Tesla tops Chinese NEV startups by vehicle registrations in Jan. 2022

In January 2022, there were 312,745 locally-made new energy passenger vehicles (NEPVs) registered across the Chinese mainland, representing a 115% year-on-year hike, according to the data compiled by ZXZC Auto Research Institute.

However, the monthly NEPV registrations plunged 35% compared to the previous month, mainly because the auto market cooled down before the Spring Festival holiday.

To be specific, the Jan. homegrown NEPV registrations were composed of 240,702 battery electric vehicles (BEVs), 72,041 plug-in hybrid electric vehicles (PHEVs), which included 14,325 range-extended electric vehicles (REEVs), as well as 2 fuel cell vehicles (FCVs).

Last month, the seven key startups (including Tesla) all faced a month-on-month decrease. Of them, the U.S.-based EV manufacturer posted the biggest decline, but it still outsold all Chinese startup rivals. Compared to the month-ago rankings, XPeng and Li Auto were still the top 2 Chinese NEV startups, while NIO surpassed HOZON Auto to the second runner-up place.

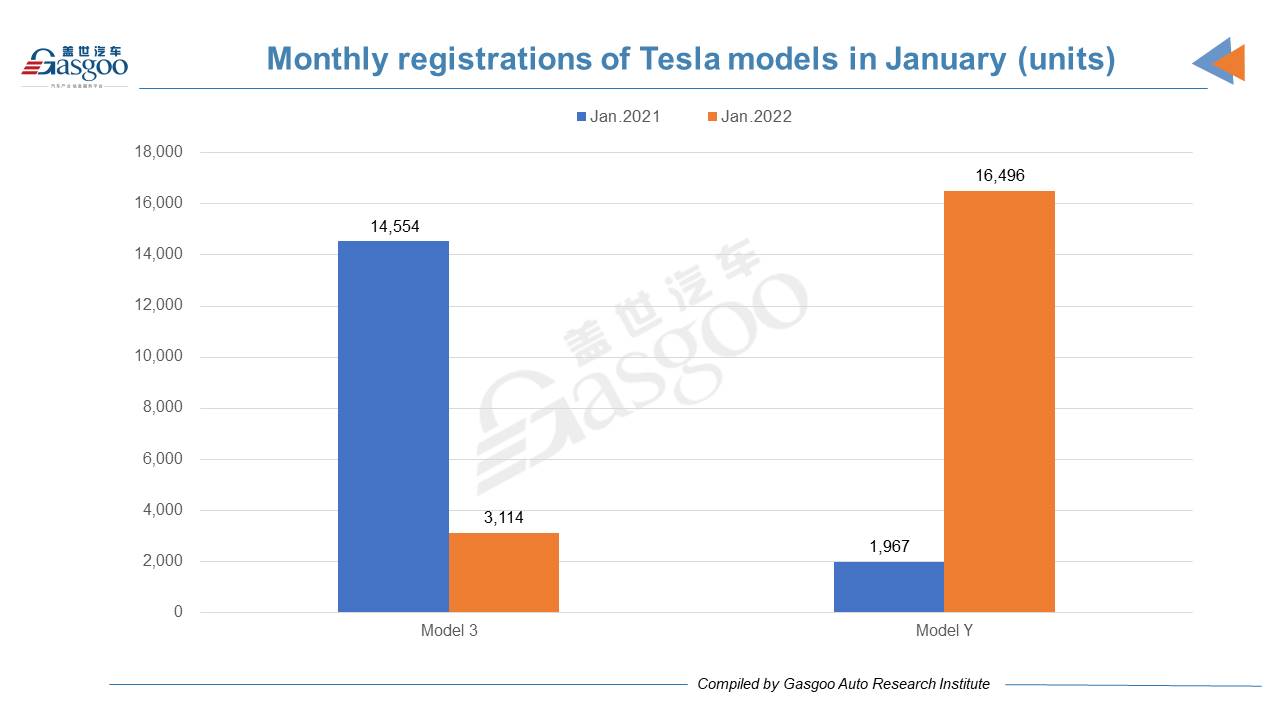

Tesla saw its monthly registrations of China-made vehicles tumble to 19,610 units in January from 70,219 units in December 2021. Aside from the holiday reason, the plunge in China’s domestic registrations also partially resulted from the higher importance attached to the export business. The Giga Shanghai typically prioritizes overseas shipments in the first half of each quarter, before ramping up locally deliveries in the latter half of the period, Tesla's CEO Elon Musk said last year.

Model Y; photo credit: Tesla

In response to China's NEV subsidy policy, Tesla announced at the end of Dec. 2021 it would bump up prices of the Model 3 and Model Y’s RWD versions. However, it is hard to evaluate how much the price rise affected the sales as the frequent price change has already been regarded as a typical move of Tesla.

Last month, XPeng still ranked highest among Chinese NEV startups by monthly registrations. The P7, which accounted for 51.6% of the startup's totals, ranked thirteenth among all locally-built NEPV models. Besides, the P5, which hit the market in Sept. 2021, contributed to 31% of the company's total volume, resulting in 11,922 units in its cumulative registrations.

After taking the honor of No.1 Chinese NEV startup by 2021's full-year sales, XPeng lifted its annual delivery target to 250,000 units for the year of 2022, indicating the company should deliver around 20,000 vehicles per month on average.

XPeng's deliveries are expected to be further increased with the advent of the G9, the company's fourth production model unveiled at the Auto Guangzhou 2021. The model is expected for large-scale delivery in September and is anticipated to account for 14% of XPeng’s annual deliveries.

In addition, XPeng's supercharging network has already covered 337 cities across Chinese mainland, including 333 prefecture-level cities and 4 direct-administrated municipalities. The widespread coverage of charging facilities may help XPeng earn more consumers who fear for the range trouble.

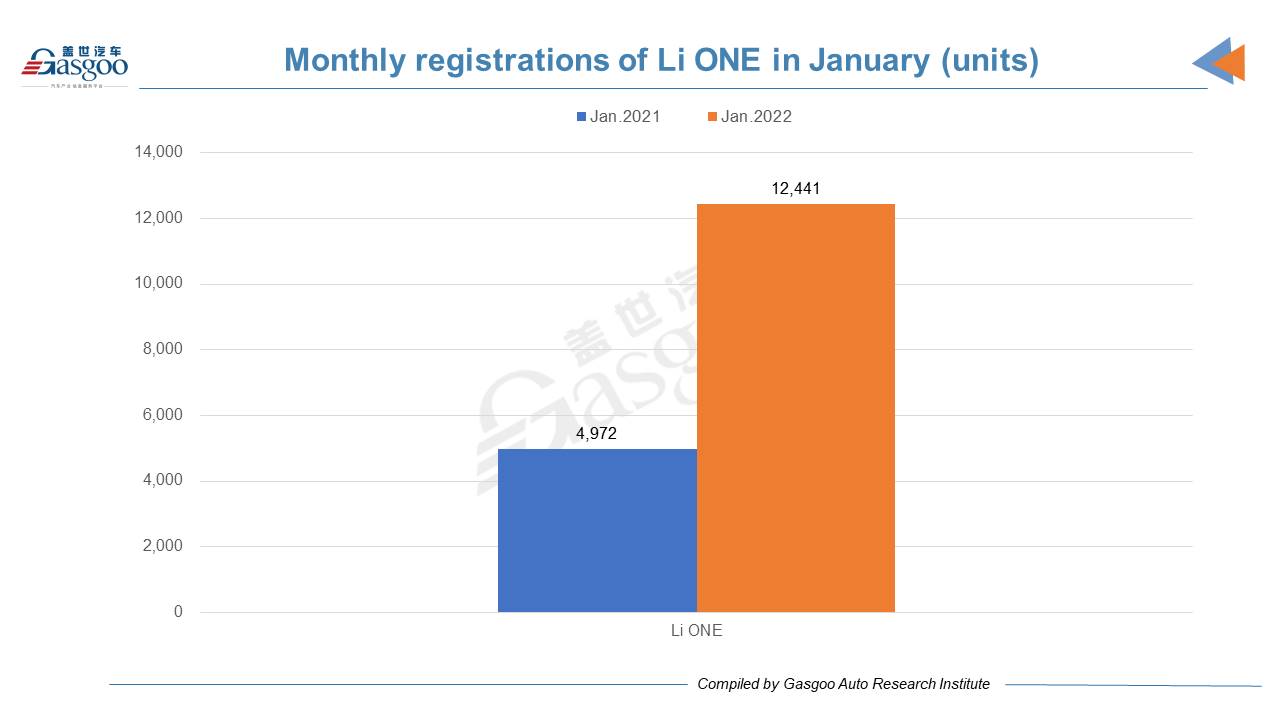

Li Auto saw its monthly registrations in January drop 11.9% from the previous month, but rocket 150.2% from the year-ago period still without new products added.

In terms of Jan. registrations, the Li ONE, Li Auto’s sole model currently for sale, ranked fourth among all locally-built NEPV models, while topped the other models owned by Chinese NEV startups.

Last year, Li Auto recorded an annual registration volume of 91,424 vehicles, which were all produced at the company’s Changzhou plant. With an initial production capacity of only 100,000 units per year, the Changzhou manufacturing base is urgent to be upgraded to raise outputs. Currently, new assembly lines are under construction, aiming to doubling the factory’s capacity.

Besides, the development of Li Auto will be supported by the municipal government of Beijing, where the automaker is building its second vehicle plant. According to the 2022 development plan Beijing’s authorities issued in early January, the capital of China will “promote Li Auto’s construction” this year.

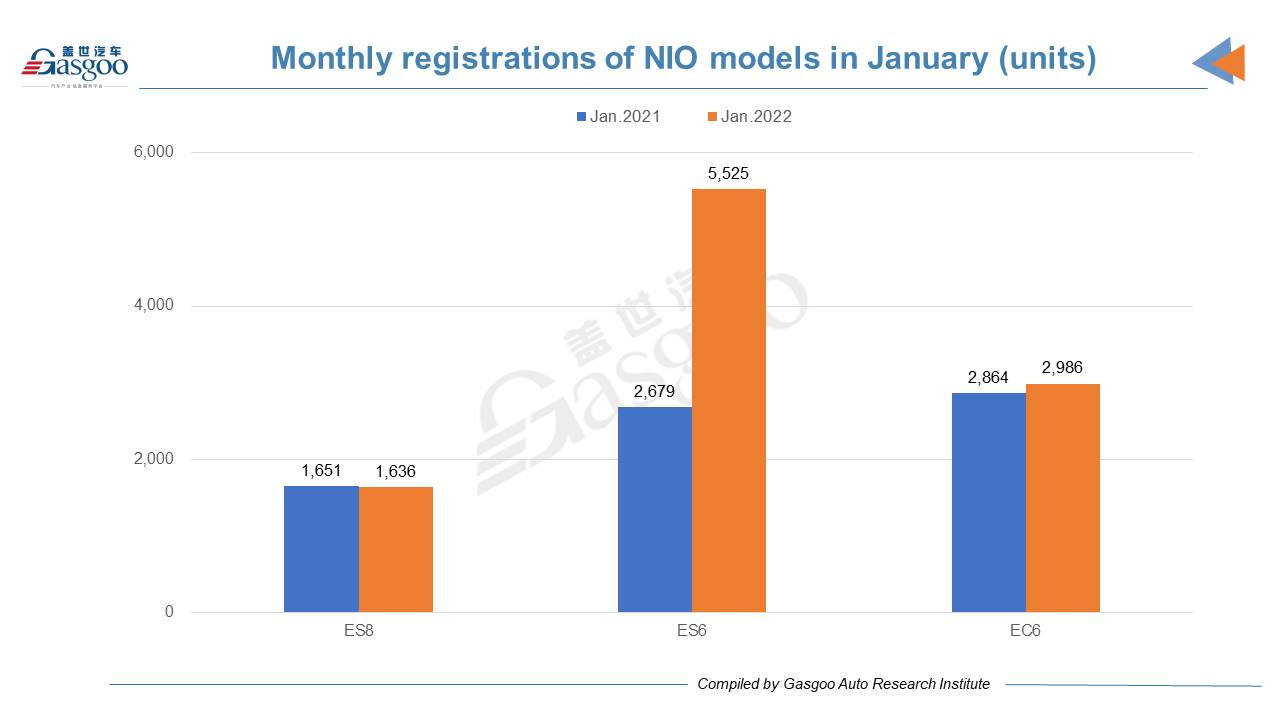

Compared to the previous month, NIO's Jan. registrations only dropped 2.9%. With 5,525 units registered, the ES6 was still NIO’s biggest sales contributor.

There were 31 ET7s registered last month. However, the scale delivery of the model will not kick off until March 28.

In January, NIO announced the launch of its 800th battery swapping station in China, as a result of the cooperation with the world's top furniture retailer IKEA. Moreover, the startup also expanded its battery swapping network on expressways by signing an agreement with Zhejiang Commercial Group Co., Ltd. in the month. Although increasingly more players are tapping the battery swap business, NIO has already reaped the first-mover advantage.

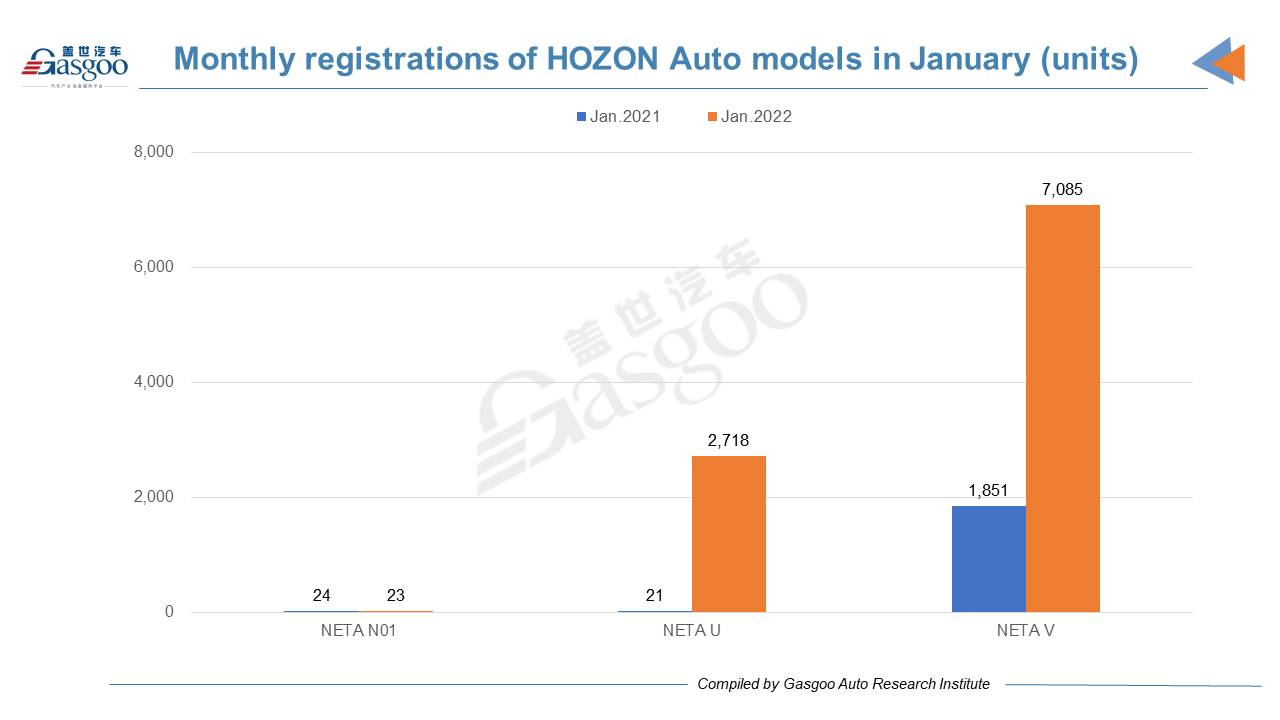

HOZON Auto recorded a registration volume of 9,826 units last month, 99.8% of which were contributed by the NETA U and the NETA V. The latter was the runner-up among the models developed by Chinese NEV startups.

As the startup's first production model, the NETA N01 only had 23 units registered in January, indicating its insignificant presence due to the lack of new versions.

Last month, HOZON Auto hit an outputs milestone of 100,000 vehicles, meaning the startup has made substantial progress in such capabilities as manufacturing, quality control, procurement synergy, as well as operation and management.

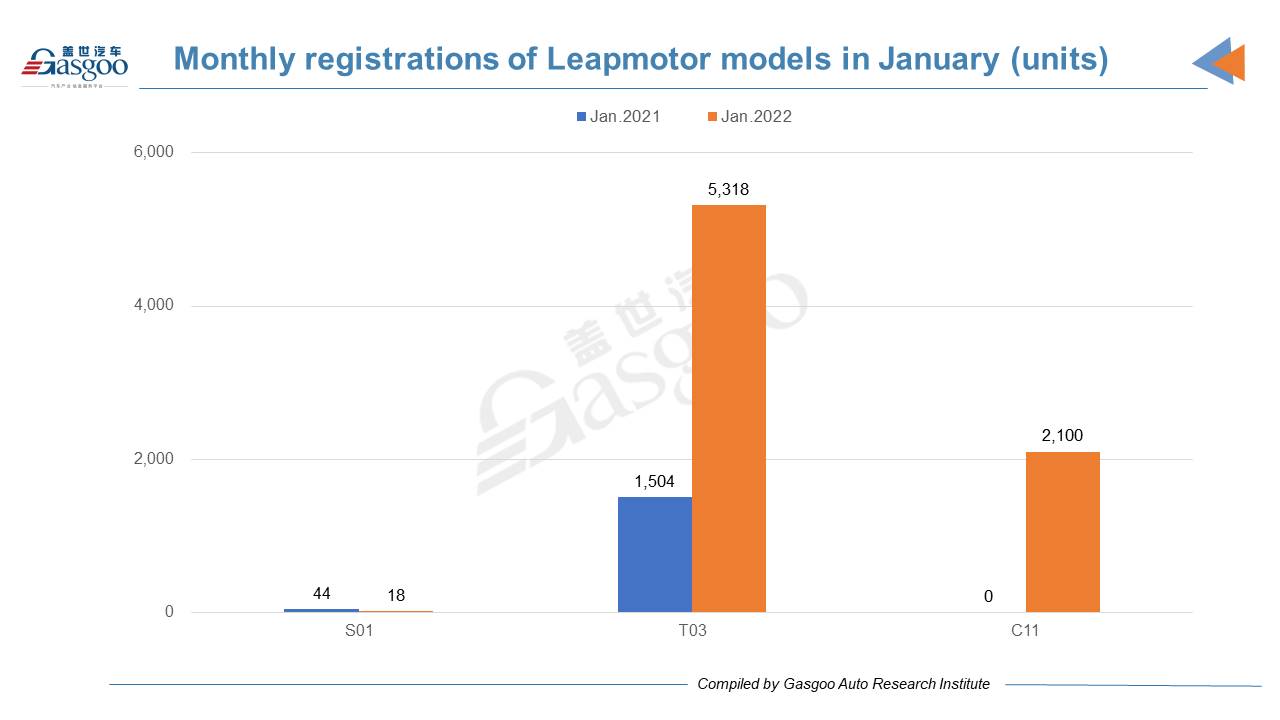

Leapmotor posted a 12.1% decrease month-over-month in Jan. registrations. The T03, serving as the startup’s largest sales contributor, had a refreshed version (the 2022 T03) put into the market at the end of December 2021. Some industry insiders said the advent of the new product is a response to the recent subsidy decline as it features a higher price range.

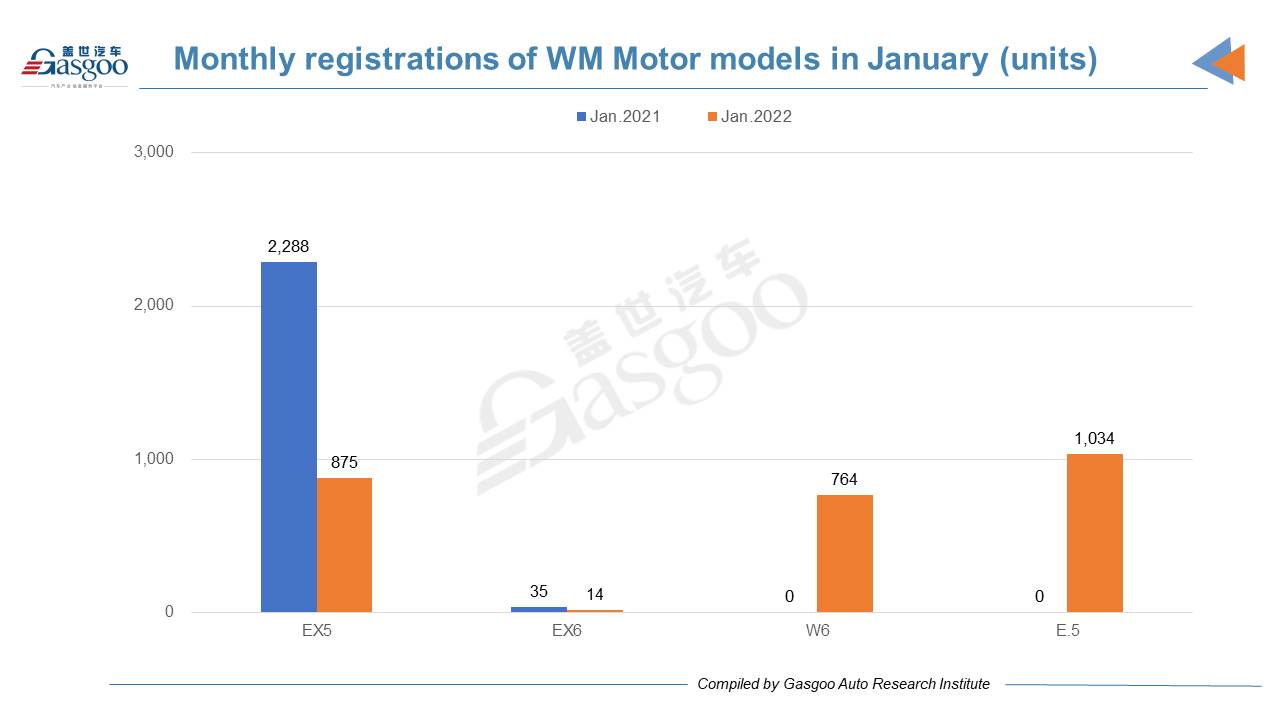

WM Motor's monthly registrations tumbled 37.8% over a month earlier to 2,687 units in January, 1,034 units of which were from the E.5, a model purposely built for mobility services. The decrease partly resulted from consumers’ complaints about the range reduction and fire incidents.