China’s homegrown new energy PV sales slide YoY for 5th month in a row

Shanghai (ZXZC)- China's automakers sold roughly 79,000 locally-produced new energy PVs (NEPVs, referring to all-electric PVs and plug-in hybrid PVs) in November, clocking a sharp decrease of 41.7% over a year ago, according to the China Passenger Car Association (CPCA).

This is the fifth month in a row for China's NEV market to post year-on-year downturn after a stricter NEV subsidy policy coming into effect. The average monthly NEPV sales for the past five months were between 65,000 units and 70,000 units, which were substantially eclipsed by that of the year-ago period.

According to Cui Dongshu, secretary general of the CPCA, the hike in marketing cost in the wake of green-car subsidy phase-out and the scarcity of China Ⅵ PHEVs were mainly attributable to the flagging sales.

(Photo source: BAIC BJEV)

For the first eleven months, the wholesale volume of homegrown NEPVs still climbed 7.7% from a year ago to around 923,000 units.

With 67,000 units (-35%) sold, all-electric PVs accounted for 86% of the overall China-built NEPV wholesale volume in November.

Of those, the volume of A00-segment (mini-sized) BEVs plunged 64% to 18,234 units, taking up 27% of all-electric PV sales, versus 49% shares for the prior-year period. With 7,835 units sold, the A0 segment (small-sized) recorded a year-on-year slump of 51% and a month-on-month decline of 11.1% due to the increasing price caused by subsidy cut and young consumers' lack of interest in EVs.

(Photo source: Geometry)

Besides, the A segment (compact sized) became the only segment featuring increase driven by the demands of private cars and car rental. Last month, the wholesale volume of A-segment all-electric PVs amounted to 39,219 units, soaring 47% month on month and jumping 17% year on year.

In addition, the wholesale volume of plug-in hybrid PVs tumbled 62% from the previous year to 11,417 units by reason of the plummet in the sales of A- and B-segment (mid-sized) vehicles.

As for the well-received NEPVs in November, the top four models remained unchanged over the previous month. Apart from the Aion S, the BAIC EU series, the Baojun NEV and BMW 5 Series PHEV all achieved remarkable year-over-year sales increase.

Retailing 2,456 units in total, Geely's Geometry moved up to the fifth last month, outselling the BYD Yuan which was hit with a sales plunge of 59.2%.

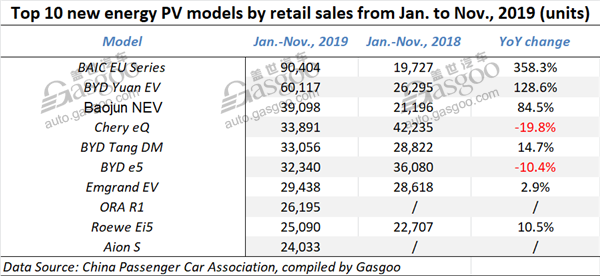

In terms of year-to-date retail sales, the BAIC EU series further consolidated its championship with an advantage of 30,287 units over the runner-up BYD Yuan EV.