CICC sees 30% upside for Nio, bullish on growth momentum for NT 2.0 platform models

CICC says Nio is a leader in the premium smart electric vehicle segment, and that its NT 2.0 platform models will bring new growth momentum.

CICC covered Nio (NYSE: NIO, HKG: 9866, SGX: Nio) early on in its US-listed shares and at one point had a price target as high as $85, although that has been revised downward over the past year.

Fast forward to today, Nio has been listed in Hong Kong for more than 3 months, and the top Chinese investment bank has initiated their coverage of the electric vehicle (EV) maker's H-shares, saying the company is a leader in the premium smart EV space with new growth momentum from its NT 2.0 platform models.

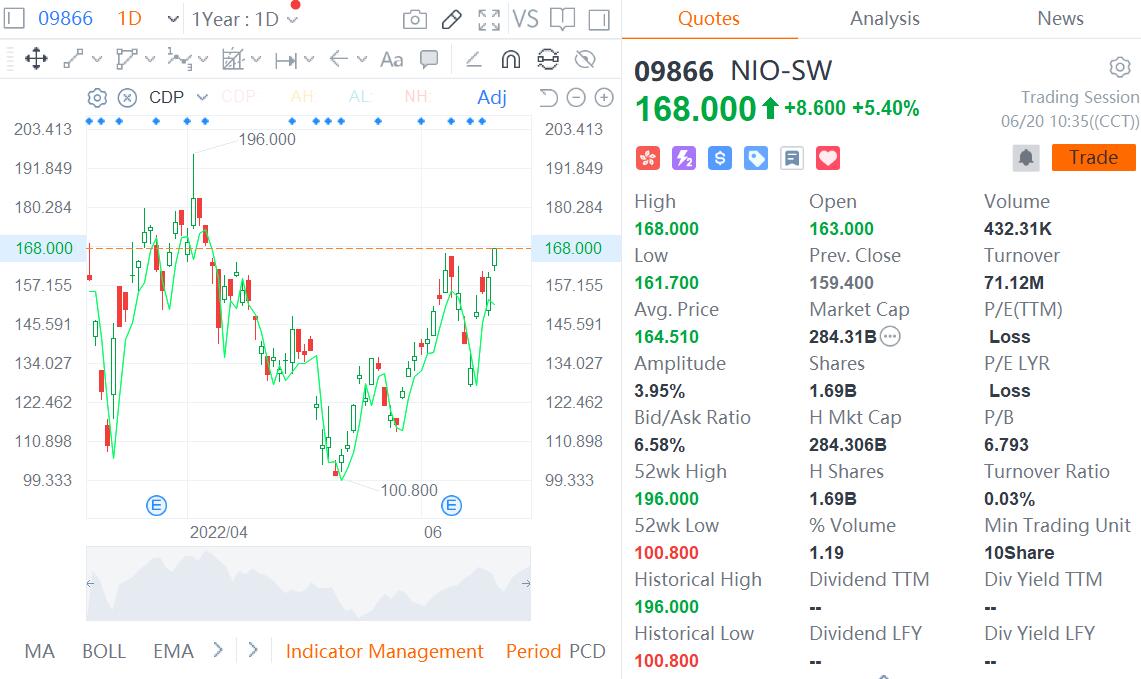

CICC gave Nio shares traded in Hong Kong a target price of HK$196 in a research note on Friday, implying a 26.2 upside from the company's closing price of HK$155.3 on Thursday. The price target corresponds to an EV/Revenue multiple of 4.0 times in 2022.

The investment bank also raised its price target on Nio's US-traded shares by 8.7 percent to $25, implying an upside of 30.3 percent, according to their research note.

CICC maintained their Outperform rating on Nio's US-traded shares and gave their initial Outperform rating on Nio's H-shares, saying that Nio's recent ES7 launch and the 2022 model year for its existing SUVs are expected to drive improved fundamentals.

(Image credit: Nio)

The team sees Nio as a leader in the premium smart EV segment, having a business model with premium services, which include its battery swap service, user community, and Nio Life, which all help reinforce its premium image.

"We believe the company's business model is scarce, with front-loaded service system investments and charging and battery swap networks acting as a moat," CICC said.

Nio's product matrix continues to broaden, with four SUVs -- the ES8, ES6, EC6, and ES7 -- and two sedans - the ET7 and ET5, the team noted.

The EV maker is competitive in the high-end pure EV market and plans to enter the mass market in 2024 with a new sub-brand, the team said.

In the short term, CICC believes Nio's NT 2.0 platform-based models are expected to drive a gradual climb in sales in 2022.

In the medium to long term, its mass production of models for the mass market is expected to allow Nio to achieve scale effects in the underlying technology development and service systems including charging and battery swap, according to CICC.

Nio's ES8, ES6, and EC6 SUVs are based on the NT 1.0 platform, while Nio's ET7, which began delivery at the end of March, ET5, which will begin delivery in September, and ES7, which was launched last week and is expected to begin delivery at the end of August, are all based on the NT 2.0 platform.

In addition to the model matrix, CICC is bullish on Nio's breakthroughs in core smart EV technologies:

In terms of electrification, the company's XPT has electric drive full-stack in-house development and manufacturing capabilities, with cumulative shipments at the forefront of the industry.

In battery, it has acquired abundant technology reserves such as ternary and lithium iron phosphate hybrid batteries and semi-solid-state batteries through deep in-house research and open cooperation, strategic investment, etc.

In smart driving, the company focuses on full-stack in-house research and plans to launch NAD by the end of the year.

CICC believes that the service experience and in-house developed smart electrification technologies are expected to be a moat for Nio, while the model for the mass market, along with the delivery of the ET5, is expected to start seeing scale effects.

Nio's shares traded in Hong Kong rose today, up 5.4 percent to HK$168 at press time.