Top 10 car, SUV models in China by Nov. wholesale volume

Shanghai (ZXZC)- According to the China Passenger Car Association (CPCA), China's passenger vehicle (PV) wholesale volume (including the vehicle sold in China and abroad) slid 16.3% over a year ago to 2,141,044 units in November, presenting year-on-year (YoY) drop for fifth month running (the "PV" mentioned here refers to cars, SUVs and MPVs locally produced in China).

For the first eleven months, China's PV wholesale volume cumulated to 21,077,358 units this year, edging down 2.5% from the previous year. This was the second time for the country to see negative YoY growth in YTD PV wholesale volume. Meanwhile, the Jan-Nov sales of the car, MPV, SUV shrank 1.5%, 16.2% and 0.9% compared with the year-ago period.

The inventory pressure almost hits the peak in history with the sales constantly sliding. The China Automobile Dealers Association (CADA) said that the Vehicle Inventory Alert Index (VIA) reached a record high of 75.1% in November, 8.2% percentage higher than that of a year ago.

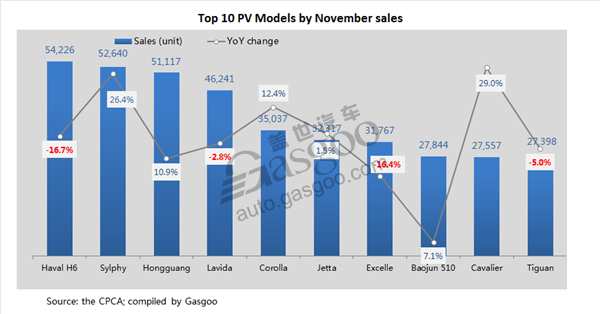

The CPCA's data show that China's car wholesale volume fell 12.2% YoY to 1,079,137 units last month and edged down 1.5% from a year earlier to 10,511,563 units for the first eleven months. There are 6 car models included in the list of top 10 PV models by Nov. wholesale volume.

The Sylphy, ranking second for 4 straight months from July to October, regained the championship in November thanks to its comfortable driving experience, smooth power performance and spacious seating room. The Buick-owned Excelle dropped one place over the previous month, while its Nov. sales exceeded 30,000 units by virtue of the price preferential policy and elevated public acceptability over three-cylinder engine. The Civic, ranking ninth on the list, boasts the biggest YoY growth powered by its good-looking exterior, favorable reputation and relatively steady price.

Although only four SUV models entered the top 10 PV list, the best-selling PV is a SUV model—the Haval H6. Seven of top 10 SUV models witnessed negative growth in November. Especially, the runner-up Baojun 510 faced the biggest YoY drop up to 44.2%. The Honda CR-V has been gradually getting rid of the depressed influence caused by the engine issue with its sales picking up recently.