CATL contributes 50.24% of China's Jan power battery installations

CATL's share of the ternary battery market was 57.17 percent in January, and 44.6 percent in the LFP battery market.

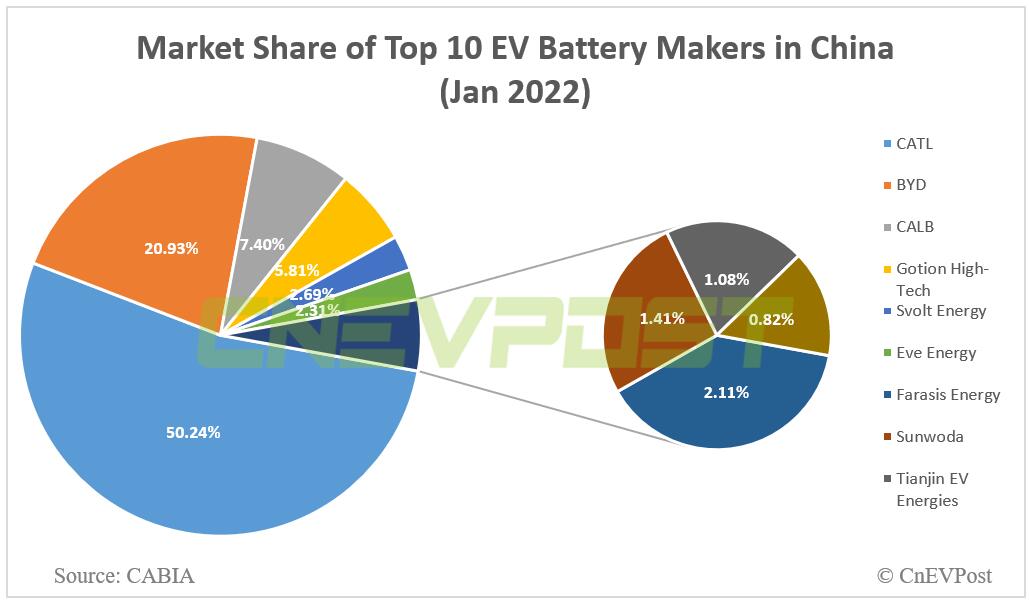

Contemporary Amperex Technology Co Ltd (CATL), the battery supplier to Tesla and Nio, had 8.13 GWh of installed capacity in China in January, accounting for a 50.24 percent market share, according to data released today by the China Automotive Battery Innovation Alliance (CABIA).

China's power battery installed base was 16.2 GWh in January, up 86.9 percent year-on-year but down 38.3 percent from December, the data showed.

In the ternary battery market, CATL's installed base in January was 4.17 GWh, with a market share of 57.17 percent.

In the lithium iron phosphate (LFP) battery market, CATL's installed base was 3.96 GWh, with a market share of 44.6 percent.

This is the first time the CABIA has published breakdown data for players in the ternary and LFP battery markets.

BYD's installed power battery volume in January was 3.39 GWh, with a market share of 20.93, the data show.

In the ternary battery market, BYD's installed volume in January was 0.15 GWh, with a market share of 2.03 percent. In the LFP market, it had an installed base of 3.24 GWh and a market share of 36.51 percent.

CALB's installed base in January was 1.2 GWh, ranking third with a 7.4 percent market share. Gotion High-Tech's installed base in January was 0.94 GWh, ranking fourth with a 5.81 percent market share.

CATL (SHE: 300750) recently responded to some investors' concerns about competitors grabbing market share.

While there are other players who will rely on price to compete for the market, CATL has the lowest cost and highest reliability of supply, local media Cailian said yesterday, citing the company's chairman Robin Zeng in a meeting summary.

Carmakers should not take the risk of supply chain volatility to get a small discount when developing strategies for the electrification transition, CATL said, according to the report.

"Bringing in multiple suppliers is the normal choice for car companies with more than 1 million units in sales," Zeng added.

Underlying CATL's innovation is the company's massive data collection and computing platform with high computing power, something second-tier players don't have, according to the minutes of the meeting.