Nio EC7, new ES8, ES6 enter China's purchase tax exemption catalog, range info revealed

China's industrial regulator has released the latest list of new energy vehicles exempted from vehicle purchase tax, including the Nio ES7, the new ES8 and the new ES6, which has not yet been officially launched.

(Nio EC7. Image credit: Nio)

Nio's (NYSE: NIO) three new NT 2.0 platform-based SUVs have been added to a list of vehicles exempted from purchase tax in China, meaning they are ready for official sales.

China's Ministry of Industry and Information Technology (MIIT) yesterday released the latest batch of new energy vehicles (NEVs) exempted from purchase tax, including the Nio ES7, the new ES8 and the new ES6, which has yet to be officially launched.

As a background, China's support policies for the NEV industry over the past few years have included state subsidies for vehicle purchases and exemptions from purchase taxes. Both of these policies expired at the end of 2022, but the latter has been extended until the end of 2023.

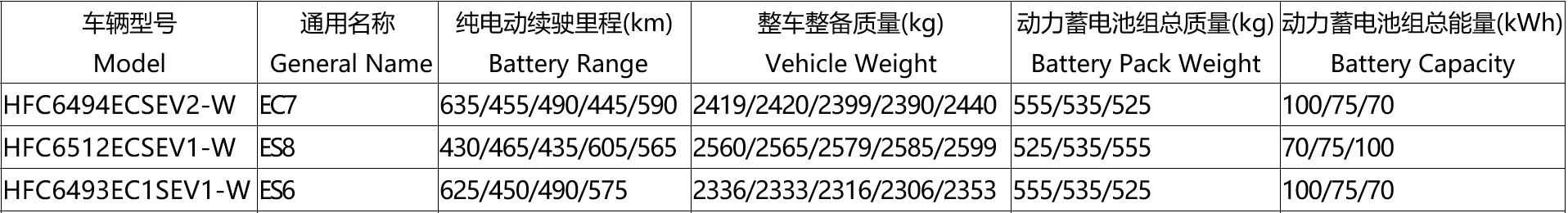

All three of Nio's new models have battery packs of 70 kWh, 75 kWh and 100 kWh capacities, with pack weights of 525 kg, 535 kg and 555 kg, respectively, the MIIT document shows.

These three battery packs will give the EC7 a range of 635/455/490/445/590 km, the new ES8 430/465/435/605/565 km, and the new ES6 625/450/490/575 km.

(The English translation in the first line was added by CnEVPost.)

The EC7 and the new ES8 were launched at Nio Day 2022 on December 24, 2022, and deliveries are set to begin in May and June 2023, respectively.

The new ES6 has not yet been officially unveiled, but a document from the MIIT last month has revealed the exterior and core specifications of the model. The new ES8 and EC7 entered the regulatory filings in December and January, respectively.

The biggest change to the three new models compared to the NT 1.0 models is the use of the same roof LiDAR and camera setup as the other NT 2.0 models.

In addition, the regulatory filings for all three models show that their battery suppliers include CALB in addition to CATL.

This shows that Nio may be trying to reduce its dependence on CATL for battery supply, as are its other local counterparts.

Xpeng (NYSE: XPEV) already switched its main battery supplier to other than CATL last year, and Li Auto first announced it was bringing in two new battery suppliers besides CATL when it unveiled the Li L7 on February 8.

On February 17, local media outlet 36kr reported that CATL is offering lower battery cost options to a handful of core customers, including Nio and Li Auto, in an effort to maintain loyalty.

The core terms of the partnership include that CATL will settle with car companies for a portion of their power battery supply at a price of RMB 200,000 per ton of lithium carbonate for the next three years. Battery-grade lithium carbonate is currently quoted at about RMB 400,000 per ton.

CATL reportedly cutting battery costs significantly for some clients including Nio, Li Auto