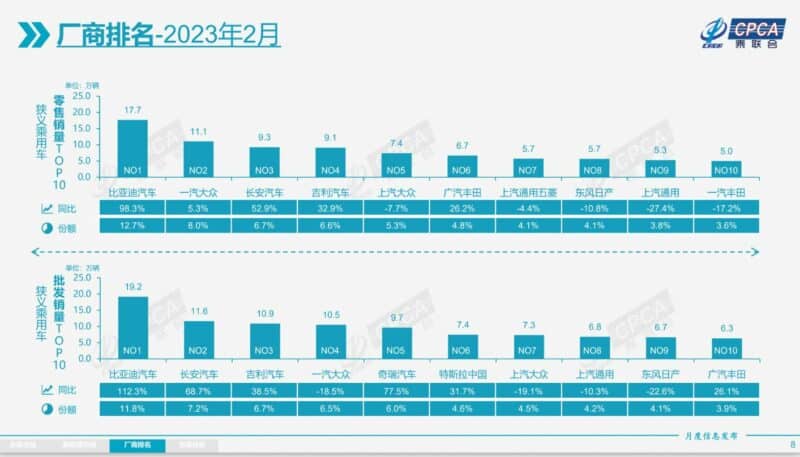

Top 10 best-selling passenger car brands in China, February 2023

In February 2023, 1.39 million passenger vehicles were sold via retail, a year-on-year increase of 10.4%, and a month-on-month increase of 7.5%. That breaks down to 656,000 sedans (a year-on-year increase of 9%), 651,000 SUVs (a year-on-year increase of 10.3%), and 82,000 MPVs (a year-on-year increase of 24.1%), according to the China Passenger Car Association (CPCA).

Furthermore, 1.664 million passenger vehicles were produced in February 2023, an increase of 11.2% year-on-year and 23.6% month-on-month. That breaks down to 761,000 sedans (an increase of 8.7% year-on-year), 836,000 SUVs (a year-on-year increase of 12.1%), and 67,000 MPVs (a year-on-year increase of 33.3%).

Let’s check out who are the top 10 vehicle retail brands in February 2023!

Top 1: BYD

BYD’s passenger vehicle retail sales reached 177,000 units, ranking first on the list, a year-on-year increase of 98.3%. At the same time, its market share in the passenger car market reached 12.7%. Furthermore, BYD exported 15,002 vehicles in February 2023.

Top 2: FAW-Volkswagen

FAW-Volkswagen came in second, with retail sales of 111,000 vehicles in February, a year-on-year increase of 5.3%, accounting for 8% of the market share.

Top 3: Changan, Top 4: Geely

The sales volume of Changan and Geely did not have a large variance, both exceeded 90,000 vehicles, ranking third and fourth with sales of 93,000 and 91,000 vehicles, respectively. Compared with the same period last year, Changan’s sales surged by 52.9% and Geely’s sales increased by 32.9% year-on-year, each having 6.7% and 6.6% of the market share, respectively.

Top 5: SAIC-Volkswagen

Its brother brand, SAIC-Volkswagen, sold only 74,000 vehicles in February, a year-on-year decrease of 7.7%, ranking only fifth, losing to both Changan and Geely. SAIC-Volkswagen claimed 5.3% of the market share.

Top 6: GAC-Toyota

GAC-Toyota achieved the highest sales volume among Japanese joint ventures with 67,000 vehicles sold, an 26.2% increase year-on-year, accounting for 4.8% of the market share.

Top 7: SAIC-GM-Wuling

SAIC-GM-Wuling sales were also sluggish, with only 57,000 vehicles sold in February, a year-on-year decrease of 4.4%, ranking seventh, accounting for 4.1% of the market share.

Top 8: Dongfeng-Nissan

Dongfeng-Nissan’s sales volume was only 57,000 units, ranking eighth, down 10.8% year-on-year, but its sales volume was second only to GAC-Toyota among Japanese joint ventures. It also claimed 4.1% of the market share.

Top 9: SAIC-GM

SAIC-GM’s sales fell 27.4% year-on-year, ranking ninth with sales of 53,000 vehicles, the largest decline among the top ten automakers in sales, claiming only 3.8% of the market share.

Top 10: FAW-Toyota

FAW Toyota lost to GAC-Toyota and ranked tenth with sales of 50,000 vehicles, a year-on-year decrease of 17.2%, accounting for 3.6% of the market share.

Source: CPCA