Thailand emerging as strategic market for Chinese automakers

Avatr entered the Thai vehicle market last week, becoming the latest on a long list of Chinese vehicle makers to explore the Southeast Asian country.

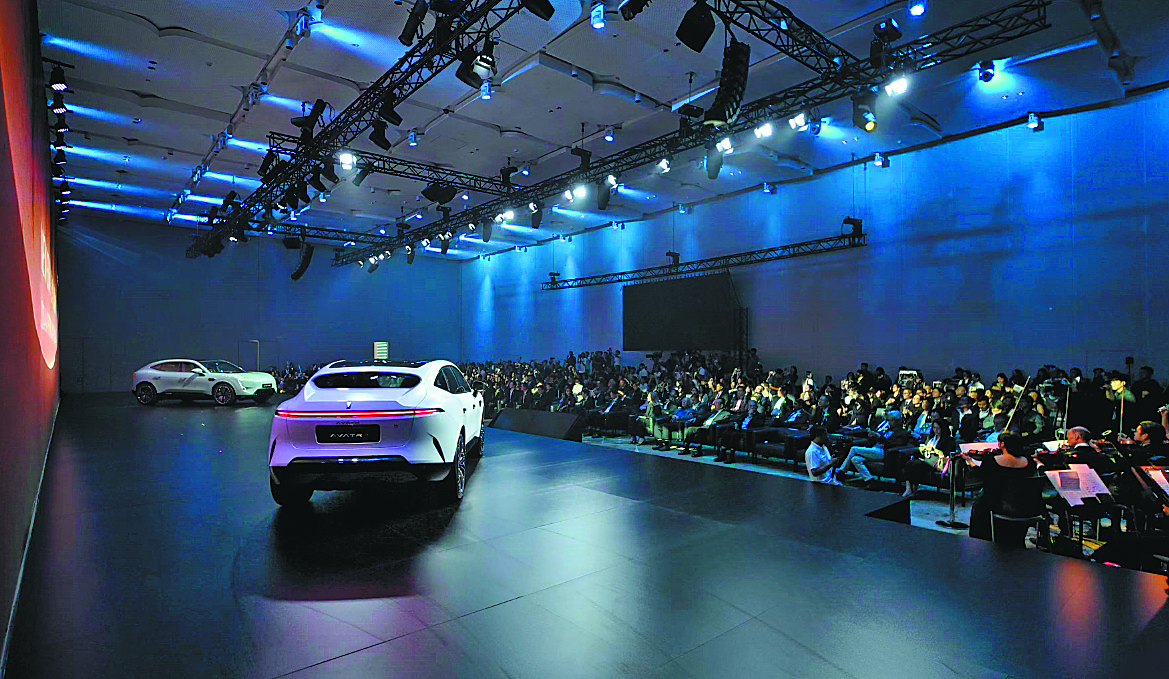

The startup unveiled the Avatr 11, an SUV coupe in Bangkok, which also marks its parent company Changan's fourth model in Thailand, following the launches of the Deepal L07 and S07 in 2023 and the Lumin L earlier this year.

Southeast Asia, with Thailand as its core, is emerging as a hub for Chinese carmakers, especially those which produce new energy vehicles, serving as a springboard for them to explore more overseas markets.

"We are confident in our ability to make Thailand a strategic market for our global business," said Avatr President Chen Zhuo.

Chinese brands have taken a leading position in Thailand's nascent but booming NEV market, thanks to the cutting-edge features available in their vehicles.

About 76,000 EVs were sold in Thailand in 2023, with about 80 percent of them Chinese models, according to Thai authorities.

The Thai government is ambitious about the EV sector. As a regional automotive manufacturing and export hub, it aims to convert 30 percent of its annual auto production into EVs by 2030.

The goals are attracting Chinese companies to not only ship more vehicles into the country but also to produce vehicles locally.

According to the Board of Investment of Thailand, many Chinese EV makers have agreed to the government's request to use auto parts made by Thai companies.

Great Wall Motor, for instance, would source 80 to 90 percent of its EV components from local materials.

Thai Deputy Prime Minister and Minister of Energy Pirapan Salirathavibhaga highlighted the importance of investments from Chinese carmakers in stimulating the economy and aiding the development of Thailand's industrial sector.

Last year, Changan announced an investment of 8.86 billion baht ($268 million) to build its first overseas EV production plant in the country, which is scheduled to start operation in 2025 with an initial capacity of 100,000 units per year.

BYD kicked off operations at its Thai plant in early July, with an annual production capacity of 150,000 vehicles.

The plant is also BYD's first factory in Southeast Asia, a fast-growing regional EV market where it has become the dominant player.

Besides BYD, companies including Neta and Aion have established plants in the region.

Aion's manufacturing facility in Thailand started production in July, with an initial annual production capacity of 50,000 units. It is also building a plant in Indonesia, which is expected to start production around the end of the year.

Neta's two plants, one in Thailand and the other in Indonesia, have already started vehicle production.

In Southeast Asia, Neta comes second only to BYD in terms of EV sales, according to the China Insights Consultancy.

"We welcome Chinese companies with new quality productive forces to set up their factories and even regional headquarters in Thailand. In return, Thailand will release more incentive measures to support their development," said Thailand's Minister of Industry Pimphattra Wichaikul, at a recent forum.

Pimphattra noted the important role the EV industry will play in the country to achieve its sustainable development goals. "This will not only benefit us, but also future generations," she said.