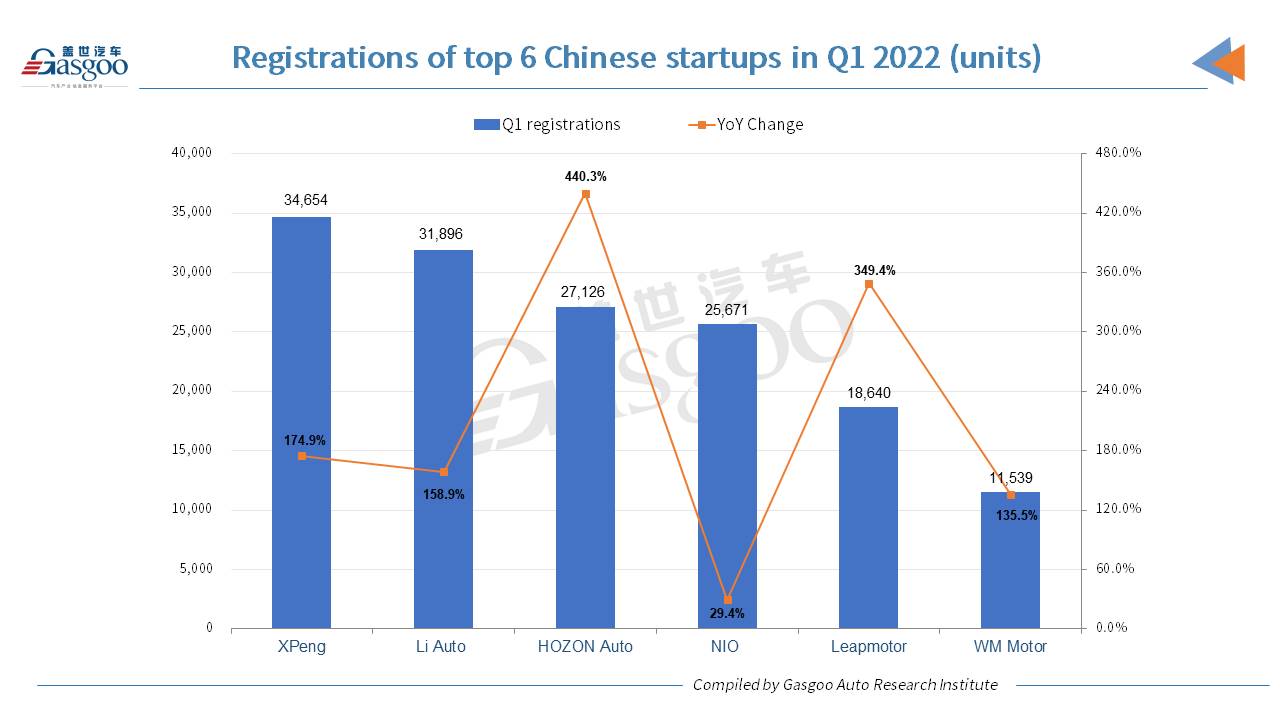

HOZON Auto outpaces other startups by Q1 registrations

HOZON Auto, the startup that names its EV brand after the Chinese mythological character Nezha (currently dubbed “NETA”), amazed industry watchers by surging registrations of its affordable vehicles in the first quarter of the year, outpacing rivals such as XPeng, Li Auto, and NIO.

According to the data compiled by ZXZC Auto Research Institute (GARI), there were 27,126 NETA-branded vehicles registered in the first three months of 2022, representing a whopping 440.3% year-on-year growth. In terms of the quarterly registrations, HOZON Auto was the second runner-up among Chinese startups, even outselling the high-profile NIO.

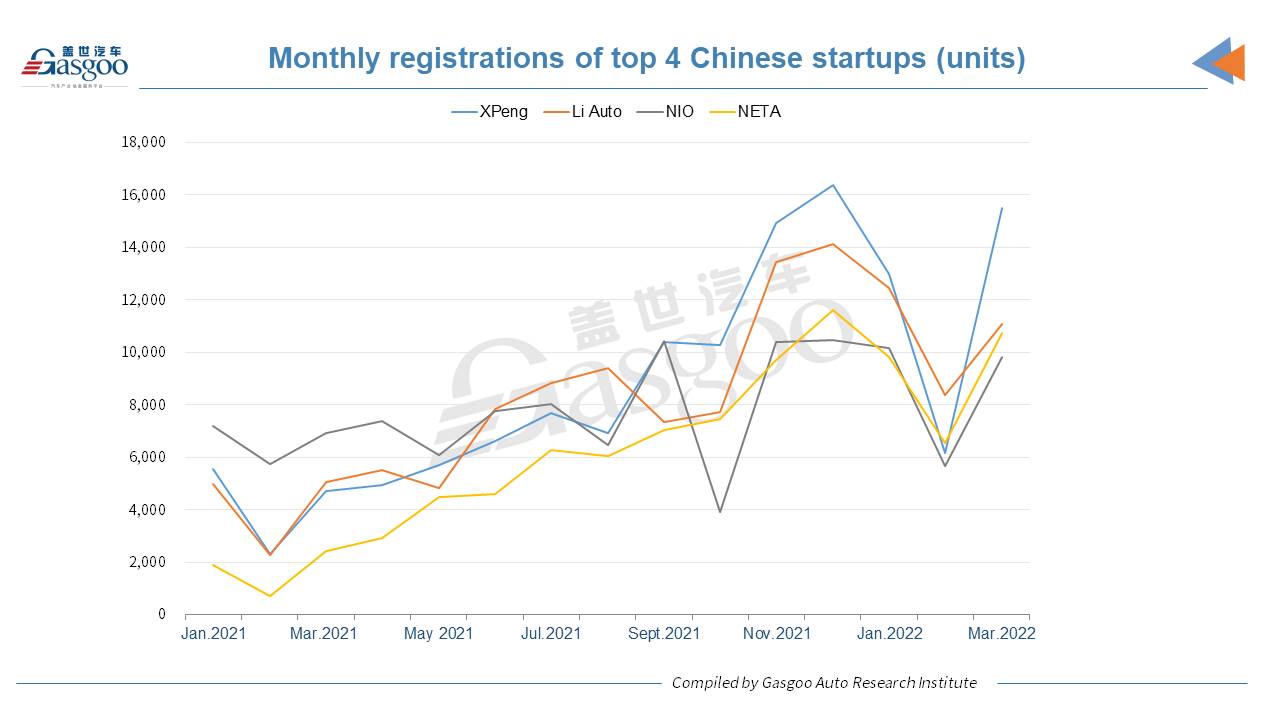

The landscape of Chinese new energy vehicle (NEV) startups used to be led by the trio affectionately coined “Wei Xiao Li”, which stands for NIO, XPeng, and Li Auto. The situation was changed in October 2021 when HOZON Auto transcended NIO, which faced a month-on-month plunge in registrations due to the retooling of production lines.

HOZON Auto continued its upward trajectory in the following two months. In December last year, its monthly registrations for the first time exceeded 10,000 units, the fourth Chinese NEV startup to hit the milestone.

Affected by the factors like the Spring Festival holiday, HOZON Auto failed to maintain the month-on-month growth impetus in the first two months of this year. Nevertheless, it still moved up to the runner-up place among Chinese startups in February and once again delivered a registration volume of over 10,000 units in March.

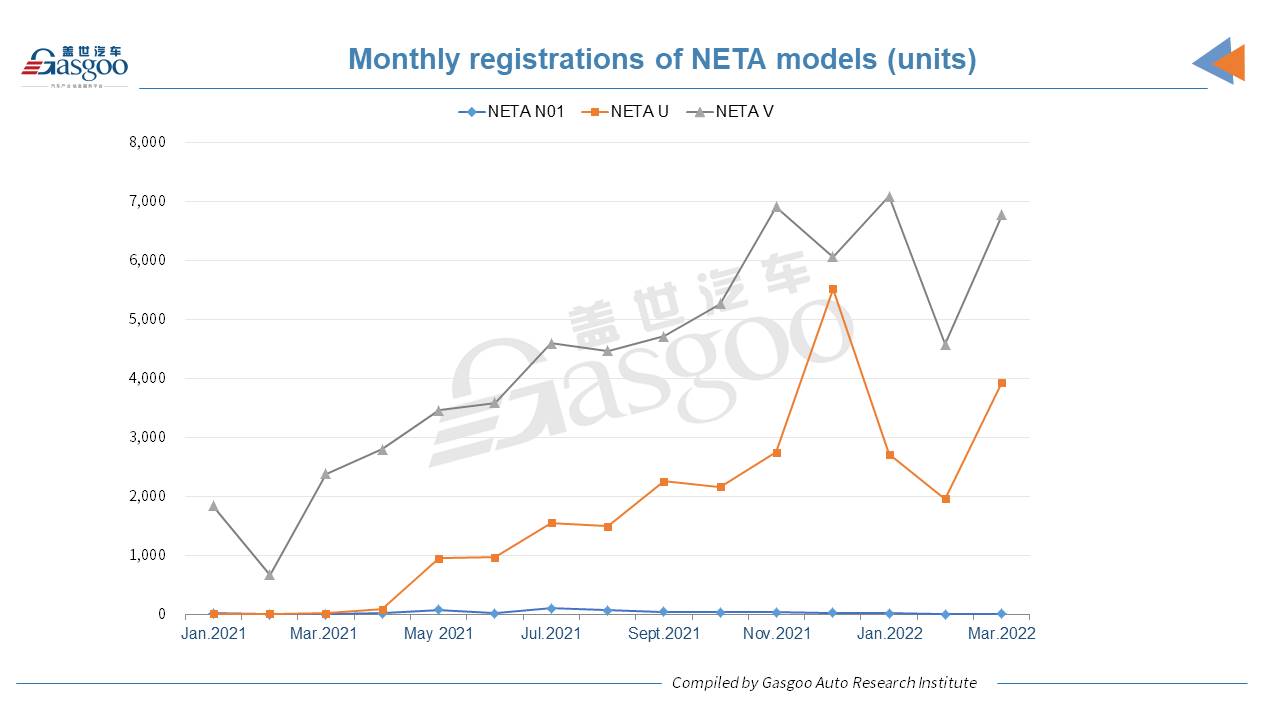

HOZON Auto currently offers three production models under NETA brand. According to the chart made by ZXZC, a fact can be learnt that the company's majority registrations were contributed by the NETA U and the NETA V. The contribution of the NETA N01, the startup’s first mass-produced model, has been so negligible. According to the data compiled by GARI, the NETA V and the NETA U accounted for 68% and 31.8% of the company's Q1 registrations.

Rural strategy

The lesser-known startup's vigorous sales growth didn’t come out of nowhere. Founded in 2014, it chose to get a head start in rural areas and lower-tier cities, which are usually neglected by major EV brands, but also see rising demands for EVs.

The three NETA-branded models are all priced below 200,000 yuan ($31,000). The cheapest NETA V SUV costs only 65,900 yuan ($10,215) after subsidies, even less than a third of Tesla’s most affordable sedan in China.

China hopes NEV sales can reach around 20% of all new vehicles sales in 2025. Driven by the national goal, the country is posting rising demands for mass-market electric vehicles, which give the startups like HOZON Auto a foothold as there are still plentiful budget buyers prioritize price over branding.

Some industry watchers regard price as a key factor to define a smart car. XPeng's chairman and CEO He Xiaopeng said a profitable smart car should be priced at least 150,000 yuan ($22,870). Nevertheless, HOZON Auto's CEO Zhang Yong believes that intelligent cars should be enjoyed by the general public rather than merely being the toy of the haves.

NETA V Pro; photo credit: NETA

In fact, the startup has rolled out some budget-friendly products with decent intelligence experience. For instance, the NETA V Pro, which hit the market in Nov. 2021 with a maximum price of 80,900 yuan ($12,330), boasts the Level 2 driver assistant system, which is backed by high-performance chips and up to 14 high-precision sensors, the most in its segment. Assisted by cameras, millimeter-wave radars and ultrasonic radars, the full-speed ACC (adaptive cruise system) is able to cover more than 20 complex scenarios such as congestion, intersection parking, uphill, and downhill. The car is also equipped with an upgraded 14.6-inch intelligent control-mounted screen with a 1,920×1,080 HD resolution and the information security protection system offered by 360 Security.

Although the intelligence level of HOZON Auto’s vehicles still trailed behind that of NIO, XPeng, and Li Auto, it does serve as a good selling point for the consumers with limited budget.

Initial focus on B2B market

Another gateway HOZON Auto picked at its initial development phase is the B2B (business-to-business) market.

2020 NETA N01; photo credit: NETA

The startup's first production model, the NETA N01, was launched to mainly serve governmental agencies and enterprise users. Before the model hit the market in July 2018, HOZON Auto has struck deals with such car rental platforms as Didi Chuxing, Yiduyongche, and Share'n Go, which agreed to purchase cars from the EV company.

The authorities of Tongxiang city, where HOZON Auto's plant is located, purchased the NETA N01s as government cars in August 2018, and bought the NETA Us two years later.

In November 2019, the company formed a strategic partnership with the municipal government of Nanning city, and subsequently delivered at least 800 vehicles to local authorities and enterprises.

HOZON Auto made its foray into the domestic car hailing market starting 2020. In January of that year, the startup deployed 1,000 EVs in Yichun city through Share'n Go for car rental service. In August, the company offered at least 1,000 NETA N01s to a Chengdu-based ride-hailing platform. About four months later, Guangxi NETA Mobility Technology Co., Ltd., a mobility service platform backed by HOZON Auto, purchased 1,200 NETA Us to operate car hailing service in Hangzhou.

B2B users made a remarkable contribution to HOZON Auto's sales about a few years ago. However, the company has realized that it is necessary to place stronger emphasis on private users, partly as it saw demands for government cars and mobility services sharply declined after the pandemic outbreak.

The efforts to shift the business focus to private users have delivered a positive result. In 2021, a total of 53,783 NETA-branded vehicles were registered by private users, which accounted for 82.5% of the startup's annual registrations, according to the data compiled by GARI. For the first quarter of this year, the share of private users stood at 87.4%.

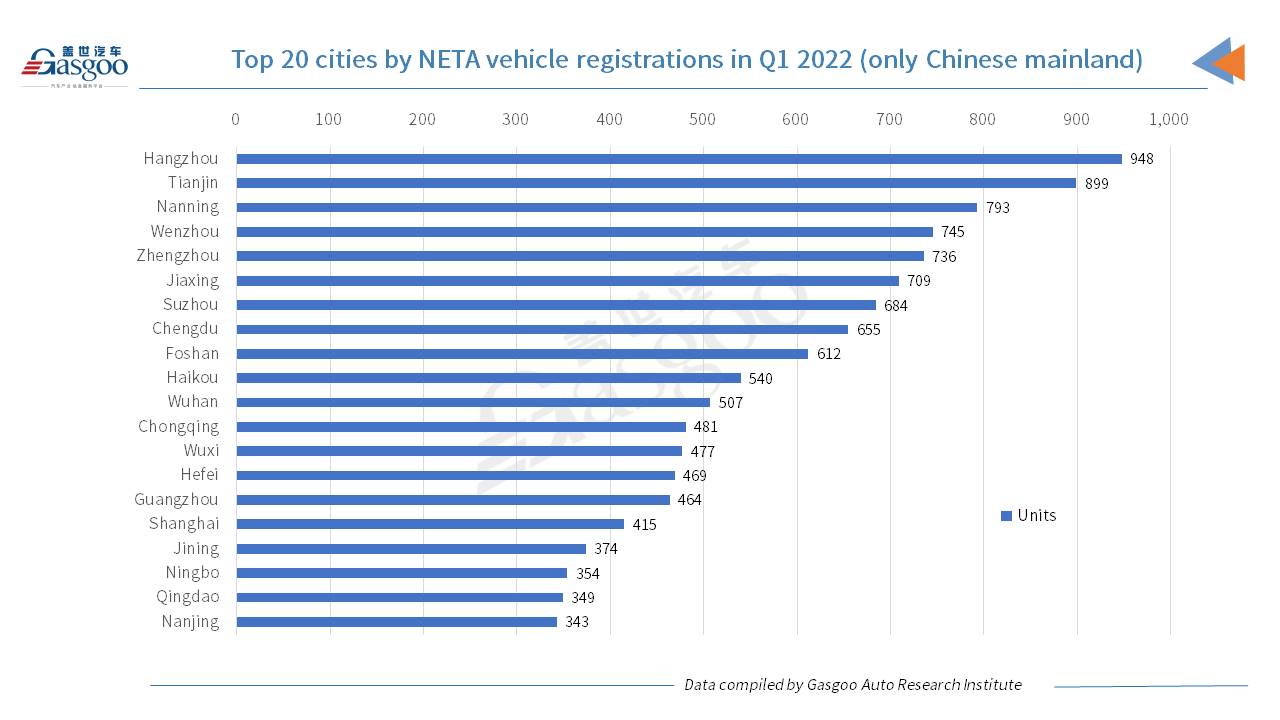

HOZON Auto is working on strengthening its presence in higher-tier cities. Regarding the first-quarter registrations of NETA-branded vehicles, the top 2 cities were Hangzhou and Zhengzhou, and both of them were the so-called new first-tier cities in China. Notably, the metropolises Guangzhou and Shanghai, and many provincial capital cities like Chengdu, Wuhan, Hefei, and Nanjing all appeared on the list of the top 20 cities.

Marketing tactic

The startup is also striving to improve its brand popularity by means of marketing tactics, some of which did work. When it launched the EV brand “Nezha” (afterwards renamed “NETA”) in 2018, the company didn't expect that a homonymous domestic animated film would become a sleeper hit in the summer of the next year. By forming crossover cooperation with the film maker, the brand was rapidly known by a wider range of consumers, and its sales correspondingly jumped.

Hong Kong IPO

There is a growing talk of an IPO in Hong Kong later this year for HOZON Auto. According to some media channels, the startup has already kicked off a Pre-IPO round of financing, which would value the company at around 45 billion yuan ($6.86 billion).

Photo credit: NETA

Although HOZON Auto has not commented on the IPO rumor yet, it is quickening the pace of fundraising. According to the business data platform Tianyancha, the startup has so far completed nine rounds of financing. The latest one was reportedly closed in February this year with over 2 billion yuan raised, valuing the company at over 25 billion yuan ($3.811 billion).

Besides, HOZON Auto introduced 360 Security and the Chinese power battery giant CATL as investors through two significant rounds completed in the second half of 2021.

Nonetheless, the money it has so far raised is far below that for a mature EV brand.

In the increasingly crowded smart car field, players are dedicated to enhancing their products' competitiveness by building up R&D capabilities, which absolutely requires vast sums of money.

What's more, HOZON Auto also needs a huge amount of capital to expand its sales and service network, especially in first-tier and second-tier cities. As money is required on all fronts, going public seems to be a necessary path which leads the startup to a higher development stage.