NIO’s battery assets operator Mirattery to raise 400 million yuan through ABNs

Shanghai (ZXZC)- Mirattery (Chinese name: Wuhan Weineng), NIO's battery asset management joint venture, on April 19 successfully issued 400 million yuan ($62.353 million) in ABNs (asset-backed medium-term notes) in China's interbank market, marking the first green battery asset ABN in the country, according to a post on the company's WeChat account.

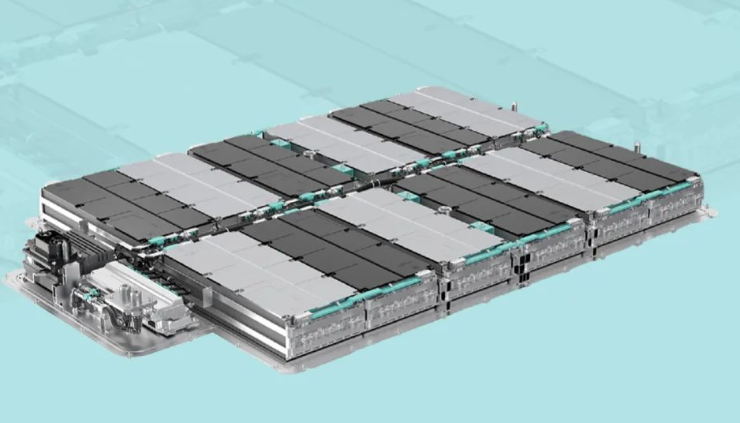

Battery assets managed by Mirattery; photo credit: Mirattery

The issue size of the senior tranche, which will mature on May 20, 2024, is 390 million yuan, with a debt rating of AAAsf and an issue rate of 3.12%.

The guarantor of the transaction is China National Investment and Guaranty Corporation, and CICC acts as the lead underwriter and bookrunner.

The proceeds from the transaction will be mainly used for Mirattery's battery asset business.

The company said the issuance of the ABN is an active attempt by Mirattery to raise capital in China's interbank market. Completing the building of direct financing channels in the interbank market will provide a further guarantee for the development of its BaaS service system.

By the end of March 2022, Mirattery had owned more than 6 GWh of battery assets under management. Leveraging its self-developed cloud-based battery management system and the experience in battery operation, the company has developed a highly efficient battery asset management solution.

Mirattery was founded in August 2020 with a registered capital of 800 million yuan ($124.706 million). It received joint investment from CATL, NIO, Guotai Junan and Hubei Science Technology Investment.

In the same month, NIO launched its BaaS battery leasing business, and Mirattery serves as the manager of the battery assets.