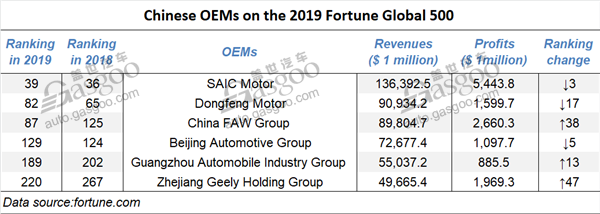

Chinese OEMs tabulated on 2019 Fortune Global 500

Shanghai (ZXZC)- The Fortune Global 500 list, one of the most authoritative ranking presenting the business performance of companies worldwide, was officially released on July 22. The world's 500 largest companies on the newly-unveiled list generated $32.7 trillion in revenues and $2.15 trillion in profits in 2018.

A total of 6 OEMs from Mainland China entered into the list, the same as that of a year earlier.

SAIC Motor, Dongfeng Motor and Beijing Automotive Group saw their rankings on the latest list fall 3, 17 and 5 places over the previous year.

SAIC Motor was still the most lucrative OEMs in China despite a slight drop in ranking, the 6th year in a row entering the top 100 list.

The China's biggest automaker has sold roughly 82,000 NEVs in the first half of the year, a year-on-year surge of 42%, the company announced via its WeChat account.

A hydrogen-refueling station jointly built by Shanghai Chemical Industry Park and the SAIC Motor was officially launched on June 5 at the Shanghai Chemical Industry Park. It is said to be the world's biggest one so far.

Moreover, the Shanghai-based auto group said it closed the first half of the year with around 145,000 vehicles exported and sold in overseas markets, a new record-breaking figure.

Dongfeng Motor faced the steepest decline in ranking with a full-year revenue in 2018 reaching $90,934.2 million.

Dongfeng Motor Group sold 1,374,440 vehicles during the first two quarters, a year-on-year drop of 8.99%. Sales of Dongfeng Honda jumped 13.34% from the year-ago period, while Dongfeng Venucia, Dongfeng Nissan, Dongfeng Infiniti, Dongfeng Renault and DPCA all suffered sales decrease over a year ago.

(Photo source: Beijing Benz)

Beijing Automotive Group slipped 5 places to the 129th, appearing in the global top 500 list for 7 consecutive years.

For the year of 2018, the Beijing-based state-owned auto group earned $72,677.4 million in revenues and $1,097.7 million in profits, rising 2.2% and 7.3% year on year respectively.

Among the other three OEMs who got their rankings climbed, China FAW outperformed Beijing Automotive Group with its ranking jumping by 38 places.

GAC Group moved up 13 places to the 189th. The group sold 999,560 new cars during the first half with a slight year-on-year decrease of 1.69%. Meanwhile, its vehicle outputs through June slid 9.49% from a year earlier to 948,157 units.

On June 26, GAC Group's mobility service platform "ON TIME" formally launched its trial operation in Guangzhou. Such hotter-selling NEV models as the Trumpchi GE3 530, the Aion S and the Toyota Levin Hybrid will be deployed on the platform at the initial stage.

The ON TIME is principally invested by GAC Group (35%), Tencent (25%) and Guangzhou Public Transport (10%) and involves other investors including the ride-hailing giant Didi.

GAC NIO, an EV manufacturer jointly owned by GAC Group and NIO, launched on May 20 the all-new car brand HYCAN (an abbreviation of “here you can”, Chinese brand name is “Hechuang”) in Hangzhou. The concept of the new brand's first model was unveiled at the same time.

Zhejiang Geely Holding Group boasts the biggest ranking growth, the only non-state-owned Chinese OEM included on the top 500 list.

Geely Automobile Holding said its cumulative sales volume for the first six months reached 651,680 units, sliding approximately 15% from the year-ago period and completing 43% of the Group's full-year sales target of 1.51 million units in 2019.

However, year-to-date sales of new energy and electrified vehicles skyrocketed 301.06% over the prior-year to 57,600. The newborn EV brand Geometry plans to roll out over 10 all-new BEV models by 2025 covering sedans, SUVs and MPVs.

The group revised downward the 2019 annual sales goal by 10% to 1.36 million units from 1.51 million units due to the continuous uncertainties in China's PV market and its determination to proactively reduce the aggregate inventories of its dealers which partly led to the lower-than-expected Jan.-Jun. sales.