Analysts raise BYD price target after strong delivery data

Essence Securities raised its price target on BYD in a report on Aug. 6, following the new energy vehicle maker's strong July delivery figures.

The report said it raised its 6-month price target to RMB 360 ($55.7) from RMB 290 per share and maintained a "Buy-A" rating as the company's battery capacity and vehicle sales exceeded expectations.

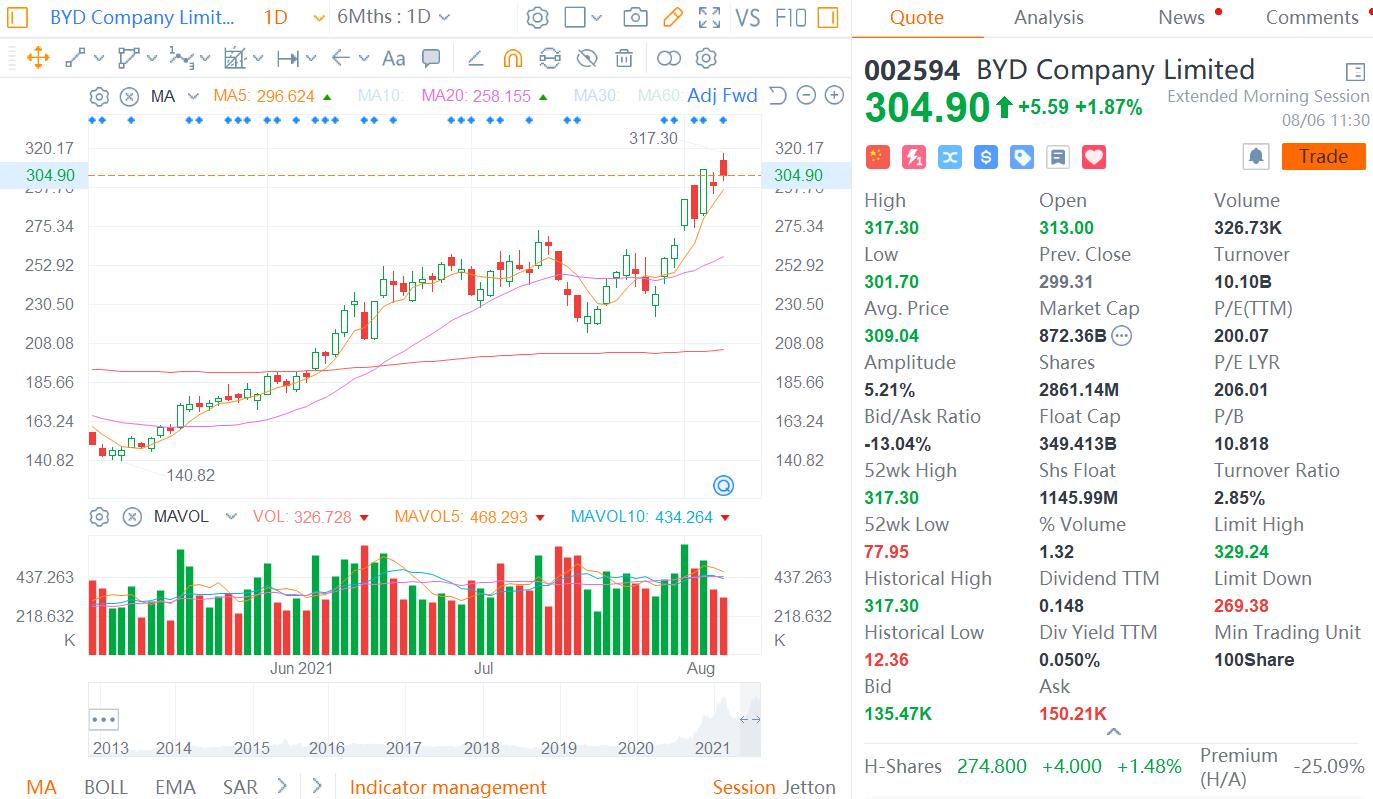

BYD's shares traded in Shenzhen closed down 2.8 percent to RMB 299.31 on Thursday, and the price target implying a 20 percent upside.

As of press time, BYD was up 1.87 percent to RMB 304.9, with a total market capitalization of about RMB 870 billion.

The report by Essence Securities said that as BYD's new energy vehicle sales expand, profit per vehicle is expected to continue upward, so it is optimistic about its full-year vehicle sales and performance.

BYD's battery base capacity has expanded significantly compared to the beginning of the year and signed an agreement with its partners to purchase 14,470 tons of lithium hexafluorophosphate from July 2021 to the end of 2022, corresponding to about 90 GWh or more of lithium iron phosphate capacity, so its future blade battery shipments are expected to exceed expectations, the report said.

The team expects BYD's 2021-2023 net profit to be RMB 6.25 billion, RMB 11.28 billion, and RMB 13.63 billion, corresponding to a PE of 137.2, 76, and 62.9 times of current market capitalization, respectively.

BYD sold 57,400 units of vehicles in July, up 82.94 percent year-over-year. New energy vehicles sold a record 50,492 units, up 234 percent year-over-year.

Han EV/DM sold 8,522 units in July, 136 units more than in June. The DM-i-based hybrid model increased by 4,961 units from June.

The new models with blade battery, Qin Plus EV, Song Plus EV, and Yuan pro, sold 4,255 units, an increase of 243.7 percent over June.

BYD sold 50,492 NEVs in July, up 234% from a year ago