CICC raises CATL price target after new deal with Tesla

China's top CICC raised its price target on local power battery giant CATL after the company announced Monday that it has extended its battery supply agreement with Tesla.

"CATL's latest agreement with Tesla is a stronger partnership than before, and we are raising our earnings forecast for CATL and raising our price target by 9 percent to 600 yuan, given the stronger-than-expected downstream demand," CICC said in a research note issued Tuesday.

The agreement, which is not restricted to the Chinese market, means CATL will take the opportunity to match Tesla's global market supply and drive its products to accelerate globally, the report said.

Boosted by global demand, CATL's forward global market share is expected to reach more than 30 percent, the report said.

In February 2020, CATL signed an agreement with Tesla to supply lithium-ion power battery products from July 2020 to June 2022.

To further extend and deepen the friendly relationship between the two companies, CATL and Tesla signed a new agreement on June 25, 2021, based on the above agreement, the company said in an announcement on Monday.

The agreement provides for CATL to supply lithium-ion power battery products to Tesla from January 2022 to December 2025, the company said.

The announcement did not specify specific quantities and amounts, saying that Tesla's purchases are determined on an order-by-order basis and that final sales amounts are subject to actual settlement of purchase orders issued by it.

In the global market, CATL is now the top-ranked power battery supplier.

Market research firm SNE Research said earlier this month that global electric vehicle battery sales were 65.9 GWh in January-April, up 146 percent from 26.8 GWh in the same period last year.

CATL's sales almost quadrupled to 21.4 GWh, further cementing the company's position as the world's largest EV battery maker, giving it a 32.5 percent market share, 10 percentage points higher than second-place LG Energy Solution's 21.5 percent. LG Energy Solution sold 14.2 GWh from January to April.

Panasonic ranked third with 9.7 GWh and 14.7% market share in January-April, while BYD ranked fourth with 4.5 GWh and 6.9% market share in January-April.

SNE believes that CATL and BYD's growth is largely driven by the rise of Chinese EV companies, while growth at LG Energy Solution is largely driven by the China-made Tesla Model Y and VW ID.3.

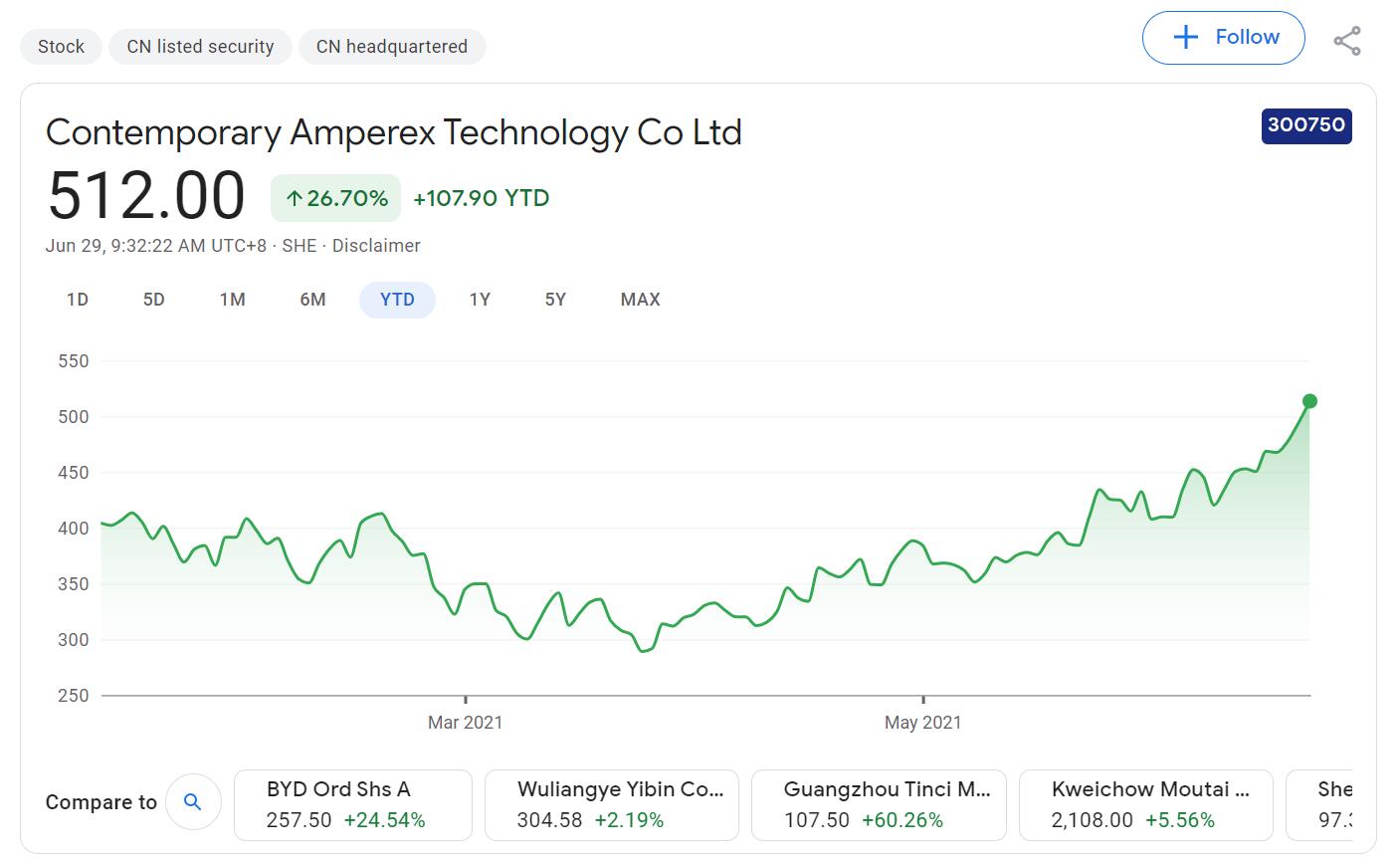

CATL opened Tuesday with a 4 percent gain at RMB 512, and its shares are up 26.7 percent so far this year. The company's market capitalization now stands at 1.2 trillion yuan.

CATL extends deal to supply lithium-ion power cells to Tesla