Deutsche Bank on China EV sales: Sept marks a transitional month

"Fab 5 China EV sales came in mixed during September as product transitions and the supply chain hurt delivery volume," Edison Yu's team said.

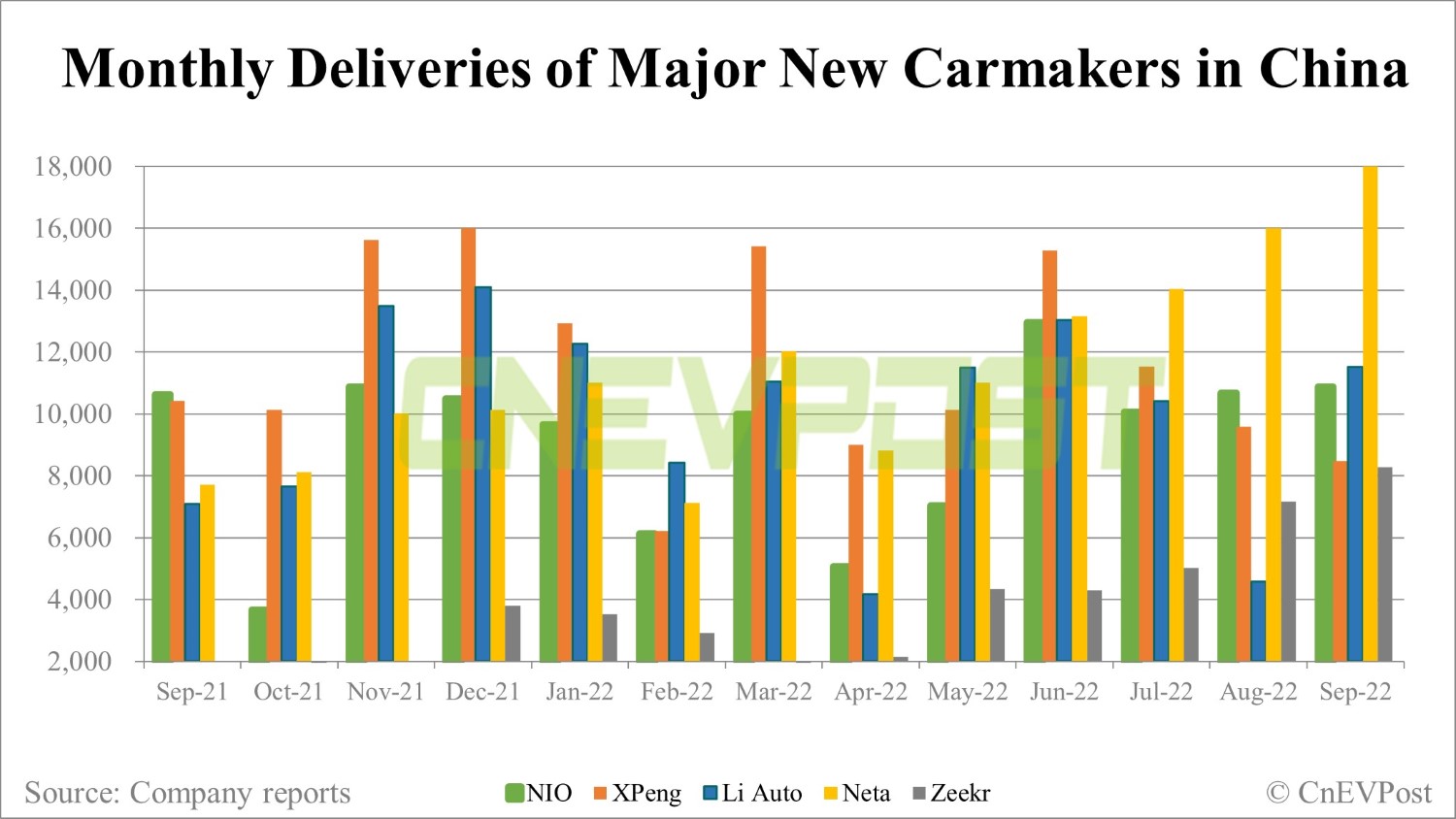

China's major electric vehicle (EV) makers have announced September deliveries in the past few days, and as usual, Deutsche Bank analyst Edison Yu's team offers their take.

As background, Yu's team is currently focused on the Chinese EV companies they call the Fab 5 -- Nio, Xpeng Motors, Li Auto, Zeekr, and Hozon Auto.

"Fab 5 China EV sales came in mixed during September as product transitions and the supply chain hurt delivery volume," Yu's team said in a research note sent to investors on Sunday.

Li Auto reported mostly in-line sales, with Nio continuing to be held back by casting parts supply for its flagship ET7 sedan, while Xpeng's struggles appear to be getting worse, the team said.

Zeekr again saw strong demand, with deliveries nearly outpacing the Xpeng, and Hozon's Neta brand set another monthly sales record of 18,000 units, the team noted.

Yu's team expects a number of new product launches to drive sales, particularly at Nio, where the ET5 is expected to become at least a 10,000 unit per month performer.

The team also expects stiff competition in the premium segment, with Li Auto's Li L8, as well as the Li L7, which will be released in the first quarter of next year, and Xpeng's G9 kicking off the SUV wars.

Here's the team's take on the five companies' September deliveries.

September EV sales

Li Auto delivered 11,531 units (+152% MoM, +63% YoY), in-line with our forecast. The new L9 full-size SUV delivered 10,123 units in the first full month, contributing nearly 90% of the sales. We expect L9 volume to be robust for the rest for the year as LI works through backlog.

We note management did lower 3Q guidance last week from 27,000-29,000 to 25,500 due to supply chain constraints.

Nio delivered 10,878 units (+2% MoM and YoY), below our forecast. Flagship ET7 sedan deliveries were lower than expected at 2,928 units, still dragged down by casting supply issues; we expect this to improve MoM and get fully resolved in Nov as Nio qualifies new suppliers.

ES7 ramped up nicely to nearly 2,000 units, in-line with our expectations (vs. 398 last month). ET5 saw 221 deliveries in just 1 day.

Xpeng delivered 8,468 units (-12% MoM; -19% YoY), meaningfully below our forecast. Sales continue to struggle (both P5 and P7) ahead of the G9 ramp which saw <200 units in the month; this should increase meaningfully going forward as production ramps up (expect at least 10,000 units in 4Q).

Zeekr delivered record monthly sales at 8,276, up from August's 7,166 as demand for the uniquely styled 001 remains robust. ASP is trending +336,000 RMB.

Hozon sold 18,005 units of its Neta-branded BEVs (+12% MoM; +134% YoY), setting a record for a third consecutive month.