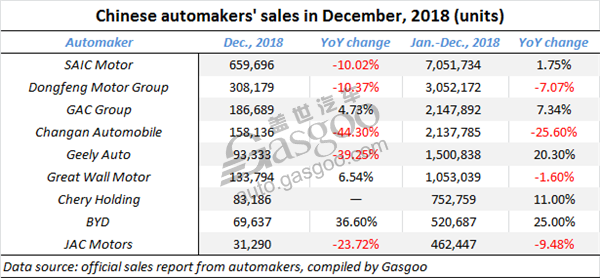

Summary: sales of China-based mainstream automakers in 2018

Shanghai (ZXZC)- China's vehicle sales in 2018 dropped 2.76% year on year (YoY) to 28,080,600 units, showing the first-time decline for the past 28 years, according to sales data released by China Association of Automobile Manufacturers (CAAM).

ZXZC hereby tabulates the sales data released by some mainstream automakers in China. Among the companies with annual sales exceeding 2 million units, Dongfeng Motor Group and Changan Automobile have seen negative growth. SAIC Motor was still the champion by yearly sales as the previous year, while only a slight growth of 1.75% was made by the Shanghai-based carmaker.

Besides, four of the first six automakers enumerated here whose annual sales topped 1 million units were hit with double-digit sales decrease in December.

SAIC Motor

SAIC Motor sold a total of 7,051,734 vehicles throughout 2018, achieving a YoY growth of 1.75% and gaining 24% of market shares in China, the automaker reported on January 4. However, in the final month last year, its sales still dropped 10.02% over a year ago to 659,696 units.

Two self-owned car brands managed by SAIC Motor PV—Roewe and MG saw their annual sales aggregated 701,885 units with a significant YoY jump of 34.45% despite China's overall sales downturn.

SAIC-GM-Wuling climbed to the 1st place topping other SAIC Motor's subsidiaries in terms of December sales. As to YTD sales, it is still the champion, yet posts the biggest YoY sales decline among subsidiaries having annual sales exceeding 10,000 units.

SAIC Volkswagen (SAIC VW) attained an annual sales volume of 2,065,077 vehicles in 2018, the fourth year in a row becoming the champion PV maker in China. SAIC-GM's cumulative sales edged down 1.5% from the previous year, while its Cadillac brand gained a vigorous YoY increase of 31.8% with around 228,000 vehicles sold last year.

Dongfeng Motor Group

During the past 2018, Dongfeng Motor Group witnessed its sales shrank 7.07% YoY to 3,052,172 units. PV sales, which accounted for nearly 86% of total sales, also showed a YoY decline of 7.69%. Of that, the annual sales of cars and SUVs reached 1,278,741 units and 1,162,201 units, sliding 0.98% and 13.61%.

Dongfeng Motor Company Limited gained a YoY growth of 4.16% last year. Except Dongfeng Venucia, Dongfeng Nissan and Dongfeng Automobile Co.Ltd both achieved positive growth. Another joint venture with Japanese automaker Dongfeng Honda posts a double-digit growth in Dec. sales and its full-year sales edged up 0.9% from a year ago.

However, both Sino-French joint ventures—Dongfeng Renault and DPCA suffered YoY decline of over 30%. Last month, the sales plunge for both of them exceeded 70%.

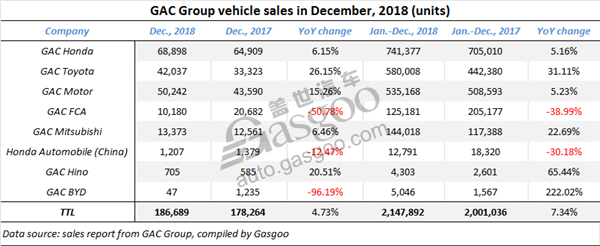

GAC Group

GAC Group announced a YoY growth of 7.34% with a total of 2,147,892 vehicles sold in 2018 and most subsidiaries achieved positive growth from the previous year. With regard to the performance in December, the automaker still attained a YoY increase of 4.73%.

Last year, three Sino-Japanese joint ventures all showed rising momentum. GAC Honda gained a YoY growth of 5.16% thanks to the fresh power coming from the tenth-generation Accord and the all-new Crider that were newly launched in 2018.

GAC Toyota saw its sales leap 31.11% in 2018 largely driven by the hotter-selling Highlander and the eighth-generation Camry. The GAC Mitsubishi, featuring relatively weaker presence than GAC Honda and GAC Toyota, also gained a YoY jump of 22.69%. However, GAC FCA, which faces the similar trouble to GAC Mitsubishi, witnessed its sales slump 38.99% with only 125,181 units delivered last year.

GAC Trumpchi, the group's self-owned car brand, had its 2018 sales grow 5.23% to 535,168 units, the second consecutively year with full-year sales exceeding 500,000 units after 2017.

Changan Automobile

Chongqing Changan Automobile Co., Ltd. saw its full-year sales in 2018 slid 25.6% from the previous year to 2,137,785 units. Meanwhile, it faced a YoY slump of 44.3% with 158,136 vehicles sold in December, according to the automaker's sales report.

The automaker said the annual sales of its self-owned Changan brand amounted to 1,499,747 units, exceeding 1 million units for the fourth year in a row.

A total of 86,832 NEVs were sold by the group, among which the Dec. NEV sales were 21,204 units.

However, speaking of the full-year sales of each subsidiary, the negative growth has happened to all of them. Particularly, Changan Ford, the major force among joint ventures, should see its sales in 2018 nearly halved over the previous year.

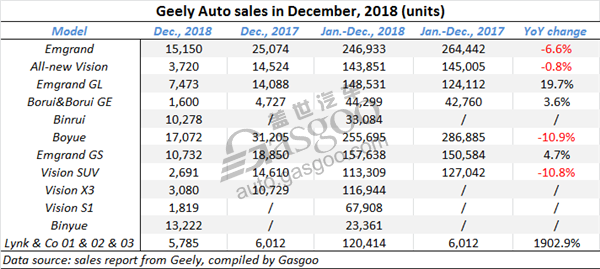

Geely Auto

Geely Automobile Holdings Limited sold 1,500,838 vehicles throughout 2018 with a YoY growth of 20.3%, making it the champion among Chinese PV makers by 2018 sales and its full-time sales exceed 1.5 million units for the first time in history.

Geely Auto saw its SUV sales total 857,922 units, accounting for 57% of the company's annual new car sales and for the first time taking the championship in terms of 2018 SUV sales in China.

As to sedan models, the full-year sales of the Emgrand and all-new Vision presented slight YoY drop of 6.6% and 0.8% respectively. However, the sales of the Emgrand GL jumped 19.7% over the year-ago period. The Binrui sedan had monthly sales exceeding 10,000 units in November and December.

The premium car brand Lynk & Co gained an annual sales volume of 120,414 units. Its sales in December calculated by ZXZC were 5,785 units.

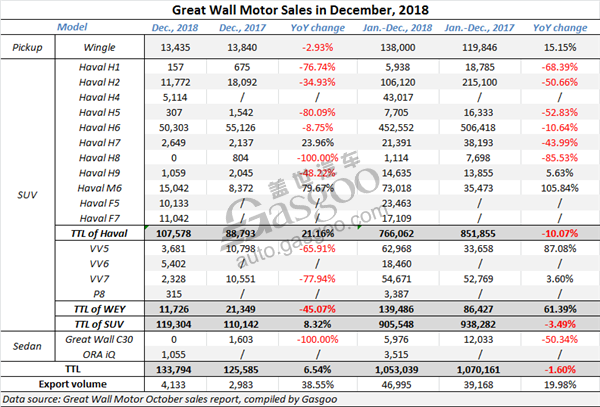

Great Wall Motor

Great Wall Motor (GWM) announced that its full-year sales in 2018 edged down 1.6% over the year-ago period to 1,053,039 units, failing to accomplish its 1.16 million-unit yearly sales target.

However, its sales in December gained a YoY increase of 6.54%, the third month in a row achieving positive growth.

The automaker saw its annual SUV sales drop 3.49% from a year ago to 905,548 units. As GWM's absolute sales mainstay, Haval SUV brand faced a YoY decrease of 10.07%, which cannot be offset by the significant YoY sales leap of 61.39% made by WEY. The best-seller must be the Haval H6, yet it was still hit with a sales drop of 10.64%.

In 2018, the sales of the WEY VV5 and VV7 shot up 87.08% and edged up 3.6% respectively despite the negative growth for both models in December. The sales of the WEY VV6 have been consecutively growing month by month after it hit the market on August 27.

Chery Holding

Chery Holding announced that its vehicle sales hit a record high of 752,759 units in 2018, rising 11% from the previous year.

Its full-year vehicle export volume jumped 18% year on year to 126,993 units, retaining its crown by annual PV export volume in China for 16 consecutive years. In addition, the automaker saw its NEV sales in 2018 skyrocket 146% over a year ago to 90,537 units.

The sales of the Tiggo 8 showed month-by-month growth for 6 straight months. The Jetour X70, the first model under Jetour, a new product series launched in early 2018, had cumulative sales exceeding 40,000 units after it went on sales in last August. The presale of the Jetour X90 has started on January 7 and the new model will officially hit the market on January 14 with an annual sales target of 150,000 units.

BYD

BYD Company Limited sold a total of 520,687 vehicles in 2018, achieving a YoY jump of 25%. Of that, its sales in December were 69,637 units, jumping 36.6% over a month ago, according to an official sales report released on January 7.

In last December, BYD's NEV sales soared 55.1% month on month (MoM) to 46,650 units. In the meantime, its full-year NEV sales aggressively surged 118% from the year-ago period to 247,811 units, which is far beyond the original 200,000-unit sales goal. To be specific, the annual sales of new energy PVs totaled 227,152 units, of which 103,263 units were all-electric vehicles and 123,889 units were plug-in hybrid vehicles. In addition, 20,659 new energy CVs were sold throughout 2018.

BYD's fuel-burning vehicle sales aggregated 272,876 units in the past 2018. The MPV sales were 141,068 units, accounting for 51.7% of total sales of vehicles with combustion engine. The sales of sedans and SUVs reached 59,161 units and 72,647 units respectively.

JAC Motors

JAC Motors sold 31,290 vehicles in December with a YoY dip of 23.72%. With 462,447 vehicles delivered throughout 2018, the automaker’s YTD sales fell 9.48% from the year-ago period.

Last month, the sales of the SUV and MPV sectors tumbled 26.49% and 79.94% YoY respectively to 8,089 units and 1,115 units, while its sedan sales splendidly grew 153.51%. Speaking of YTD sales, only the sedan sector attained a YoY surge of 41.10%, yet the other two PV sectors both had double-digit decline.

Meanwhile, the export volume slumped 54.45% in December compared with the same period a year ago. On the contrary, the cumulative volume in 2018 jumped 14.90% to 74,777 units.

Sales of all-electric PVs skyrocketed 500.86% to 11,182 units in December and its YTD sales amounted to 63,671 units, remarkably surging 125.28% from the previous year.