Analysis on Overall Trend for China PV Market

Shanghai, ZXZC -ZXZC Automotive Research Institute has released a report on Overall Trend for China PV Market in July, 2017. The report analyzed the China PV market and sales growth, policy stimulus results in pre-expenditure, changes of market shares, etc.

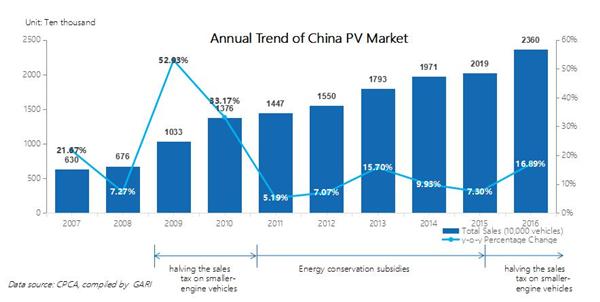

1.China PV Market Has Entered into Maturity Phase with Slower Growth

China PV Market has entered into maturity phase with slower growth. Meanwhile, with the consumption update and the increase in purchasing additional cars or changing for a new car, the increment market has transformed into stock market.

Stimulated by the improvement of overall demand and the policy of halving the sales tax on smaller-engine vehicles, China PV Market in 2016 had a obvious increase to 23.6 million units, up 16.9%.

2.Policy Stimulus Results in Pre-expenditure and China Auto Market is Undergoing Weak Growth

Monthly sales trends show that affected by both seasonal changes and pre-expenditure, the sales growth in the first half year of 2017 has slowed down, with an overall growth of only 2.4%. January, April and May, in particular, experienced negative growth.

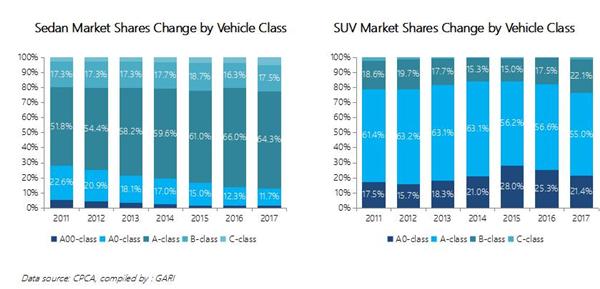

3.Expansion of SUV Market Shares and Declining of Sedan Market Shares

With the change in consumption views, shares of SUVs have increased rapidly while shares of sedans have constantly decreased. In the first half of 2017, shares of sedans are below 50% for the first time while the market shares of SUV have increased to 41.5%.

Subjected by weaker overall market trend, the sedan cars represented a negative growth in the first half of 2017 with a sharp decrease of 3.3%, below the average.

4.Shares of A-Class and Above Have Gradually Expanded

With the rise of resident incomes and reduction in cost for purchasing a car, the market shares of Grade A0 and below have gradually decreased year by year; benefited by rapid grow of SUV market, the market share of A0-class SUV had a sharp increase. However, as a consequence of the overall slowdown, their shares have represented a gradual downward trend.

A-Class models are still dominating the market. With the consumption upgrade, the shares of B-class and above models have been gradually expanded.

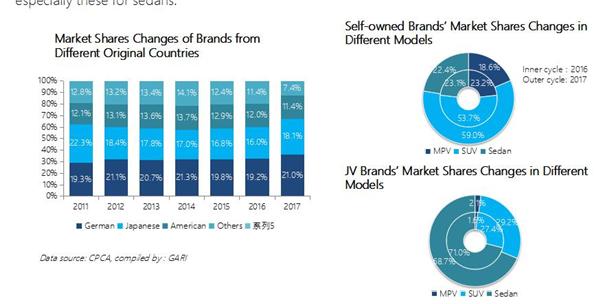

5.Significant Increase in the Market Shares of Self-owned Brands, especially those in SUVs

The shares of self-owned brands have significantly increased, reaching up to 40% in 2016 and 42.1% in the first half of 2017. SUVs made a great contribution, with the market share of 59% in the first half of 2017.

Among the JV-brands, Germany, Japanese and American vehicles seized the most market shares, especially these for sedans.

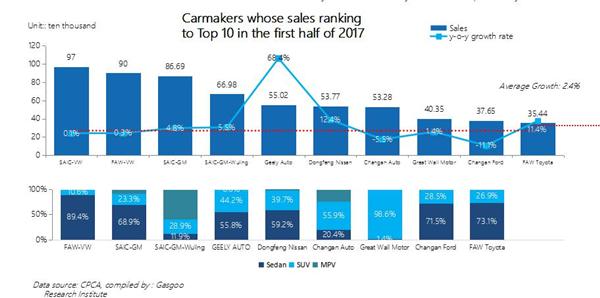

6.Sales of Geely Auto increased significantly while Korean car brands failed to enter into TOP 10

SAIC-VW, FAW-VW and SAIC-GM were still the top 3 brands, but their growth rate showed an obvious slowdown. As sales suffered setbacks, Korean brands dropped out of Top 10. Among Top 10, Geely Auto achieved the highest growth rate of 68%.

For self-owned brands , other brands have been mainly dominated by SUVs except Geely Auto.