The Big Read – Dongfeng (2/6) – 80’s trucks, 90’s Citroens and 21st century Fengshens and Voyahs

We left Dongfeng last week when it just established itself with a formal corporate structure. We will further track the development of the company from its core business of trucks, the first steps into passenger car making leading to the inevitable self-owned brand. The latest development is Dongfeng’s response to the increasing popularity of high-end New Energy Vehicles.

From water to diesel

Liuzhou Automobile was one of seven enterprises that merged with Second Automobile Works in 1981 to form the Dongfeng Motors Industry Association. I’ve chosen Liuzhou Auto as example because it is allowed to produce vehicles under its own brand names. The other six companies are still part of the Dongfeng empire, but serve as component manufacturers or assembly factories for regular Dongfeng products.

Liuzhou Automobile was formed as the Liuzhou Agricultural Machinery Factory on October 6, 1954 by the government of Guangxi Autonomous Region. The company name is usually abbreviated to Liunong. The enterprise was set up to become a leading developer of agricultural tools and its main product became water turbine pumps. These pumps were used to irrigate the hilly grain fields in the south of China. Production of the water pumps started in 1957 and Liunong quickly became a leading force in the sector, selling its products all over China.

There’s another factory in the same city, called the Liuzhou Machinery Factory (or Liuji for short) and loyal readers may remember that this is the predecessor of Wuling Automobile. Liuji is then a renowned manufacturer of diesel engines. In 1969 the provincial governments instructs both factories to cooperate on a vehicle project. As already told in the Automaker Story about Wuling, Liunong and Liuji develop a prototype in the record time of only 23 days. Still in 1969 this car is unveiled as the Feiyue LGS130 truck and equipped with a Liuji diesel engine. It’s in fact a copy of the Nanjing Yuejin NJ130 truck.

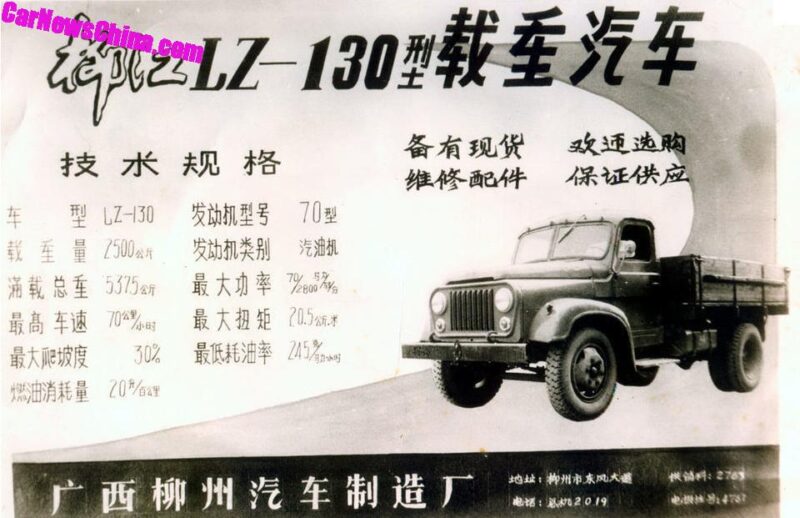

Liunong and Liuji have clearly divided the responsibilities. Liunong makes the cabs, frames and carriages, while Liuji supplies the engines. Several smaller factories in the area serve as part supplier. In 1970 Liunong starts assembling the truck and distributes it under the brand name Liujiang LZ130. The water pumps are slowly phased out and from 1973 the company concentrates on building diesel powered trucks. This is reflected in a name change to Liuzhou Automobile Manufacturing Plant.

Feiyue LGS130

Liujiang LZ130

Enter Dongfeng

In 1978 Dongfeng launches the EQ140 truck and Liuzhou Automobile takes advantage of the ‘capital investment’ program (as explained last week) by the Shiyan company. It secures a supply of mechanical components (cabs, frames) for this truck and equips it with a 6105Q diesel engine, sourced from Yuchai, another well-known diesel engine manufacturer. The new truck hits the market in 1979 as Guangxi LZ140.

This development opens the door for Liuzhou Automobile’s inclusion in the Dongfeng Motor Industry Industry Association in 1981. Dongfeng takes managerial control of the Liuzhou plant, although the product line-up remains the same. Only the brand name changes, instead of Liujiang or Guangxi the trucks are now sold as Dongfeng. In the late eighties Dongfeng also takes formal control of Liuzhou Automobile. It acquires a 75% shareholding, while Guangxi province retains 25%. This equity division is still current.

Liuzhou Automobile’s output quickly rises under the influence of Dongfeng. In 1987 it passes an annual production of 5,000 trucks, in 1991 that number doubles. In 1992 Liuzhou Automobile replaces the old Liujiang and Guangxi trucks with an entirely new model, now with an European style front-steer cabin. At the same time it get its own brand name back. The new truck is known as Chenglong.

I’ll fast forward through the remainder of Liuzhou Automobile truck story. Chenglong makes medium sized trucks. In 2003 the company adds a second brand called Balong for heavy trucks. With Balong also the American style torpedo cab returns. The two brands co-exist for twelf years, but at the end of 2015, Balong and Chenglong were merged and all vehicles carry the Chenglong brand. Despite the brand name, technology is shared with Dongfeng’s self-branded trucks. The Chenglong brands keeps growing and today the annual output is about 55,000.

Fengxing passenger cars

Liuzhou Automobile is one the first companies in the Dongfeng empire to produce passenger cars. This story also underlines the autonomy some of the subsidiary companies enjoyed in the earlier days of the Dongfeng empire. As we will learn in a few weeks from now, Dongfeng’s passenger car program was initially linked to Taiwan manufacturer Yulon and Nissan. Liuzhou Automobile however engaged with China Motor Corporation, a related Taiwanese manufacturer, for its first car.

China Motor makes Mitsubishi models for the Taiwanese market. One of them is the (4th generation) Delica Space Gear, an MPV. Liuzhou Automobile acquires the platform for this car from the Taiwanese in 2001 and the first few years the Fengxing Lingzhi is just a locally assembled, rebadged Taiwanese Mitsubishi. China Motor ends production of this car in 2007, but Liuzhou Automobile keeps it going until today. Fengxing is the company’s passenger car brand and Lingzhi (Future) is the model name. Of course the car today is unrecognizable from the early Lingzhi, because Fengxing does its fair share of development and implements a large number of facelifts over the years, the most recent one in 2020. A self-developed, larger MPV loosely based on the Lingzhi appeared in 2013. This MPV is sold under several names like F600, CM7 or Lingzhi Plus.

Fengxing Lingzhi (2008)

Current Lingzhi M5

Placed below the Lingzhi, Fengxing introduces another Mitsubishi-based MPV in 2007. This time the donor is the shortened platform of a Mitsubishi, the Chinese adaptation is called Jingyi (Joyear). This car is much more aimed at the private car market and competes with for instance the hugely popular Wuling Hongguang. For the first six years of its life it’s a MPV, but thereafter Fengxing launches a few restyled X3 and X5 versions that must connect with the increasing popularity of SUVs/crossovers.

So far Fengxing vehicles have been based on technology not used anywhere else within Dongfeng, but that changes when the brand rolls out its second-generation cars in the mid-2010s. The S50 compact sedan is based on the Nissan Sylphy and the Jingyi X5/X6 (crossovers) and S500/SX6 (MPVs) use the Qashqai platform. Also, the Mitsubishi engines are ditched in favour of Nissan or Peugeot units.

The Jingyi-series evolves into the T5 and T5L in 2019 and becomes the first model to be marketed as Forthing. In 2018 Dongfeng decides to put the English name on all of its cars, also in China itself, so Fengxing becomes Forthing. Last year the much more dramatically styled T5 Evo crossover coupe joined the lineup. This year the compact MPV-range will be replaced by the even so remarkable M4.

Fengxing Jingyi

Fengxing Jingyi SUV

Fengxing Jingyi X5 (mk.1)

Fengxing Jingxi X5 (mk.2)

Fengxing Jingyi S50

Fengxing SX6

Fengxing T1EV

Fengxing M4

Fengxing T5

Fengxing T5 Evo

What we learn from Liuzhou Automobile is that this Dongfeng subsidiary companies still operates with a certain autonomy, but increasingly uses the technology available within the group to its advantage. We can conclude that the rationale behind the Dongfeng Motor Industry Association worked out pretty well in this case.

The French connection

The Fengxing brand was not the first passenger car production for Dongfeng however. Almost ten years before the Lingzhi MPV a far better known car rolled of the assembly line in Xiangyang (actually Xiangfan, as the city was known until 2010), the Fukang hatchback. Together with the FAW-VW Jetta and the SAIC-VW Santana this Citroen Fukang became one of the archetypical cars in China, probably because they were the first modern joint venture products.

In the mid-1980s Dongfeng was already contemplating passenger car production and when the government installed the joint venture policy, the company rapidly put in an application. It was granted in 1987. Dongfeng first talked to Toyota, but the Japanese weren’t interested and so Citroen became an option. The French were denied a joint venture with SAIC, when Volkswagen got the deal, and so they jumped on this new opportunity. The first contracts for Shenlong Automobile (literally: divine dragon, but translated as Dongfeng Citroen Automobile) were signed in late 1990 and production started in 1992. Dongfeng built the Xiangyang factory (in Hubei province) already in 1984, the first factory outside of their Shiyan base.

Citroen Fukang

Citroen Fukang 988 VIP

Citroen C3-XR

Citroen C-Elysee (mk.2)

Citroen C4L

Citroen C-Triomphe

Citroen C6 (mk.2)

The Fukang, known as Citroen ZX in Europe, wasn’t the same runaway success as the Volkswagens. The main problem was the lack of a dedicated supply chain. Dongfeng didn’t have one, so in the early years the Citroen production relied heavily on the components industry SAIC and Volkswagen set up in Shanghai. But Shenlong learned quickly and gradually built its own supply chain. And it started adapting the cars to the Chinese market. The Fukang 988, a sedan version of the car, appeared in 1998, not much later followed by the stretched VIP version.

Shenlong added the Picasso (2001) and Xsara and replaced the Fukang 988 with the C-Elysee (both 2003). In 2004 Peugeot joined Shenlong, after dropping out of a difficult joint venture with Guangzhou Automobile a few years earlier. And by that time the sales numbers started to take off. Shenlong also added two new factories in Wuhan. Peugeot brought the 206 and 307 to China, while Citroen introduced the C-Triomphe, a range topping China-only model. More models followed later on and in 2015 Shenlong sold almost 750.000 cars. A new factory in Chengdu raised capacity to over a million vehicles.

Peugeot 207 Cross

Peugeot 308

Peugeot 408 (mk.1)

Peugeot 408 (mk.2)

Peugeot 4008

Peugeot 508

But that capacity remained unused, because the way down was much steeper than the way up. In a rather puzzling turn of events, both the French brands quickly fell from grace and reached rock-bottom in 2020. Shenlong only sold 50.000 cars that year. In retrospect the rapid decline is attributed to a lack of New Energy models, lack smart connectivity options and a drop in perception of French cars as premium products in general. Also it didn’t help that Shenlongs dealer network shrunk and Peugeot and Citroen managers didn’t see eye to eye. Eventually the turnaround came in 2021, when Shenlong doubled its sales, but there’s still long way to go back to the former glory days.

In 2018 Shenlong brought back the Fukang, which was discontinued in 2009. This time Fukang became a brand. The make markets two models, the e-Elysee and the ES500. The former is the BEV-version of the Citroen C-Elysee, the latter a rebadged Fengshen E70. Both cars are aimed more at the professional market (ride sharing, taxi’s) than the consumer market.

Back to Dongfeng

We left Dongfeng om 1992, when it formed the corporate structure. It worked fine for a few years, but at the end of the nineties the operating arm, Dongfeng Motor Company, ran into financial troubles due to the Asian financial crisis. Dongfeng created a new company called Dongfeng Motor Co., Ltd. in 2001 and performed a debt to equity swap. Next Dongfeng Corporation bought back all the equity. In 2003 the new company was renamed Dongfeng Motor Industrial Investment and a few months later Dongfeng Motor Group Co., Ltd (DFMG). In December 2005 DFMG was listed on the Hong Kong stock exchange, while Dongfeng Motor Corporation retain two thirds of the share capital.

After China became a member of the World Trade Organisation in 2001, a number of international car manufacturers lined up to try their luck. Dongfeng signed a whole lot of them for new joint ventures. Kia was the first in 2002, Honda and Nissan followed in 2003. The same year Dongfeng also established a domestic joint venture with Sokon Industry. Later joint ventures with Yulon Motors (2010) and Renault (2013) completed the Group’s impressive expansion.

Dongfeng still produces many trucks. The heavy trucks are mainly made by the wholly owned Commercial Vehicle division of DFMG. The medium trucks and light commercial vehicles are made with the Dongfeng-Nissan joint venture, which will be discussed in two weeks time. Dongfeng also has several scattered passenger car brands produced with different joint ventures or subsidiaries, but its main self-owned brand is Fengshen. This is made by another wholly-owned DFMG division, called Passenger Vehicle Company.

The Fengshen brand

Within Dongfeng, Fengshen can mean two different. First it can be Fengshen Automobile, an car assembly subsidiary of Dongfeng-Nissan, that makes Nissans. Alternatively, Fengshen can mean the car brand of DFMG. It’s the latter I’m going to talk about now. Dongfeng’s independent brand development started in 2007, but the Passenger Vehicle Company was formally established in June 2009, coinciding with the start of production of the first model and the end of life for the Citroen Fukang.

The first Fengshen was the S30 sedan, later joined by the H30 hatchback and AX3 crossover, was a heavily restyled Citroen Fukang. So Fengshen did what so many new Chinese brands had done before: get your hands on foreign technology and production line. Fengshen would make full use of the French connection, several of their cars would share technology with models from Peugeot and Citroen. But not their second model, the 2011 A60. That was a restyled Nissan Sylphy.

Fengshen E30L

Fengshen EX1

Fengshen H30

Fengshen S30

Fengshen A30

Fengshen A60

Fengshen L60

Fengshen A9

Fengshen AX3

Fengshen AX4

Fengshen AX5

Fengshen AX7

Fengshen Yixuan

Fengshen Yixuan GS

Fengshen Yixuan Max

Racy version of Fengshen Yixuan Max

The connection with PSA (parent company of Peugeot and Citroen) grew stronger in 2014. PSA was in a bit of a pickle moneywise and DFMG invested alongside the French state. DMFG acquired a 14% shareholding, that lasted until PSA merged into Stellantis. The new owners wanted the Chinese to divest their interest and DMFG currently only holds 2,5% of Stellantis shares. The shareholding in PSA led to the joint development of the CMP platform. PSA used it for many (sub-)compact cars in Europe, while Fengshen developed their compact/midsize Yixuan series on the platform. Besides these cars, The Fengshen AX4 and L60 are on older PSA platforms and the range-topping A9 is shared with the China-only second generation Citroen C6.

The Nissan Qashqai platform is one of the most used platforms by Dongfeng brands and so Fengshen also has a few crossovers on this technology, namely the AX5 and AX7 models.

The Voyah brand

One of the more remarkable developments in the Chinese market is the rapid rise in popularity of medium to high-end New Energy Vehicles. This is mainly driven by the well-known startups like NIO and LI Auto. Many of the legacy automakers have flocked to the market. Where Fengshen was quite a late entry in China’s industry, Dongfeng’s high-end brand Voyah (Lantu in Chinese) has outpaced most of its competitors. The Voyah is already available to consumers, while Changan’s AVATR, SAIC’s Zhiji/IM and Great Wall’s Shalong are not.

And there’s another big difference with Fengshen. Cars of that brand were always based on acquired technology, while the Voyah is clean-sheet design all done by Dongfeng itself. The new ESSA-platform follows all current trends, with lightweight materials, high-end options like air-suspension and a scalable skateboard architecture, accepting both full electric and range-extended drive trains. Autonomous driving features are of course brought up to Level 2, which is state-of-the-art in this segment.

The Voyah Free is the first model, a large SUV co-designed by Italdesign. It taps into the market popularized by the BYD Tang, with a 500 kW all-wheel drive electric power train and an optional 1.5-liter range-extender. The range-extender lifts the range from 500 km to 860 km (NEDC-cycle). While the Free is rather conservative looking car, Voyah’s second model, the Dreamer MPV, is a far more bold statement.

Lautu Automotive Technology was formally established in June 2021 and is for 90% held by DFMG, while the other 10% are controlled by several executives of the company through a management partnership. The cars are made in the factory abandoned by Renault, after their joint venture with Dongfeng ended. The Fengshen brand is the typical SOE-brand serving the mainstream market. It never made a big impact. Dongfeng obviously hopes Voyah will do better in the premium segment.

Next week

This concludes the general history of Dongfeng. Below is an overview of the corporate structure. In the coming weeks we will explore Dongfeng’s many joint ventures with international brands, Starting next week with Honda, Kia and Renault.