Li Auto to report Q4 earnings on Feb 25, what to watch?

Deutsche Bank maintains a Hold rating on Li Auto and a $34 price target, implying 14.8 percent upside.

Li Auto will report unaudited financial results for last year's fourth quarter and for the full year on Friday, February 25, before the US stock market opens, so what do investors need to watch for? Deutsche Bank analyst Edison Yu's team offers their take.

In a research note sent to investors Thursday, Yu's team said they expect Li Auto to have a mostly solid quarter, supported by upside vehicle deliveries.

The team expects the company to report revenue of RMB 10.58 billion, a gross margin of 20.7 percent, and adjusted EPS of RMB 0.11 in the fourth quarter.

For comparison, the consensus analyst estimate for revenue in the Bloomberg survey was RMB 10.05 billion, with a gross margin of 21.1 percent and adjusted EPS of RMB -0.04.

Li Auto has previously released data showing that it delivered 35,221 units of the Li ONE, the company's only model, in the fourth quarter of last year, up 143.5 percent year-on-year and up 40 percent from the third quarter.

When it announced its third-quarter earnings at the end of November last year, Li Auto guided for 30,000-32,000 vehicles delivered in the fourth quarter. It exceeded the upper end of its guidance range for deliveries in the fourth quarter.

The company's guidance for fourth-quarter revenue at that time was RMB 8.82 billion to RMB 9.41 billion, implying year-on-year growth of 112.7 percent to 126.9 percent.

For the first quarter of 2022, Yu's team expects Li Auto management to likely give delivery guidance of at least 31,000 units.

The team believes that Li Auto's plant in Changzhou, which already has a capacity of 15,000 units per month, will be able to come close to producing that many vehicles in the second quarter, although that will depend on supply chain conditions.

In addition to the Li ONE, Li Auto is expected to announce a full-size SUV X01 with extended-range technology (EREV) in the second quarter, with deliveries likely to begin in the third quarter, the team noted.

Overall, Yu's team's expectations for Li Auto's full-year 2022 deliveries have been revised upward to 165,000 units from the previous 135,000 units.

While Li Auto's management believes the refreshed Li ONE is capable of reaching a 25 percent gross margin, inflationary pressures could depress that number to 22-23 percent even with an overall increase in production, Yu's team said, adding that they are lowering their gross margin estimate for Li Auto in 2022 by 40 basis points to 21.3 percent.

As for Li Auto's share price performance, the team believes the stock is likely to trade strongly into its inclusion in the Mainland-Hong Kong stock connect in mid-March.

However, the team does not see a compelling reason to own the stock for the rest of the year, as it does not have new products available until the third quarter and the new EREV X01 is targeting a relatively small segment.

In addition, earlier this week tech media outlet 36kr reported that Li Auto CTO Kai Wang will be leaving the company in the near future, less than two years after he joined.

Wang will be the highest-ranking executive to leave Li Auto since its inception, and the business he managed, including autonomous driving, computing platform, and operating system LiOS, has been handed over to Li Auto co-founder and chief engineer Ma Donghui, according to the report.

Yu's team believes this reinforces their view that the company has much room for improvement in the technology front (ADAS/AD).

The team maintains a Hold rating on Li Auto and a $34 price target.

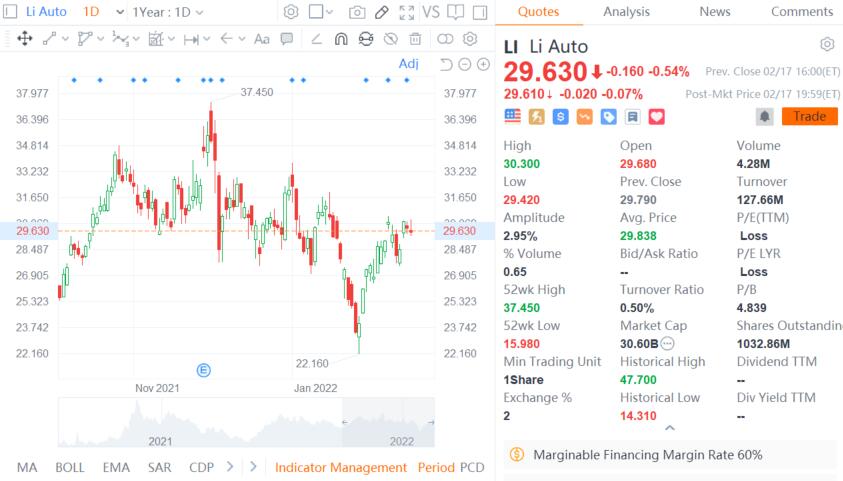

Li Auto closed down 0.54 percent to $29.63 on Thursday on the US stock market, and the price target implies a 14.8 percent upside.

Li Auto aims to double production this year, says vice president Li Bin