Li Auto to launch more new models

Even though the second-quarter revenue exceeded expectations, Li Auto had seen revenue decrease compared with the previous quarter. Total revenues were RMB8.73 billion (US$1.30 billion) in the second quarter of 2022, representing an increase of 73.3% from RMB5.04 billion in the second quarter of 2021 but a decrease of 8.7% from RMB9.56 billion in the first quarter of 2022.

Its net loss in the reporting period surged to RMB641.0 million (US$95.7 million) from RMB235.5 million in the second quarter of 2021, and RMB10.9 million net loss in the first quarter of 2022.

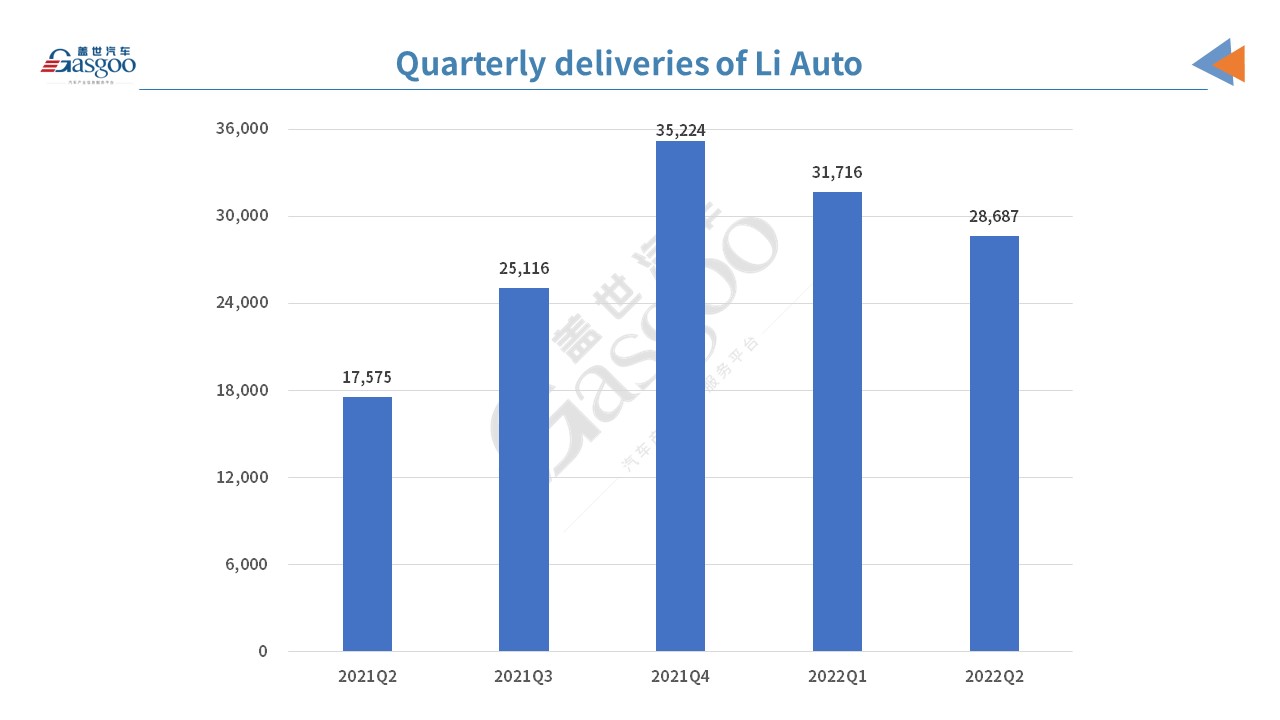

Quarterly delivery changes are the direct cause of the year-on-year revenue increase and quarter-on-quarter revenue decrease. The supply shortage resulting from COVID-19 resurgences exerted certain negative effect on its deliveries. In April, the COVID-resurgences affected the Yangtze River Delta where 80% of Li Auto’s suppliers are located. Some suppliers suspended production or logistics completely, hurting the automaker’s production plan.

The gross margin was 21.5% in the three months, down by 1.1 percentage points from the previous quarter and up by 2.6 percentage points from the same quarter of last year.

The L9, its all-new model launched on June 21 this year, will have higher gross margin than the Li ONE, the company’s executives said on the earnings call of the second quarter. Its first battery electric vehicle, due in next year, will also make contributions to improve the automaker’s profit and cash flow.

In the next several months, the gross margin will, to a large extent, hinge on the battery cost. Kevin Shen, co-founder and president of Li Auto, said that there was a slight drop in battery material cost in the recent month, but taking the year as whole, the cost may fluctuate significantly in the rest months of this year.

The quarterly operating expenses soared 92% from a year ago while its selling, general and administrative expenses represented an increase of 58.6% versus the same period of 2021. Those are the results of more employees and higher salary cost. And its efforts to expand the sales and service network also raised the rent expenses.

The automaker has been augmented the investment in research and development which hit a new high, RMB1.53 billion, in the second quarter of this year and accounted for 17.5% of its total revenue.

Photo credit: Li Auto

For this quarter, Li Auto expects deliveries to be between 27,000 and 29,000. The L9, which rolled off the production on August 18, is expected to have a monthly delivery volume of over 10,000 units in September. If we subtract that and the automaker’s July deliveries (10,422), the Li ONE’s total deliveries in August and September will be 8,578 units at most. According to a local media, the Li ONE’s registrations in the first two weeks of August was less than 2,000 units.

Does that mean the L9 will grab the market share of the Li ONE?

Li Auto emphasized that its first mass-production model remains competitive among vehicle models priced at RMB300,000 to RMB400,000. To stimulate the demand for the Li ONE, Li ONE recently started to offer RMB7,000 of insurance promotion. “We are working closely with our sales team to increase customers’ attention for the Li ONE and keep their interest in all products,” Kevin said during the call.

Photo credit: Li Auto

Even though Li Xiang, the company’s founder, said that less than 10% buyers with a budget of RMB300,000 to RMB350,000 will turn to a model priced at RMB500,000, but there are certain number of customers, who originally plan to buy the ONE and will finally choose the L9, especially those who has flexibility in purchasing vehicles.

Comparatively speaking, the L9 boosts much more advanced features. The L9 is built on the company’s second-generation range-extended platform while the ONE rides on the first generation. The Li L9 features the company’s self-developed autonomous driving system, Li AD Max, powered by dual Orin-X chips with computing power improved to 508 TOPS.

At the beginning of this month, Li Auto revealed that the newly-launched L9 had accumulated over 50,000 orders, among which non-refundable orders confirmed exceeded 30,000. And orders are increasing, according to the executives at the call.

The automaker said the six-seat, full-size flagship smart SUV for families has a very special product positioning. For models in the L9’s price range, no other competitors can match the model in terms of size and intelligent features. “So currently what we are considering is to attract those potential buyers whose car budget ranges from RMB400,000 to RMB500,000.

After the automaker launched the L9, especially after the test drive started, the order intake of the Li ONE has slowed down and potential customers of the Li ONE may turn to buy the L9. It is because of the slowdown of the Li ONE order the waiting time is shorter than last month. When the company set its third-quarter outlook, it had taken the slowing momentum of the Li ONE into consideration.

After the L9, the next new model from Li Auto will be named the L8. Li Xiang revealed that the new model will adopt a fastest-ever and ahead-of-schedule pace in launching and delivery. It takes only two months for the L9 to start delivery after the product launching, but the L8 will be faster.

According to the company product portfolio planning going viral online, the L8, codenamed X02, will ride the same platform as the L9, code-named X01. Deliveries of the L8 for the first full month will exceed 10,000 units while the L9’s monthly production capacity is 15,000 units.

Li Xiang is very confident about the L8’s market performance. “Compared with other new recently-launched competitors, I think the L8 will be the most advanced in product competitiveness,” the founder said.

The X03, likely to be called L7 or L5, was also captured in spy shots and is considered to be the next-generation of the Li ONE. The X03 will be a big five-seat SUV, larger than the Audi Q7.

Photo credit: Li Auto

The range-extended approach is still regarded by the Beijing-based company as the best technology roadmap for SUVs in the next five years, so it will spare no efforts to improve the system’s efficiency. Li Xiang took the BYD Han sedan and the BYD Tang SUV as an example to illustrate his point. He said the battery-electric Han outsells the hybrid version while the hybrid Tang is much more popular than the pure electric version. “People who would like to buy an SUV priced above RMB200,000, even RMB300,000, have a clear expectation for scenarios: for journeys.

The CEO underlines the potential of the range-extended system which deserves more and more study. The range-extended vehicles are electric vehicles with range extenders, rather than fossil fuel vehicles plus batteries. That is totally different. That is why such automakers as Dongfeng and Changan also choose range extended technology.

Continuous investment in range extended products doesn’t mean ignoring the battery electric vehicle products and both segments share the same purpose to replace fossil fuel vehicles. With regard to the company’s efforts in battery electric vehicle segment, Li Xiang said the product in this segment would be in an all-new form, which will feature a larger space than the company’s current range-extended SUVs.

Photo credit: Li Auto

Its main focus in the battery electric segment will be long-range driving and super-fast charging. Li Xiang also disclosed that the company’s test vehicle has been able to run 400 kilometers after 10-minute charging.

Based on the Li L9 customer data at the moment, 80% customers can be able to install charging piles at their home while 100% can have stable access to charging infrastructure. Therefore, Li Auto’s infrastructure layout priority will not be to solve charging issues at home or in urban areas, but to make those infrastructure convenient for those long-range travelers, like those who drive across the Yangtze River Delta, the Pearl River Delta.

What’s more, last year, Anhui Zhongding Sealing Parts Co.,Ltd., ranking 85th on Automotive News 2022 list, once announced that one of its subsidiaries has become the exclusive supplier of the X03’s automotive thermal management assembly products.