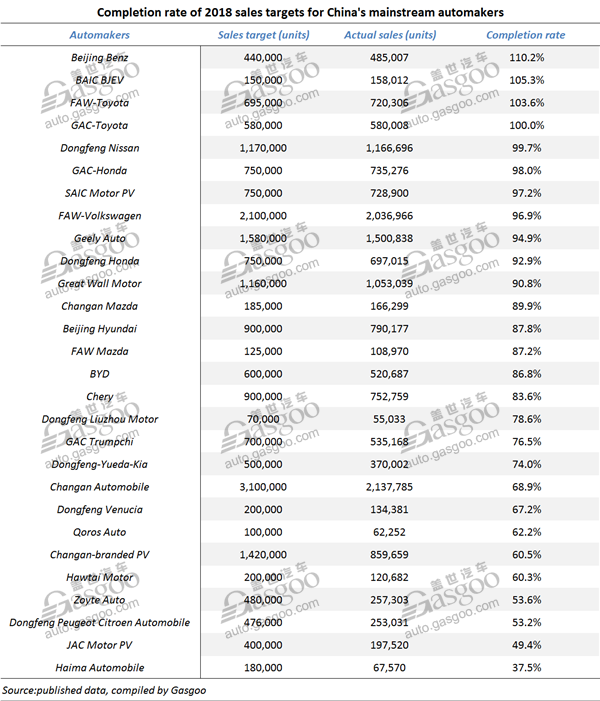

Summary: 2018 sales target completion rate for China-based mainstream automakers

Shanghai (ZXZC)- China's vehicles sales dropped 2.76% year on year (YoY) to 28,080,600 units, the first-time YoY negative growth for the past 28 years, according to data released by China Association of Automobile Manufacturers (CAAM).

The cooling performance was also reflected in the completion rate of sales target for many automakers in China. By compiling the sales data and sales goal announced by 28 mainstream China-based automakers, ZXZC finds out that companies failing to complete their targets comprise the majority. Some of them even didn't realize 50% of goals.

Last year, such automakers as Dongfeng Venucia, Qoros Auto, Changan-branded PV, Hawtai Motor, Zoyte Auto, DPCA, JAC Motors PV and Haima Automobile fulfilled less than 70% of targets and the latter two companies even saw their annual sales halved over a year ago.

However, some automakers' sliding performances cannot be entirely blamed to the overall climate, while more important reason should be their own incompetency in products.

Haima Automobile only completed 37.5% of sales target with only 67,570 vehicles sold last year. The sales of the Haima S5 SUV amounted to 27,234 units, accounting for 40.3% of the automaker's total sales, yet sharply sliding 140% from a year earlier, which is much higher than the average sales drop of 5% for overall SUV market. Apart from the sales plunge caused by product weakness, the frequent personnel changes and corporation strategic transformation somewhat negatively impacted its sales performance.

JAC Motors's PV sales in 2018 were 197,520 units, only fulfilling 49.4% of the target. According to the data announced by JAC Motors, its annual sales of SUVs and MPVs evidently shrank 23.16% and 16.08% respectively. It is worth mentioning that JAC Motors saw its all-electric PV sales in 2018 skyrocketed 125.28% to 63,671 units, offsetting the sale downturn to some degree. However, with the NEV subsidy being phased out, the automaker needs to find more powerful weapon to survive the cooling market trend.

Beijing Benz, BAIC BJEV, FAW-Toyota and GAC-Toyota overfulfilled their sales targets, and Dongfeng Nissan, GAC-Honda and SAIC Motor PV all almost completed corresponding goals.

Beijing Benz delivered 485,007 vehicles throughout 2018, 45,007 units more than the original target. It monthly sales were rather stable thanks to the driving force from the Mercedes-Benz E Class, C-Class and GLC-Class.

FAW-Toyota also performed well in completion rate of sales target. The hotter-selling Corolla had YoY sales increase of 9.4% despite the drop of overall car sales. In fact, Sino-Japanese joint ventures generally enjoyed pretty high completion rate, such as GAC-Toyota, Dongfeng Nissan and GAC-Honda.

BAIC BJEV is the only China-owned automaker that exceeded its sales goal. According to latest reports, the NEV marker sets a sales target of 220,000 units for 2019, determining to face the fierce competition from a number of joint venture EV markers and bear the pressure brought by the subsidy phase-out.

Although Geely Auto failed to accomplish the target, its annual sales topping 1.5 million units made it the champion by China-owned PV brand sales in 2018.