CITIC Securities raises Nio price target from $45 to $51

The team expects Nio's revenue to reach RMB 66.7 billion in 2022, up from its previous forecast of RMB 59.8 billion.

(Image credit: CnEVPost)

China's top brokerage CITIC Securities raised its price target on Nio to $51 from $45, maintaining a Buy rating, in a research report released today, saying it is bullish on the company's investment value in the electric vehicle (EV) space.

"We are bullish on the company's competitive advantage and investment value in the electric smart vehicle space, with strong certainty of their long-term growth," said CITIC Securities' team of chief new energy vehicle analyst Yuan Jiancong.

The company will continue to benefit from its premium service, NAD smart driving solution, BaaS battery rental and fast battery swap business model as EV penetration rises and the market space for luxury models opens up further in the future, the team said.

Considering that the smart EV market industry has entered a high growth phase and China's leading local companies are entering an arms race in smart driving, it would be reasonable for the new carmakers to maintain a PS valuation range of 5-10x in the coming year, they said.

Nio has the highest win rate in building a premium brand and a solid position among local premium brands, the team said, adding that they expect Nio's revenue to reach RMB 66.7 billion in 2022.

The team gave Nio a valuation of 8x PS, corresponding to a target market cap of $83.5 billion and a corresponding price target of $51.

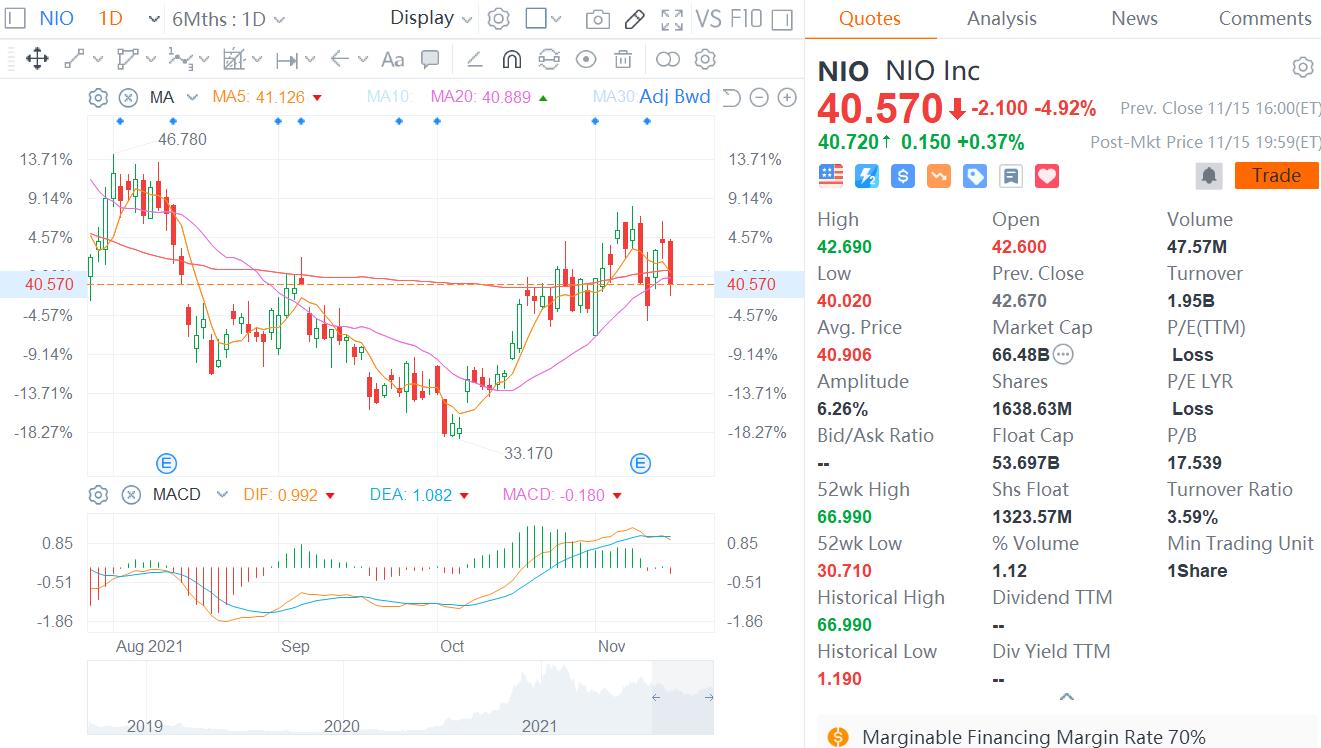

Nio closed down 4.92 percent to $40.57 on Monday, and the target price implies an upside of about 26 percent.

Previously CITIC Securities had a revenue forecast of RMB 59.8 billion for Nio in 2022, and based on a valuation of 8x PS, they had a price target of $45 for Nio.

The team said in today's report that Nio's overall gross margin in the third quarter was 20.3 percent, up 1.7 percentage points from the second quarter and 7.4 percentage points from the same quarter last year, indicating further improvement in the company's profitability.

The company is further investing in product development, capacity enhancement, charging, battery swap, and sales and service network building, with significant growth in R&D and sales expenses, helping to solidify its long-term competitiveness, the team said.

The team reiterated its previous view that Nio is expected to become a catch-up company to Tesla with its ability to sustain financing, strong R&D team, approach to building cars with Internet thinking, differentiated product competitiveness and continuous product iteration.