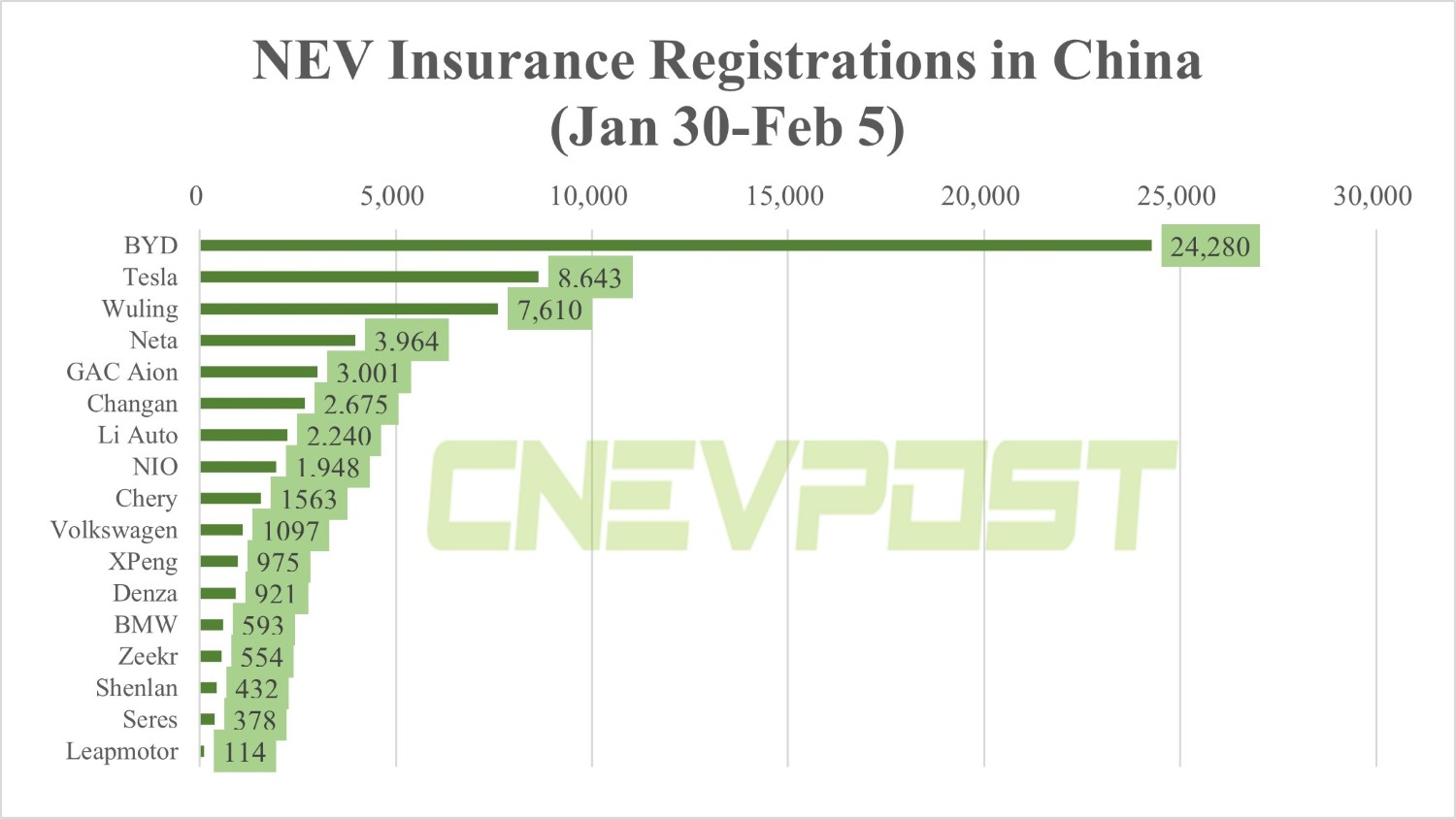

China NEV insurance registrations for week ending Feb 5: BYD 24,280, Tesla 8,643, Nio 1,948

Insurance registrations for NEVs in China by major EV makers rebounded last week, although they have not yet reached the levels seen before the Chinese New Year holiday.

New energy vehicle (NEV) insurance registrations for major electric vehicle (EV) makers in China rebounded last week, with the Chinese New Year holiday coming to an end.

BYD NEVs saw 24,280 insurance registrations for the week ending February 5, the highest among all automakers, according to figures shared by several auto bloggers on Weibo today.

Tesla vehicles saw 8,643 insurance registrations for the week, Li Auto 2,240, Nio 1,948, Xpeng 975 and Zeekr 554.

Neta vehicles had 3,964 insurance registrations last week, and Leapmotor had 114.

Nio delivered 8,506 vehicles in January, bringing the cumulative deliveries since inception to 298,062.

The latest insurance registration figures mean that Nio is likely to see its 300,000th vehicle delivered in the next few days.

Nio's management had expected the company's 300,000th vehicle delivery to be around January 1.

Nio's historical deliveries to the end of January plus last week's insurance registrations totaled 300,010, but last Monday and Tuesday were the last two days of January, January 30 and 31, respectively.

The Chinese New Year holiday fell from January 21 to 27, and the seasonal factor led to a general decline in deliveries by NEV makers in January.

In the week prior to last week, BYD vehicles had 5,280 insurance registrations, Tesla had 3,356 and Nio had 427.

Last week was the first work week after the Chinese New Year holiday, but many Chinese people's holiday will extend to the 15th day of the first month of the lunar calendar, February 5 this year, especially for migrant workers.

January was a recent low point for sales as China's purchase subsidies for NEVs were withdrawn at the end of last year, allowing some consumers to bring forward demand and car companies to decelerate production and sales during the Chinese New Year holiday, CICC analyst Qiu Xiaofeng's team said in a research note earlier today.

With only 20 days of sales before the Chinese New Year holiday, and with the recent trend of declining lithium carbonate prices evident, some manufacturers actively let production and sales slow down in January, CICC said.

Several local governments released subsidy policies for NEV purchases, and the intensive launch of new models starting in February is expected to drive demand to recover beyond expectations, the team said.

Retail sales of new energy passenger vehicles in China are expected to be 360,000 units in January, up 1.8 percent from a year earlier but down 43.8 percent from December, the China Passenger Car Association (CPCA) said on January 28.

The country's retail sales of all passenger vehicles in January are expected to be 1.36 million units, down 34.6 percent from a year earlier and down 37.3 percent from December, according to the CPCA.

Auto dealers saw a weaker-than-normal seasonal performance in January due to the impact of the wave of Covid infection and the early timing of Chinese New Year, which disrupted the sales pace, the CPCA said previously.