Great Wall Motors posts profit slump amid continuous market gloom

Shanghai (ZXZC)- Great Wall Motors (GWM), China's biggest SUV manufacturer, reported a 58.95% year-on-year slump in first-half net profit attributable to the listed company's shareholders after offering discounts, intensifying brand promotion and increasing R&D cost.

In the latest interim report, GWM said its semi-annual net profit reached around RMB1.517 billion. Meanwhile, total operating revenue during the reporting period slid 15% over a year ago to roughly RMB41.377 billion.

Other key accounting data include:

The net profit attributable to the Company's shareholders after extraordinary gains/losses plunged 65.32% over the prior-year to RMB1.241 billion.

The net cash flow from operating activities amounted to RMB6.113 billion, tumbling 59.12%.

Basic earnings per share were at RMB0.16622, compared with RMB0.40492 for the same period a year ago.

Weighted average return on net assets was 2.87%, decreased by 4.43 percentage points from the year-ago period.

Amid a depressed domestic automotive market climate, both production and sales volume of automobiles declined from that of the same period last year. In June, affected by the implementation of China VI Emission Standards in certain regions and the reduction in subsidies for new energy vehicles (NEVs), most enterprises chose to step up their promotional efforts to reduce inventory, thus slowing the decrease of the automobile sales.

Compared with the traditional automobile market, the NEV market sustained a vigorous growth rate, reaching 49.6% year-on-year in the first half of 2019, but its overall market size was still small, said GWM.

For the first six months, GWM achieved a sales volume of 460,300 vehicles. Of that, sales volume of SUV amounted to 358,900 units, thus enabling itself to maintain its leading position in the domestic SUV market.

Revenue from the sale of automobiles in the domestic market reached RMB34,407,119,485.82, representing approximately 85.34% of the Group’s operating revenue.

For the first two quarters, Chinese automakers' export performance was somewhat affected by such factors as overseas economic fluctuations and Sino-US trade frictions.

During the period, China's automobile companies exported 488,000 vehicles, representing a year-on-year decline of 4.7%.

However, GWM still saw its first-half auto exports in overseas markets jump 16.77% to around 26,000 units. The revenue generated from the export business reached RMB1,993,679,169.49, accounting for approximately 4.95 % of the Group's operating revenue.

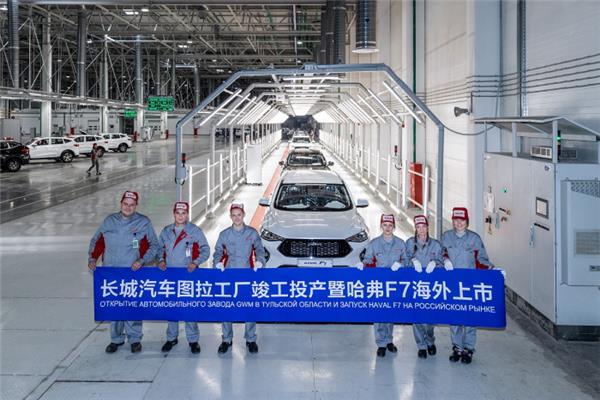

The Group's plant in Tula Oblast, Russia was officially completed and put into operation on June 5, 2019. The Haval F7 was produced in this factory and sold in overseas markets, signifying GWM's globalization strategy reached a new milestone.

At the Auto Shanghai 2019, the Group presented the world debut of "Great Wall Pao" high-end pick-up truck marque, which was based on new platform, offering 3 models including commercial pick-up truck, passenger pick-up truck and off-road pick-up truck. On August 18, new P Series Pickup was officially launched, opening the era of Chinese passenger pickup and globalization.

Besides, on June 20, 2019, GWM's wholly-owned subsidiary HYCET E-Chuang Technology Co., Ltd. officially released "I era" powertrain technology products, including 4N20 engine, 9DCT transmission and 6001 electric drive system, demonstrating its comprehensive strength in powertrain integration innovation (Photo source: GWM, data source: GWM's semi-annual report).