Hozon Auto’s NETA brand outsells XPeng, NIO in February

February is generally an off-peak season for new vehicle sales in China for the month has fewer selling days and China’s New Year holiday always comes at the beginning of the month. In February this year, deliveries of major Chinese electric vehicle startups were not as outstanding as the three months before.

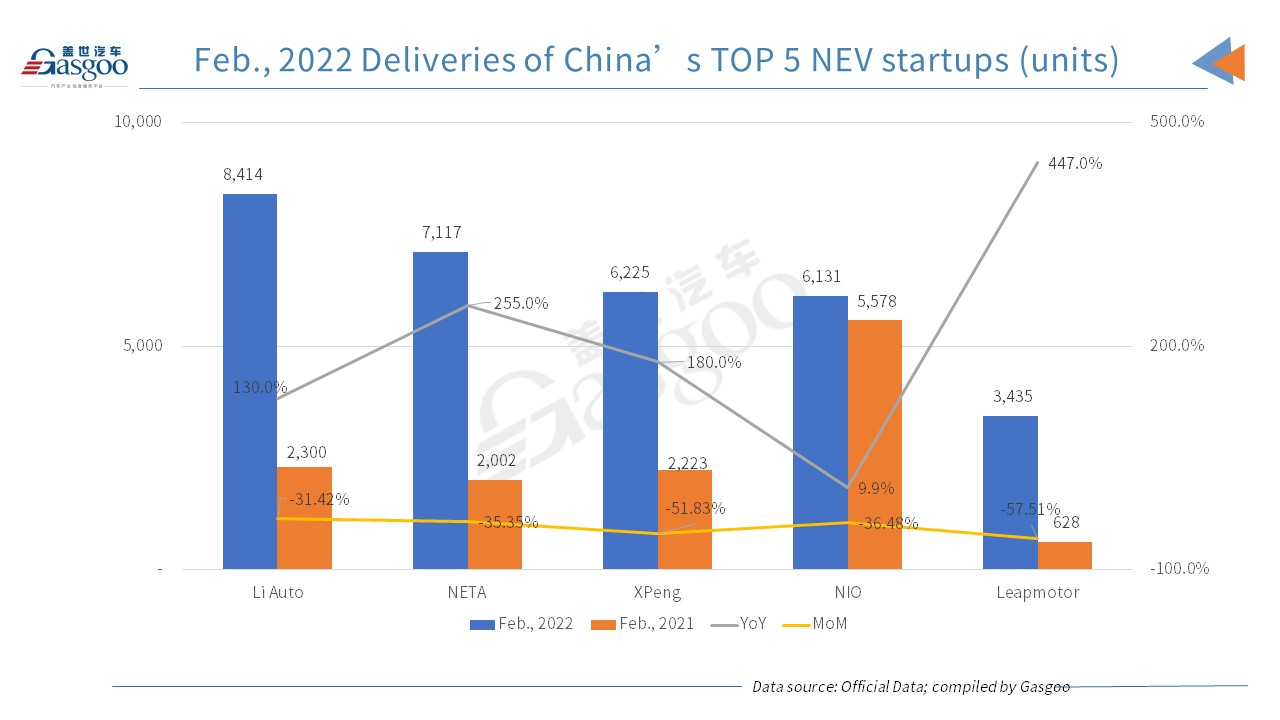

None of the top 5 local electric vehicle startups delivered over 10,000 vehicles last month. Compared with January deliveries, NIO, Xpeng, Li Auto, NETA and Leapmotor all had a month-over-month delivery decrease of more than 30% in February, but they all achieved an increase year over year.

Among the top 5 local electric vehicle startups, Li Auto reclaimed the championship lead by monthly deliveries six months after it outsold other startups with 9,433 vehicles delivered last August. Even though it delivered the most vehicles last month, its production was affected by the holiday season and supply shortages resulted from an outbreak of the pandemic in Suzhou.

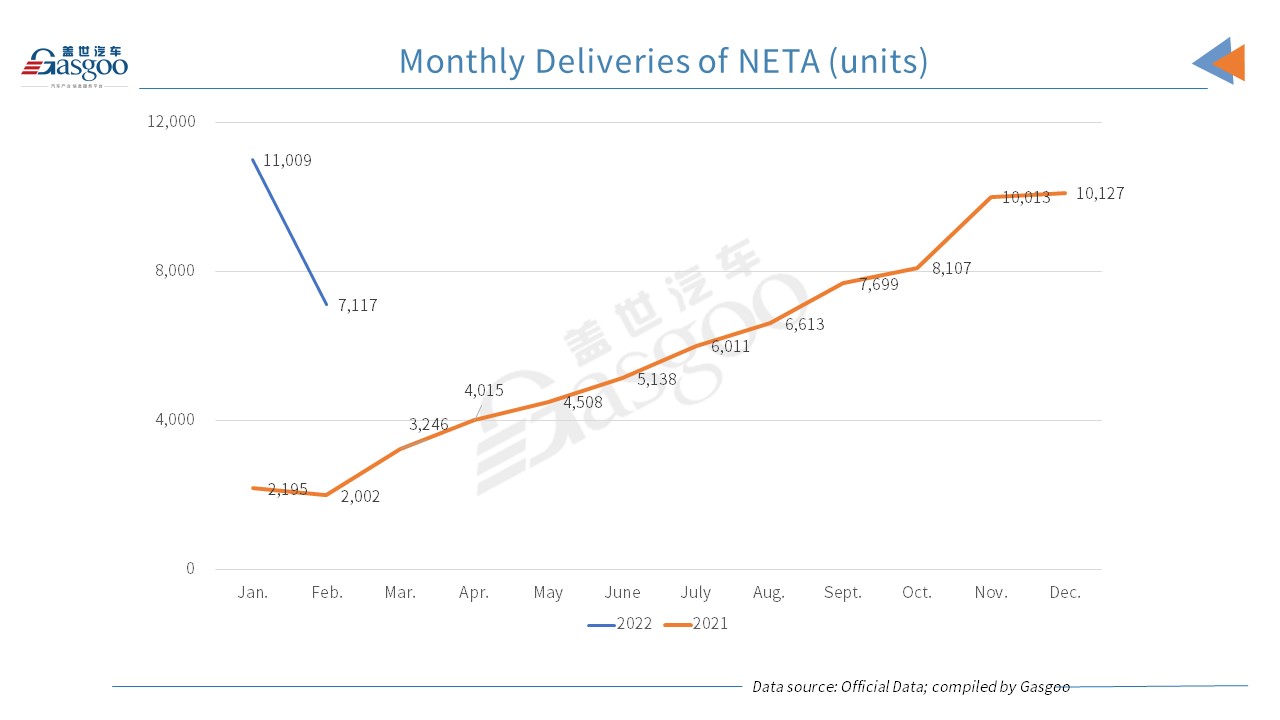

Hozon Auto’s NETA brand followed, outperforming XPeng and NIO. The company surpassed NIO twice last year, in August and in October, but it was the first time for NETA to deliver more vehicles than XPeng in a month.

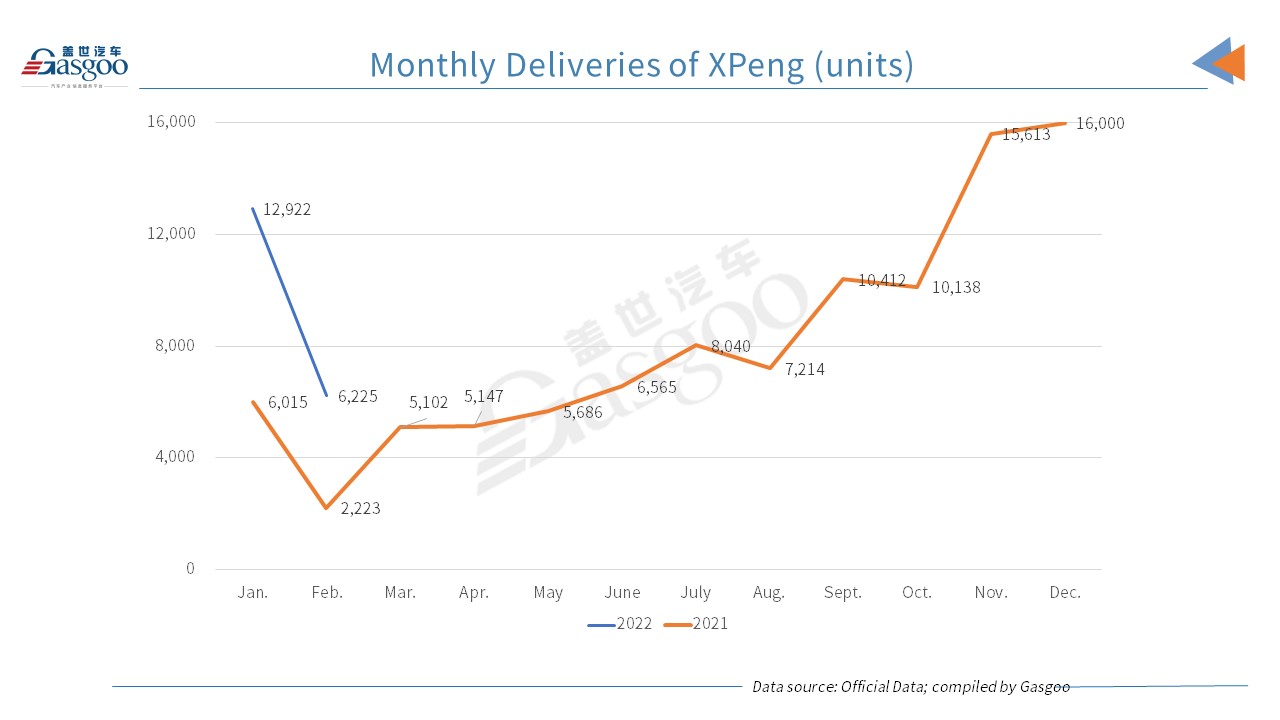

XPeng delivered 6,225 vehicles in February, the lowest level during the past eight months. During the Chinese New Year holiday, its Zhaoqing plant completed a new round of technology upgrade which started from late January to early February, and had resumed production as planned.

NIO ranked fourth among the five startups, and the company achieved the smallest year-over-year growth rate. The NIO-JAC manufacturing plant had production suspension during the Chinese New Year holiday for adjusting production lines to prepare for the delivery of the ET7.

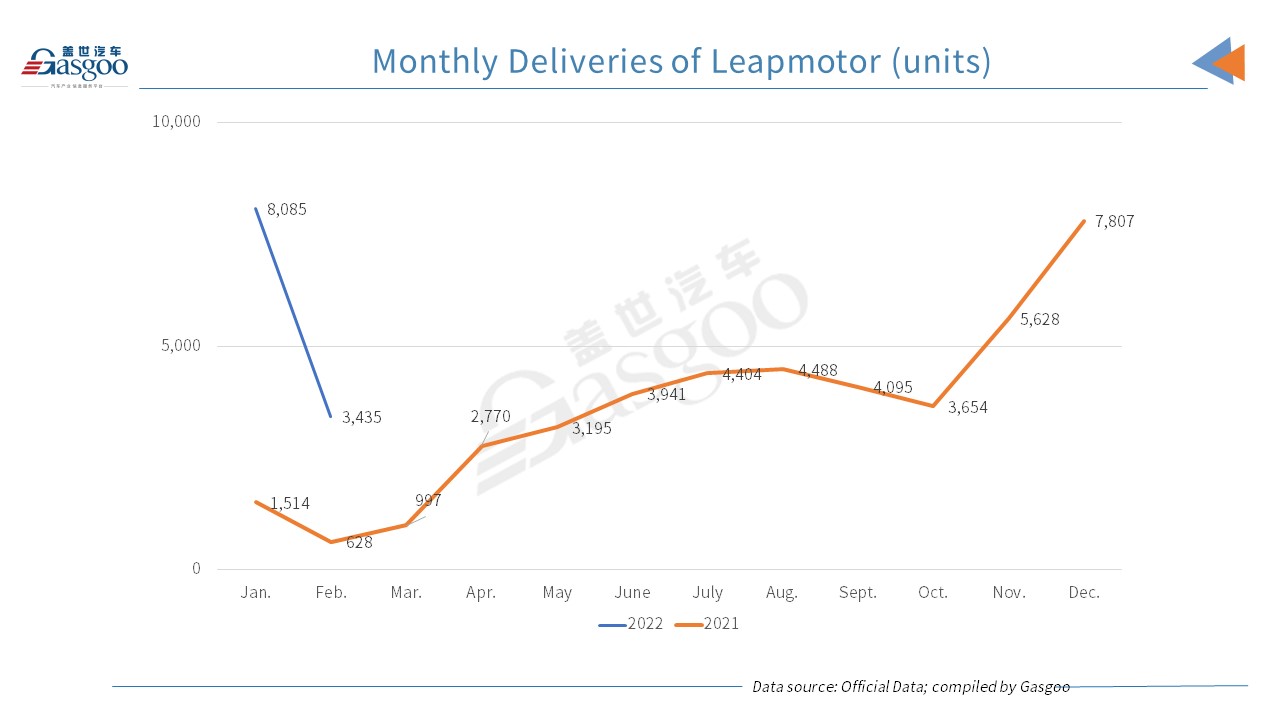

Leapmotor’s monthly deliveries were also affected by the holiday as well as the supply crunch in automotive chips and batteries. Ever since the addition of the C11, Leapmotor has been facing production capacity problems.

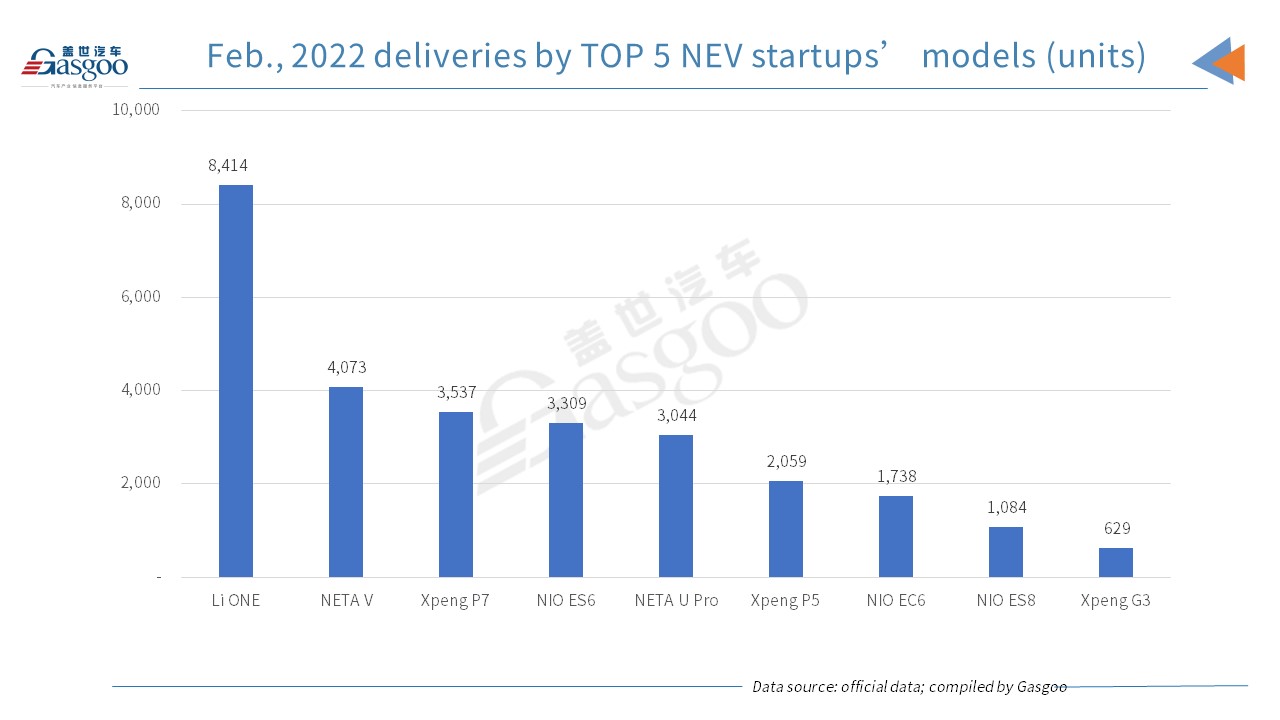

By models, the Li ONE, the only model from Li Auto, was clearly in the lead in the second month of this year. The NETA V, an electric subcompact crossover, was a distant second, but surpassed the XPeng P7, a smart sports sedan, and the NIO ES6, a five-seater high-performance premium smart electric SUV.

This year will see more models from those startups. NIO aims to deliver three new models this year, the ET7 on March 28, the ET5 in September and the ES7 within this year. The X01 from Li Auto, which is expected to have significant improvements in sensors, computing power and safety redundancies, is projected to commence delivery in the third quarter. The XPeng G9, the automaker’s first global market-oriented model, will start presale in April. NETA plans to sell the NETA S at the end of this year.

With more products to come, automakers’ production capacity will be of great significance. In the meantime, supply chain disruption, price increase in materials and sporadic COVID-19 outbreaks will continue to affect the production.

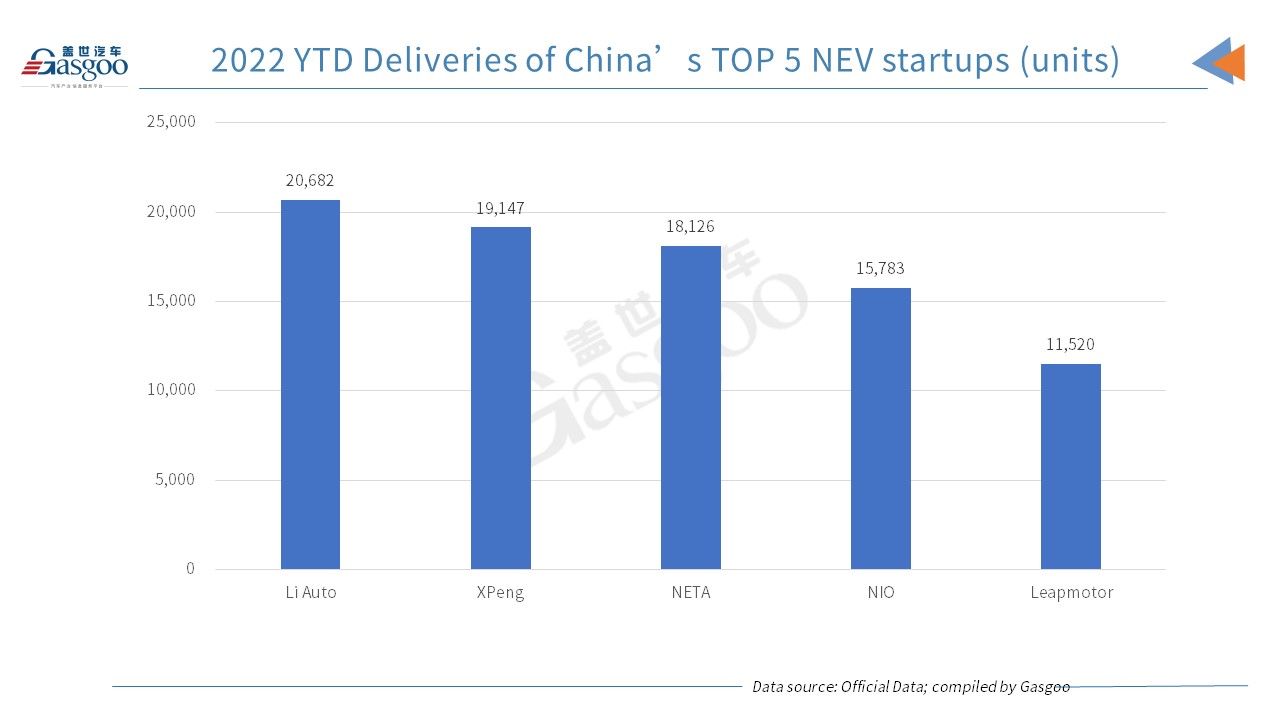

By the year-to-date deliveries of 2022, Li Auto remained the most popular local startup and became the only one whose Jan.-Feb. deliveries surpassed 20,000 units. According to the automaker’s latest financial results report, Li Auto projected its deliveries of the first quarter to range from 30,000 to 32,000 units. That means its deliveries of this month are expected to be from 9,318 to 11,318 units.