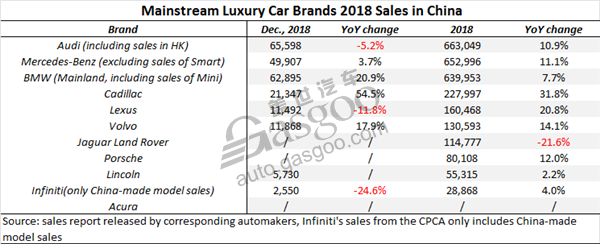

Summary: 2018 sales in China for mainstream luxury carmakers

Shanghai (ZXZC)- According to the resultant sales performance announced by premium car makers and the China Passenger Car Association (CPCA), Audi finally transcended Mercedes-Benz, taking the championship in terms of single brand's 2018 sales in China.

Audi

Most automakers tabulated here realized positive growth in full-year sales. However, a few companies, such as Jaguar Land Rover and Acura were still negatively hit by the overall slowing economic climate or the their own problems in product and development strategies.

Audi gained the crown in China in terms of the 2018 single luxury car brand sales. Last year, it saw its China sales grow 10.9% from the previous year. Out of that, sales of China-made Audi cars exceeded 600,000 units for the first time with a year-on-year increase of 10.2%. Deliveries of imported cars jumped 20% to 60,188 in 2018.

In fact, from July last year, Audi had been holding the championship based on single brand’s sales for six straight months.

The car marker rolled out 16 new models in China during the past 2018. The annual sales of such models as the Audi A6L, the Audi Q5 (including the Audi Q5L) and the Audi A4L all surpassed 100,000 units.

Mercedes-Benz

Although the single brand sales champion was taken by Audi, Mercedes-Benz also did quite a good performance. Last year, the company saw its China sales evidently climbed 11.1% from a year ago to 652,996 units. The locally-produced models made up over 70% of the brand’s total sales.

The German premium car brand plans to roll out 15 new models in this country, including the new E-Class, the mid-cycle refresh GLC L, the all-new GLE and the all-new EQC, the automaker told local media on January 29.

BMW

Including sales of Mini, BMW sold a total of 639,953 vehicles in China, recording a new high performance, while it was still outnumbered by Audi and Mercedes-Benz.

BMW's China sales in the first half of the year slightly climbed 2.2% over the year-ago period. Powered by models like the BMW X3, the automaker finally achieved a double-digit YoY growth for the entire year.

It is worth mentioning that BMW’s NEV sales in China totaled around 23,400 units, topping other premium car makers in terms of NEV full-year sales.

Cadillac

Following the three German premium car brands, Cadillac was the other one whose 2018 sales in China exceeded 200,000 units and also the sales champion among the so-called second-tier luxury car brands. The Cadillac XT5 accounted for nearly 30% of total sales.

Actually, the General Motors-owned car brand fulfilled its annual sales target for China (200,000 units) by the end of last November.

Lexus

Lexus sold 11,492 vehicles in China in last December, which made the brand successfully completed its 1.6 million-unit sales goal.

As a premium car brand solely relying on import, Lexus makes a reasonable product layout in both sedan and SUV sectors. The new Lexus ES, the new LS and three small-sized SUV models successively hit China’s market last year. The sales of the Lexus Hybrids soared 42% over the year-ago period to 49,549 units.

Volvo

Volvo Cars achieved double-digit growth in both December sales and full-year sales thanks to the popularity of the China-made Volvo XC60 and the S90.

In 2019, the Geely-owned Swedish premium car brand plans to roll out several new models in China, including the China-made XC40 and S60 as well as the imported all-new V60 and the mid-cycle refresh XC90.

Jaguar Land Rover

Jaguar Land Rover retail sales in China slid 21.6% compared to 2017's record year. The company said the ongoing challenging market conditions in China as slowing economic growth and trade tensions with the U.S. continue to impact automotive sales volumes across the industry.

Porsche

In 2018, China once again became the largest single market for Porsche, who saw its sales rose 12% from a year ago in this country.

Lincoln

Lincoln obtained a positive sales growth last year despite the Sino-U.S. trade friction. Especially, annual sales of the Lincoln Navigator surged 84% compared with the previous year.

Infiniti

We only got the sales data of Infiniti's locally-produced models from the CPCA, while the less-than-30,000-unit sales volume was quite a depressed number.

The automaker set a sales goal of 100,000 vehicles for 2018's Chinese market, yet the final performance was clearly far from its original ambition.

Acura

Honda didn't announce the concrete sales number of each model in December and 2018. For the first eleven months, Acura only sold 8,085 vehicles with a sharp YoY drop of 42.7%.

Some insiders said Acura has not figured out the real demands for Chinese consumers. Although it is accelerating the product localization in China, the automaker fails to keep up the pace of Chinese market's development in terms of construction of sales channels, marketing strategy as well as the model upgrade.