Tesla China’s Oct. registrations slump MoM, but still top Chinese NEV startups

Shanghai (ZXZC)- In October 2021, China's monthly insurance registrations of locally-made new energy passenger vehicles (NEPVs) stood at 291,183 units, soaring 134% year on year, while dropping 10.3% month on month, according to the China Banking and Insurance Regulatory Commission (CBIRC).

The NEPV registrations for the month of October was composed of 237,570 battery electric vehicles (BEVs), 53,612 plug-in hybrid electric vehicles (PHEVs), which included 10,313 range-extended electric vehicles (REEVs), as well as one fuel cell vehicle (FCV).

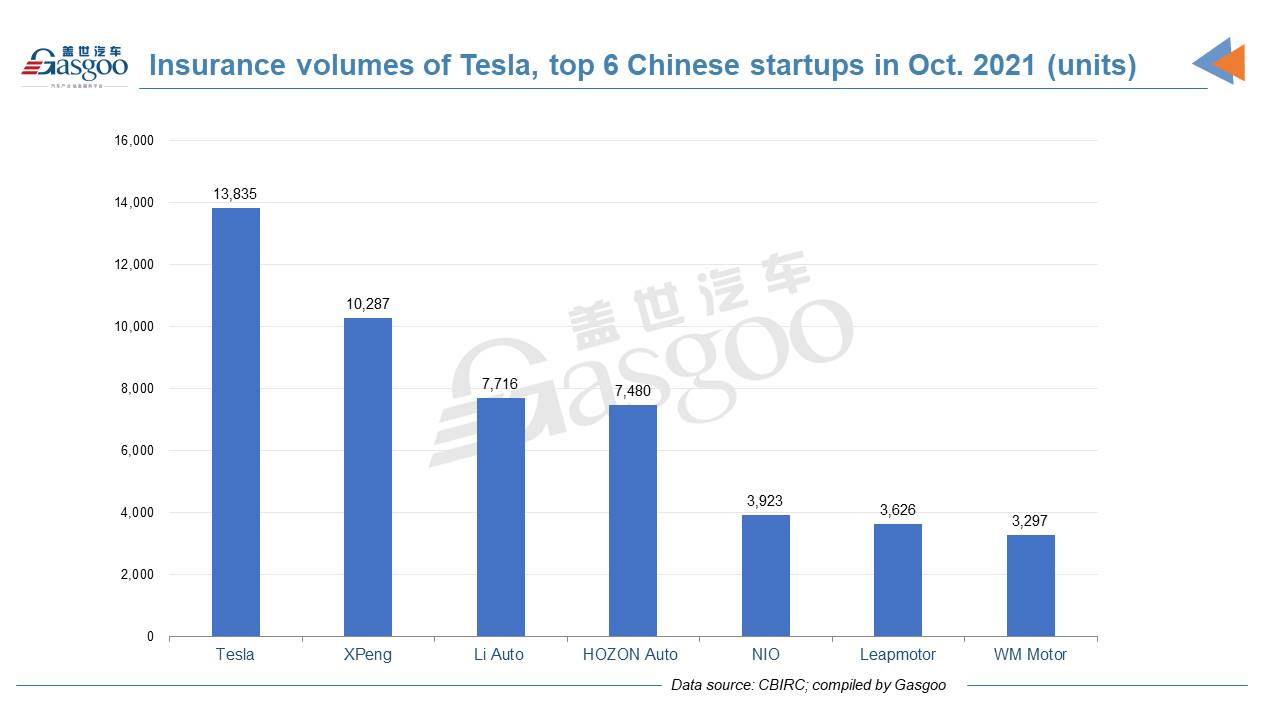

Among startups (including Tesla), the US.-based EV manufacturer still outperformed its Chinese rivals with 13,835 China-made vehicles registered last month, while it posted a 73.4% slump compared to the previous month.

The Model 3 registrations tumbled to only 427 units in October from 19,016 units in September. The steep flop probably resulted from the shift of production capacity for overseas market demands, and some backlogged orders to be delivered in November.

Despite the sharp month-on-month decrease, the Model Y still recorded an insurance volume topping 10,000 units in October, accounting for up to 97% of the company's total volume. It was credited the runner-up NEV model in China by Oct. registrations, following SGWM’s Wuling Hongguang MINIEV.

The Model Y's strong outperformance of the Model 3 largely linked to the launch of the cheaper RWD Standard Range (SR) version. The made-in-China Model Y hit the market in January with the first two trim levels priced at 339,900 yuan ($53,200) and 369,900 yuan ($57,900). The price range has to-date increased to 347,900 to 387,900 yuan. Due to the higher prices, the Model Y was being outnumbered by the Model 3 for many months until the RWD SR version was launched in early July.

The Model Y SR was put into the market with a post-subsidy price of only 276,000 yuan ($43,200), which were not much pricier than the Model 3 SR Plus. Thanks to Chinese consumers' preference for SUVs, the Model Y's registrations started exceeding those of the Model 3 in August and have been growing month-over-month for two straight months as of Oct.

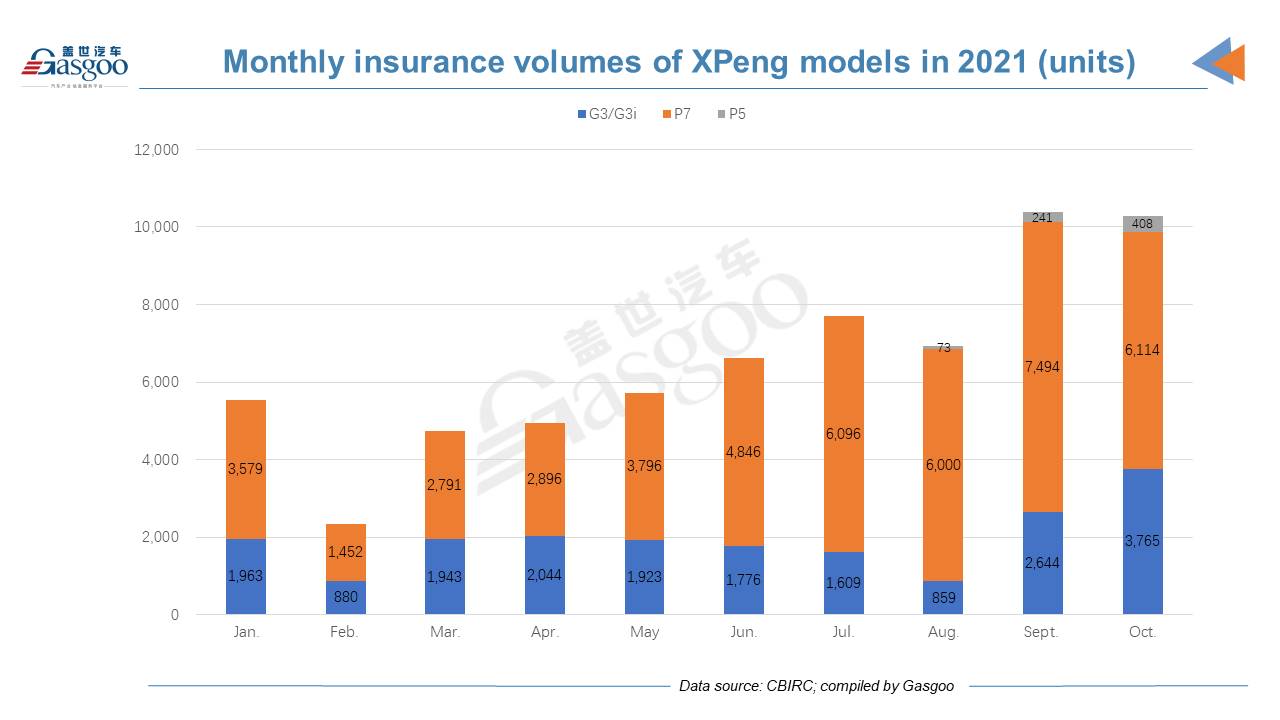

Despite a slight month-on-month drop, XPeng still recorded monthly registrations exceeding 10,000 units in October. For the first ten months of the year, the Guangzhou-based carmaker had a total of 65,206 vehicles registered, ranking second among Chinese NEV startups.

Regarding Oct. registrations, the P7 was still XPeng's best-selling model, accounting for 59% of the company’s total volume. The model’s monthly registrations have been topping 6,000 units for four straight months since July.

The continuous growth in the P7’s sales partly owed to the introduction of cheaper variants. In March, P7’s 480N and 480E versions were launched with after-subsidy prices of below 240,000 yuan ($37,570).

XPeng's registrations are expected to further grow with the deliveries of the 480G version, which hit the market on September 30. Priced at 219,900 yuan ($34,420) after subsidies, the 480G has to-day been the cheapest version of the P7’s lineup.

It is worth mentioning that the monthly registrations of the XPeng G3 hit all-time highs of 3,765 units, 3,639 units of which were the G3is.

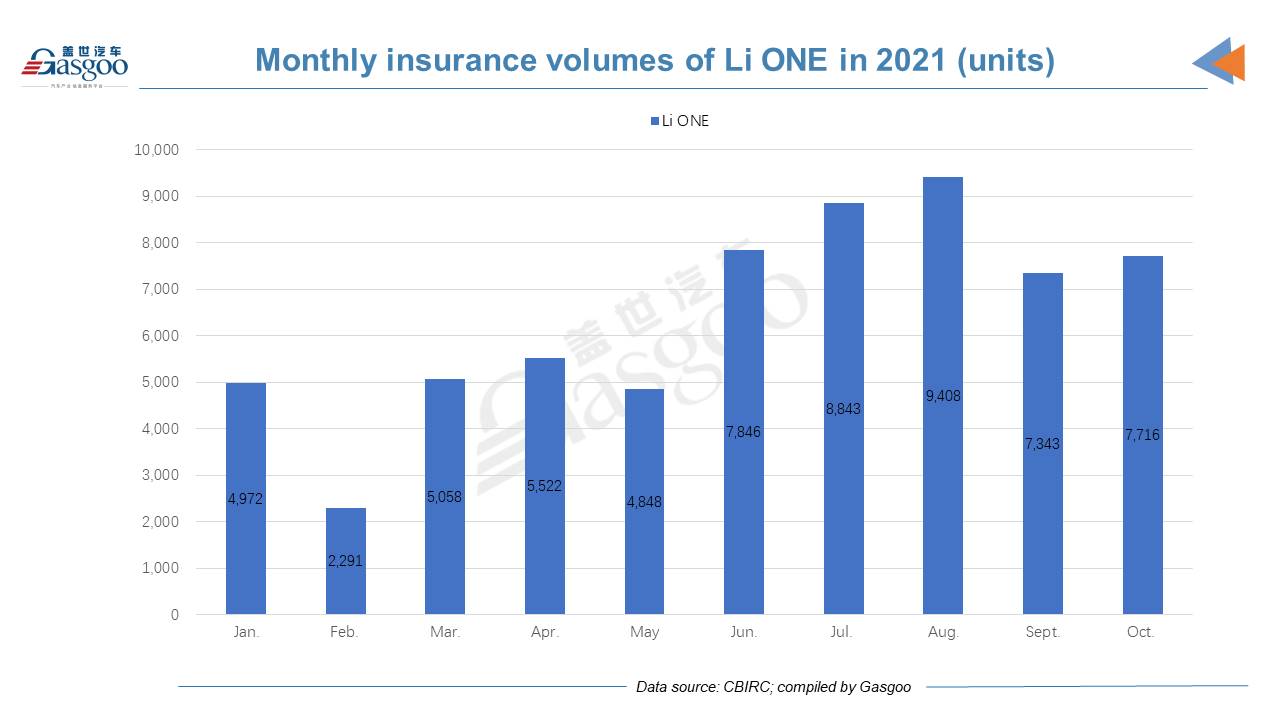

Both Li Auto and HOZON Auto logged Oct. registrations between 7,000 and 8,000 units.

With 7,716 vehicles registered, the Li ONE, Li Auto's sole model for sale, ranked highest among the NEV models launched by Chinese startups regarding the Oct. insurance volume. It also had a 5.1% growth from the previous month. As for Jan.-Oct. performance, the Li ONE’s registrations exceeded 600,000 units.

The robust registrations were significantly shored up by the Li ONE's mid-cycle facelift that went on sale in May. Compared to the older version, the refreshed one features a more compact electric motor with higher outputs, which can save more space for the fuel tank. It is capable of a NEDC range of up to 1,080km on a full charge and with the oil tank filled up.

HOZON Auto saw its monthly registrations hit arecord highs of 7,480 units in October, once again cracking the top 3 Chinese NEV startups list.

With 5,267 vehicles registered last month, the Nezha V was still the biggest sales contributor to HOZON Auto. Its upgraded version, the Nezha V Pro, hit the market in early November, aiming to help further spur the model’s sales with higher power outputs and more intelligent features.

HOZON Auto and its affiliated companies have applied for registrations of over 1,200 patents, the majority of which are about fuel cell, controller, camera, engine, battery pack, and other EV-related technologies, according to PatSnap, a patent analysis and consulting firm.

The company has introduced 360 Security as its second largest investor, expecting to leveraging the latter’s deep insights into AI and software to improve the intelligence performance for its products.

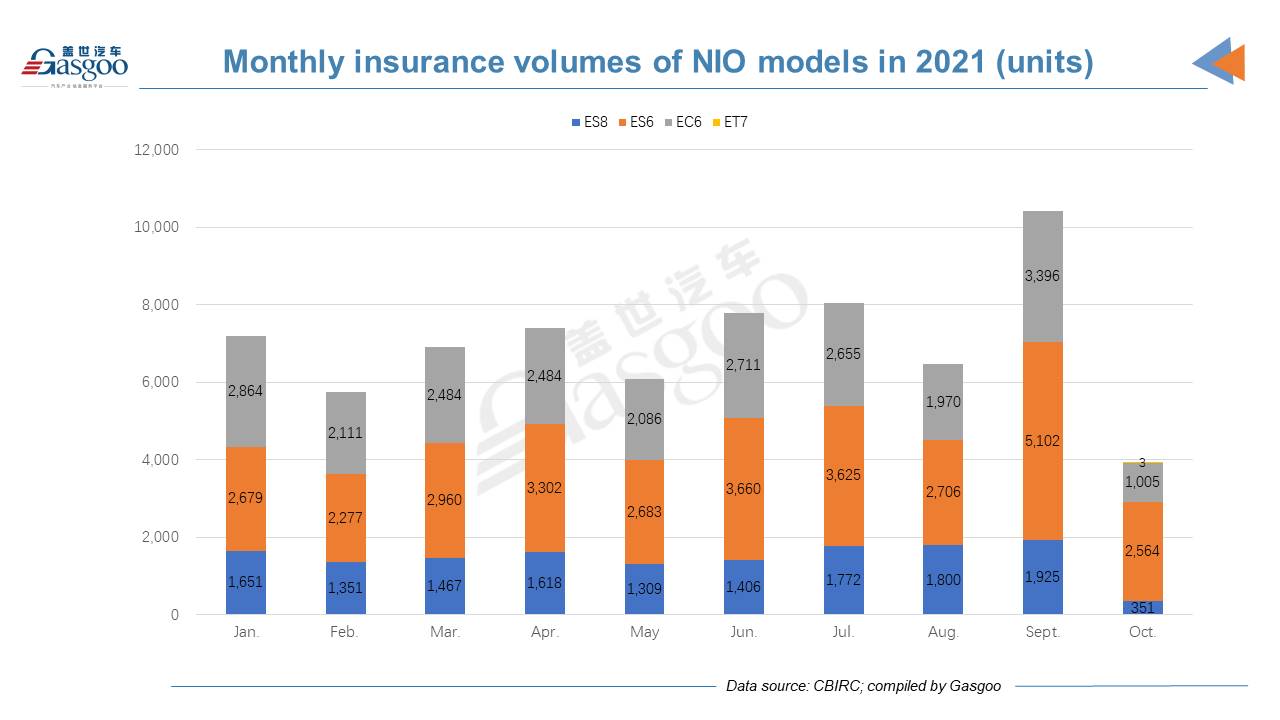

NIO's Oct. registrations amounted to 3,923 units, the lowest level for the past 15 months. Although it was still the No.1 Chinese NEV startup in terms of year-to-date registrations, NIO outsold XPeng by only 4,771 units.

The carmaker attributed the plunge to the reduction in production volume as a result of the restructuring and upgrades of manufacturing lines at its Hefei car plant, as well as some supply chain uncertainties.

However, NIO said its new order volume reached another all-time high in October, foreseeing an upward sales movement in the following two months.

There were three ET7s registered last month, while the model will temporarily have little effect on NIO’s overall registrations as the scale delivery is scheduled to start in the first quarter of 2022.

Leapmotor's Oct. registrations edged down 4.3% from a month earlier, mainly because the supply chain was somewhat disrupted by chip shortage and industrial power rationing, said the automaker.

The C11 registrations stood at only 117 units in October. Nonetheless, according to Leapmotor’s statement, order volume of the model reached up to 4,248 units last month.

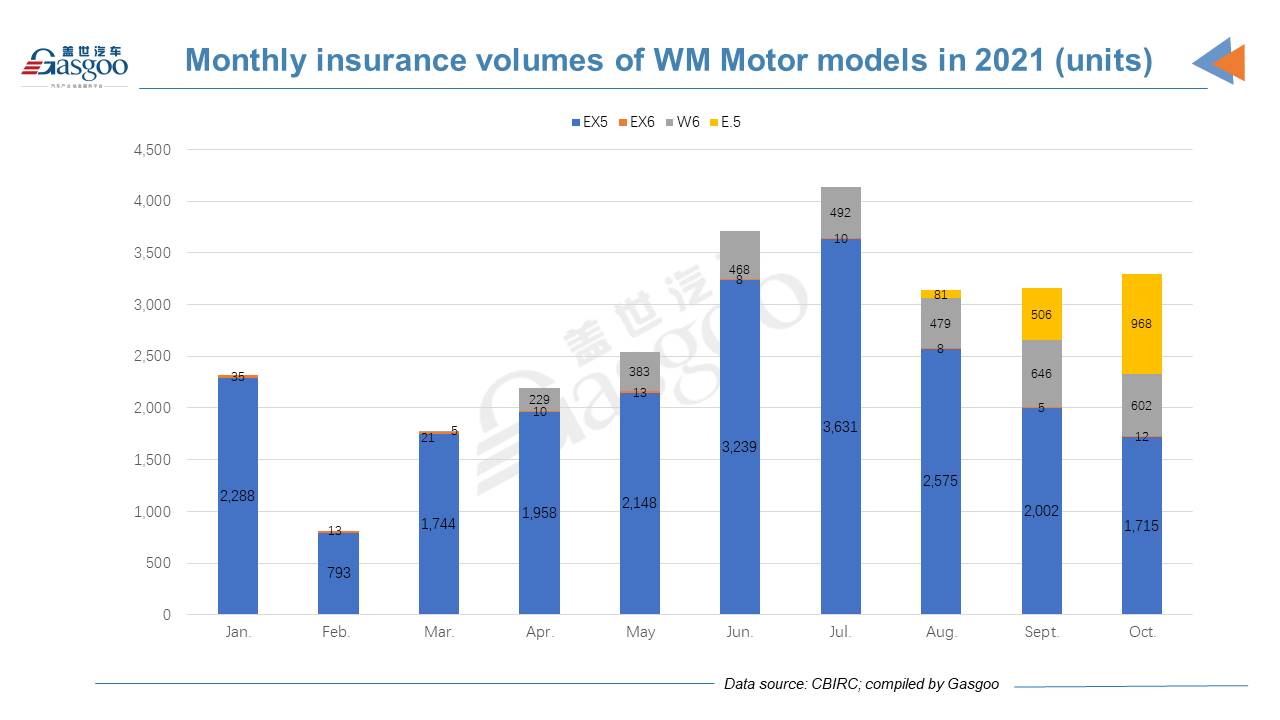

WM Motor saw its monthly registrations edge up to 3,297 units in October. The growth entirely resulted from the rise in the insurance volume of the E.5, which is launched for mobility service market.