How do we Chinese think about Great Wall’s interest in FCA?

Haval H8

During the past week, the news that a famous Chinese automaker made at least one offer to buy FCA has become a favorite of global media and especially sparked heated discussion in China.

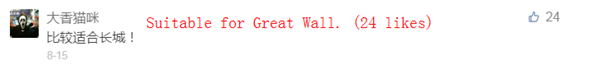

Before the automaker’s identity was revealed, readers in China made a broad guess. Some people said it should be Great Wall because it has similar product portfolio to Jeep.

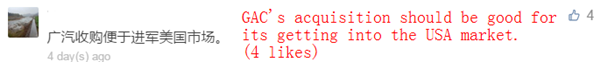

Meanwhile there are also many people who thought it should be Guangzhou Automobile Group Co. for it’s FCA current joint venture partner in China.

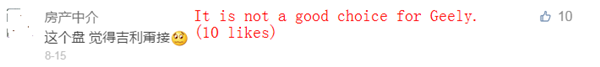

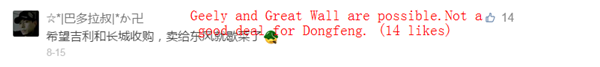

Relatively speaking, fewer people thought or hoped it was Zhejiang Geely Holding Group or Dongfeng Motor Corp. for the former was busy with the work on recently bought Proton and the latter didn’t seem an ideal match for Jeep.

Besides, even some people suggested Beijing Automobile Beijing Automotive Group Co. to make an offer, which once established a joint venture with Daimler-Chrysler to produce Jeep.

Yesterday, Great wall confirmed its interest in Jeep. In order to be the largest SUV maker in the world, Great Wall thinks the merger and acquisition will enable it to achieve its goal sooner and better.

Some compatriots are proud of Great Wall’s ambition and fully support the automaker. Frankly speaking, it is sort of nationalism. After the success of many local enterprises, such as Alibaba and Geely, the public’s expectation towards our own brands ran high.

Of course, there are some people who thought the deal matches Great Wall’s development strategy. If the Chinese automaker manages to buy Jeep, the target can provide sophisticated worldwide distribution network and maybe some technology. Even some consumers hope the deal will bring them local-produced Grand Cherokee.

However, there are also other people who thought it is difficult and unreasonable for Great Wall to purchase Jeep. First of all, Jeep brand is more established than Great Wall and is a jewel in FCA. It is quite a question whether FCA will sell the brand. Even though FCA’s CEO have been seeking a partner or buyer, it is more plausible for him to attract a larger company either in scale or in power.

Then Great Wall can’t afford to buy Jeep. In 2016, Great Wall’s sales revenue was about $14.76 billion, much less than FCA’s $131 billion. According to Morgan Stanley analyst Adam Jonas, Jeep’s market value reaches up to $33.5 billion. Without outside help, Jeep is beyond Great Wall’s affordability.

And also, there are some customers who don’t like Jeep that much. In their opinion, Jeep’s quality is not so good and it is not worthy to buy such a brand.

Maybe only time can tell us which automaker can buy Jeep or FCA.