China issues new NEV subsidy policy with higher tech thresholds, reduced subsidy amounts

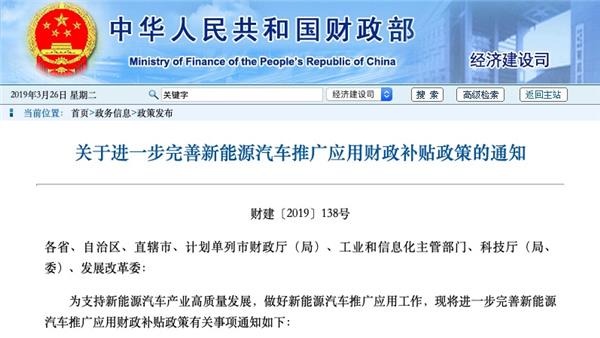

Shanghai (ZXZC)- Chinese authorities on March 26 unveiled a tougher new energy vehicle (NEV) subsidy policy to boost a high-quality development of NEV industry.

The newest policy will steadily lift the energy density threshold for the NEV power battery system, moderately raise the energy consumption threshold for new energy complete vehicles and enhance the driving range threshold of all-electric passenger vehicles (PVs), China's Ministry of Finance said in a joint statement.

The statement showed that the subsidy for all-electric PVs will be given in accordance with only two mileage sections, compared with 5 sections for 2018 policy. The vehicles with NEDC-rated range between 250km and 400km will be offered RMB18,000 of subsidy. As for vehicles with range over 400km, subsidy will be halved to RMB25,000 compared to the 2018 policy.

Apart from the largely contracted subsidy amount, the latest policy also sets stricter requirements on NEV's top speed, energy density and energy consumption. For instance, new energy PVs qualified with subsidy must get a 30-minute top speed of at least 100km/h and an energy density of power system of no less than 125Wh/g.

Affected by such factors as NEV economies of scale, cost reduction and subsidy phase-out policies, China lowers the subsidy standard for new energy PVs, buses and trucks to ensure that the fittest NEV makers will survive and prevent drastic market fluctuation.

From 2019, the country will prepay part of subsidies to those vehicles with driving range requirements after they are licensed. Car owners can apply for liquidation legally after vehicles meet range requirements. However, those vehicles that fail to cumulate 20,000-km range within two years after they were registered will not be subsidized and the government will deduct the prepayment in the process of liquidation.

The statement said that after a three-month transition period starting March 26, 2019, local governments should stop subsidizing the purchase of new energy vehicles (excluding new energy buses and fuel cell vehicles). The funds will be used to construct infrastructures, such as charging and hydrogen refueling facilities, and operate supporting services. If local governments maintain subsidies after June 25, the central government will reduce the funds accordingly.

Partly thanks to substantial subsidies provided during the past several years, China has become one of fastest-growing NEV market in the world. In 2018, the country's NEV sales surged 61.74% to around 1.256 million units, according to the China Association of Automobile Manufacturers (CAAM).

The newest policy suggested that NEV makers in China will be confronted with heavier cost pressure brought by the greatly reduced state subsidy and removal of local government's subsidies. If automakers try to transfer the increased cost by raising prices of terminal delivery, the sales volume will be decreased, thus negatively influencing final profits.

Before the new policy came out, many Chinese NEV makers had conveyed the intent to lift prices to ensure that profit on each vehicle won't be harmed severely. Due to the limited driving range and charging facilities, NEV is still not competent enough to threaten fuel-burning vehicle's market position. The price increase may make consumers who intended to buy NEVs change their minds now.

From the time being, Chinese NEV makers present different attitudes about this issue, according to insiders from automakers and the response ZXZC received from companies. Some NEV producers, like XPENG Motors, are reportedly ready to raise prices, while some will maintain the current prices, such as GAC New Energy and BYD. More carmakers hold a wait-and-see attitude for now and will take further measures based on future market situation.