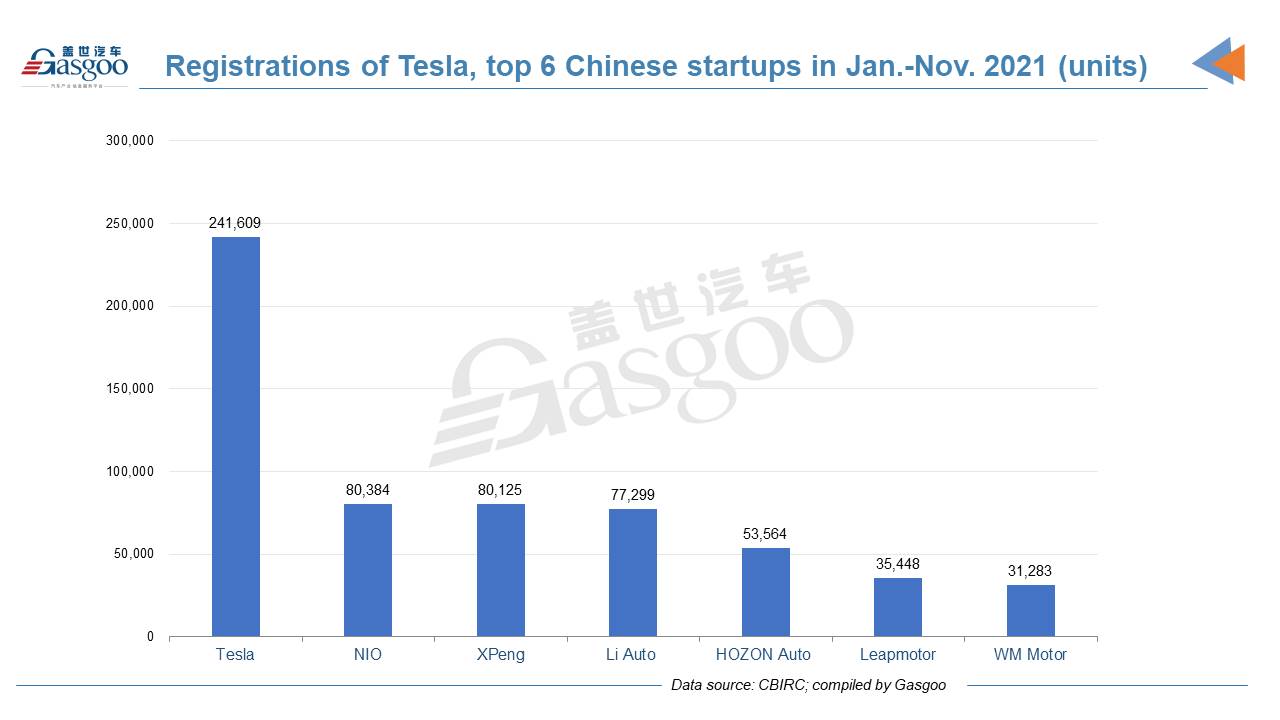

XPeng almost catches up with NIO by Jan.-Nov. insurance registrations

In November 2021, China's monthly insurance registrations of locally-made new energy passenger vehicles (NEPVs) reached 365,298 units, accounting for 21.4% of total new PV registrations and surging 107% year on year, according to the China Banking and Insurance Regulatory Commission (CBIRC).

The Nov. homegrown NEPV registrations consisted of 295,202 battery electric vehicles (BEVs), 70,095 plug-in hybrid electric vehicles (PHEVs), which included 15,803 range-extended electric vehicles (REEVs), as well as 1 fuel cell vehicle (FCV).

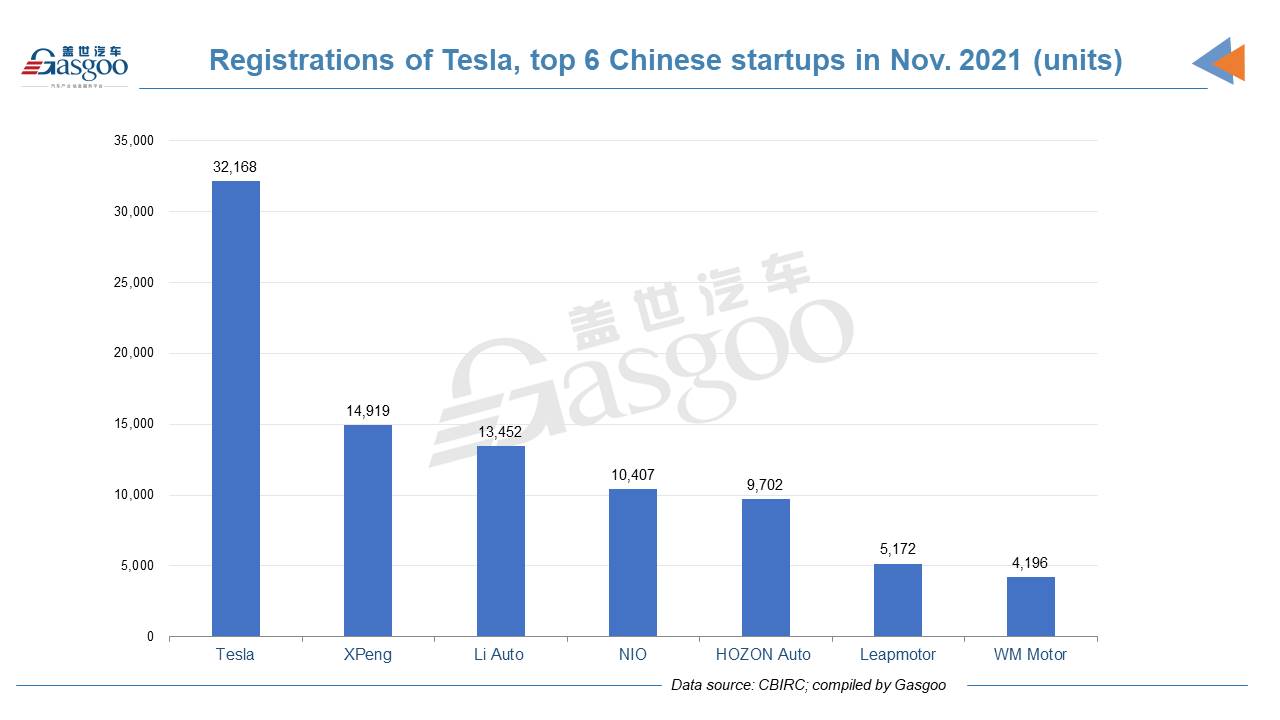

Among startups (including Tesla), the U.S.-based EV manufacturer still outperformed its Chinese rivals with a significant lead. With 32,168 China-made vehicles registered in Nov., Tesla also scored a 132.5% month-on-month surge. Among all auto brands, it was honored the second runner-up in terms of Nov. locally-made NEPV registrations, following BYD and Wuling.

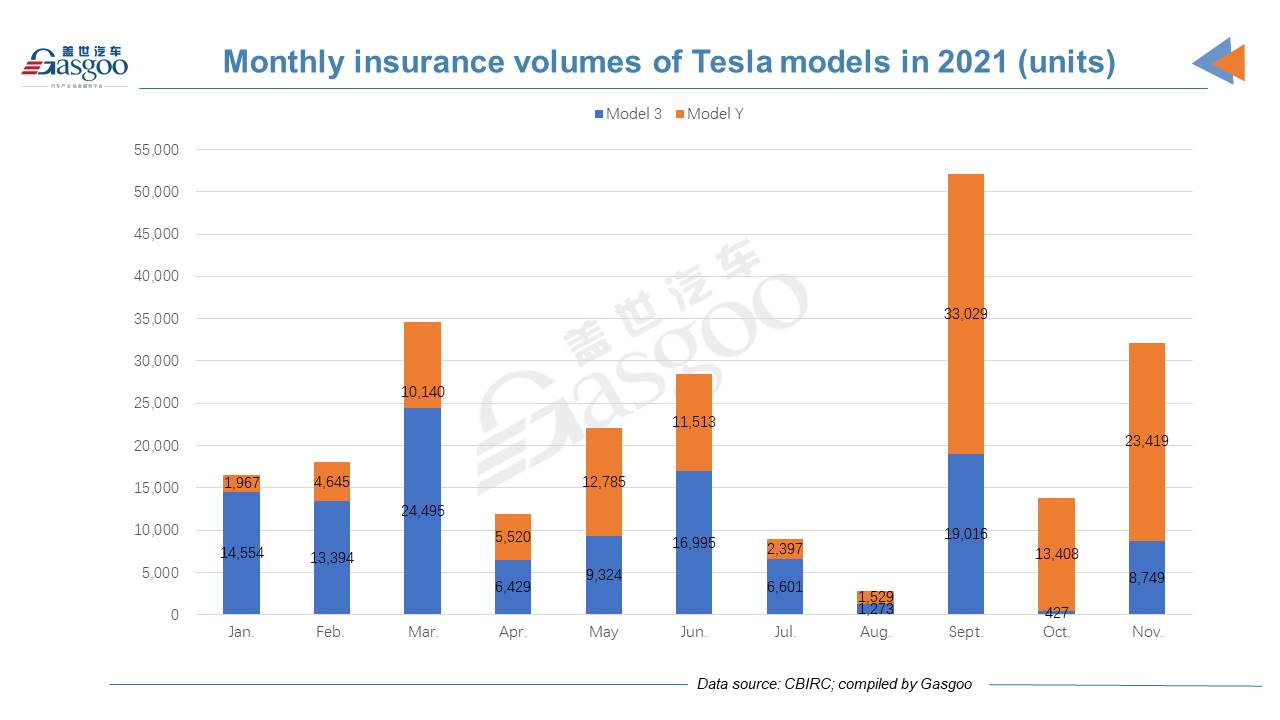

With 23,419 units registered, the Model Y was credited the runner-up among both China-made SUV models and NEPV models in November.

Since the delivery kicked off in January, the Model Y has so far recorded monthly registrations topping 10,000 units for six months. In September, it transcended the Haval H6 first the time to become the best-selling SUV model in China.

Model Y

According to the CBIRC's data, there were 1,069 units of the Model Y AWD Performance version registered last month. With delivery beginning in late Nov., the Performance version features a NEDC-rated range of 566km and can zip from 0-100km/h within only 3.7 seconds. Its advent is expected to further drive the sales of the China-made Model Y.

The Model 3's lineup also had a new member last month. On Nov. 19, the upgraded Model 3 Standard Range Plus (SR+) was launched with its name changing to “the Model 3 RWD”. Compared to the previous SR+, the new version's range grew to 556km under CLTC (China light-duty vehicle test cycle) from 468km under NEDC (New European Driving Cycle) due to the use of 60kWh battery pack. According to Tesla China’s official website, the fresh version is expected for delivery in the first quarter of 2022.

Tesla's Shanghai Giga is amid rapid production growth as it not only serves the domestic market, but also strives to meet the demands of export. The company plans to invest 1.2 billion yuan ($188.45 million) in revamping the assembly lines of its Shanghai factory’s first phase, according to a document dated Nov. 26 on a governmental website of Shanghai enterprises’ and public institutes' environmental information. The project was expected to start in December this year and be completed in April next year. The retooling work aims to develop the Giga Shanghai into the world’s largest EV manufacturing factory with annual capacity of 1 million to 1.5 million vehicles.

Three Chinese NEV startups recorded new vehicle registration of over 10,000 units in Nov. Compared to October, XPeng and Li Auto still occupied the first two spots, while NIO climbed one place to the third.

As for year-to-date performance, XPeng was still outsold by NIO, but the difference was only 259 units. Thus, it is still too early to decide the final winner of the No.1 Chinese NEV startup.

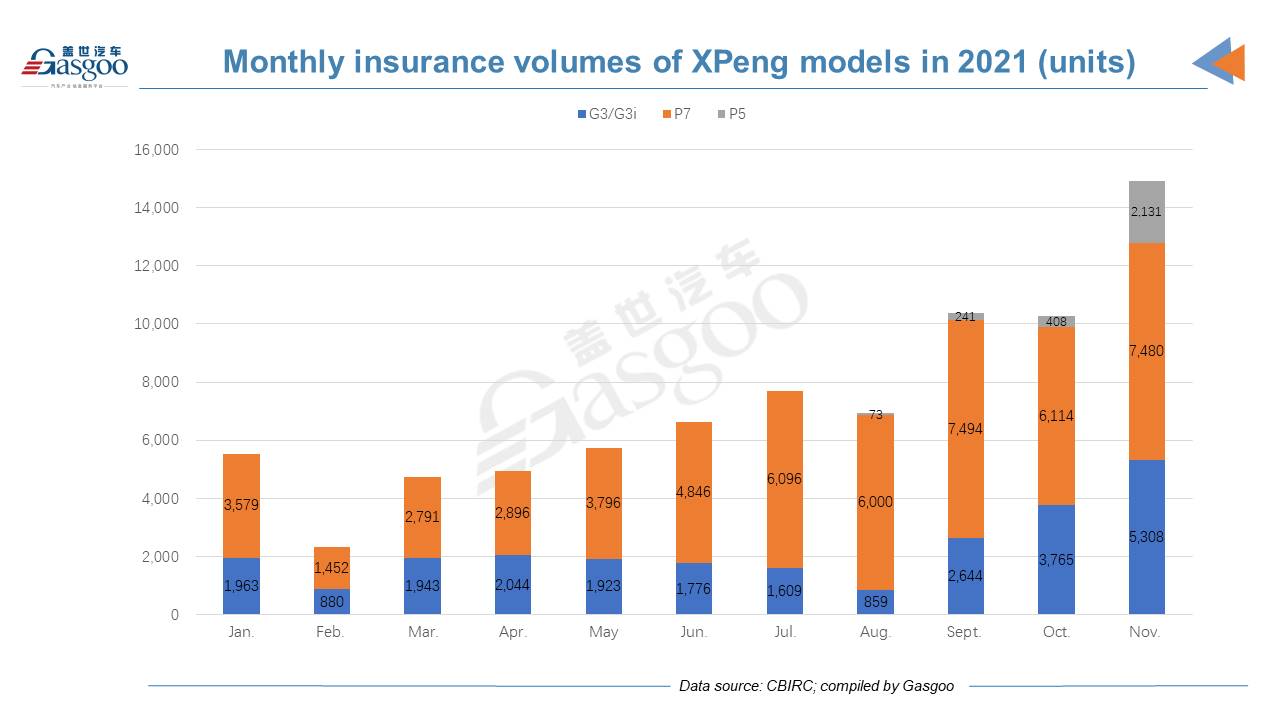

XPeng's monthly registrations hit all-time highs of 14,919 units in November. Two of its three production models—the G3 and the P5—met their highest-ever monthly volume as well.

The P7 made up 50% of XPeng's total new vehicle registrations last month, ranking 13th among all locally-made NEPV models. The G3i contributed 97.8% of the G3's Nov. registrations. The biggest driving force was from the P5, whose monthly registrations in Nov. rocketed 422.3% from the previous month.

XPeng P7; photo credit: XPeng

XPeng said it is dashing with all its might to cope with the challenges of global supply chain, expand production capacity, and sales and service network. The company revealed at the latest quarterly earnings call that its Zhaoqing plant was ramping up outputs under two shifts. To support robust sales growth, XPeng planned to build over 350 sales outlets and more than 600 own-brand supercharging stations in China by the end of 2021. The target for supercharging network has been hit ahead of schedule with 661 stations deployed as of November.

With only one mass-produced model for sale, Li Auto saw its monthly registrations achieve record highs of 13,452 units. The Li ONE ranked third among China-made NEPV models by Nov. registrations and was the first Chinese startup-owned model to hit 10,000 units of monthly insurance volume.

Li ONE; photo credit: Li Auto

Priced above 330,000 yuan ($51,820), the 2021 Li ONE REEV 6-seater is the only version Li Auto is selling, according to the company's website. The single-version structure resulted from the startup's decision to stop selling the 7-seater variant for the 2021 Li ONE after the company learnt that the majority of its users preferred the 6-seater seating arrangement through a survey. It also reflects Li Auto's strategy for only reserving what consumers really demands.

Li Auto is about to launch its second production model, the X01 REEV, in the second quarter of 2022 with deliveries starting in the third quarter next year.

To ramp up the outputs of the Li ONE and the yet-to-be-launched model, Li Auto said it planned to double the annual capacity of its Changzhou manufacturing base to 200,000 units per year by 2022.

After being outsold by HOZON Auto in October, NIO climbed one spot to the third place in Nov. on the list of Chinese NEV startups, scoring a 165.3% leap month-over-month.

NIO ES6

NIO currently has three models for volume delivery, while none of them cracked the top 20 NEPV models rankings by Nov. registrations. The best-selling NIO-branded model, the ES6, only ranked 25th.

As part of endeavors to increase production capacity, NIO had revamped and upgraded the production lines at the JAC-NIO Advanced Manufacturing Center, and the installation of the first batch of manufacturing facilities commenced last month at its second production base, located in the Hefei-based NeoPark. The new factory is about to start production in the third quarter next year.

Once the two plants become fully operational, NIO's total capacity would be lifted to 600,000 vehicles per year, said William Bin Li, Chairman and CEO of NIO.

The CBIRC's data show that three NIO ET7s were registered last month. The company confirmed at the NIO Day 2021 the model will be available for delivery from March 28 next year.

HOZON Auto dropped one spot to be the No.4 Chinese startup in Nov., while its monthly registration volume hit a highest-ever level. Its biggest sales contributor, the NETA V, immediately followed the Li ONE and the XPeng P7 as the third hottest-selling model owned by a Chinese startup.

NETA U

HOZON Auto is rapidly expanding its circle of friends with leading technology developers and auto parts suppliers. Aside from the external aids of 360 Security, Huawei, and Horizon Robotics, HOZON Auto last month struck a deal with CATL for the strategic cooperation on technology R&D and supply chain business, and confirmed the introduction of CATL as an investor of its D2 round. The move came only 11 days after the close of the D1 funding round.

Both Leapmotor and WM Motor achieved their best-ever monthly registrations in Nov. as well.

About 77% of Leapmotor's Nov. registrations were contributed by the T03. The C11, the startup's third production model with registration beginning in Sept., saw its insurance volume zoom up to 1,146 units last month.

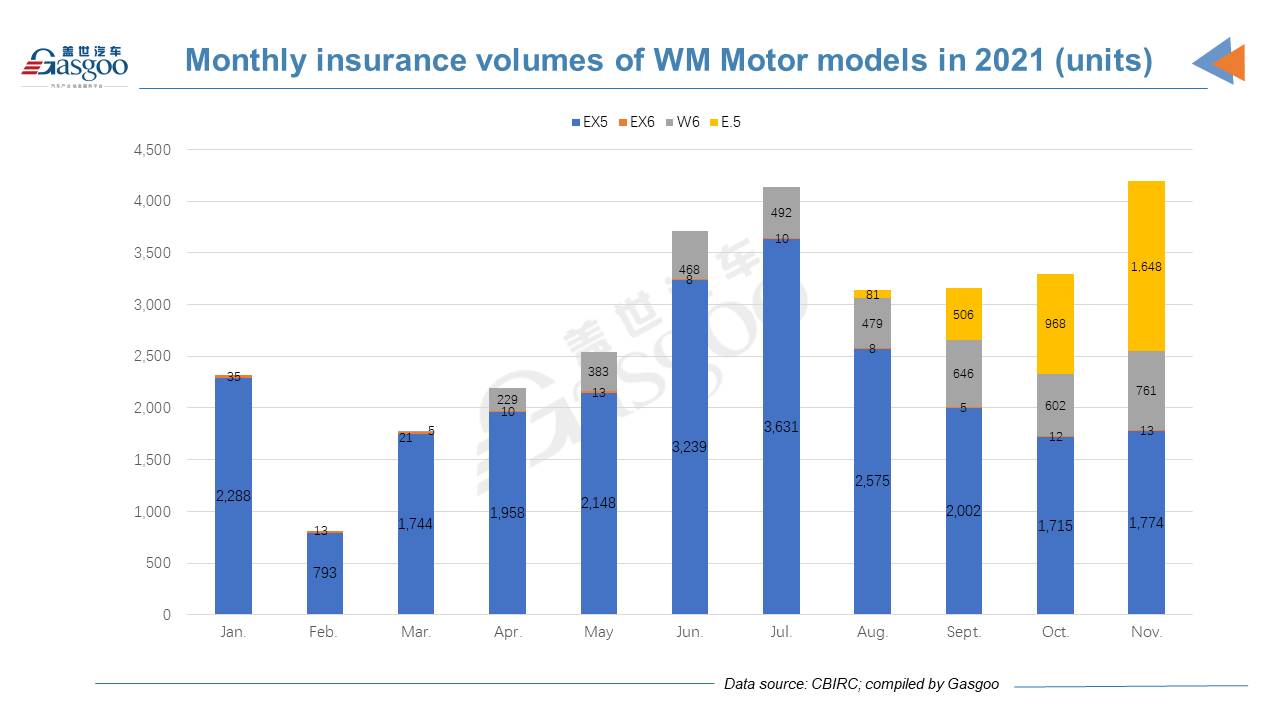

WM Motor's registrations jumped 27.3% over a month ago to 4,196 units in Nov., 2,252 units of which were registered for car rental service.