Gap between Tesla and Chinese NEV startups’ insurance registrations much narrows in July

Shanghai (ZXZC)- In July 2021, China's insurance registrations of locally-produced new energy passenger vehicles (NEPVs) reached 214,335 units, surging 143% year on year, while edging down 2% month on month, according to the China Banking and Insurance Regulatory Commission (CBIRC).

For the first seven months of this year, there were a total of 1,202,777 locally-made NEPVs registered across China, representing a 206.5% year-over-year hike.

According to Chinese policy, NEPVs hereby merely include all-electric, plug-in hybrid electric, range-extended electric and fuel cell-powered cars, SUVs, MPVs, and minibuses.

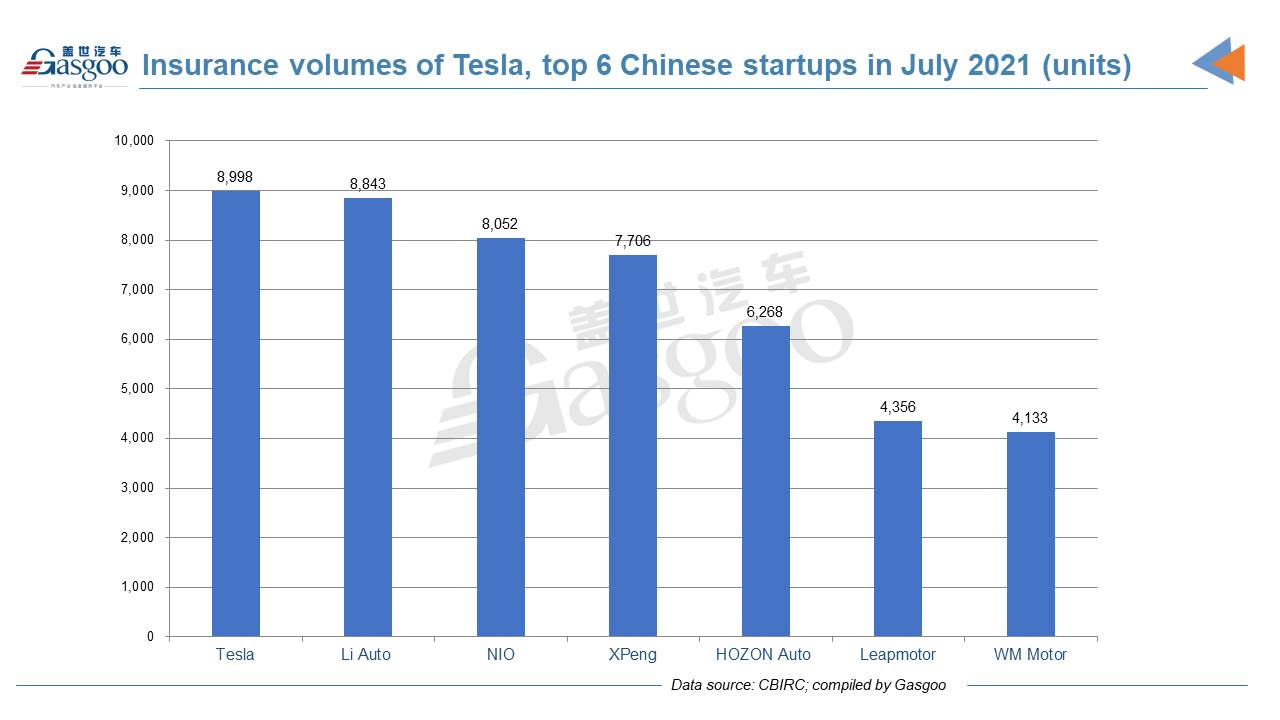

In July, Tesla still outsold all of its Chinese startup rivals with an insurance volume of 8,998 units. However, the sales gap significantly narrowed due to the sales slump Tesla suffered last month.

Tesla's registrations of China-made vehicles in July plunged 68.4% compared to the previous month and also hit this year's lowest level. Both the Model 3 and the Model Y faced month-on-month decrease of over 60%.

“Due to strong U.S. demand and global average cost optimization, we have completed the transition of Gigafactory Shanghai as the primary vehicle export hub,” Tesla said in its second-quarter financial results.

The statement may explain why Tesla's sales tumbled in Chinese market, as the limited capacity of Gigafactory Shanghai should be used to ensure export in priority.

In addition, Tesla introduced in China a cheaper version of the locally-built Model Y, which made some buyer suspend their shopping plan and wait for it to come online in August. This was another factor leading to the sales decline in July.

The registrations of the top 6 Chinese NEV startups totaled 39,358 units in July, jumping 14.2% from the previous month. All of the 6 companies closed the month of July with a record-breaking monthly figure.

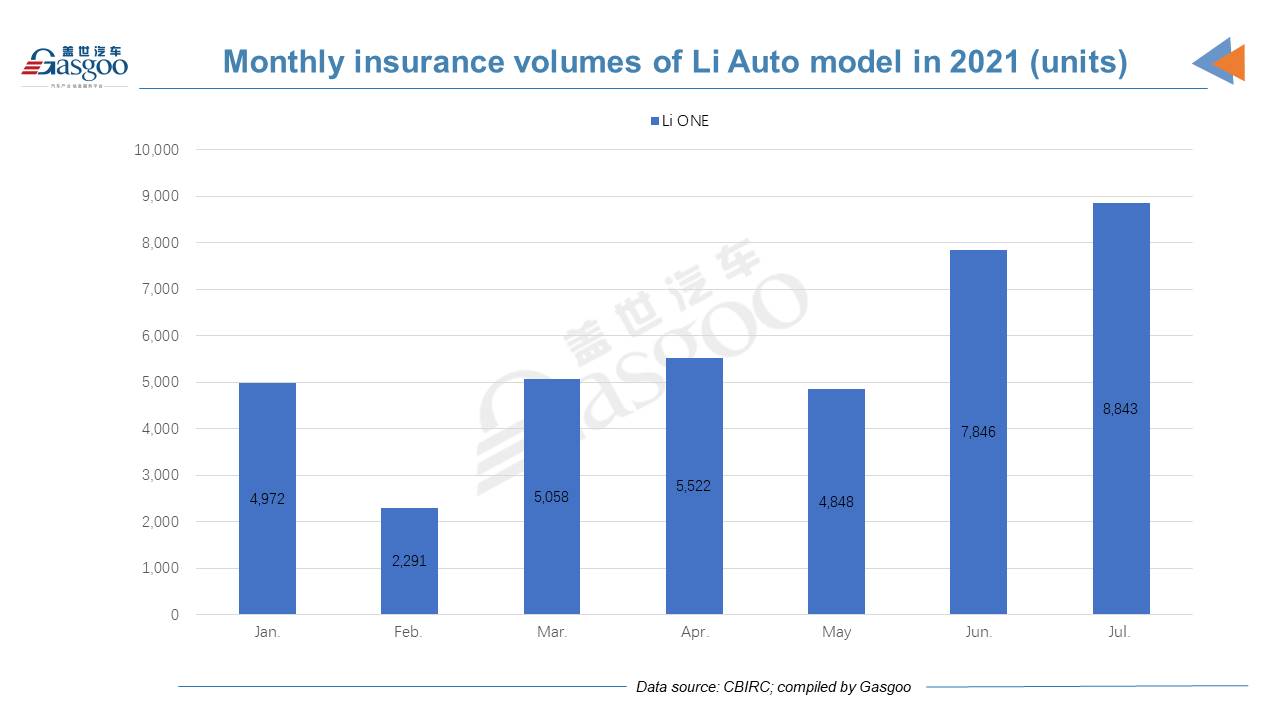

In July, Li Auto continued topping other Chinese startups with only one model for sale. The monthly registrations of the Li ONE rose 12.7% month on month to 8,843 units, for the first time surpassing 8,000 units. A total of 7,321 Li ONEs were registered by private users.

Among China-made NEV models, the Li ONE was the runner-up by July registrations, following the Wuling Hongguang MINIEV (30,204 units).

To shore up the rapid sales growth, Li Auto is accelerating the expansion of its direct sales and service network. As of July 31, the company had 109 retail stores in 67 cities, as well as 176 service centers and Li Auto-authorized body and paint shops in 134 cities.

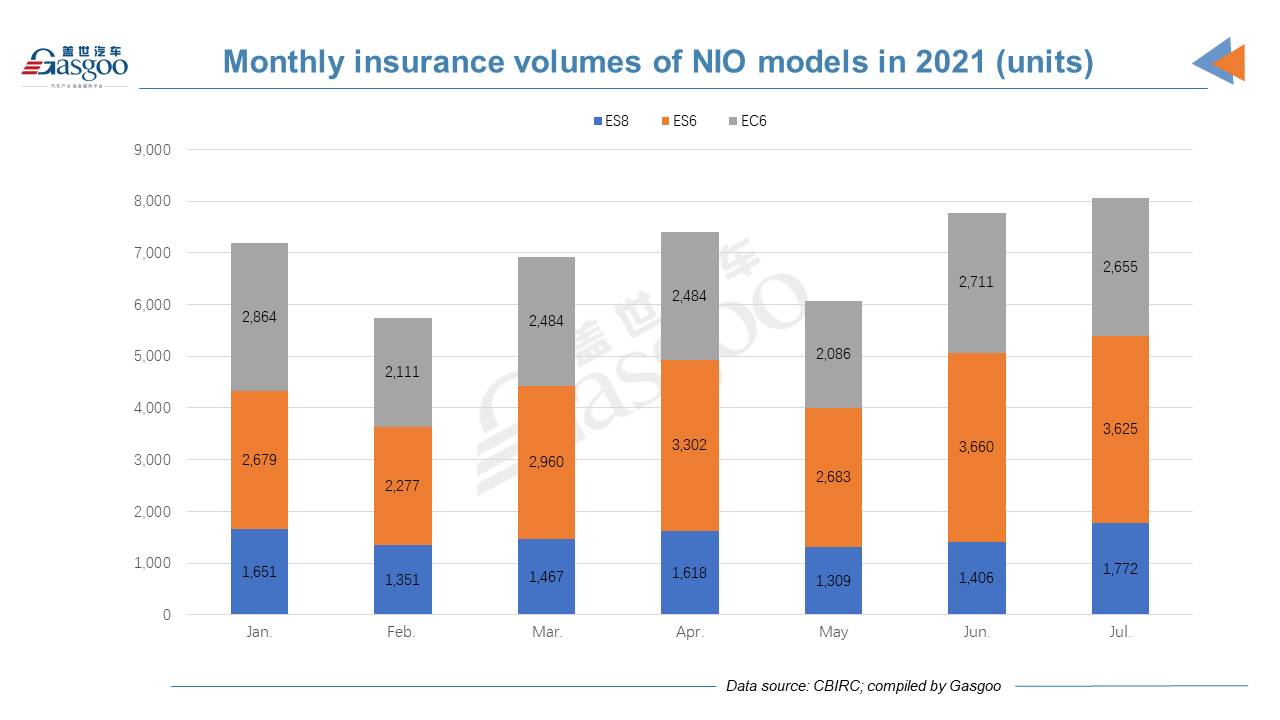

In July, NIO was once again outsold by Li Auto, while it was still the champion among Chinese NEV startups in terms of year-to-date registrations.

Last month, NIO's monthly insurance volume exceeded 8,000 units for the first time as well and edged up 3.5% compared to June thanks to the growth in the ES8 registrations.

On the list of made-in-China NEV models by July registrations, the ES6 and the EC6 ranked 17th and 24th respectively. The ES8 failed to enter the top 30.

“NIO's whole production capacity is around 7,500 units per month, and it is striving to hit monthly deliveries of 8,000 units,” a people with direct knowledge of this matter told a local media outlet after the July delivery performance was announced.

At the end of April, NIO's founder and CEO William Bin Li stated that 400 vehicles can be built per day in Hefei. With 25 working days per month, that translates into a capacity of 10,000 vehicles. However, the global chip shortage and bottlenecks with batteries have limited the monthly capacity to around 7,500 units, according to Li. He also expected the impact of chip problem would ease from the third quarter, while the latest delivery figures indicate that the influence has not been apparently whittled down.

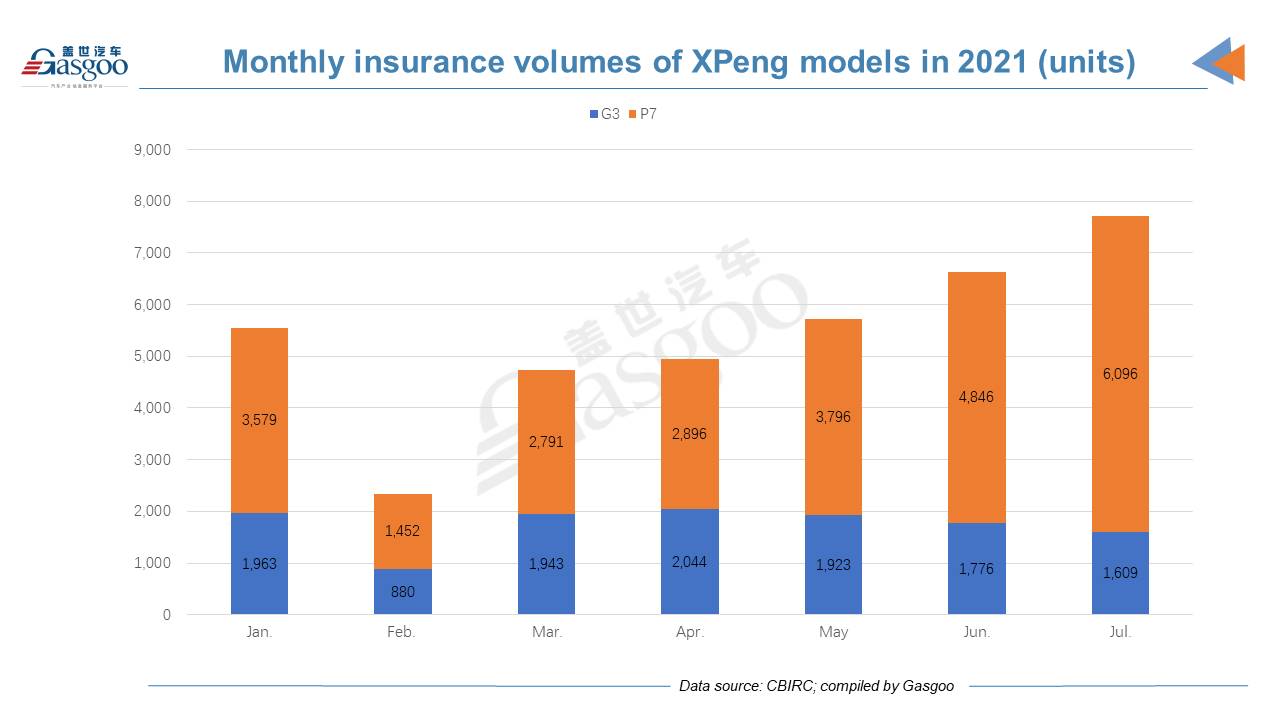

XPeng was still the No.3 Chinese NEV startup in July. Its monthly registrations surpassed 7,000 units for the first time, while leaping 16.3% from a month earlier despite the 9% decrease in the G3 registrations.

With 6,096 units registered in July, the XPeng P7 ranked 6th among locally-made NEV models, immediately following the Tesla Model 3. A total of 5,570 P7s were registered by private users.

XPeng partly attributed its robust delivery growth to consumers’ increasing acceptance to intelligent EVs and its rapid iteration capability for smart EVs. In the second quarter, the attach rate of XPILOT 3.0 software reached 25%, He Xiaopeng, CEO and Chairman of XPeng, said on Aug. 26 at an earnings call. In June, the mileage penetration rate of the NGP highway solution exceeded 60%, and NGP assisted XPeng’s customers in driving for around 1.45 million kilometers.

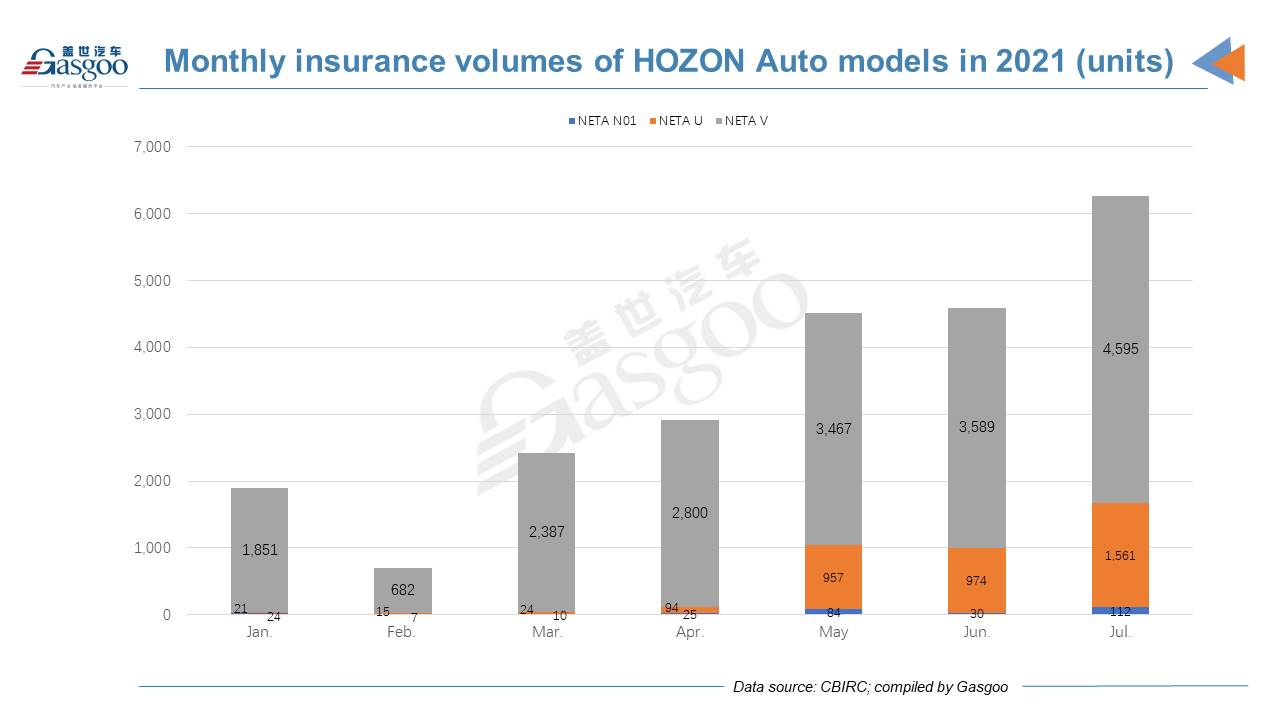

HOZON Auto saw its monthly insurance volume surge 36.5% month on month to 6,268 units, 73.3% of which were contributed by the sales of the NETA V. It was also the first time for the startup to record monthly registrations topping 6,000 units.

Among the three NETA-branded models, the NETA V was the only one among the top 30 locally-built NEV models by July registrations, ranking 12th on the list.

Currently, HOZON Auto's vehicles are all produced at its self-built plant in Tongxiang, Zhejiang province. Located in Yichun, Jiangxi province, the second plant is expected to start production at the end of this year. By that moment, HOZON Auto will feature a total capacity of 150,000 vehicles per year.

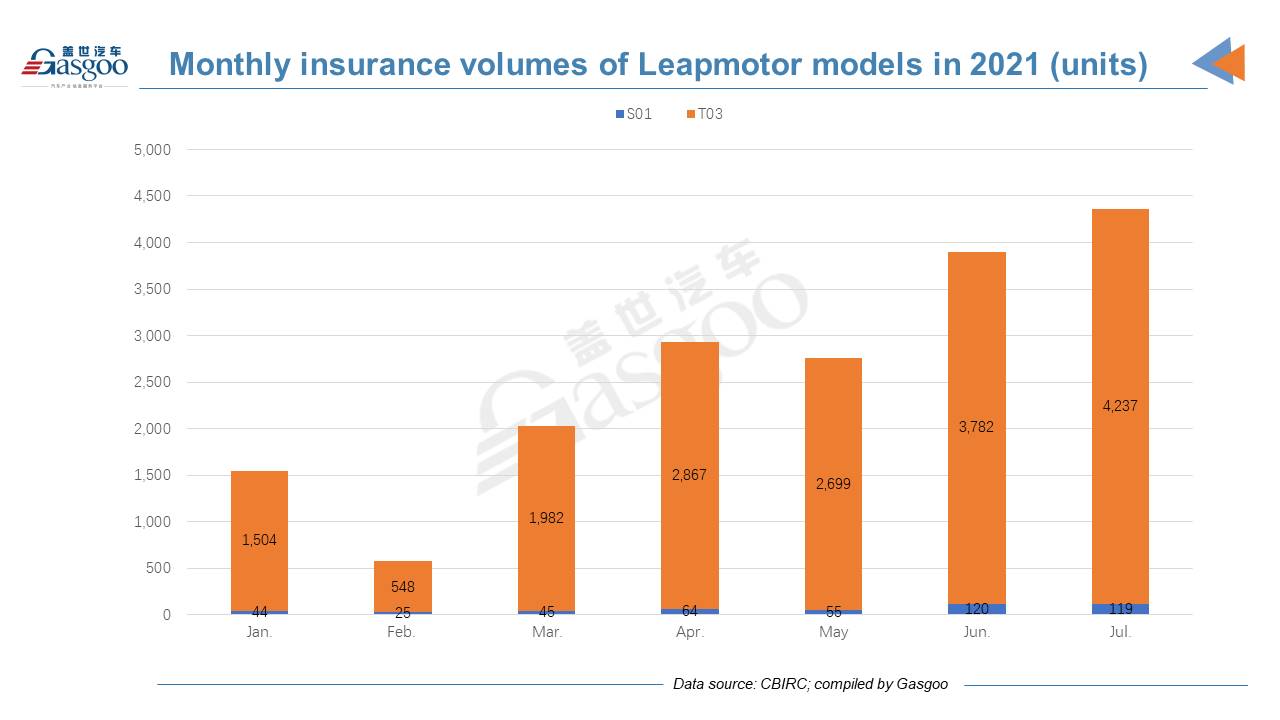

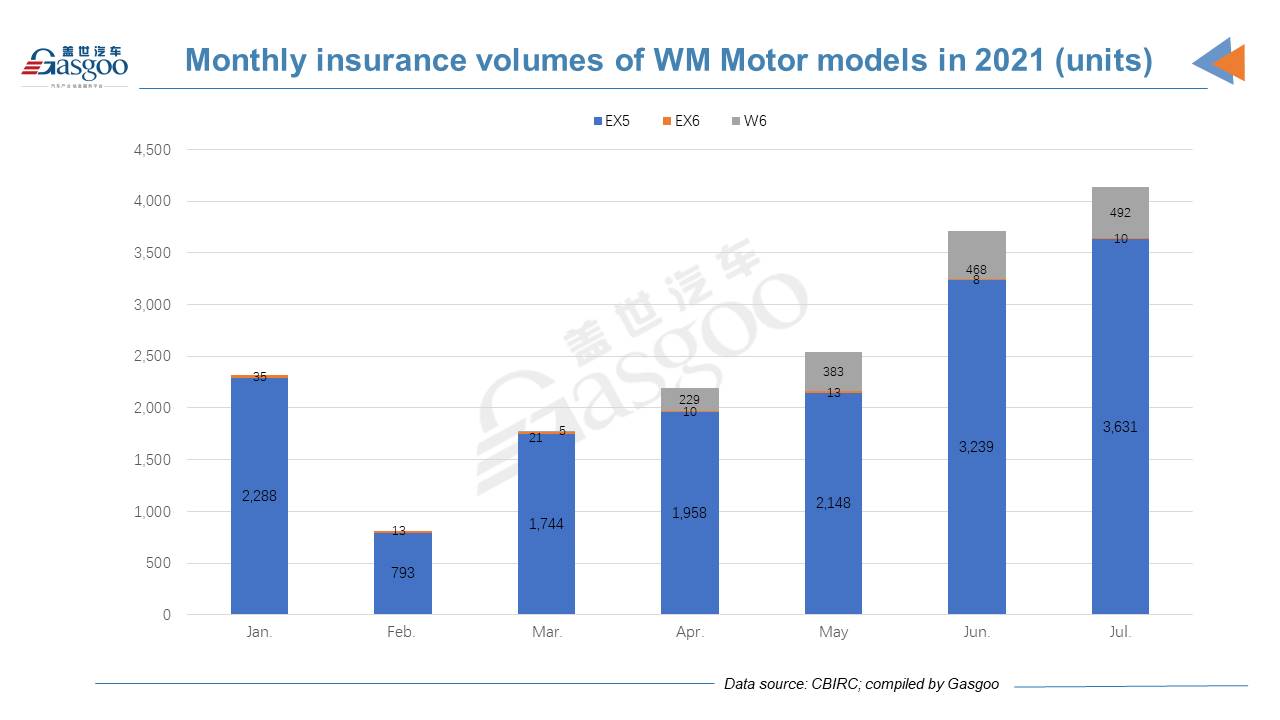

Both Leapmotor and WM Motor recorded July registrations between 4,000 and 5,000 units.

With 4,237 units registered, the T03 ranked 14th among made-in-China NEV models last month and accounted for up to 97.3% of Leapmotor's total July registrations.

WM Motor also heavily relied on a single model. Among 4,133 new vehicles registered in July, 3,631 units were the EX5s. Notably, 2,266 EX5s were registered for car rental services.