Nio mulling raising $3 billion from investors, report says

Update: Nio says the report of its $3 billion funding plan is false. Check here.

Nio is considering raising about $3 billion and has approached investors from the Middle East, according to Bloomberg.

(Image credit: CnEVPost)

Just as Nio (NYSE: NIO) has completed the issuance of $1 billion in convertible senior notes, a report about its new funding plan has reignited investor concerns about its financial situation.

Nio is considering raising about $3 billion and has approached investors from the Middle East, a Bloomberg report said today, citing people familiar with the matter.

The fundraising could take place as early as next year, a person familiar with the matter said, according to the report.

Negotiations are currently underway and details are subject to change, the people said, adding that there's no certainty Nio will proceed with the fundraising.

Nio declined to comment, Bloomberg noted.

Earlier today, Nio announced the completion of a $1 billion offering of convertible senior notes.

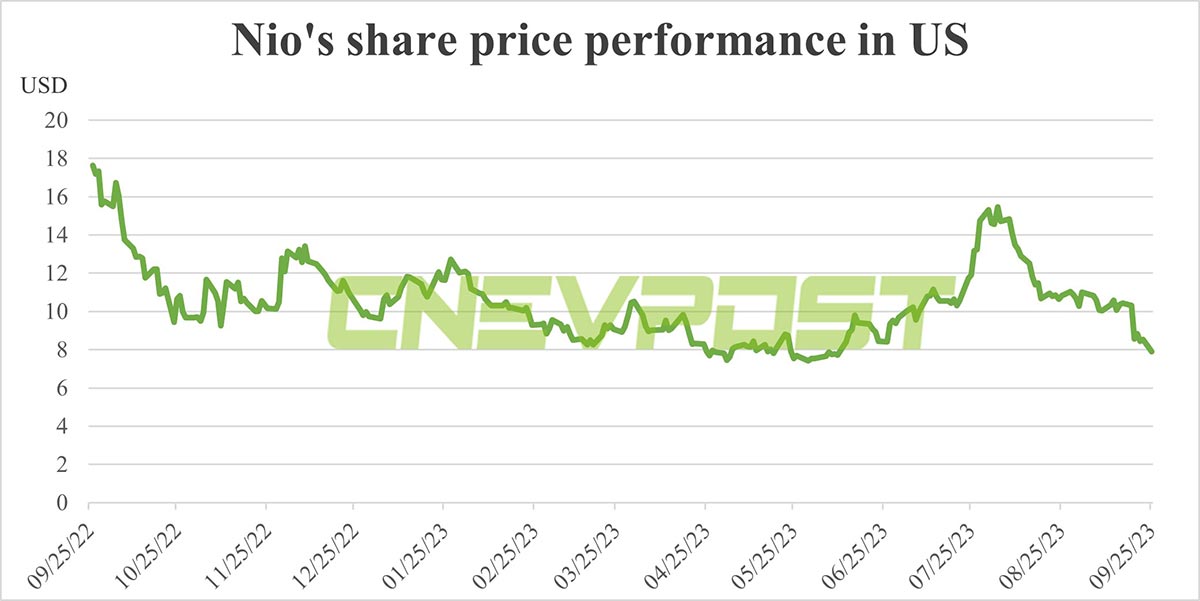

After the company announced the note-offering plan on September 19, its US-traded stock closed the day down 17.07 percent, its biggest one-day drop in four years.

The convertible senior notes offering is Nio's second financing in the past three months.

On June 20, Nio signed a share subscription agreement with CYVN Holdings, an investment vehicle majority-owned by the Abu Dhabi government, which planned to invest a total of about $1.1 billion in it through the issuance of additional new shares and the transfer of existing shares.

On July 12, Nio announced that it closed a $738.5 million strategic equity investment provided by CYVN Investments RSC Ltd, an affiliate of CYVN Holdings.

The CYVN entities also acquired certain class A ordinary shares of Nio from an affiliate of Tencent for total consideration of $350 million, according to its July statement.

Following the completion of the investment transaction and the secondary share transfer, CYVN Investments owns a total of about 7.0 percent of Nio's total outstanding shares.

Bloomberg's report today has fueled investor concerns about Nio's finances, leading to a fresh sell-off in its stock.

At press time, Nio was down 7.39 percent to $7.90 in pre-market trading on the US stock market.

Nio's deliveries have been weak in several months of this year due to the switch of models from the older NT 1.0 platform to the latest NT 2.0 platform and the release of several new models.

Nio delivered 23,520 vehicles in the second quarter, down 24.23 percent from the first quarter and down 6.14 percent year-on-year.

Its gross margin fell to 1.0 percent in the second quarter, down from 13.0 percent in the same period last year and from 1.5 percent in the first quarter.

Nio hopes to achieve double-digit gross margins in the third quarter and 15 percent in the fourth quarter, the company's management said in an analyst call after it announced its second-quarter earnings on August 29.

Nio's cash and cash equivalents, restricted cash, short-term investments and long-term time deposits balances stood at Chinese yuan 31.5 billion as of June 30, down 6.3 billion Chinese yuan from 37.8 billion Chinese yuan at the end of the first quarter.

Nio's deliveries have rebounded significantly over the past two months, delivering a record 20,462 vehicles in July and 19,329 in August.

It had previously guided for third-quarter deliveries of 55,000 to 57,000 vehicles, implying year-on-year growth of about 74.0 percent to 80.3 percent.

Nio announces closing of investment from Abu Dhabi fund