Nio reportedly delays mass production plans for in-house developed batteries

Based on its latest plans, Nio has slowed down some of the equipment purchases for its battery factory, according to local media.

Nio will manage its cash flow carefully, with some fixed-asset investments postponed, Li said on a June 9 analyst call after the company reported first-quarter results.

Li didn't explicitly mention which investments would be delayed at the time, but the low-priority but expensive battery project could be one of them.

Battery production lines need extremely high investment, requiring the introduction of high-volume, fully automated production lines, with investment budgets that can reach billions or even tens of billions of RMB, 36kr's report noted.

For a battery production line, typically around RMB 200 million ($27.8 million) is needed to produce 1 GWh of battery cells, while the large cylindrical production line Nio is seeking could cost even more, the report said, citing an industry source.

Nio started to set up its battery R&D team in 2021, with related planning taking place in early 2022. With battery prices skyrocketing, its battery development team has even vowed to ensure that in-house developed batteries will be used in production cars starting in 2024, according to the report.

Nio's production lines for the battery aren't moving full speed ahead, and it's focusing on 150-kWh semi-solid-state battery pack this year, the report said.

A large number of Nio's R&D and industrialization staff are put on the semi-solid-state battery pack project, and other cell and battery pack projects have been delayed to varying degrees, and the in-house battery production lines are apparently no longer urgent, the report said.

Nio recently updated the owner's manuals for its vehicles to begin to include the 150-kWh battery pack, which Li said at the launch of the new ES6 in May that the new pack would be in service in July.

On June 30, Beijing WeLion New Energy Technology, the supplier of the batteries, began delivering 360 Wh/kg lithium cells to Nio and held a delivery ceremony in Huzhou, Zhejiang province, where its production base is located.

In addition, lithium prices have plummeted and battery supply is no longer an issue threatening the company, 36kr said, citing a person familiar with the matter.

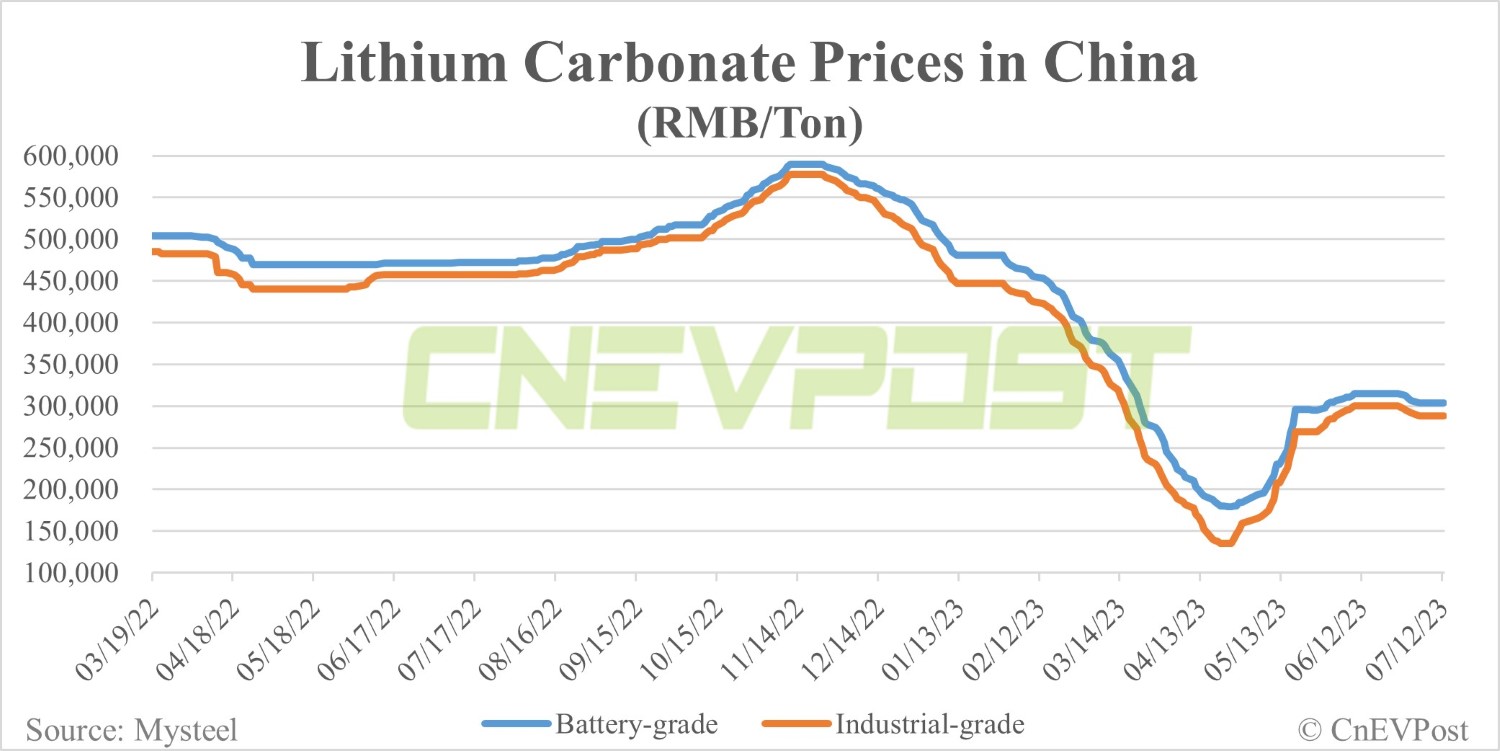

The price of lithium carbonate, a key raw material for power batteries, rose to about RMB 600,000 per ton in China at one point in November 2022, about 14 times the June 2020 average price of RMB 41,000 per ton.

After that, however, lithium carbonate prices began to slide and only stopped falling by April.

Until April 21, lithium carbonate prices hadn't seen a single one-day increase in China this year, down about 65 percent since the beginning of the year.

Prices for lithium carbonate have remained largely stable over the past month, with battery-grade lithium carbonate currently priced at around RMB 300,000 and industrial-grade at about RMB 290,000, according to data from Mysteel.

($1 = RMB 7.1903)

NIO plans new 40 GWh battery plant in Hefei, report says