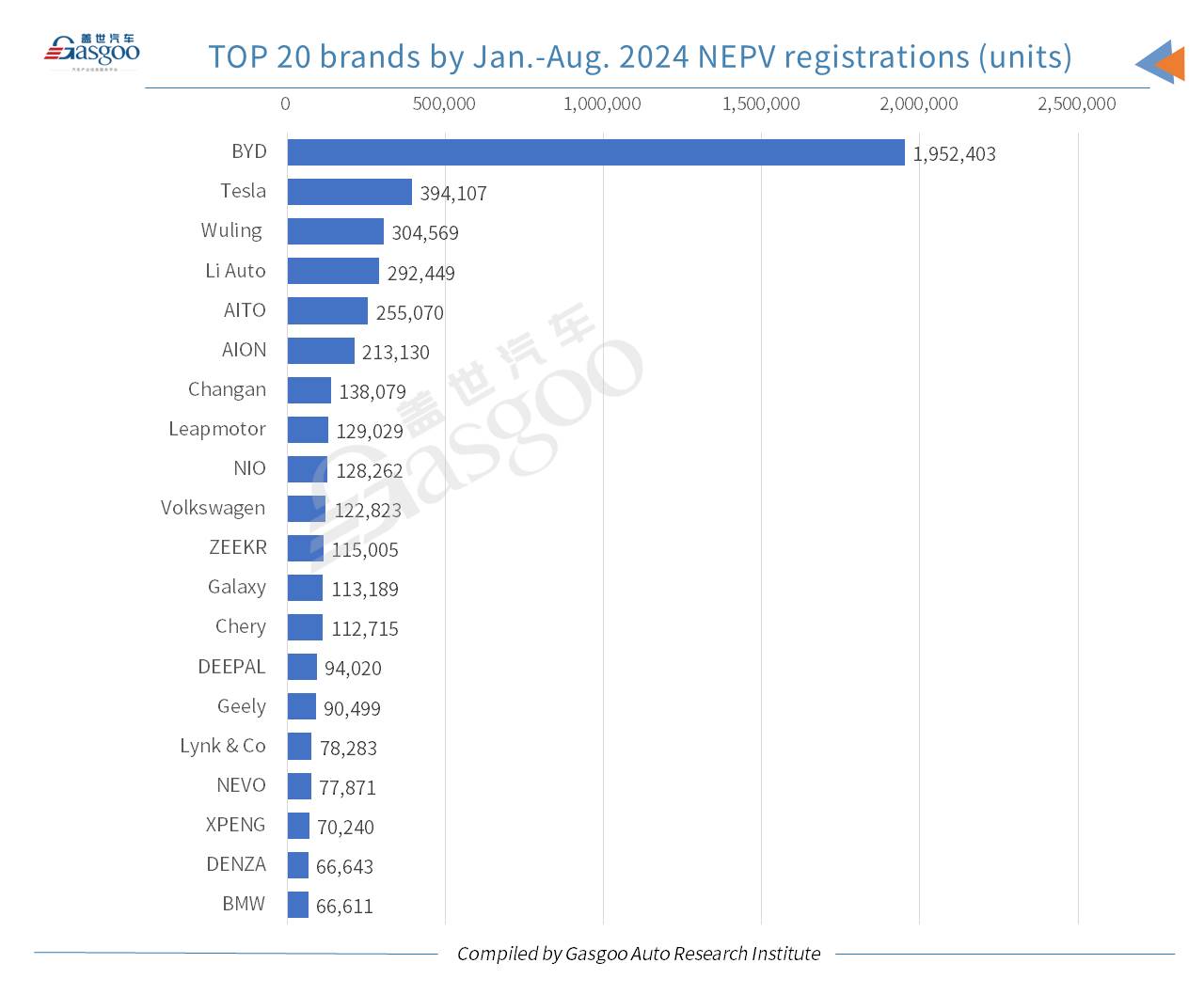

As for the performance of specific brands by Jan.-Aug. NEPV registrations, the most striking finding is the continued dominance of BYD, which occupied the top position with a significant lead over other brands. Tesla maintained its second position, while Wuling and Li Auto ranked third and fourth, respectively. Three brands from Geely Holding, namely, ZEEKR, Galaxy, and Geely, all cracked the top 20 list.

On the top 20 list of NEPV models by Aug. registrations, BYD's products took up to 12 spots. Of those, the Seagull led the pack with 27,723 units registered, outnumbering the runner-up Model Y by 3,055 units.

Besides, the Li L6 ranked 9th with 8,616 units registered in Aug. Notably, Li Auto announced on Sept. 19 that the cumulative deliveries of the Li L6 had surpassed 100,000 units, only five months after it hit the market.

For the first eight months of 2024, BYD's Qin PLUS topped other NEPV models with a registration volume of 327,953 units. Besides, the Model Y, the Song PLUS, the Seagull, and the Yuan PLUS all recorded a registration volume between 200,000 units and 300,000 units.

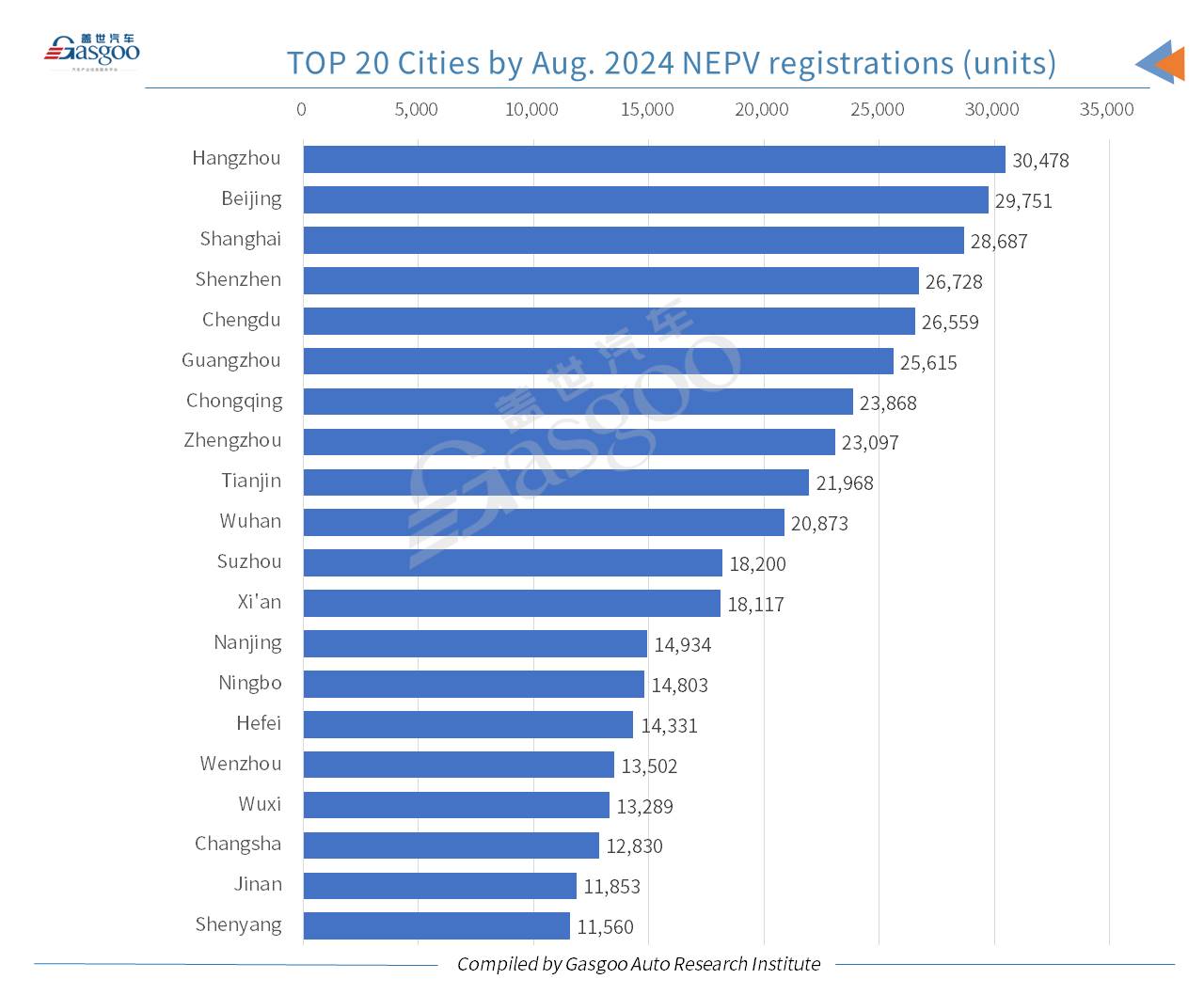

In August, Hangzhou outdid other cities with 30,478 locally-made NEPVs registered, which accounted for 66.76% of the city's overall PV registrations. Beijing, Shanghai, Shenzhen, and Shenzhen secured the second to fifth places with respective registrations all surpassing 26,000 units.

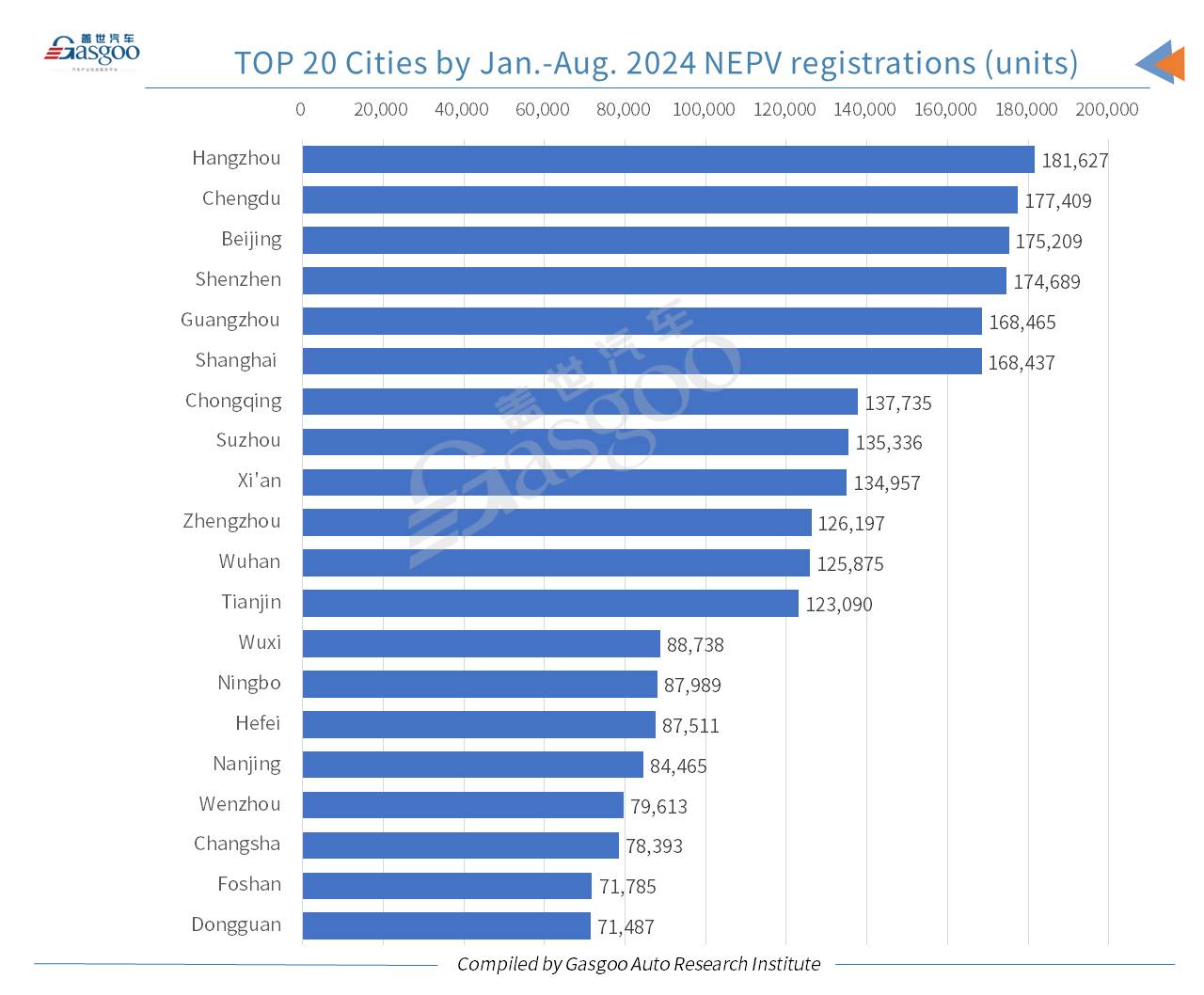

During this year's first eight months, there were 12 cities on the Chinese Mainland with over 100,000 domestically-built NEPVs registered each.