Li Auto, XPeng, NIO all have delivery growth in May

The very first day of a month is the day for China’s new energy vehicle (NEV) startups to announce deliveries of the previous month.

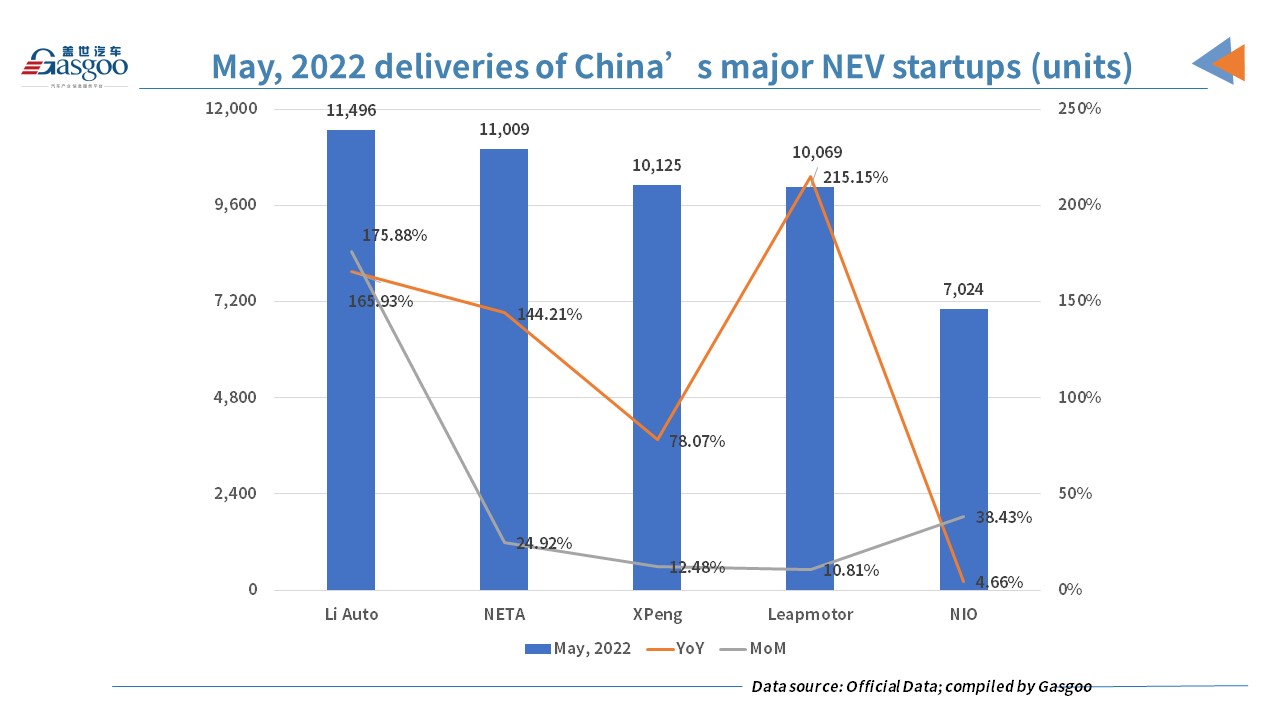

Today, the first day of June, NIO, XPeng, Li Auto, Hozon and Leapmotor released their deliveries in May and showed resilient results in spite of various industry-wide challenges.

Among the said startups, Li Auto’s ranking bounced back to the first from the last one in April. The Beijing-based automaker was also the only one with a three-digit increase both year over year and month over month.

Even though its monthly deliveries have recovered, it also warned that its suppliers have not yet fully recovered. As a result, it will continue to encounter challenges due to parts supply shortages.

“As such, our Changzhou manufacturing base has not yet reverted to its normal production level, resulting in delayed deliveries for some of our users. At present, we are actively collaborating with our supply chain partners to restore production capacity, aiming to shorten the delivery waiting time for Li ONE users, while meeting all pandemic prevention and containment requirements,” Yanan Shen, co-founder and president of Li Auto, said in a statement.

According to the quarterly outlook Li Auto announced in May, it wants deliveries to be between 21,000 and 24,000 vehicles in the April-to-June period. Since we have known the results of April and May, its June deliveries should reach 5,337 at least to fulfill the goal.

Hozon Auto, the manufacturer of NETA-branded vehicles, delivered the same number of vehicles in May as in January. Besides, Hozon remained second in terms of the total deliveries of the first five months of this year.

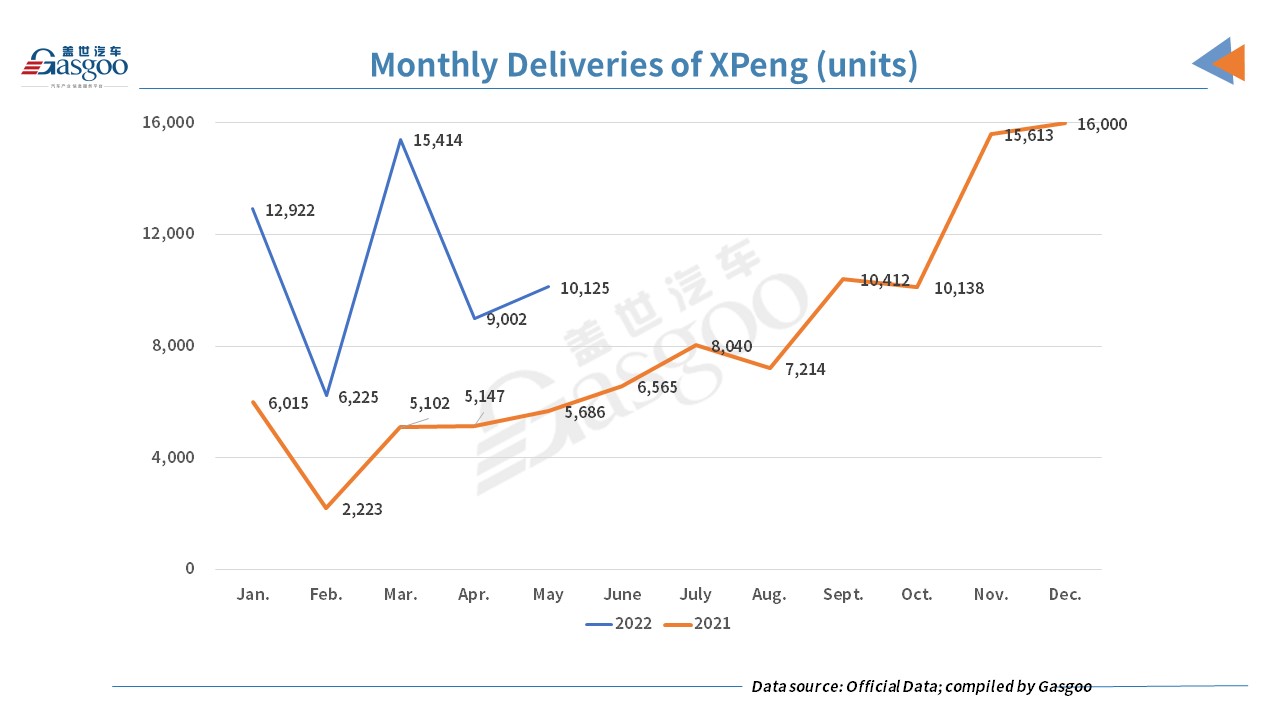

XPeng also managed to deliver over 10,000 new vehicles last month. In mid-May, the company resumed double-shift production at its Zhaoqing plant as supply chains and key manufacturing areas in China started to gradually recover.

XPeng has been continuing to improve its supply chain and enhance its own R&D ability to cope with the parts supply shortage and increasing cost, He Xiaopeng, Chairman and CEO of XPeng, said in May when the company reported its first-quarter financial results.

For example, from 2021 on, XPeng has contacted many battery partners and will basically complete its diversified layout in battery supply in the second quarter of this year. That can minimize the risks of supplier concentration in regions.

The P7 remained the main contributor, but the G3i had the largest increase at 28.5% when compared with the previous month. The May deliveries of the G3i were also the best results of the model so far this year.

XPeng expects its second-quarter deliveries to be in a range of 31,000 units to 34,000 units, so after deducting the deliveries in April (9,002) and May (10,125), the automaker has to deliver at least 11,873 vehicles in June to meet the target.

Last month, Leapmotor recorded a new high in monthly deliveries. From the beginning of this year, the company’s monthly deliveries have been growing stably.

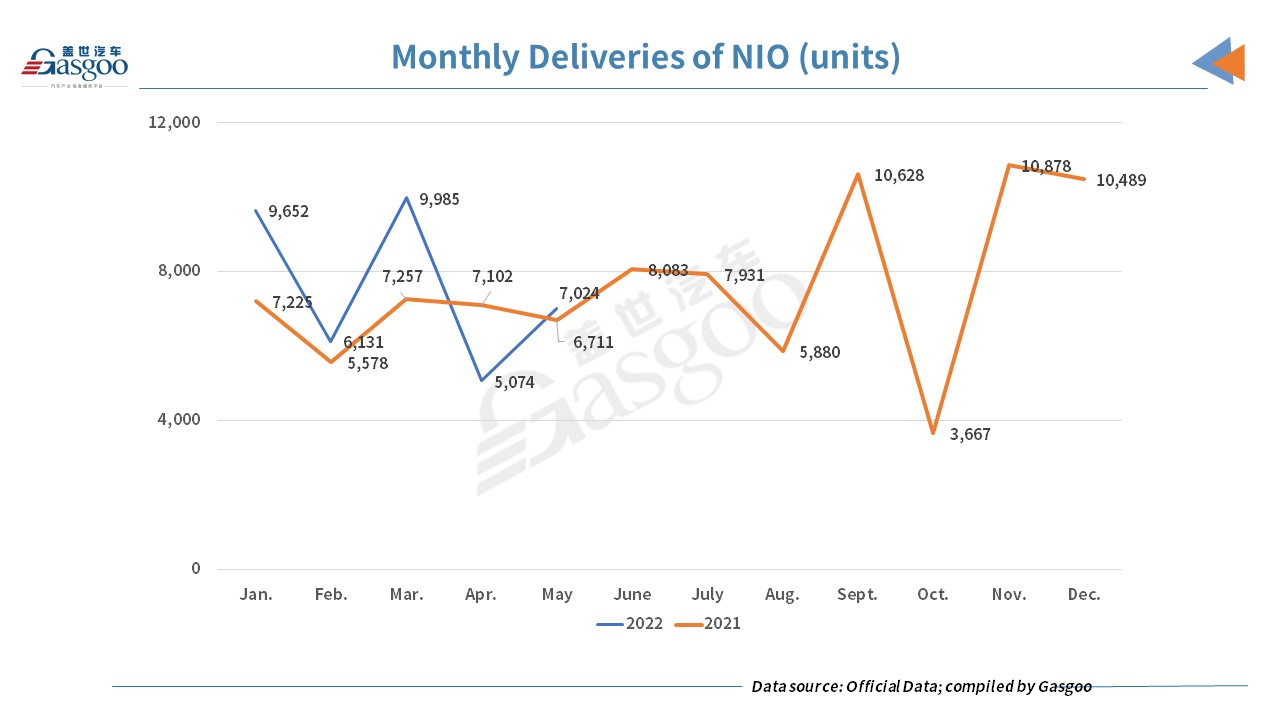

Compared with the other players, NIO, with four models for sale, was the only one whose May deliveries were fewer than 10,000 units. Like others, the startup’s production had been recovering in May from the impact of COVID-19 outbreaks in certain regions, but vehicle deliveries were still constrained, the company said.

NIO will work closely with partners to ramp up its production capacity to a higher level and to accelerate the delivery starting from June.