China’s homegrown new energy PV sales keep falling in August

Shanghai (ZXZC)- Chinese automakers sold roughly 71,000 locally-produced new energy passenger vehicles (NEPVs) in August, a year-on-year decrease of 15.5%, while up by 6% from a month ago, according to the China Passenger Car Association (CPCA).

For the first eight months, the country's NEPV wholesale volume totaled approximately 714,000 units, surging 41.7% from a year ago. The association said all aspects of vehicle production and sales were hard to swiftly adapt to the significant cost increase triggered by the NEV subsidy phase-out starting end-June.

(Photo source: BAIC BJEV)

Among the NEPVs sold in August, 56,875 vehicles were driven by all-electric system, a year-on-year drop of 2%. Of that, both car and SUV sectors recorded 1% decrease from the prior-year with 39,342 units and 17,450 units sold respectively, while wholesale volume of MPVs plunged 89% to only 83 units, according to a post on the WeChat account of Cui Dongshu, secretary-general of the CPCA.

PHEV sales tumbled 47% over the year-ago period to 13,966 units in August. Sales volume of cars and SUVs running on plug-in hybrid power system were 7,830 units (-44%) and 5,611 units (-54%).

Both BEV and PHEV sectors posted downturn in August sales of smaller-sized vehicles.

Sales volumes of A00-segment (mini) and A0-segment (small-sized) all-electric PVs evidently fell 15% and 45% respectively to 17,884 units and 6,685 units last month. Besides, plug-in hybrid system-powered A- and B-segment (medium) PVs saw their sales plummet 50% and 67% compared with August, 2018.

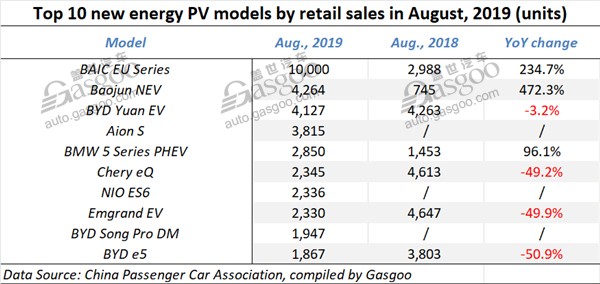

Among the top 10 NEPV models by August retail sales, four models-the BYD Yuan EV, the Chery eQ, the Emgrand EV and the BYD e5-recorded year-on-year sales decrease. However, the top 2 models still achieved stupendous increase.

Compared with July, the BAIC EU Series maintained its championship. The Baojun NEV outperformed the BYD Yuan EV to the runner-up place. Models sitting from the 4th to 6th places remained unchanged. The Emgrand EV and the BYD e5 were ranked 8th and 10th, while still faced drastic decline.

Regarding year-to-date retail sales, the top 10 NEPV models all accomplished growth. Models ranked from 1st to 7th were entirely as same as that of July. The ORA R1 dropped 1 place to the 9th and its former place was supplanted by the Baojun NEV. The EADO EV entered the top 10 list with a splendid growth of 707.3%.