Analysts say automaker valuations have broken through old framework and expected to keep going higher

With a large number of Chinese car companies' stock prices moving higher, the traditional valuation framework has become difficult to justify. In the analysts' view, the past framework may already need to be updated.

In the past, auto stocks had strong cyclical attributes. Looking forward, the sector faces a combination of landscape optimization and business model innovation, and valuations will continue to move upward, Cheng Siqi, chief analyst for the auto sector at CSC Financial, said in a research note released Wednesday.

Valuations of Chinese automakers including Great Wall Motor, Changan Automobile and BYD have already broken out of their original frameworks, and future marginal changes will affect valuations more, Cheng said.

In terms of marginal changes, whether the pattern is interpreted or the model is validated will be marginally better, and valuations will steadily rise at existing levels, the report said.

"The cyclical nature of the auto industry will gradually weaken, and research on it needs to focus more on the long-term dimension, and we will mainly discuss how to study the fundamentals of vehicle manufacturers from the medium- to long-term dimension," he said.

The report said that the core capabilities of car companies include: manufacturing end capabilities, supply system control capabilities, market demand control capabilities, electrification capabilities, intelligent construction capabilities and channel marketing capabilities.

Cars have certain sociable attributes, and brand influence is the most direct and subjective factor that car consumers care about, he mentioned.

According to the analyst, China's passenger car industry has strong demand and stable growth, and there is still room for growth in the long run, with annual passenger car sales expected to be 35.65 to 41.94 million units in 2037.

The market share of local brands increased from 27.4 percent in 2008 to 41.7 percent in 2021, with a clear trend of brand concentration, he said.

The report said there is still room to improve the market share of local brands compared to 70 percent in developed countries. Car companies' satisfaction with market demand and electrification are the main drivers now, and the competitiveness and intelligence of plug-in hybrid products will be the key in the future.

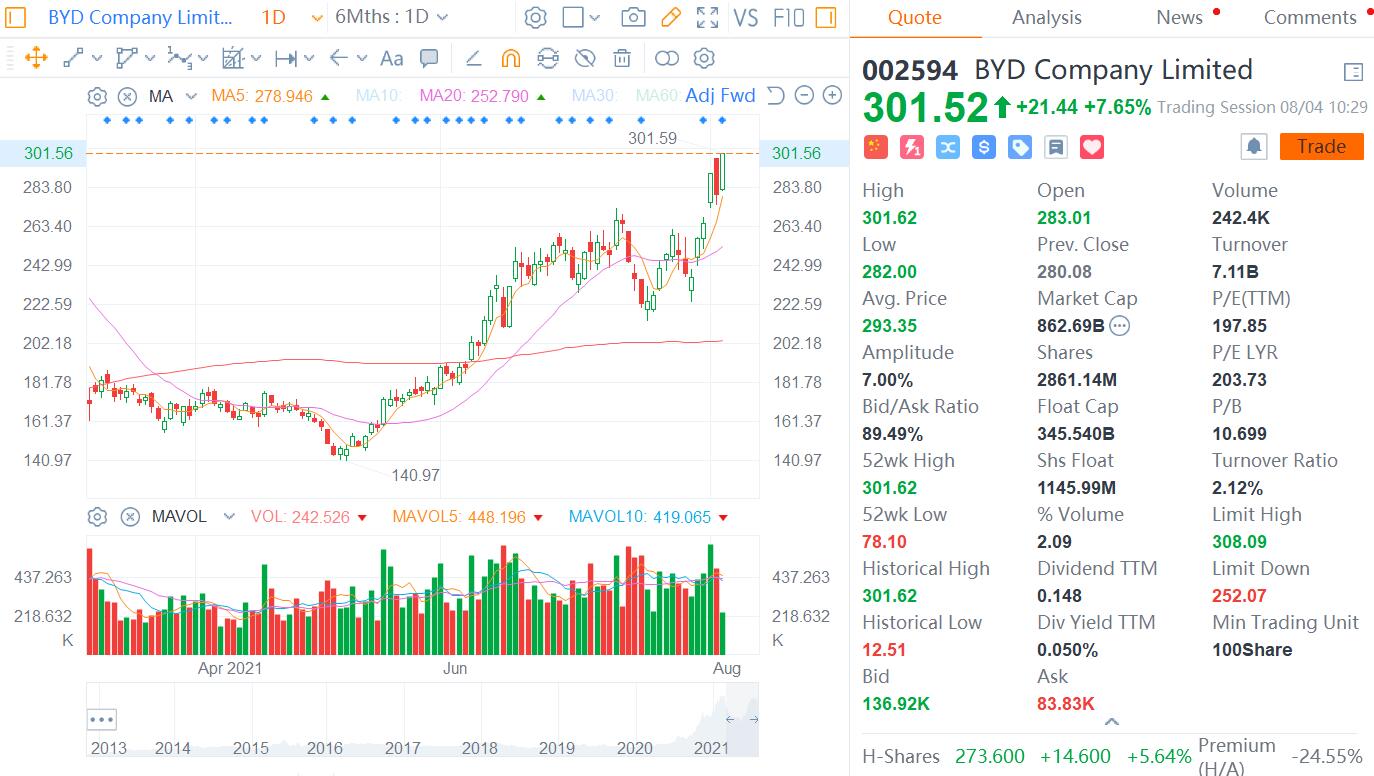

China's new energy vehicle stocks surged on Wednesday, with an ETF tracking the sector up more than 5 percent at press time and BYD up nearly 8 percent to top RMB 300 for the first time.

Analysts say BYD's market cap on track to reach RMB 1 trillion