China’s power battery sector faces YoY, MoM drop in Feb. 2024 output, sales, installed capacity

Shanghai (ZXZC)- In the first two months of 2024, the power battery sector in China experienced overall growth. Nonetheless, the Spring Festival holiday impacted February's market dynamics negatively, resulting in lower production, sales, and installation capacity for power batteries.

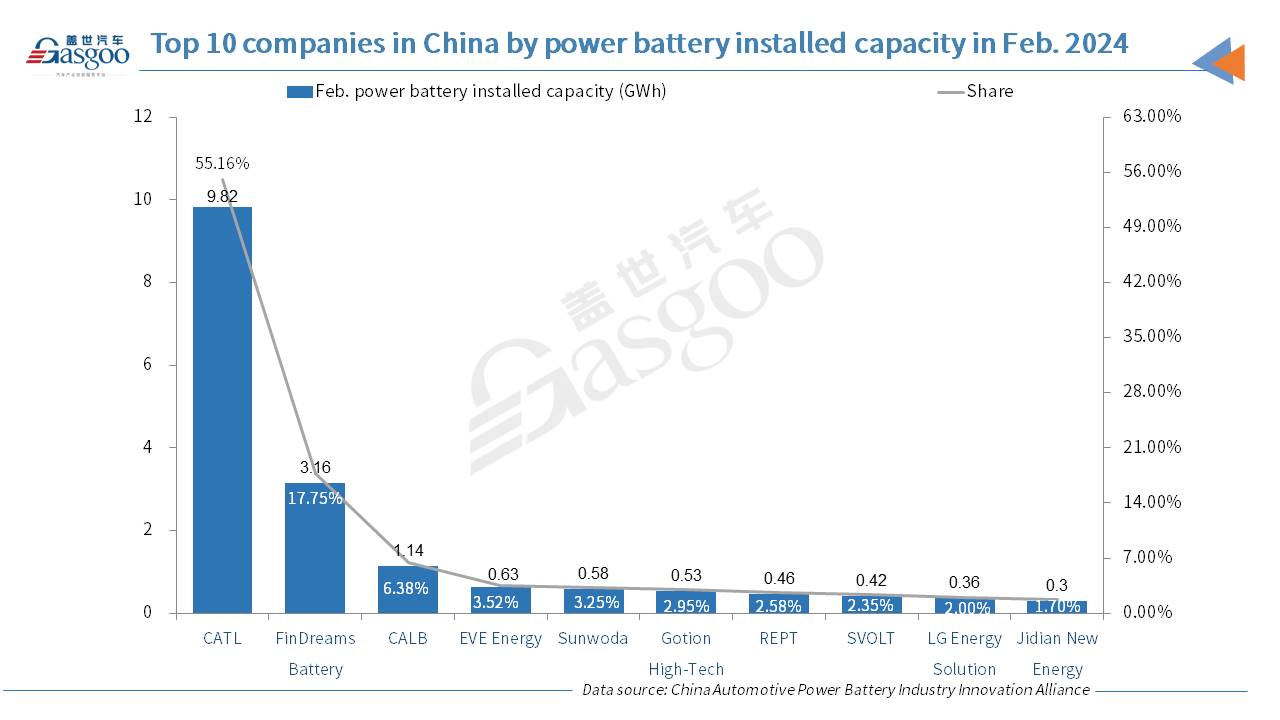

In February, the installed capacity for power batteries in China was 18 GWh, marking an 18.1% decrease year-over-year and a 44.4% drop from the previous month, according to the data by the China Automotive Power Battery Industry Innovation Alliance (CAPBIIA). Of this, ternary batteries contributed 6.9 GWh, accounting for 38.7% of the total installation volume, with a slight increase of 3.3% year-over-year but a month-over-month plunge of 44.9%. Lithium iron phosphate (LFP) batteries saw an installed capacity of 11 GWh, representing 61.3% of the total, with a year-over-year decrease of 27.5% and a month-over-month slump of 44.1%.

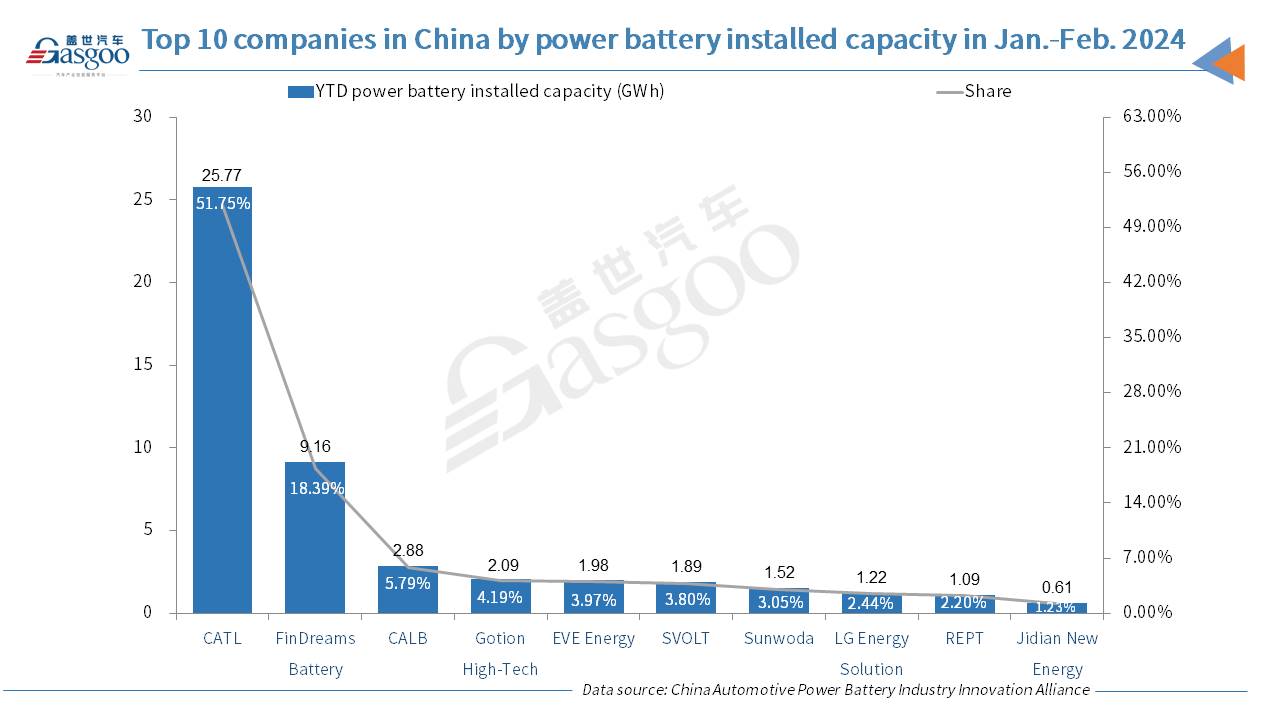

For the first two months of the year, China's cumulative power battery installation volume reached 50.3 GWh, a robust increase of 32% year-over-year. Ternary batteries accounted for 38.9% of this total, with a year-to-date volume of 19.5 Wh and a notable year-over-year soar of 60.8%. LFP batteries, making up 61.1% of the total, had a cumulative installation volume of 30.7 GWh in this period, growing 18.6% year over year.

In February, a total of 36 power battery companies in China saw their batteries installed onto new energy vehicles, three fewer than that of the same period last year. The top 3, top 5, and top 10 companies accounted for 78.6%, 85.3%, and 96.7% of the total installation, respectively.

In the first two months of 2024, a total of 41 power battery companies in China had their batteries installed onto complete vehicles, 2 companies more than that of the same period last year. The top 3, top 5, and top 10 power battery companies accounted for 75.2%, 83.3%, and 95.9% of the total installation, with a volume of 37.8GWh, 41.9GWh, and 48.2GWh, respectively.

In February, the combined output of power and other types of batteries was 43.6 GWh, a 33.1% decrease from the prior month and a 3.6% decline year-over-year.

During January and February, the cumulative production of power and other battery types totaled 108.8 GWh, reflecting a 29.5% increase year-over-year.

Blade Battery; photo credit: BYD

Sales volumes in February for both power and other battery types combined stood at 37.4 GWh, experiencing a 34.6% month-over-month decrease and a 10.1% fall compared to the same period last year. Power batteries dominated with 89.8% of the sales volume at 33.5 GWh, facing a 33.4% decrease from the previous month and a 7.6% decrease year-over-year. Other batteries accounted for 10.2% of the total sales, at 3.8 GWh, showing sharper declines of 43.2% month-over-month and 27% year-over-year.

The combined sales volume for the first two months for both power and other batteries was 94.5 GWh, marking a 26.4% year-over-year increase. Power batteries made up 88.8% of this total with 83.9 GWh, showing a significant year-over-year increase of 31.3%. Sales of other battery types totaled 10.6 GWh, accounting for 11.2% and registering a 2.3% decline from the previous year.

Exports in February for both power and other batteries totaled 8.2 GWh, down 1.6% from the previous month and slid 18% year over year, making up 22% of the month's total sales. Power battery exports were at 8.1 GWh, constituting 98.6% of exports with a minimal 0.7% dip month-over-month and a 10.9% decline year-over-year. Exports of other battery types were significantly less, at 0.1 GWh, which is 1.4% of the total, with both a month-over-month decrease of 38.2% and a substantial year-over-year plunge of 87.2%.

China's cumulative exports for the first two months for both power and other batteries reached 16.6 GWh, accounting for 17.6% of total sales, with a year-over-year decline of 13.8%. Power batteries represented 98.1% of these exports with 16.3 GWh, slightly down by 1.9% year-over-year. Other batteries had a minuscule export volume of 0.3 GWh, 1.9% of total exports, showing a year-over-year fall of 88.2%.