Citi gives Xpeng's H shares Buy rating and HK$207.5 price target

Citi initiated coverage of Xpeng Motors' H-shares in its latest research note, giving it a Buy rating and a target price of HK$207.5, which corresponds to a projected P/S ratio of 12.4x for FY2022.

P/S ratio is a stock valuation metric calculated by the ratio of a company's market capitalization to its revenue in the most recent year.

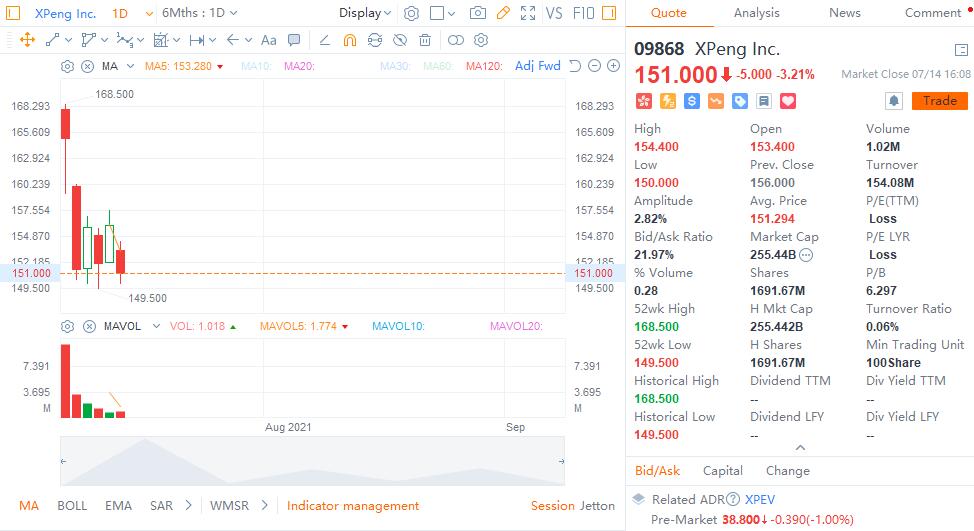

Xpeng closed down 3.21 percent to HK$151 in Hong Kong on Wednesday, more than 8 percent below its offering price of HK$165. Citi's target price implies a 37 percent upside.

Citi said it is bullish on Xpeng's successful listing in Hong Kong, with opportunities for Chinese mainland investors to invest in it later this year.

Xpeng has the potential to be included in the MSCI in the future, which would improve liquidity, the note said.

Hang Seng Indexes Company Limited said last Thursday that Xpeng will be included in the Hang Seng Composite Index and the Hang Seng Consumer Goods Manufacturing and Services Index after the market close on July 20, 2021, effective Wednesday, July 21, 2021.

Within the Hang Seng Composite Index, Xpeng is classified in the Hang Seng Composite Industry Index (Non-Essential Consumption), the Hang Seng Composite Large Cap Index and the Hang Seng Composite Large and Mid-Cap Index.

Previously Xpeng's local peers Nio and Li Auto were both included in FTSE Russell's Global Equity Index, with Nio on Sept. 2, 2020, and Li Auto on Dec. 21.

Last Friday, Citi said the move is expected to boost liquidity for Xpeng stock and increase the likelihood it will be included in the Hong Kong-Mainland Stock Connect as early as the fourth quarter.