Nio Q2 earnings preview: Gross margin to remain under pressure, but stronger execution starts to show

Nio's gross margin will be under pressure due to lower deliveries, but stronger execution is starting to show up, which could help vehicle margins recover in the second half, according to Deutsche Bank.

ET5 Touring and ES8 are also growing rapidly, the team said, adding that they expect Nio's deliveries to grow sequentially in the fourth quarter with the help of the new EC6.

Nio management had previously mentioned that they expect vehicle margins to return to double digits in the third quarter and over 15 percent in the fourth quarter. The company had a vehicle margin of 5.1 percent in the first quarter.

Based on the factors outlined by Nio management, this appears to be achievable, although the full impact of the benefits may not be seen until next year, Yu's team said.

SG&A will rise sequentially in the second quarter due to higher marketing expenses, but as a percentage of sales in the second half of the year it should fall sharply, according to the team.

In addition, cash burn will naturally improve in the second half due to good working capital and capex will be close to flat year-on-year or about $7 billion, the team said.

Nio saw record deliveries in July, and order intake should remain healthy in the coming quarters, driven largely by ES6, the team noted.

At the same time, opex and capex will be more controlled as Nio cuts spending on non-core initiatives.

Taking all these factors into account, the team raised their forecast for Nio's deliveries in 2023 by 10,000 units to 180,000 units and raised gross margins by 40 basis points to 7.4 percent.

For 2024, the team raised their delivery forecast for Nio from 270,000 units to 285,000 units and raised their forecast for gross margin from 13.7 percent to 13.9 percent.

The adjustments to these parameters resulted in the team raising their price target on Nio to $17 from the original $13. The team maintained its Buy rating on Nio.

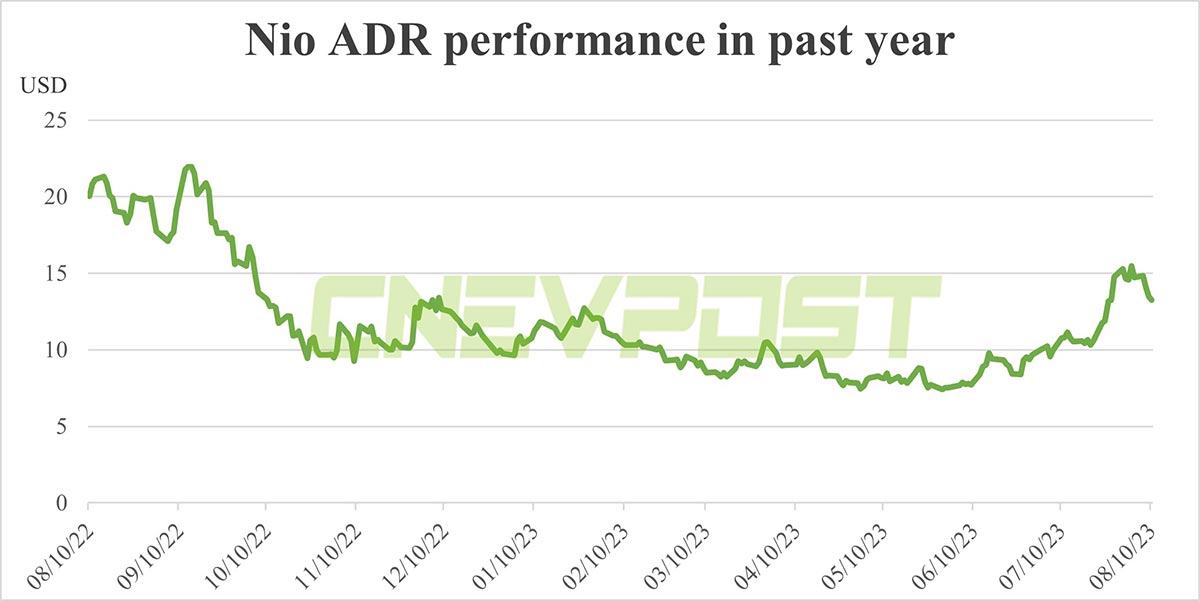

Nio closed down 1.56 percent to $13.25 in the US stock market yesterday, and the price target implies a 28 percent upside.

"Positioning-wise, we think the stock can finally recapture momentum after being a relative laggard all year and also see some small potential for strategic optionality," the team wrote.

CnEVPost wishes to re-emphasize that the adjustments Wall Street analysts make to the price target are the result of their tweaking of a handful of parameters in complex valuation models.

Therefore, it is more important to pay attention to why these top minds in the world are adjusting the parameters in their models than to the changes in the price target.