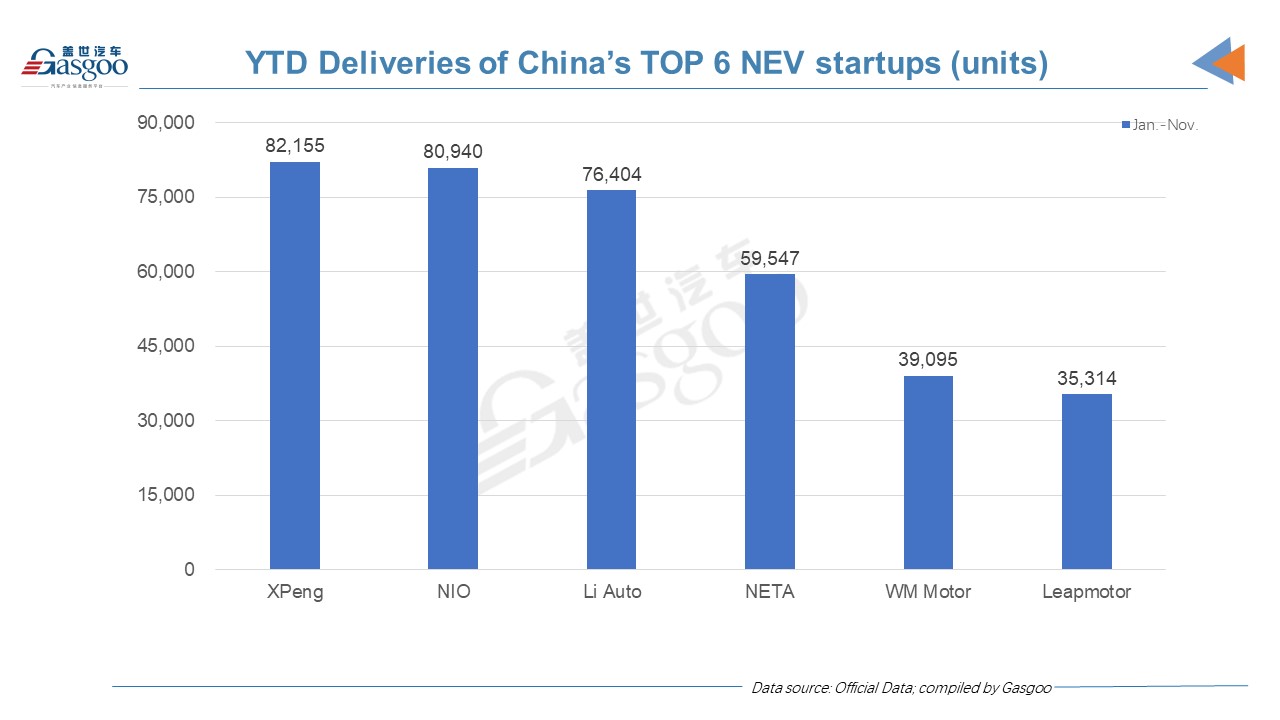

China's EV startup delivery update: XPeng outsells NIO year-to-date

Beijing (ZXZC)- China’s main automobile startups achieved their best delivery results in November, with Li Auto and Hozon’s NETA surpassing the 10,000 delivery milestone for the very first time and XPeng outperformed NIO in terms of total deliveries in the first eleven months of this year.

Thanks to the low base of last year, deliveries of the six new energy vehicle (NEV) startups ZXZC compiled all saw at least two-digit year-on-year growth. Compared with the previous month, Li Auto had a surge of 196.6%, the largest growth among those startups.

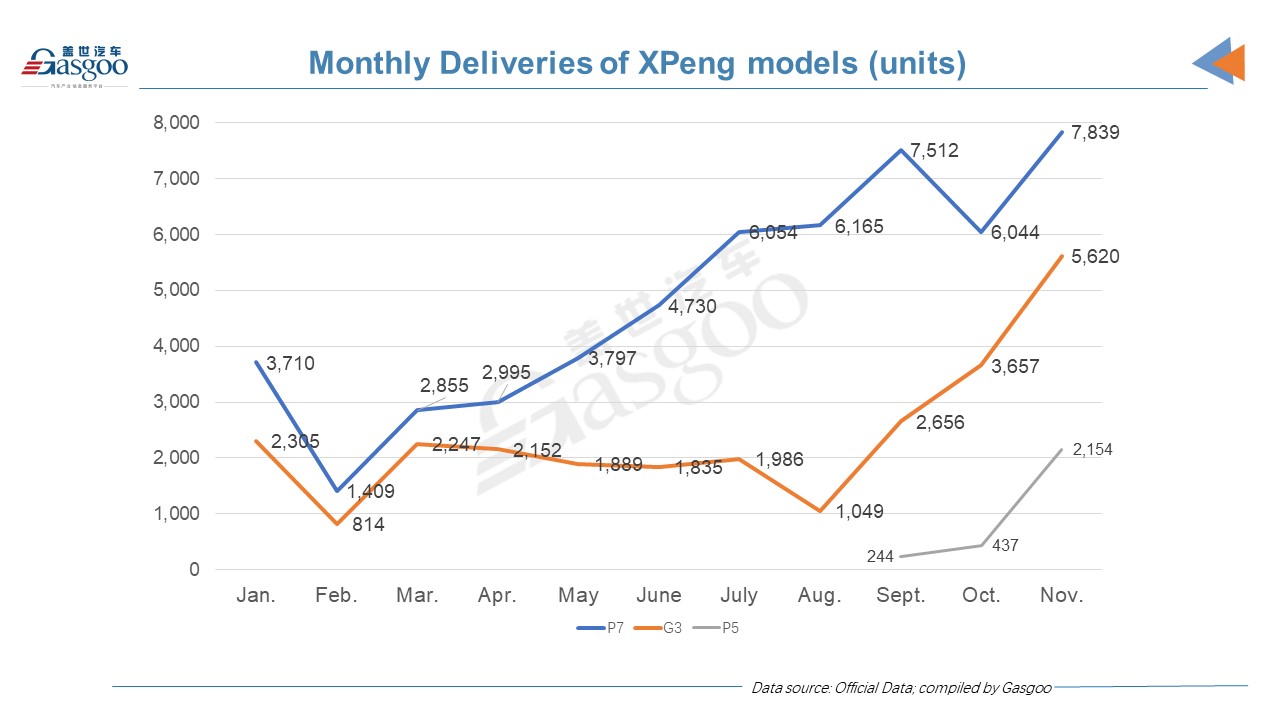

XPeng was not only the delivery champion in November, but also the first startup to deliver over 15,000 vehicles in one single month. From September to November, the Guangzhou-based company’s monthly deliveries have exceeded 10,000 units for three months.

All of XPeng’s three models had the highest monthly delivery volume in November in the past eleven months. The P7 was still the main contributor with 7,839 delivered while the P5, whose scale delivery started in October, hit a monthly delivery record of 2,154 vehicles.

Li Auto eventually became a member of the so-called 10,000 delivery club in November. With only one model, the Li ONE, for sale, the company delivered 13,485 vehicles last month. The Li ONE is not only the first model from China’s startups, but also the first Chinese-branded model with a starting price of over 300,000, to have monthly deliveries of over 10,000.

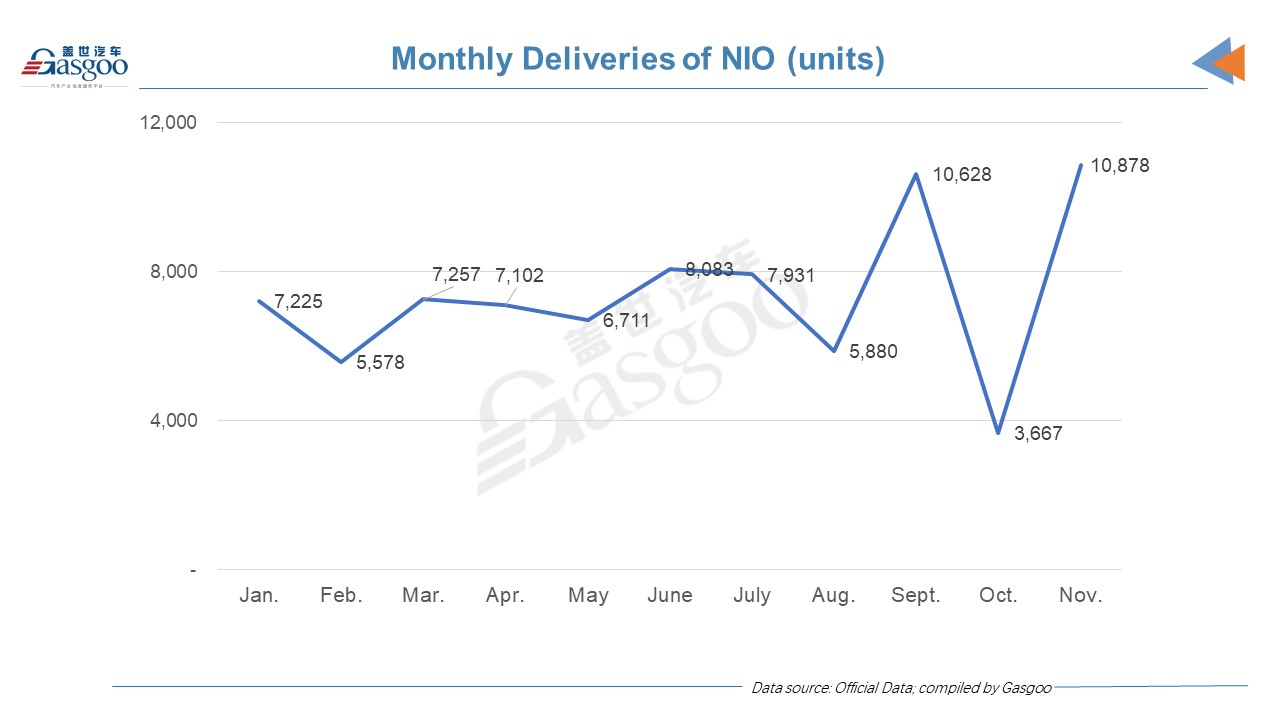

NIO’s monthly deliveries returned to over 10,000 level with 10,878 vehicles delivered last month. That is another record monthly volume for NIO. But the company didn’t reveal specific deliveries of every model.

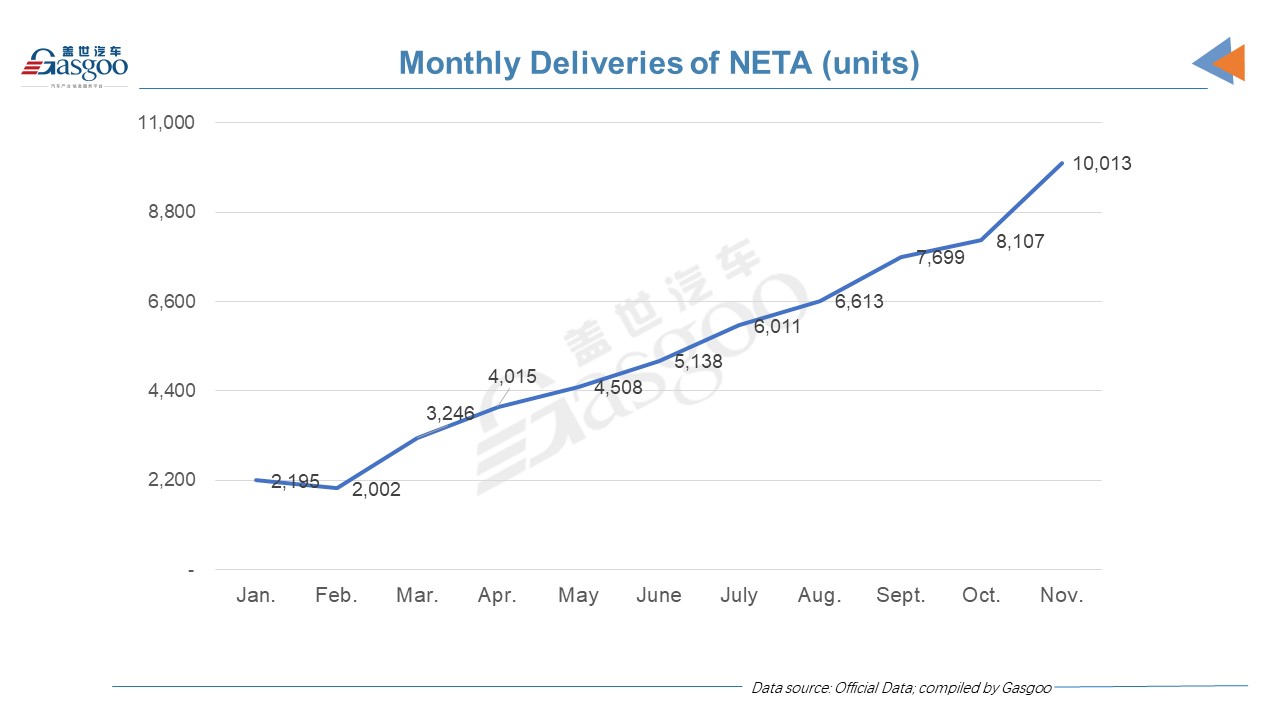

Another new member of 10,000 delivery club is the NETA brand from Hozon. The brand’s November deliveries soared 372% from a year ago to 10,013 units, 91% out of which are individual users. Actually, in the first eleven months of this year, except February when vehicle sales are always weak, NETA’s monthly deliveries are increasing stably.

Both Leapmotor’s deliveries and orders set new highs in November. Among its 16,310 orders of last month, 7,005 are for the C11 while 9,297 are for the T03. Besides, the company said that its monthly deliveries were affected by supply chain disruptions.

WM Motor’s monthly deliveries hit a new high in November with 5,027 vehicles delivered, only two more than the deliveries of October. The company also did not give specific delivery volume by models, but it said that the M7, whose production and delivery is due to start in 2022, will help boost its deliveries.

By the year-to-date sales, NIO was outnumbered for the first time this year. XPeng delivered a total of 82,155 vehicles in the period, 1,215 more than the volume of NIO which was followed by Li Auto.

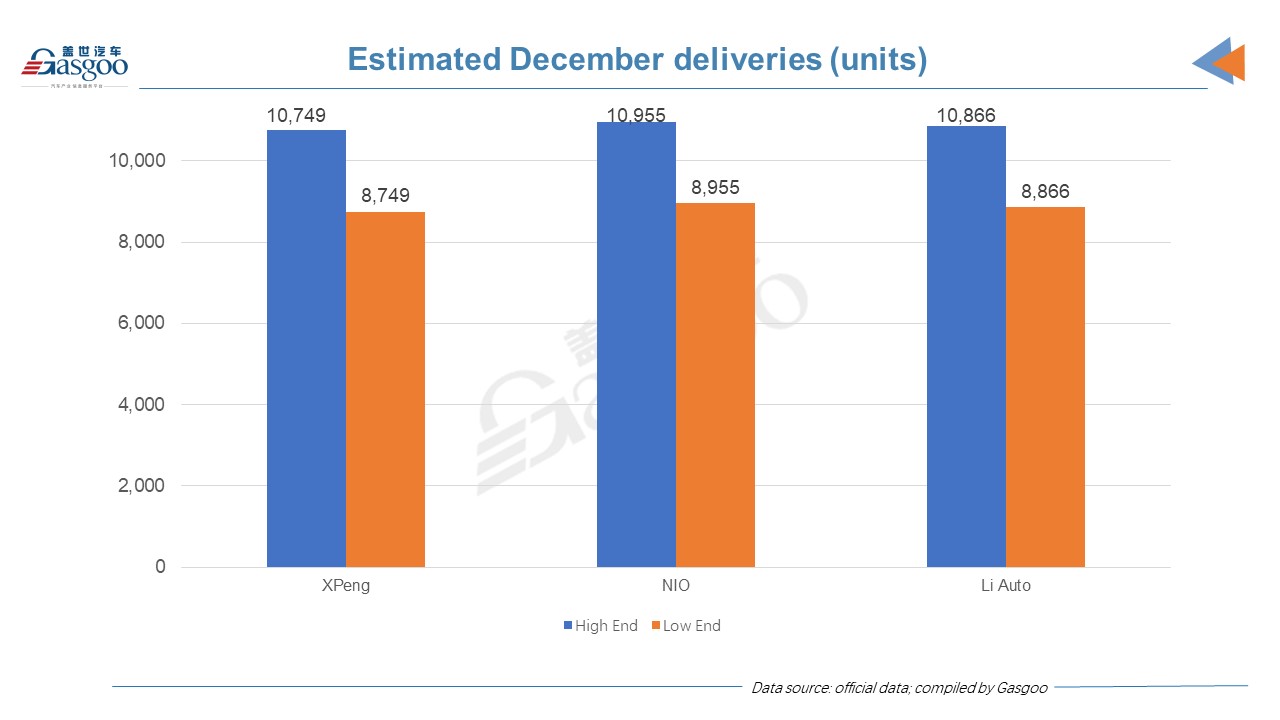

When announcing the third-quarter financial results, XPeng, NIO and Li Auto also revealed their outlook for the fourth quarter. Based on the combined sales of October and November, their December deliveries are expected to range from 8,700 to 11,000 vehicles.