Lithium carbonate prices keep falling as supply-demand imbalance fears persist

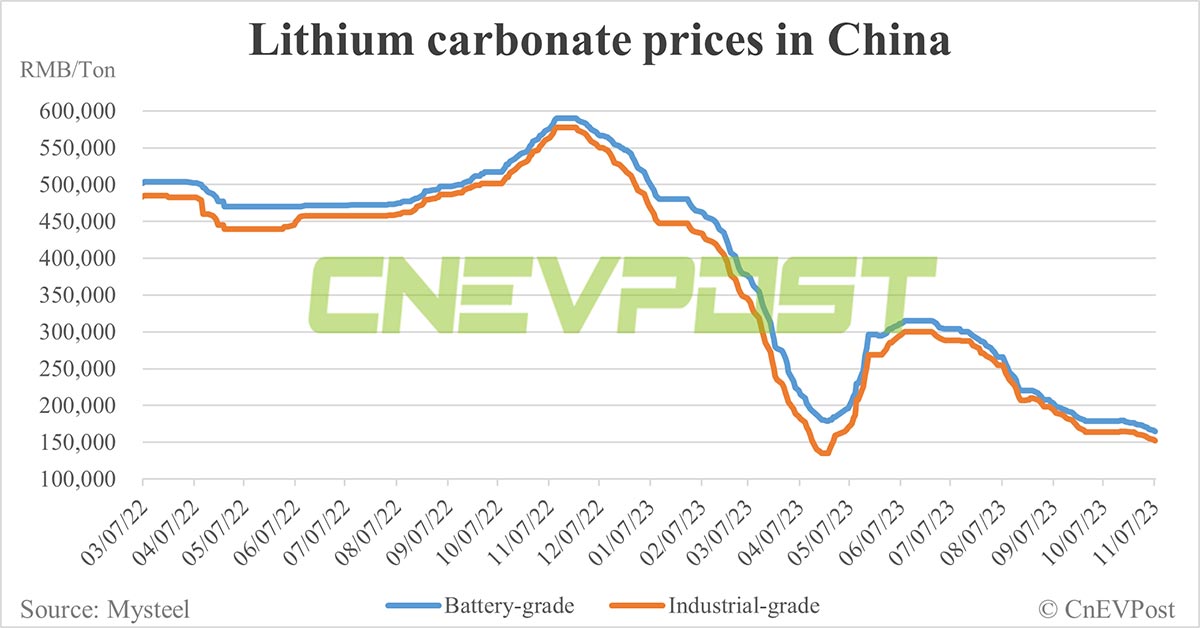

The average price of battery-grade lithium carbonate in China is falling close to RMB 150,000 per ton, about half of what it was at the end of June, as supply-demand imbalances continue.

A new round of lithium carbonate price declines since the end of June continues unabated, as oversupply concerns persist.

On November 7, the average price of battery-grade lithium carbonate fell to RMB 158,500 per ton, a two-year low, after falling for 13 consecutive days, Securities Daily said in a report today, citing data from Shanghai Metals Market.

Separately, daily quotes from Mysteel monitored by CnEVPost showed that battery-grade lithium carbonate was quoted at RMB 165,000 per ton on November 7, down RMB 1,000 per ton from the previous day, the ninth consecutive day of decline.

Industrial-grade lithium carbonate also fell RMB 1,000 to RMB 152,500 per ton yesterday, the ninth consecutive day of decline.

Since June 25, the average price of battery-grade lithium carbonate has fallen 48 percent from RMB 315,000 per ton, according to Mysteel.

The imbalance between supply and demand is the main reason for this round of sustained decline in lithium carbonate, and many industry watchers believe that the current price has not bottomed out, according to the report in Securities Daily.

During last year's lithium carbonate price surge, a large number of players in the industry flocked to the upstream, leading to a rapid expansion of production capacity, the report said, citing Tao Wenmei, an analyst at Wanchuang Investment Bank.

However, downstream demand was unable to absorb this increased capacity in a short period of time, so prices plummeted, Tao said.

The price of lithium carbonate in China rose to about RMB 600,000 per ton at one point in November 2022, about 14 times the June 2020 price that averaged RMB 41,000 per ton.

After that, however, lithium carbonate prices began to decline. After a small rebound in May-June, the price decline resumed.

New energy vehicle (NEV) makers' preparations for China's Lunar New Year holiday three months from now are the main source of demand for lithium carbonate at the moment, said Mo Ke, founder of RealLi Research, as cited by Securities Daily.

However, the Lunar New Year holiday is usually the lowest production time of the year for NEV makers, so demand in the lithium carbonate market is weak, Mo said.

China's 2024 Lunar New Year holiday will start on February 10 and last until February 17.

Mo believes lithium carbonate prices could fall below RMB 80,000 per ton next year, and potentially to RMB 50,000 to RMB 60,000 per ton in 2025.

After that, lithium carbonate could begin a new upward cycle as the market self-regulates its capacity, Mo said.

Lithium carbonate supply in China is still rising despite the continued price decline.

Some lithium producers that had previously shut down production for maintenance are starting to resume production, while at the same time, China's lithium carbonate imports are increasing, according to Securities Daily.

China's lithium carbonate imports were 13,700 tons in September, up 26 percent from August and up 9 percent year-on-year, the report said, citing customs data.

In January-September, China's cumulative lithium carbonate imports were 110,000 tons, up 5.6 percent year-on-year.

Falling lithium carbonate prices are good news for NEV makers, as it means lower battery costs.

Chinese battery giant CATL asked cathode material suppliers in early July to offer a 5 percent to 10 percent discount in settling lithium carbonate prices, local media Cailian said in a July 20 report, citing three industry chain sources.

In early October, a research note by local brokerage Tianfeng Securities, which lowered their forecast for CATL's earnings in the third quarter, circulated in Chinese media as well as on social media.

Subsequently, several auto bloggers on Weibo said this could be due to CATL's concessions to two key customers, Nio (NYSE: NIO) and Zeekr.

William Li, Nio's founder, chairman, and CEO, said in an analyst call on November 10, 2022, after the announcement of its earnings report, that every RMB 100,000 increase in the price of lithium carbonate would negatively impact Nio's gross margins by 2 percentage points.

On September 21, CnEVPost asked Li the following questions in an interview following Nio's Nio In 2023 Innovation Day event:

The price of lithium carbonate has been falling for three months now, to less than RMB 200,000 per ton, how does this affect Nio's gross margin?

Li said at the time that every RMB 50,000 drop in the price of lithium carbonate would result in roughly a 1.5 percent improvement in Nio's gross margin.

Nio is pleased to see lithium carbonate prices returning to rationality and sees further room for them to fall, Li told CnEVPost at the time.

In addition, the plunge in lithium carbonate prices over the past year could be potentially holding back the development of sodium-ion batteries.

With the prolonged decline in the price of lithium carbonate, a key raw material for lithium-ion batteries, the cost advantage of sodium-ion batteries is seen to have diminished significantly.

Few models have been confirmed to carry sodium-ion batteries this year, with only Chery's iCar, Sehol E10X, and Jiangling EV3 having been confirmed to use the batteries, Shanghai Securities News said in a May 31 report.

The cost advantage of sodium batteries was no longer prominent when the price of battery-grade lithium carbonate fell back to around RMB 300,000 per ton, the report said.

($1 = RMB 7.2799)

Lithium carbonate prices to fall sharply as demand far below expectations, Li Auto CEO says